Global Defense Cyber Security Market Size, Share, and COVID-19 Impact Analysis, By Platform (Software & Service and Hardware), By Solution (Cyber Threat Protection, Threat Evaluation, Content Security, and Others), By Type (Critical Infrastructure Security & Resilience, Application Security, Cloud Security, and Others), By End User (Land Force, Naval Force, and Air Force), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Aerospace & DefenseGlobal Defense Cyber Security Market Insights Forecasts to 2032

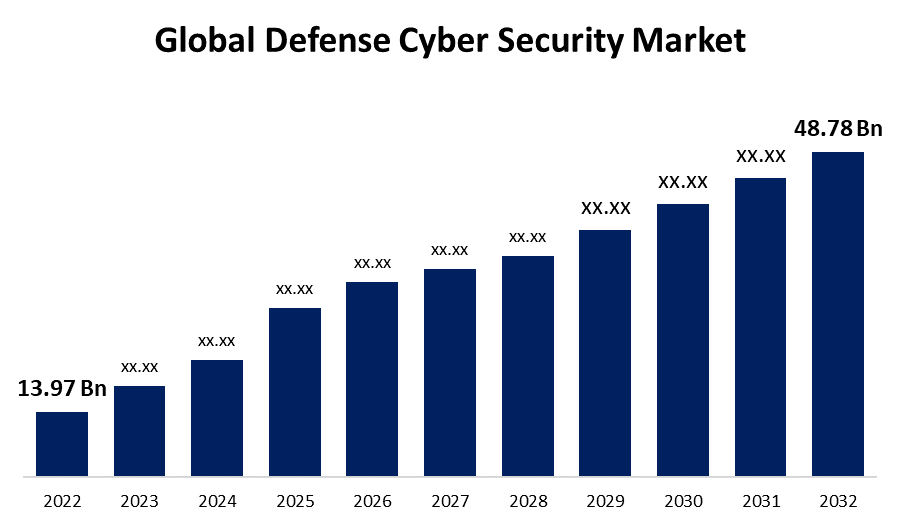

- The Global Defense Cyber Security Market Size was valued at USD 13.97 Billion in 2022.

- The Market is growing at a CAGR of 13.3% from 2022 to 2032

- The Worldwide Defense Cyber Security Market Size is expected to reach USD 48.78 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Defense Cyber Security Market size is anticipated to exceed USD 48.78 Billion by 2032, Growing at a CAGR of 13.3% from 2022 to 2032.

Market Overview

Defense cyber security relates to cyber security solutions that are utilized by the defense industry to track, identify, report, and counter cyber-attacks, which are internet-based efforts to compromise sensitive data via spyware and malware, as well as phishing, in order to ensure data confidentiality. The defense sector has seen rapid growth in recent years. Beyond traditional insurgent activity, the defense industry is concerned. Because of advancements in information technology, modernized weapons, and an increase in the volume of sensitive information, dependable and improved cyber security network solutions have become critical for the defense sector. Growing demand for cyber security services or solutions for a variety of applications in the defense or military fields is projected to propel global market growth during the forecast period. The defense industry's investment in cyber security has grown, as charges of one nation attacking another for political purposes and increasing sophisticated cyberattacks. Governments and organizations are investing more in cyber security than ever before in these uncertain times of defense goods and services.

Report Coverage

This research report categorizes the market for the global defense cyber security market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the defense cyber security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the defense cyber security market.

Global Defense Cyber Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 13.97 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 13.3% |

| 2032 Value Projection: | USD 48.78 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Platform, By Solution, By Type, By End User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Lockheed Martin, The Thales Group, BAE Systems, General Dynamics, Northrop Grumman Corporation, Raytheon Technologies, Booz Allen Hamilton, Leonardo, Leidos, L3Harris Technologies and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing frequency and sophistication of cyberattacks has been one of the primary drivers of the global defense cybersecurity market. As technology advances, so do cyber adversaries' methods and capabilities. Hackers, state-sponsored actors, and cybercriminals are constantly improving their methods for breaching defense and gaining unauthorized access to sensitive defense information. Defense and government organizations around the world operate critical infrastructure and systems that are attractive targets for cyber adversaries. Military command and control systems, weapons systems, communication networks, intelligence databases, and other sensitive assets are examples of this. A successful cyberattack on any of these systems could have serious ramifications, including a threat to national security. The increasing use of cloud-based services in defense operations has necessitated the implementation of robust cloud security measures. As defense agencies store sensitive data and run critical applications in the cloud, maintaining information confidentiality, integrity, and availability becomes critical.

