Global Cryogenic Tanks Market Size, Share, and COVID-19 Impact Analysis, By Cryogenic Liquid (Liquefied Natural Gas, Liquid Nitrogen, Liquid Oxygen, Liquid Hydrogen, and Other), By Application (Storage and Transportation), By End-User (Manufacturing, Healthcare, Food Industry, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Energy & PowerGlobal Cryogenic Tanks Market Insights Forecasts to 2032

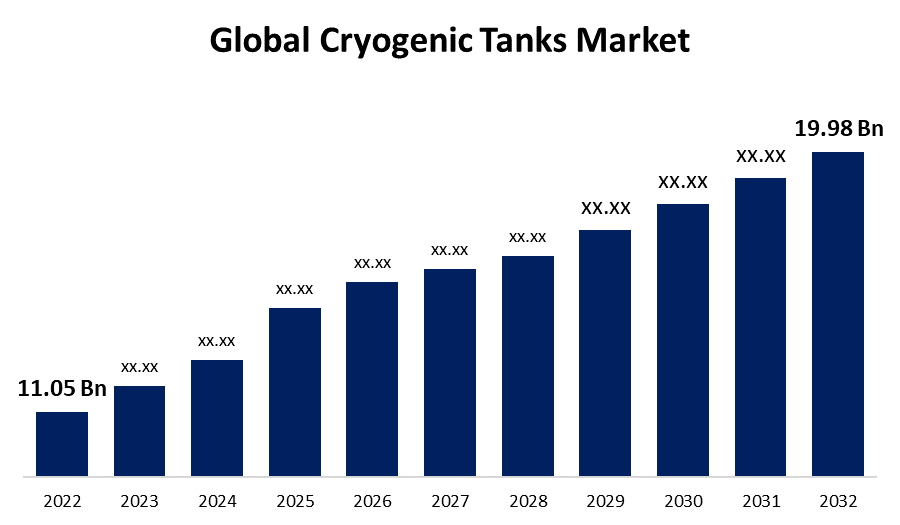

- The Cryogenic Tanks Market Size was valued at USD 11.05 Billion in 2022.

- The Market is growing at a CAGR of 6.1% from 2022 to 2032

- The Worldwide cryogenic tanks market is expected to reach USD 19.98 Billion by 2032

- Asia-Pacific is expected to have significant growth during the forecast period

Get more details on this report -

The Global Cryogenic Tanks Market is expected to reach USD 19.98 Billion by 2032, at a CAGR of 6.1% during the forecast period 2022 to 2032.

Market Overview

Cryogenic tanks are specially designed containers used for the storage and transport of liquefied gases, typically at extremely low temperatures. These tanks are built to withstand the extreme cold and maintain the cryogenic temperatures required to keep substances such as liquid oxygen, nitrogen, helium, and argon in their liquid state. The tanks are constructed with materials that offer high thermal insulation properties, such as stainless steel or aluminum, and they incorporate advanced vacuum insulation techniques to minimize heat transfer and maintain the low temperatures. Cryogenic tanks are essential in various industries, including healthcare, aerospace, research, and industrial processes, where the storage and handling of cryogenic fluids are critical. These tanks ensure the safe and efficient storage and distribution of liquefied gases, enabling their use in a wide range of applications.

Report Coverage

This research report categorizes the market for cryogenic tanks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cryogenic tanks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the cryogenic tanks market.

Global Cryogenic Tanks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.05 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.1% |

| 2032 Value Projection: | USD 19.98 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Cryogenic Liquid, By Application, By End-User, By Region |

| Companies covered:: | Chart Industries, Cryofab, INOX India, Linde PLC, Air Products, Cryolor, Air Water Inc., Wessington Cryogenics, Super Cryogenic Systems Pvt. Ltd., FIBA Technologies, ISISAN, Suretank Group Ltd., Eden Cryogenic LLC, and others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cryogenic tanks market is driven by several factors due to increasing demand for liquefied natural gas (LNG) as a cleaner and more efficient energy source has spurred the need for cryogenic tanks in LNG storage and transportation. Additionally, the growing applications of cryogenic fluids in industries such as healthcare, aerospace, and electronics have further fueled the market. Furthermore, the expanding space exploration and research activities, which require the storage and transport of cryogenic fuels like liquid oxygen and hydrogen, have contributed to the market growth. Technological advancements in cryogenic tank design, such as improved insulation materials and safety features, have also stimulated market expansion. Overall, government initiatives promoting the adoption of clean energy sources and the development of infrastructure for LNG have played a significant role in driving the cryogenic tanks market forward.

