Global Delivery Robots Market Size, Share, and COVID-19 Impact Analysis, By Solution (Hardware and Software), By Number of Wheels (2-wheel robots, 3-wheel robots, 4-wheel robots, and 6-wheel robots), By End-Use (Food & beverage, Retail, Healthcare, Postal service, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Electronics, ICT & MediaGlobal Delivery Robots Market Insights Forecasts to 2032

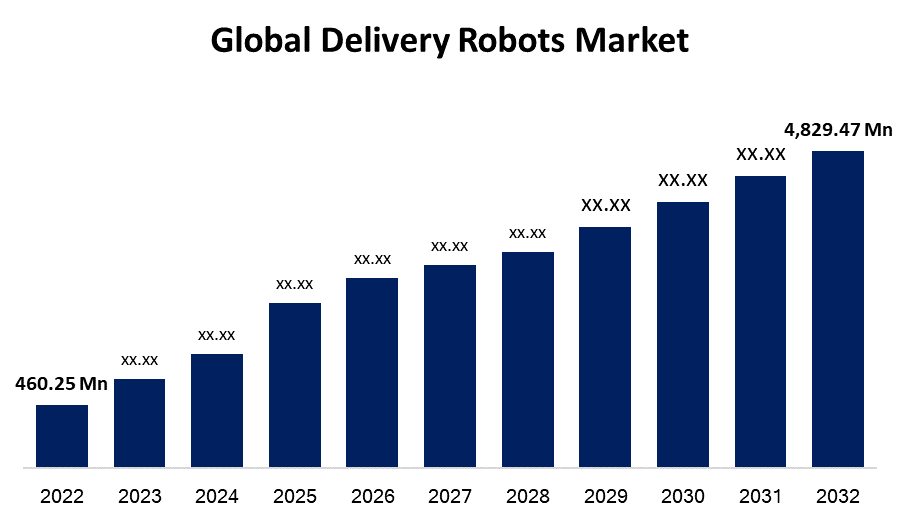

- The delivery robots Market Size was valued at USD 460.25 Million in 2022.

- The Market Size is Growing at a CAGR of 26.5% from 2022 to 2032.

- The Worldwide delivery robots Market Size is expected to reach USD 4,829.47 Million by 2032.

- Asia-Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global delivery robots Market Size is expected to reach USD 4,829.47 Million by 2032, at a CAGR of 26.5% during the forecast period 2022 to 2032.

Market Overview

Delivery robots are autonomous machines designed to transport goods from one location to another without human intervention. These robots offer a convenient and efficient solution for last-mile delivery, especially in urban areas. They are equipped with sensors, cameras, and navigation systems to navigate sidewalks, streets, and other public spaces. Delivery robots come in various forms, including wheeled robots, drones, and even humanoid robots. They can carry packages of different sizes and shapes, making them versatile for a wide range of delivery needs. These robots can operate 24/7, reducing delivery times and increasing the overall efficiency of the delivery process. While still being tested and regulated in many areas, delivery robots have the potential to revolutionize the logistics industry and transform the way goods are transported.

Report Coverage

This research report categorizes the market for delivery robots market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the delivery robots market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the delivery robots market.

Global Delivery Robots Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 460.25 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 26.5% |

| 2032 Value Projection: | USD 460.25 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Solution, By Number of Wheels, By End-Use, By Region |

| Companies covered:: | JD.com, Relay Robotics, Kiwibot, Nuro Inc, ST Engineering, Alibaba Group, Starship Technologies, Boston Dynamics, Eliport, Ottonomy, Panasonic Holding Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for delivery robots is driven by several key factors. The increasing demand for efficient last-mile delivery solutions in urban areas is a major driver. Delivery robots offer a cost-effective and time-efficient alternative to traditional delivery methods, addressing challenges like traffic congestion and limited parking spaces. The advancements in robotics and artificial intelligence technologies have significantly improved the capabilities of these robots, enabling them to navigate complex environments and interact with humans safely. Additionally, the growing e-commerce sector and the surge in online shopping have created a need for faster and more flexible delivery options, which delivery robots can fulfill. Moreover, environmental concerns and the push for sustainable practices have further propelled the adoption of delivery robots as they reduce carbon emissions and minimize the reliance on fossil fuels.

Restraining Factors

The delivery robots market faces several restraints that impact its growth and adoption. The regulatory and legal challenges pose a significant restraint. Many regions lack clear guidelines and policies specifically tailored to autonomous delivery robots, leading to uncertainties and barriers to implementation. Concerns related to safety and liability hinder widespread acceptance. Accidents or incidents involving delivery robots can raise questions about responsibility and potential harm to pedestrians or property. Additionally, the high initial costs of developing and deploying delivery robot systems can limit market entry for smaller businesses. Overall, public acceptance and trust issues need to be addressed, as people may have concerns regarding the security of their deliveries or potential job displacement. Overcoming these restraints will be crucial for the successful expansion of the delivery robots market.

