Global Diesel Exhaust Fluid Market Size, Share, and COVID-19 Impact Analysis, By Technology (Selective Catalytic Reduction (SCR), Lean NOx Trap (LNT), Exhaust Gas Recirculation (EGR)), By Supply (Cans, IBCs, Bulk & Pumps), By Vehicle (Passenger, Commercial, Light Commercial Vehicles, Heavy Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Diesel Exhaust Fluid Market Insights Forecasts to 2033

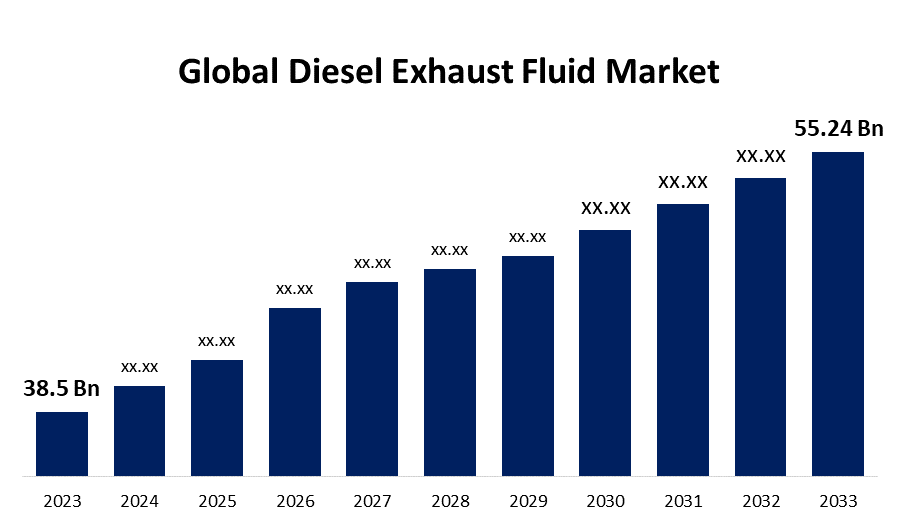

- The Global Diesel Exhaust Fluid Market Size was Valued at USD 38.5 Billion in 2023

- The Market Size is Growing at a CAGR of 7.49% from 2023 to 2033

- The Worldwide Diesel Exhaust Fluid Market Size is Expected to Reach USD 55.24 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Diesel Exhaust Fluid Market Size is Anticipated to Exceed USD 55.24 Billion by 2033, Growing at a CAGR of 7.49% from 2023 to 2033.

Market Overview

DEF is used widely in diesel engine emission control systems. It is an odourless solution composed of pure water and high-quality urea. The primary goal of DEF is to reduce nitrogen oxide (NOx) emissions, which are known to contribute to air pollution and smog formation. DEF fuel is the future of many sectors that are currently unable to be electrified. Strict emission standards imposed by governments throughout the world to combat pollution are projected to fuel the diesel exhaust fluid market expansion during the forecast period. Many countries in Europe and North America have adopted the Euro 6 and Tier 4 emission regulations, respectively. These guidelines encourage the use of selective catalytic reduction (SCR) systems, which increase the use of diesel exhaust fluid. The expanding network of diesel exhaust fluid market availability makes it easier for both consumers and enterprises to obtain this product, resulting in significant infrastructure expansion. A huge number of diesel exhaust fluid market dispensing stations are presently being established in retail fuel stations, truck stops, and rest areas. With the convenience of availability, consumers and companies are gaining access to diesel exhaust fluid, causing the market to expand.

Report Coverage

This research report categorizes the market for the global diesel exhaust fluid market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global diesel exhaust fluid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global diesel exhaust fluid market.

Global Diesel Exhaust Fluid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Supply, By Vehicle, By Region |

| Companies covered:: | Engen Petroleum Ltd, Borealis AG, BASF SE, Yara, Mitsui Chemicals Inc, BP p.l.c, Nissan Chemical Corporation, GreenChem, NOVAX Material & Technology Inc, Royal Dutch Shell PLC, Adeco doo, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The new developments in technology in SCR systems, which include increased efficiency, durability, and integration with engine management systems, have the effect of improving the efficiency and dependability of the use of diesel exhaust fluid (DEF), which drives its acceptance across a wide range of industries and applications. Furthermore, the growing popularity of industrial sectors such as construction, mining, and manufacturing, as well as an increase in agricultural activities, drives demand for diesel-powered equipment, increasing consumption of diesel exhaust fluid (DEF) for emission control in these applications.

Restraining Factors

Variations in diesel fuel costs have a direct impact on the demand for diesel exhaust fluid (DEF). This is because higher fuel costs may result in less vehicle utilization or fleet optimization measures, reducing DEF consumption and limiting market expansion.

Market Segmentation

The global diesel exhaust fluid market share is classified into technology, supply and vehicle.

- The selective catalytic reduction (SCR) segment is expected to hold the largest share of the global diesel exhaust fluid market during the forecast period.

