Global Compounding Pharmacies Market Size, Share, and COVID-19 Impact Analysis, By Therapeutic Area (Hormone Replacement Therapy, Pain Management, Specialty Drugs, Dermatology, Nutritional Supplements, and Others), By Age Cohort (Pediatric, Adult, and Geriatric), By Compounding Type (Pharmaceutical Ingredient Alteration, Currently Unavailable Pharmaceutical Manufacturing, Pharmaceutical Dosage Alteration, and Others), By Sterility (Sterile and Non-sterile), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: HealthcareGlobal Compounding Pharmacies Market Size Insights Forecasts to 2032

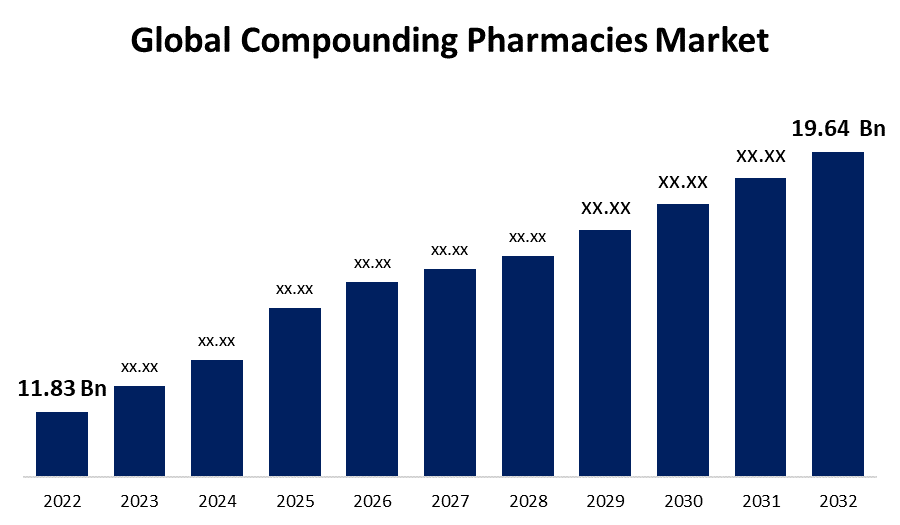

- The Compounding Pharmacies Market Size was valued at USD 11.83 Billion in 2022.

- The Market is Growing at a CAGR of 5.2% from 2022 to 2032

- The Worldwide Compounding Pharmacies Market Size is expected to reach USD 19.64 Billion by 2032

- Asia-Pacific is expected to grow fastest during the forecast period

Get more details on this report -

The Global Compounding Pharmacies Market Size expected to reach USD 19.64 Billion by 2032, at a CAGR of 5.2% during the forecast period 2022 to 2032.

Market Overview

Compounding pharmacies are specialized facilities that prepare customized medications to cater to individual patient needs. Unlike standard pharmacies that dispense mass-produced drugs, compounding pharmacies formulate medications from scratch, allowing for personalized dosages, ingredients, and delivery methods. These pharmacies play a crucial role in providing tailored solutions for patients who cannot tolerate certain ingredients in commercially available medications, require unique dosage forms, or need specific combinations of drugs. Compounding pharmacists work closely with healthcare providers to create prescriptions that address patients' unique medical requirements.

Report Coverage

This research report categorizes the market for compounding pharmacies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the compounding pharmacies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the compounding pharmacies market.

Global Compounding Pharmacies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.83 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.2% |

| 2032 Value Projection: | USD 19.64 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Therapeutic Area, By Age Cohort, By Sterility, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Walgreen Co., JL Diekman and AQ Touchard, Fagron, Albertsons Companies, The London Specialist Pharmacy Ltd., Galenic Laboratories Limited, Aurora Compounding, MEDS Pharmacy, Apollo Clinical Pharmacy, Formul8, Fusion Apothecary, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The compounding pharmacies market is driven by a confluence of factors that collectively shape its growth and significance in the healthcare industry. A primary driver is the rising demand for personalized medicine, as patients increasingly seek tailored treatments that match their specific medical needs, allergies, and preferences. This demand is further fueled by the limitations of mass-produced medications, which might not cater to diverse patient requirements. Additionally, the prevalence of chronic diseases and conditions, such as hormone imbalances, pain management, and dermatological issues, has necessitated specialized treatments that can be uniquely compounded. Another driver is the expanding geriatric population, as elderly individuals often require customized dosages and formulations due to their altered metabolism and potential difficulty in swallowing conventional pills. Furthermore, compounding pharmacies play a vital role in pediatric care by enabling the preparation of child-friendly medications in appropriate dosages and flavors. The compounding pharmacies market also responds to the limitations of commercial drug formulations. Certain patients may be allergic to specific ingredients like dyes, gluten, or preservatives found in mass-produced drugs. Compounding pharmacists can formulate medications that exclude these allergens, ensuring patient safety and adherence. Moreover, compounding allows for the creation of medications in unique forms such as creams, gels, troches, and lozenges, expanding treatment options for patients who have difficulty with traditional delivery methods. The ongoing advancements in pharmaceutical technology and compounding practices are yet another driver of market growth. Innovations in compounding equipment, techniques, and quality assurance processes enhance the precision, consistency, and safety of compounded medications. However, regulatory frameworks also influence the market, as evolving guidelines help ensure the quality, safety, and efficacy of compounded products, thereby fostering trust among healthcare professionals and patients.