Restraining Factors

The cryogenic tanks market faces certain restraints that impact its growth. One of the key challenges is the high cost associated with the manufacturing and maintenance of cryogenic tanks, making them less accessible to small and medium-sized enterprises. Additionally, the complex nature of handling cryogenic fluids and ensuring their safety poses a significant challenge for end-users. The stringent regulations and standards governing the storage and transportation of cryogenic materials also add to the complexities. Moreover, the limited infrastructure for cryogenic storage and distribution, especially in emerging economies, hinders market growth. Finally, the volatility in raw material prices, such as stainless steel, can affect the overall cost of cryogenic tanks, impacting their adoption in the market.

Market Segmentation

- In 2022, the liquid nitrogen segment accounted for around 26.5% market share

On the basis of the cryogenic liquid type, the global cryogenic tanks market is segmented into liquefied natural gas, liquid nitrogen, liquid oxygen, liquid hydrogen, and others. The liquid nitrogen segment has emerged as the dominant player, holding the largest market share in the cryogenic tanks industry. Several factors contribute to its leading position such as liquid nitrogen is widely used across various industries, including healthcare, food and beverages, electronics, and metallurgy. Its applications range from cryosurgery, cryopreservation, and cryogenic grinding to inert gas purging, rapid freezing, and cooling in industrial processes. Increasing demand for nitrogen gas in various sectors, particularly in the food and beverages industry for packaging and freezing purposes, has bolstered the adoption of liquid nitrogen and, subsequently, cryogenic tanks. Additionally, liquid nitrogen offers several advantages such as its low temperature, inertness, and ability to be easily converted into gas, making it a versatile choice for diverse applications. Moreover, advancements in cryogenic tank design and insulation techniques have further enhanced the storage and transport efficiency of liquid nitrogen, driving its market share. Overall, the wide range of applications and inherent benefits of liquid nitrogen have propelled its dominance in the cryogenic tanks market.

- In 2022, the storage segment dominated with more than 64.8% market share

Based on the type of application, the global cryogenic tanks market is segmented into storage and transportation. The storage segment has emerged as the dominant force in the cryogenic tanks market, capturing the largest market share. Several factors contribute to its significant position. The storage of liquefied gases such as liquid oxygen, nitrogen, helium, and argon is crucial in various industries, including healthcare, aerospace, and industrial processes. The need for reliable and efficient storage solutions to maintain the cryogenic temperatures required for these substances has propelled the demand for cryogenic tanks in the storage segment. Moreover, the growing utilization of liquefied natural gas (LNG) as a cleaner energy source has further driven the demand for cryogenic storage tanks to store and transport LNG. Additionally, the increasing adoption of cryogenic storage tanks in emerging economies and the expansion of LNG infrastructure have boosted the growth of the storage segment. Furthermore, technological advancements in tank design, insulation materials, and safety features have enhanced the storage capabilities and reliability of cryogenic tanks, consolidating the dominance of the storage segment in the cryogenic tanks market.

Regional Segment Analysis of the Cryogenic Tanks Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 29.8% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region dominates the market share in the cryogenic tanks industry for several compelling reasons because this region's robust economic growth has led to increased industrial activities, driving the demand for cryogenic tanks across various sectors. The countries like China, India, Japan, and South Korea have made substantial investments in LNG infrastructure, leading to a surge in the adoption of cryogenic tanks for LNG storage and transportation. The rapid urbanization and expanding middle-class population in the region have spurred the demand for cryogenic tanks in healthcare, food processing, and electronics industries. Moreover, favorable government policies, such as energy diversification plans and environmental regulations promoting clean energy sources, have further accelerated the adoption of cryogenic tanks in the Asia-Pacific region. Additionally, the presence of key market players and ongoing technological advancements contribute to the region's dominance in the cryogenic tanks market share.

Recent Development

- In February 2022, Air Liquide collaborated with Airbus, Korean Air, and Incheon to establish the inaugural roadmap for hydrogen utilization in and around Incheon airport, facilitating the advancement of a hydrogen ecosystem.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cryogenic tanks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Chart Industries

- Cryofab

- INOX India

- Linde PLC

- Air Products

- Cryolor

- Air Water Inc.

- Wessington Cryogenics

- Super Cryogenic Systems Pvt. Ltd.

- FIBA Technologies

- ISISAN

- Suretank Group Ltd.

- Eden Cryogenic LLC

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global cryogenic tanks market based on the below-mentioned segments:

Cryogenic Tanks Market, By Cryogenic Liquid

- Liquefied Natural Gas

- Liquid Nitrogen

- Liquid Oxygen

- Liquid Hydrogen

- Other

Cryogenic Tanks Market, By Application

- Storage

- Transportation

Cryogenic Tanks Market, By End-User

- Manufacturing

- Healthcare

- Food Industry

- Others

Cryogenic Tanks Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?