Global Corporate Wellness Market Size, Share, and COVID-19 Impact Analysis, By Services (Health Risk Assessment, Smoking Cessation, Fitness, Weight/Nutrition Management, Stress Management, Others), By Delivery Model (Onsite, Virtual), By End User (Small-sized Organizations, Medium-sized Organizations, Large Organizations), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Corporate Wellness Market Insights Forecasts to 2032

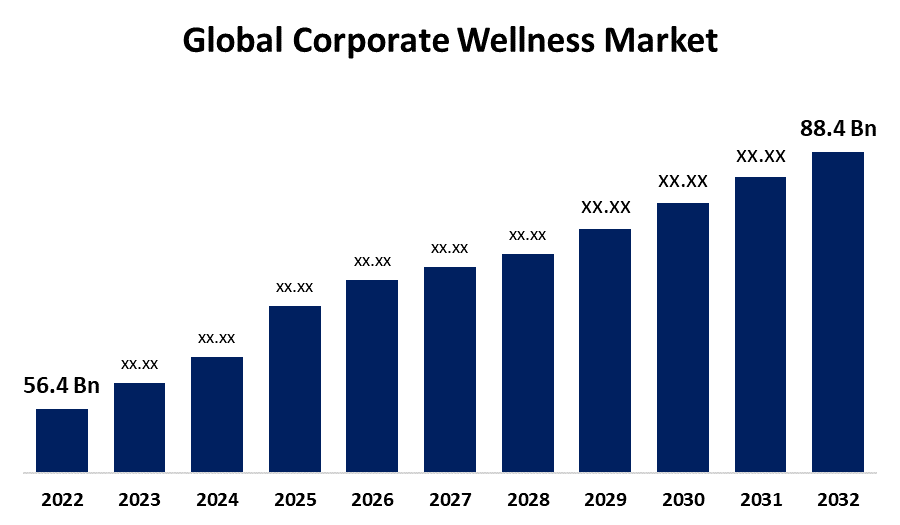

- The Global Corporate Wellness Market Size was valued at USD 56.4 Billion in 2022

- The Market Size is Growing at a CAGR of 4.6% from 2022 to 2032

- The Worldwide Corporate Wellness Market Size is expected to reach USD 88.4 Billion by 2032

- Asia Pacific Market is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Corporate Wellness Market Size is expected to reach USD 88.4 Billion by 2032, at a CAGR of 4.6% during the forecast period of 2022–2032.

The market refers to the industry focused on promoting and improving employee health and well-being within organizations. It includes a wide range of wellness programs and initiatives focused on improving the physical, mental, and emotional health of the workforce. Health risk assessments, fitness and nutrition programs, stress management workshops, mental health support, and ergonomic workplace solutions are examples of corporate wellness offerings. The rise in the prevalence of lifestyle-related diseases such as obesity, diabetes, and stress-related disorders has increased the need for preventive health measures, driving demand for the corporate wellness market during the forecast period. Recent global market trends include the use of digital and virtual wellness solutions to accommodate remote work arrangements, the incorporation of data analytics to measure program effectiveness, and an increase in collaboration between employers and healthcare providers to provide comprehensive and personalized wellness experiences to employees.

Global Corporate Wellness Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 56.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.6% |

| 2032 Value Projection: | USD 88.4 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Services, By Delivery Model, By End User, By Region |

| Companies covered:: | ComPsych Corporation, Privia Health, Virgin Pulse, EXOS, Marino Wellness, Vitality, Wellsource, Inc., Central Corporate Wellness, Truworth Wellness, Wellness Corporate Solutions, SOL Wellness, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Organizations are increasingly implementing corporate wellness programs to improve employee health and productivity, reduce health risks, and lower employee healthcare costs. Companies are becoming more conscious of the importance of having a mentally and physically healthy workforce. As a result, corporations have increased their investments in employee wellness programs, solutions, and services. Furthermore, an increase in the prevalence and early onset of chronic diseases, as well as a decrease in employee healthcare costs, are driving market growth. Because of today's work culture, the majority of people do not have enough time to engage in mental and physical activities after work or in free time, resulting in health problems. Chronic diseases pose a significant global threat, as the prevalence of many of these disorders continues to rise. Hence, corporate wellness programs driving the market growth during the forecast period.