Restraining Factors

The compounding pharmacies market faces constraints stemming from regulatory challenges, as varying guidelines can lead to inconsistencies in quality and safety. Additionally, concerns about standardized dosing and potential lack of evidence-based efficacy might hinder market growth. The industry's expansion is also impeded by the need for specialized compounding facilities and trained professionals, which can limit accessibility and scalability. Moreover, insurance coverage limitations for compounded medications and the potential risk of contamination or errors pose further restraints, highlighting the importance of stringent quality control measures and standardized practices in this sector.

Market Segmentation

- In 2022, the pain management segment accounted for around 32.6% market share

On the basis of the therapeutic area, the global compounding pharmacies market is segmented into hormone replacement therapy, pain management, specialty drugs, dermatology, nutritional supplements, and others. The dominance of the pain management segment in the compounding pharmacies market can be attributed to persistent global concerns about pain, both acute and chronic, which have spurred demand for tailored pain relief solutions that suit individual patient needs. Compounded medications allow for precise formulation adjustments, combining various pain-relieving agents to maximize efficacy and minimize side effects. With rising cases of conditions like musculoskeletal disorders and neuropathic pain, compounded pain management medications have gained traction. This segment's success also reflects the growing recognition among healthcare professionals and patients about the advantages of personalized pain management approaches.

- The adult segment held the largest market with more than 42.4% revenue share in 2022

Based on the age cohort, the global compounding pharmacies market is segmented into pediatric, adult, and geriatric. The adult segment's dominance in the compounding pharmacies market is primarily due to the higher incidence of chronic diseases and complex medical conditions among the adult population. Adults often require customized medications to address specific health needs, allergies, and dosage preferences. Compounded medications enable precise tailoring of treatments, making them particularly suitable for adult patients with unique medical requirements. Additionally, the aging population and increased awareness of personalized healthcare solutions have further amplified the demand for compounded medications among adults, solidifying the segment's position as a revenue leader in the market.

- The pharmaceutical ingredient alteration segment held the largest market with more than 34.6% revenue share in 2022

Based on the compounding type, the global compounding pharmacies market is segmented into pharmaceutical ingredient alteration, currently unavailable pharmaceutical manufacturing, pharmaceutical dosage alteration, and others. The Pharmaceutical Ingredient Alteration segment's dominance in the compounding pharmacies market can be attributed to its pivotal role in addressing patient-specific requirements. This segment involves modifying pharmaceutical ingredients to create customized medications that suit individual needs, whether due to allergies, intolerances, or specific dosing requirements. Compounding pharmacies excel in altering ingredients to exclude allergens or unnecessary components, ensuring patient safety and efficacy. As the demand for personalized medicine rises, this segment gains prominence for its ability to provide tailored solutions, positioning it as a key driver of market growth and revenue.

- The sterile segment held the largest market with more than 54.5% revenue share in 2022

Based on the sterility, the global compounding pharmacies market is segmented into sterile and non-sterile. The dominance of the sterility segment in the compounding pharmacies market is attributed to the paramount importance of ensuring patient safety and product efficacy. Sterility is a critical factor in compounding, as contaminated medications can pose serious health risks. This segment encompasses stringent quality control measures to maintain aseptic conditions during formulation. With regulatory bodies emphasizing the need for safe compounded medications, the sterility segment's significance has grown. Patients and healthcare providers alike prioritize sterile compounded products, driving the segment's market share and highlighting its role in maintaining the integrity of customized medications.

Regional Segment Analysis of the Compounding Pharmacies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

