Global Composites In Oil & Gas Industry Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Epoxy, Composites, Polyester, Phenolic), By Fiber Type (Carbon, Glass, and Others), By Application (Pipes, Tanks, Top Side Applications, Pumps & Compressors), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Composites In Oil & Gas Industry Market Insights Forecasts to 2032

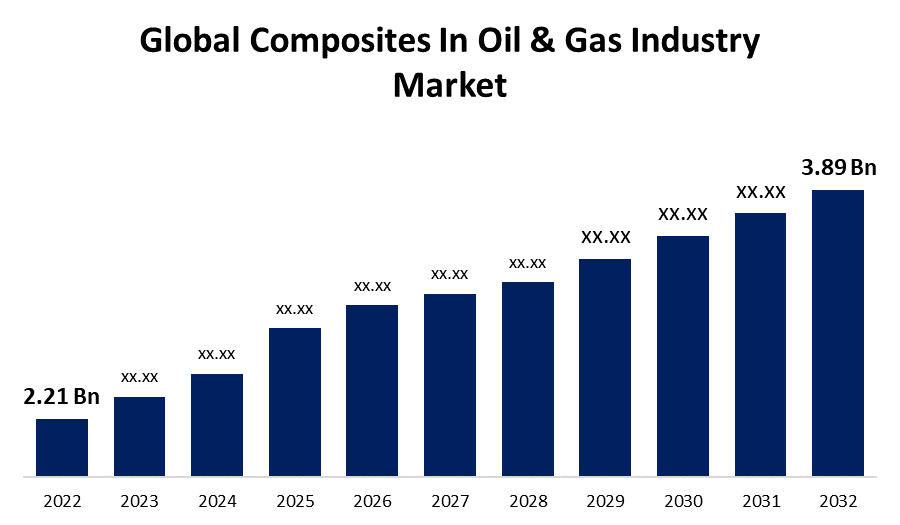

- The Global Composites In Oil & Gas Industry Market Size was valued at USD 2.21 Billion in 2022.

- The Market is Growing at a CAGR of 5.8% from 2022 to 2032.

- The Worldwide Composites In Oil & Gas Industry Market Size is expected to reach USD 3.89 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Composites In Oil & Gas Industry Market size is anticipated to exceed USD 3.89 Billion by 2032, Growing at a CAGR of 5.8% from 2022 to 2032. Composites' superior properties, such as lightweight, corrosion as well as resistance to chemicals, excellent mechanical strength, and minimal maintenance cost, have increased demand in the oil and gas industry.

Market Overview

Composites are manufactured in the oil and gas industry through the combination of different components in a matrix. Glass fibers, carbon fibers, or aramid fibers are used in the most common composites, which are made with an epoxy, phenolic, or polymer matrix. Certain technical, technological, and economic requirements must be met by the oil and gas industry. This is most noticeable in building materials, which must withstand corrosion, fatigue, and weight. Composites are used in the oil and gas industry because of their unique properties, such as light weight, corrosion resistance, and low installation costs, which make them suitable for demanding applications. They have the advantage of being light, which eliminates the need for bulky and expensive buoyancy tanks. Composites have been used in a variety of applications in the oil and gas industry, including structures such as piping structures, risers, jumpers, gratings, walkways, ladders, handrails, flooring, decking, flexible tubes, composite riders, caissons, accumulator bottles, BOP, and others. The market is growing due to multiple benefits such as lightweight, corrosion and resistance to chemicals, excellent mechanical strength, and low maintenance cost.

Report Coverage

This research report categorizes the market for the global composites in oil & gas industry market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the composites in oil & gas industry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the composites in oil & gas industry market.

Global Composites In Oil & Gas Industry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.21 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.8% |

| 2032 Value Projection: | USD 3.89 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Resin Type, By Fiber Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Baker Hughes, Strohm, NOV Inc., SLB (Schlumberger N.V.), DOW, Halocarbon, LLC, Halliburton, Shawcor, TechnipFMC plc, Freudenberg SE, The Chemours Company, Metalubgroup, Weatherford, Future Pipe Industries, Saudi Arabian Amiantit Co. and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for lightweight and durable materials in the oil and gas industry is one of the major drivers of the oil and gas composites market. Furthermore, rising demand for glass-fiber reinforced polymer composite in piping systems will drive market value growth during the forecasted period. Composites have several advantages over traditional materials like steel and aluminum, such as a high strength-to-weight ratio, corrosion resistance, and the ability to withstand high temperatures and pressures. Composites are also simpler to install and maintain, which can help oil and gas companies cut costs.

