Global Decaffeinated Coffee Market Size, Share, and COVID-19 Impact Analysis, By Product (Roasted and Raw), By Bean Species (Arabica, Robusta, and Others), By Distribution Channel (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Decaffeinated Coffee Market Size Insights Forecasts to 2035

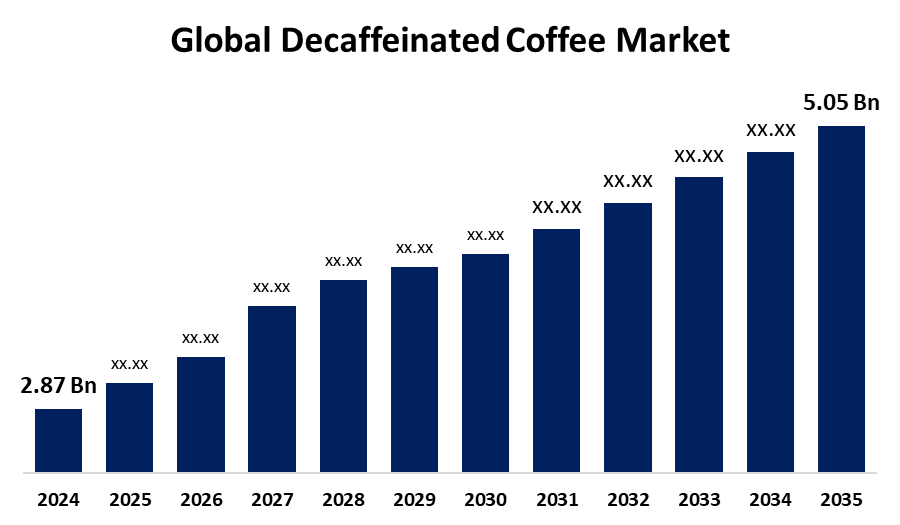

- The Global Decaffeinated Coffee Market Size Was Estimated at USD 2.87 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.27% from 2025 to 2035

- The Worldwide Decaffeinated Coffee Market Size is Expected to Reach USD 5.05 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Decaffeinated Coffee Market Size was worth around USD 2.87 Billion in 2024 and is predicted to grow to around USD 5.05 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 5.27% from 2025 to 2035. The rising health awareness and evolving consumer lifestyles are driving increased demand for decaffeinated coffee. Enhanced product offerings and ongoing innovations are expected to sustain market growth in the coming years.

Market Overview

The decaffeinated coffee market refers to the manufacturing, selling, and consuming of coffee products that have had the majority of their caffeine content, usually at least 97%, removed while maintaining the flavor and aroma of regular coffee. People who want to enjoy coffee without the energizing effects of caffeine are catered to in this sector.

The worldwide industry concentrated on making and marketing coffee that has had the majority of its caffeine extracted. Growing consumer health consciousness and the need for better beverage options are its main drivers. Commercial institutions such as cafes and restaurants, as well as health-conscious people, are important consumers. The direct contact method, the Swiss water process, and the supercritical carbon dioxide method are some of the procedures used in decaffeination. In response to growing demand, major coffee brands are increasing the variety of decaf coffee they provide.

Report Coverage

This research report categorizes the decaffeinated coffee market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the decaffeinated coffee market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the decaffeinated coffee market.

Global Decaffeinated Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.87 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.27% |

| 2035 Value Projection: | USD 5.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 287 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product, By Bean Species, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Swiss Water Decaffeinated Coffee Inc., The Eight OClock Coffee Company, Lifeboost Coffee LLC, Koa Coffee, Don Pablo Coffee, Koffee Kult, Fresh Roasted Coffee, LLC, Kicking Horse Coffee Co. Ltd., Volcanica Coffee Company, Others., and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing public awareness of health issues and dietary changes for the better. Young and health-conscious consumers prefer decaf due to worries about the health risks associated with caffeine. The availability and quality of products have improved due to increased accessibility and a variety of decaffeination techniques. This transformation is further supported by industry-led and government-led awareness campaigns. Innovations that improve market appeal and convenience include decaf-based syrups. In general, changing wellness and lifestyle trends are anticipated to support market growth in the upcoming years.