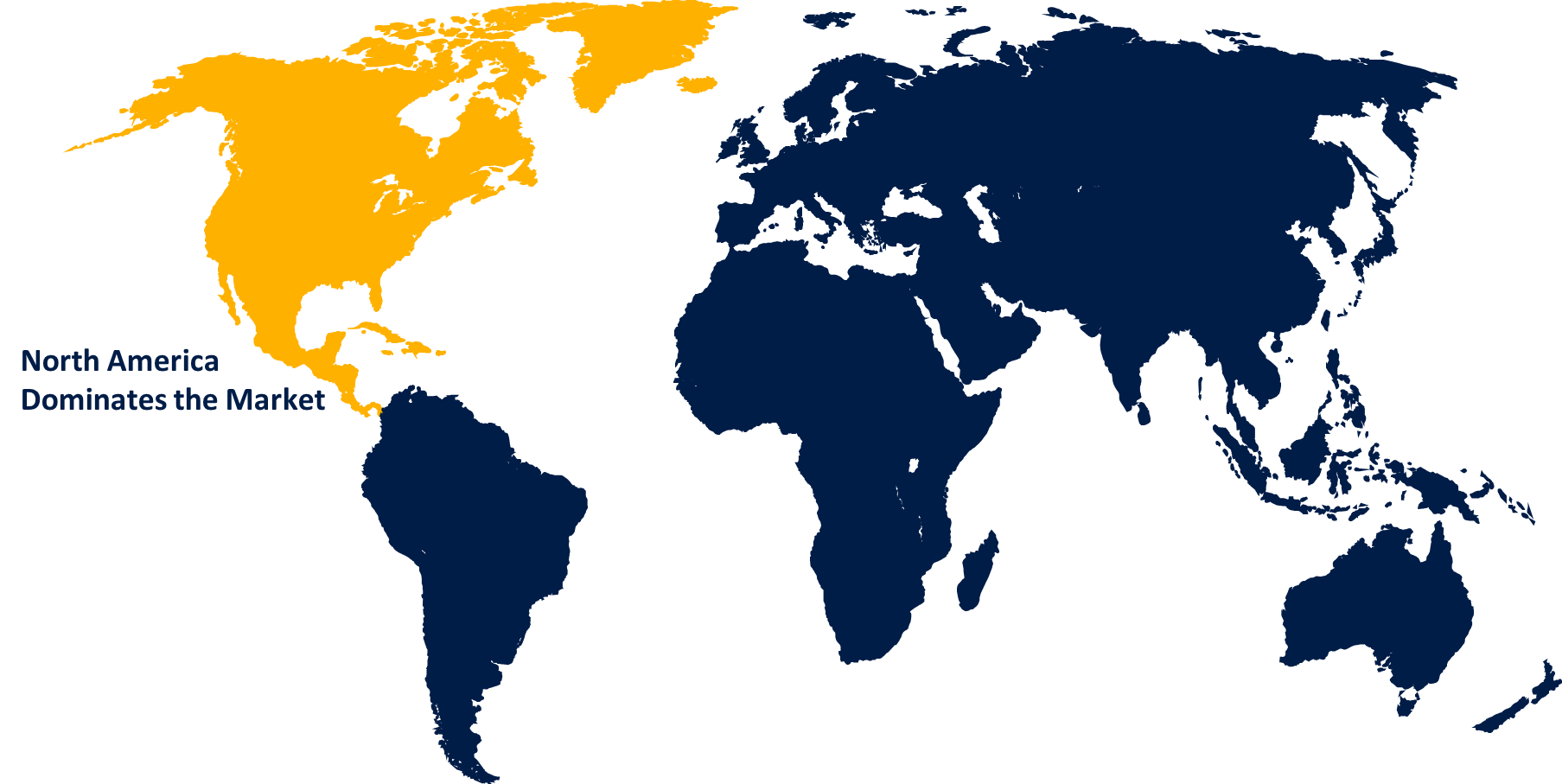

North America dominated the market with more than 40.7% revenue share in 2022.

Get more details on this report -

Based on region, North America holds the largest share due to advanced healthcare infrastructure, high prevalence of chronic diseases, and demand for personalized treatments contribute to its dominance. Additionally, stringent regulatory frameworks ensure quality and safety in compounded medications, fostering trust among patients and healthcare providers. The presence of well-established compounding pharmacies and increasing awareness among consumers about the benefits of customized medications further propels North America's market share.

Asia Pacific region is expected to experience the fastest growth rate in the compounding pharmacies market during the forecast period. This growth is driven by factors such as the increasing prevalence of chronic diseases, the expanding geriatric population, and the growing demand for personalized healthcare solutions. Rapid urbanization, improving healthcare infrastructure, and rising disposable incomes further contribute to the region's growth potential.

Recent Developments

- In February 2023, Harrow, a well-known eye care pharmaceutical company in the United States, has announced the availability of its patent-pending next-generation compounded Atropine formulations via ImprimisRx.

- In July 2022, Fresenius Kabi sold Fagron a 503B outsourcing plant in Boston. Fagron has expanded its sterile compounding presence in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global compounding pharmacies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Walgreen Co.

- JL Diekman and AQ Touchard

- Fagron

- Albertsons Companies

- The London Specialist Pharmacy Ltd.

- Galenic Laboratories Limited

- Aurora Compounding

- MEDS Pharmacy

- Apollo Clinical Pharmacy

- Formul8

- Fusion Apothecary

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global compounding pharmacies market based on the below-mentioned segments:

Compounding Pharmacies Market, By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

Compounding Pharmacies Market, By Age Cohort

- Pediatric

- Adult

- Geriatric

Compounding Pharmacies Market, By Compounding Type

- Pharmaceutical Ingredient Alteration

- Currently Unavailable Pharmaceutical Manufacturing

- Pharmaceutical Dosage Alteration

- Others

Compounding Pharmacies Market, By Sterility

- Sterile

- Non-sterile

Compounding Pharmacies Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?