Restraining Factors

Defense organizations frequently face budget constraints, which can make it difficult to invest in cutting-edge cybersecurity solutions and services. The high costs of advanced cybersecurity technologies, skilled personnel, and ongoing maintenance can be significant deterrents. The defense industry typically employs a diverse set of legacy systems, software, and hardware. It can be difficult and time-consuming to integrate new cybersecurity solutions with existing infrastructure. Compatibility issues and the need for extensive testing may cause new technology adoption to be delayed.

Market Segmentation

The Global Defense Cyber Security Market share is classified into platform, solution, and type.

- The software & service segment is expected to lead the market over the forecast period.

The global defense cyber security market is categorized by platform into software & service and hardware. Among these, the software & service segment is expected to lead the market over the forecast period. The increased adoption of on-premise and cloud-based defense platforms by key companies can be attributed to the growth. Furthermore, the growing importance of software in digitizing military operational processes is expected to drive the segmental growth.

- The cyber threat protection segment is expected to hold the largest share of the global defense cyber security market over the forecast period.

Based on the solution, the global defense cyber security market is divided into cyber threat protection, threat evaluation, content security, and others. Among these, the cyber threat protection segment is expected to hold the largest share of the global defense cyber security market over the forecast period. The cyber threat protection segment is the market leader and is expected to grow at the fastest CAGR during the forecast period. Cyber threat protection security solutions are designed to assist security professionals in defending systems and networks against malware and other specialized cyberattacks. Such attacks seek to infiltrate networks or systems in order to disrupt services or steal data, frequently for financial gain. Firewalls, sandboxing, TSL/SSL inspection, and browser isolation are all examples of cyber threat protection.

- The application security segment is expected to hold the largest share of the global defense cyber security market over the forecast period.

Based on the type, the global defense cyber security market is divided into critical infrastructure security & resilience, application security, cloud security, and others. Among these, the application security segment is expected to hold the largest share of the global defense cyber security market over the forecast period. Because of the various software applications for the defense sector, the application security segment is projected to dominate the market. Application security is the process of authenticating, authorizing, encrypting, logging, and testing security measures within applications to prevent unauthorized access and modification.

Regional Segment Analysis of the Global Defense Cyber Security Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America holds the largest share of the global defense cyber security market in 2022.

Get more details on this report -

North America holds the largest share of the global defense cyber security market in 2022. The expansion is attributed to significant defense industries such as Lockheed Martin, Raytheon Technologies Corporation, Northrop Grumman Corporation, and General Dynamics transforming their cyber security assistance in this region, as well as increasing government contracts to boost military power.

Asia Pacific is expected to grow at the fastest pace in the global defense cyber security market during the forecast period. The defense cyber security market in the Asia-Pacific region has grown significantly. Countries such as China, India, Japan, and South Korea have made significant investments in cybersecurity to safeguard critical infrastructure and sensitive data. The rise in cyber threats and geopolitical tensions in the region has prompted governments to strengthen their cyber defense capabilities, which has contributed to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global defense cyber security along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lockheed Martin

- The Thales Group

- BAE Systems

- General Dynamics

- Northrop Grumman Corporation

- Raytheon Technologies

- Booz Allen Hamilton

- Leonardo

- Leidos

- L3Harris Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Thales announced the launch of SCRED, a collaborative project involving 11 French companies and organizations focused on cyber security. The project's goal over the next three years is to build a single platform to provide cyber threat intelligence services to businesses and government agencies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Defense Cyber Security Market based on the below-mentioned segments:

Global Defense Cyber Security Market, By Platform

- Software & Service

- Hardware

Global Defense Cyber Security Market, By Solution

- Cyber Threat Protection

- Threat Evaluation

- Content Security

- Others

Global Defense Cyber Security Market, By Type

- Critical Infrastructure Security & Resilience

- Application Security

- Cloud Security

- Others

Global Defense Cyber Security Market, By End User

- Land Force

- Naval Force

- Air Force

Global Defense Cyber Security Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?