Restraining Factors

The significant manufacturing costs and problems with taste perception. Widespread acceptance is further hampered by limited availability and customer misconceptions. While legal obstacles hinder international expansion, the narrow market image limits wider appeal. To fully realize the market's potential, these obstacles must be removed.

Market Segmentation

The decaffeinated coffee market share is classified into product, bean species, and distribution channel.

- The raw segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the decaffeinated coffee market is classified into roasted and raw. Among these, the raw segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the compared to roasted decaf coffee, raw decaffeinated coffee is more affordable. It is distinguished by a mild or delicate scent that influences the customer's choice to buy. The demand for raw decaffeinated coffee has also increased recently due to the accessibility and affordability of technologically sophisticated home appliances like coffee roasters.

- The arabica segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the bean species, the decaffeinated coffee market is categorized into arabica, robusta, and others. Among these, the arabica segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the main reason for this is that Arabica beans have less caffeine than Robusta beans. The product's smooth and sweet flavor is another factor driving up demand. Industry players market it as a high-end decaf coffee alternative. It is anticipated that growing commercial use by well-known coffee brands and significant participants in the ready-to-drink sector will support this segment's expansion in the years to come.

- The online segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channels, the decaffeinated coffee market is categorized into online and offline. Among these, the online segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the easy availability and accessibility, the widespread presence of supermarket and hypermarket networks in many nations around the world, the growing number of decaffeinated coffee products in the portfolio offerings of neighborhood grocery stores, convenience stores, and other offline marketplaces, and other factors are the main drivers of this segment's growth. The brands favor efficient physical distribution because it increases customer engagement and brand visibility.

Regional Segment Analysis of the Decaffeinated Coffee Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the decaffeinated coffee market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the decaffeinated coffee market over the predicted timeframe. The regional growth can be attributed to the expansion of this market is facilitated by increased product availability through both online and offline points of sale, such as big-box stores and e-commerce companies with extensive delivery networks. The region's growing demand for decaffeinated coffee is also being fueled by factors such as growing awareness of the negative effects of caffeine, increased mindfulness around caffeine usage, and the availability of strong alternatives that provide a comparable taste, aroma, and experience.

Asia Pacific is expected to grow at a rapid CAGR in the decaffeinated coffee market during the forecast period. The region's growth is being driven by the demand for this market is expected to grow over the next few years due to some factors, including rising disposable income levels, expanded quick commerce and e-commerce industry penetration, a large number of retail industry players operating in the region, significant demand from restaurants and ready-to-drink coffee serving businesses, and the entry of multiple coffee and coffee product brands in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the decaffeinated coffee market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Swiss Water Decaffeinated Coffee Inc.

- The Eight O'Clock Coffee Company

- Lifeboost Coffee LLC

- Koa Coffee

- Don Pablo Coffee

- Koffee Kult

- Fresh Roasted Coffee, LLC

- Kicking Horse Coffee Co. Ltd.

- Volcanica Coffee Company

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, British Airways picked Grind's specialty coffee to be served on short-haul aircraft departing from Gatwick and Heathrow. The company produced various product blends for British Airways High Life Cafe project. British Airways short-haul flights include Decaf Black, ready-to-drink Iced Caramel Latte Can, and Long Black.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the decaffeinated coffee market based on the below-mentioned segments:

Global Decaffeinated Coffee Market, By Product

- Roasted

- Raw

Global Decaffeinated Coffee Market, By Bean Species

- Arabica

- Robusta

- Others

Global Decaffeinated Coffee Market, By Distribution Channel

- Online

- Offline

Global Decaffeinated Coffee Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?