Market Segmentation

- In 2022, the hardware segment accounted for around 73.4% market share

On the basis of the solution, the global delivery robots market is segmented into hardware and software. The hardware segment has consistently held the largest market share in the delivery robots market. This can be attributed to several factors. The hardware component is an essential and foundational element of delivery robots, encompassing the physical structure, sensors, navigation systems, power sources, and other critical components. As delivery robots become increasingly sophisticated and capable, the demand for advanced and reliable hardware components rises. The hardware segment includes various types of robots, such as wheeled robots, drones, and humanoid robots, catering to different delivery requirements and environments. This diversity in robot types expands the market for hardware components. Additionally, hardware innovations drive the overall performance and capabilities of delivery robots, enabling them to navigate complex terrains, handle different package sizes, and interact with their surroundings effectively. Moreover, the hardware segment often involves partnerships and collaborations with technology manufacturers, further contributing to its market dominance. Overall, the hardware segment's large market share reflects the crucial role it plays in shaping the functionality and success of delivery robots.

- In 2022, the 2-wheel robots segment dominated with more than 39.5% market share

Based on the number of wheels, the global delivery robots market is segmented into 2-wheel robots, 3-wheel robots, 4-wheel robots, and 6-wheel robots. The 2-wheel robots segment has emerged as a dominant player, holding the largest market share in the delivery robots market. Several factors contribute to its significant presence. The 2-wheel robots offer a versatile and agile solution for navigating urban environments and delivering packages efficiently. Their compact size and maneuverability enable them to traverse sidewalks, streets, and other pedestrian areas with ease, making them well-suited for last-mile delivery. Advancements in robotics and sensor technologies have enhanced the capabilities of 2-wheel robots, allowing them to navigate obstacles, avoid collisions, and optimize delivery routes. Additionally, 2-wheel robots are often cost-effective compared to other robot types, making them an attractive choice for businesses seeking affordable delivery solutions. Furthermore, the growing demand for same-day and on-demand deliveries in e-commerce has further propelled the adoption of 2-wheel robots. Their ability to carry various package sizes, from small parcels to larger boxes, makes them versatile for a wide range of delivery needs. Overall, the 2-wheel robots segment's largest market share underscores its efficiency, flexibility, and suitability for urban delivery operations.

Regional Segment Analysis of the Delivery Robots Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

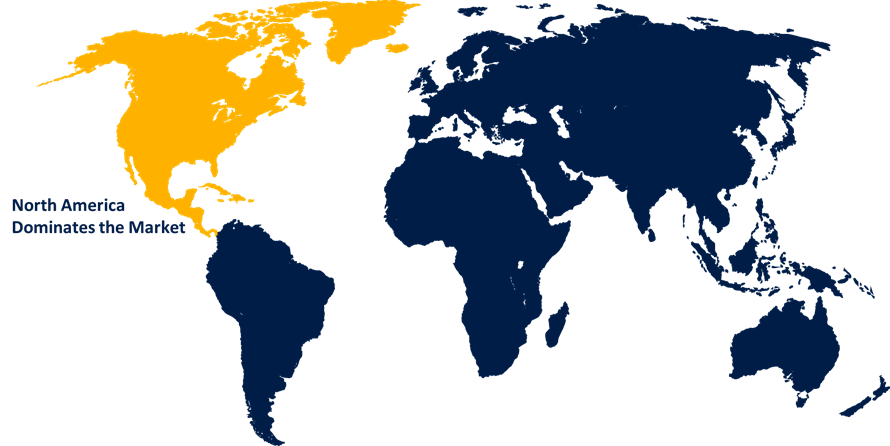

North America dominated the market with more than 44.5% revenue share in 2022.

Get more details on this report -

Based on region, North America has consistently held the largest market share in the restraint robots market. There are several reasons contributing to this dominance. North America is home to several technologically advanced countries, including the United States and Canada, which have a strong focus on innovation and the adoption of cutting-edge technologies. This has facilitated the development and deployment of restraint robots in various industries across the region. North America has a robust healthcare sector, where restraint robots find extensive use in hospitals and medical facilities for patient management and ensuring staff safety. Furthermore, the region has a well-established law enforcement infrastructure, where restraint robots are utilized for handling potentially dangerous situations, reducing risks, and enhancing operational efficiency. Additionally, stringent safety regulations and standards in North America have pushed organizations to adopt advanced restraint technologies, further driving market growth. The presence of major robotics manufacturers and strong investment in research and development activities also contribute to the region's leadership in the restraint robots market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global delivery robots market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- JD.com

- Relay Robotics

- Kiwibot

- Nuro Inc.

- ST Engineering

- Alibaba Group

- Starship Technologies

- Boston Dynamics

- Eliport

- Ottonomy

- Panasonic Holding Corporation

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Suzuki Motor Corporation and LOMBY Inc. have joined forces to develop autonomous delivery robots. In this collaborative project, Suzuki will handle the development and design of the robot's base, while LOMBY will be responsible for creating the prototype, making necessary modifications, and establishing a delivery system. They will also conduct demonstration testing to showcase the capabilities of the autonomous delivery robot.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global delivery robots market based on the below-mentioned segments:

Delivery Robots Market, By Solution

- Hardware

- Software

Delivery Robots Market, By Number of Wheels

- 2-wheel robots

- 3-wheel robots

- 4-wheel robots

- 6-wheel robots

Delivery Robots Market, By End-Use

- Food & beverage

- Retail

- Healthcare

- Postal service

- Others

Delivery Robots Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?