Restraining Factors

Despite an increase in the adoption of workplace wellness programs, implementing corporate wellness programs in low- and middle-income countries presents several challenges. Various factors, such as low awareness, budget constraints, privacy concerns, lack of confidence, and others, are impeding employer and employee acceptance of these programs.

Market Segmentation

By Services Insights

The health risk assessment segment is expected to hold the largest share of the global corporate wellness market during the forecast period.

Based on the services, the global corporate wellness market is classified into health risk assessment, smoking cessation, fitness, weight/nutrition management, stress management, and others. Among these, the health risk assessment segment is expected to hold the largest share of the corporate wellness market during the forecast period. Corporate employee health programs primarily consist of screening activities to identify health risks and the implementation of appropriate interventional strategies to encourage employees to live a healthy lifestyle. More than 80% of employers who provide employee well-being services decide to assess their employee's health risks. Proceeding to implement appropriate strategies and promoting a healthy lifestyle among employees. Companies are launching various health risk assessment programs, which are driving segmental growth during the forecast period.

By Delivery Model Insights

The virtual segment is witnessing significant CAGR growth over the forecast period.

Based on the delivery model, the corporate wellness market is segmented into onsite and virtual. Among these, the virtual segment holds the significant CAGR growth over the forecast period. The outbreak of the COVID-19 pandemic has shifted the preference toward virtual workplace wellness, raising employer adoption for improving employee efficiency. Furthermore, the growing number of employees who work from home is contributing to the rising demand for virtual wellness programs.

By End User Insights

The large organizations segment is witnessing substantial CAGR growth over the forecast period.

Based on the end user, the corporate wellness market is segmented into small-sized organizations, medium-sized organizations, and large organizations. Among these, the large organizations segment holds the market with substantial CAGR growth over the forecast period. The rising investment by companies in wellness programs for their employees is one of the key factors supporting the segment growth. The growing awareness among large organizations and employers to incorporate wellness programs to improve team members work efficiency and work culture also promotes segment growth during the forecast period.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market share over the forecast period. Employees' shifting preferences toward companies with workplace wellness programs, increased adoption of these programs by employees to improve employee engagement and reduce absenteeism, the launch of new workplace wellness programs by companies, and other factors are expected to drive market growth in the North American region Moreover, according to the RAND employer survey, roughly half of employers in the United States offer wellness programs to their employees. Employers with a larger workforce provide more complex wellness programs. Furthermore, the significant dominance of the office culture influences the region's business owners to incorporate such services to help their employees' health.

Europe corporate wellness market accounts for the second-largest market share during the forecast period. The increasing number of initiatives launched in the region to promote workplace wellness is a significant factor driving market growth. Furthermore, the increasing adoption of these services by businesses to improve workplace efficiency contributes to the Europe market growth during the forecast period.

Asia Pacific corporate wellness market is expected to grow at the highest CAGR during the forecast period. Some of the factors contributing to regional growth include an increase in the number of companies in the region, increased employee awareness of workplace wellness, and increased adoption of these services by employers to reduce work-related health problems.

List of Key Market Players

- ComPsych Corporation

- Privia Health

- Virgin Pulse

- EXOS

- Marino Wellness

- Vitality

- Wellsource, Inc.

- Central Corporate Wellness

- Truworth Wellness

- Wellness Corporate Solutions

- SOL Wellness

Key Market Developments

- In October 2022, Exos launched a new digital application called "The Game Changer" to reduce stress and increase employees' enthusiasm for their jobs.

- In September 2022, Procter & Gamble India launched the "Happy Minds 2.0" mental health program for its employees. The initiative offers workplace counseling services.

- In August 2021, TRX, a functional fitness company, launched a corporate digital program called "TRX for Employee Wellbeing." The company provides live workout classes through these fitness programs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global corporate wellness market based on the below-mentioned segments:

Corporate Wellness Market, Services Analysis

- Health Risk Assessment

- Smoking Cessation

- Fitness

- Weight/Nutrition Management

- Stress Management

- Others

Corporate Wellness Market, Delivery Model Analysis

- Onsite

- Virtual

Corporate Wellness Market, End User Analysis

- Small-sized Organizations

- Medium-sized Organizations

- Large Organizations

Corporate Wellness Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?