Based on the technology, the global diesel exhaust fluid market is categorized into selective catalytic reduction (SCR), lean NOx trap (LNT), exhaust gas recirculation (EGR). Among these, the selective catalytic reduction (SCR) segment is expected to hold the largest share of the global diesel exhaust fluid market during the forecast period. It can tolerate high voltages, currents, and power The voltage loss across a conducting SCR is modest. This will reduce power dissipation in the SCR. It can be protected with the use of a fuse.

- The bulk & pumps segment is expected to grow at the fastest CAGR during the forecast period.

Based on the supply, the global diesel exhaust fluid market is categorized into cans, IBCS, bulk & pumps. Among these, the bulk & pumps segment is expected to grow at the fastest CAGR during the forecast period. Bulk & pumps supply is an important part of the diesel exhaust fluid (DEF) business. It caters to large-scale DEF customers, particularly commercial fleets and industrial plants. Bulk & pumps provide significant economic savings over smaller containers such as bottles and drums, particularly for high-volume consumers.

- The heavy commercial vehicles segment is expected to hold a significant share of the global diesel exhaust fluid market during the forecast period.

Based on the vehicle, the global diesel exhaust fluid market is categorized into passenger, commercial, light commercial vehicles, heavy commercial vehicles. Among these, the heavy commercial vehicles segment is expected to hold a significant share of the global diesel exhaust fluid market during the forecast period. Heavy commercial vehicles have large mileages and heavy payloads, necessitating the most effective DEF solution. Higher amounts consumed in trucks justify favorable bulk pricing. While the upfront expenses of larger DEF tanks and premium after-treatment systems are unavoidable when trying to fulfil emission standards, bulk providers collaborate closely with OEMs/fleets to optimize overall DEF consumption. Condition-based DEF replenishment prevents under- or overfilling. Diagnostic tools monitor post-treatment health, proactively addressing concerns. This reduces repair costs and prevents costly downtime. This optimization of affordability through collaboration has acquired a bigger market share for the heavy commercial vehicle class.

Regional Segment Analysis of the Global Diesel Exhaust Fluid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global diesel exhaust fluid market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global diesel exhaust fluid market over the forecast period. Both the United States and Canada have a large number of automobiles on the road, as well as demanding emission laws, such as the US Clean Air Act (CAA), which is driving the North American diesel exhaust fluid industry. The strong demand for diesel-intensive vehicles and equipment is a result of Mexico's growing economic activity and improved business climate, while demand for DEF in the country has been pushed by compliance with pollution regulations. Canada's demand and regulation patterns are analogous to those of the United States; therefore, DEF demand trends are projected to be similar.

Europe is expected to grow at the fastest CAGR growth of the global diesel exhaust fluid market during the forecast period. The European Union Euro6 has introduced requirements requiring the installation of SCR systems in new diesel vehicles, which is increasing demand for DEF in the European region. The German diesel exhaust fluid market had the biggest market share, while Australia's diesel exhaust fluid market was the fastest expanding in the region. The Austrian government has declared that it will invest 100 million in DEF infrastructure over the next five years. This investment will cover the installation of new diesel exhaust fluid dispensing terminals at fuel stations, as well as the expansion of the national DEF logistics network. This development is likely to increase demand for DEF in the Europe region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global diesel exhaust fluid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Engen Petroleum Ltd

- Borealis AG

- BASF SE

- Yara

- Mitsui Chemicals Inc

- BP p.l.c

- Nissan Chemical Corporation

- GreenChem

- NOVAX Material & Technology Inc

- Royal Dutch Shell PLC

- Adeco doo

- Others

Key Market Developments

- In October 2023, Monomoy Capital Partners, a private investment firm specializing in middle-market private equity and finance, is delighted to announce the sale of Shaw Development to Madison Dearborn Partners. Shaw Development is a top designer, producer, and assembler of sensors, fluid management systems, and related components used largely in diesel exhaust fluid (DEF) applications. Monomoy's investment in Shaw will be remembered as one of the company's most successful collaborations.

- In January 2022, Total Energies has announced plans to expand in Mozambique through the acquisition of BP's retail network, wholesale fuel business, and logistics assets. The transaction includes a network of 26 service stations, a portfolio of commercial customers, and a 50% stake in SAMCOL, a logistics company previously co-owned by Total Energies and BP that manages the Matola, Beira, and Nacala petroleum import terminals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global diesel exhaust fluid market based on the below-mentioned segments:

Global Diesel Exhaust Fluid Market, By Technology

- Selective Catalytic Reduction (SCR)

- Lean NOx Trap (LNT)

- Exhaust Gas Recirculation (EGR)

Global Diesel Exhaust Fluid Market, By Supply

- Cans

- IBCs

- Bulk & Pumps

Global Diesel Exhaust Fluid Market, By Vehicle

- Passenger

- Commercial

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Diesel Exhaust Fluid Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?