Restraining Factors

The high cost of composite materials in comparison to traditional materials such as steel and aluminium is a major restraint for the oil and gas composites market. Composites are frequently more expensive to produce, and their installation may necessitate specialized equipment and expertise, which can raise the overall cost of using them in oil and gas applications. Furthermore, the long-term performance and durability of composites in harsh oil and gas environments are still unknown, which may make some companies hesitant to use them.

Market Segmentation

The Global Composites In Oil & Gas Industry Market share is classified into resin type, fiber type, and application.

- The epoxy segment is expected to hold the largest share of the global composites in oil & gas industry market during the forecast period.

The global composites in oil & gas industry market is categorized by resin type into epoxy, composites, polyester, and phenolic. Among these, the epoxy segment is expected to hold the largest share of the global composites in oil & gas industry market during the forecast period. Epoxy resin demand for pipe and pipeline coatings, storage tanks and vessel applications, Epoxy resin composites are used to build offshore structures like risers, platforms, and marine equipment. They provide superior resistance to corrosion and durability in harsh marine conditions. They have a high strength-to-weight ratio, are stiff, and are long-lasting. These elements will contribute to market growth.

- The glass segment is expected to hold the largest share of the global composites in oil & gas industry market during the forecast period.

Based on the fiber type, the global composites in oil & gas industry market is divided into carbon, glass, and others. Among these, the glass segment is expected to hold the largest share of the global composites in oil & gas industry market during the forecast period. The expansion can be attributed to its use in a variety of applications, including frac plugs, frac balls, handrails, ladders, tanks, and others. Furthermore, the low cost of glass fiber composites, combined with their exceptional characteristics such as excellent mechanical durability, mobility, and lightweight, is driving their increasing demand in the oil and gas industry.

- The pipes segment is expected to grow at the fastest pace in the global composites in oil & gas industry market during the forecast period.

Based on the application, the global composites in oil & gas industry market is divided into pipes, tanks, top side applications, and pumps & compressors. Among these, the pipes segment is expected to grow at the fastest pace in the global composites in oil & gas industry market during the forecast period. The growth can be attributed to composite pipe properties such as resistance to crude oil, paraffin build-up, and the capacity to support relatively high pressure in harsh operating environments.

Regional Segment Analysis of the Global Composites In Oil & Gas Industry Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global composites in oil & gas industry market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global composites in oil & gas industry market over the predicted years. North America has been a leader in the use of composites in the oil and gas industry. With its well-established exploration and production operations, the United States, in particular, leads the region. The need to replace aging infrastructure and pipelines that are prone to corrosion and leaks is driving demand for composites. Furthermore, the shale gas revolution has created new opportunities for composite materials, particularly in unconventional drilling methods. Adoption of composites is aided by regulatory support for environmentally friendly practices, as they are lighter, more durable, and resistant to chemical degradation.

Asia Pacific is expected to grow at the fastest pace in the global composites in oil & gas industry market during the forecast period. The Asia-Pacific region has experienced a surge in composites adoption in the oil and gas industry, owing to rapid industrialization, urbanization, and rising energy demand. Countries like China, India, and Australia are heavily investing in oil and gas infrastructure development, particularly in offshore fields. Composites are being used to improve the performance and longevity of harsh-environment equipment. Furthermore, rising environmental awareness and the need for energy-efficient solutions are driving up demand for lightweight composites in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global composites in oil & gas industry along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baker Hughes

- Strohm

- NOV Inc.

- SLB (Schlumberger N.V.)

- DOW

- Halocarbon, LLC

- Halliburton

- Shawcor

- TechnipFMC plc

- Freudenberg SE

- The Chemours Company

- Metalubgroup

- Weatherford

- Future Pipe Industries

- Saudi Arabian Amiantit Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, NOV and Aker Solutions have signed an innovative long-term technology cooperation agreement to optimize Subsea system solutions for long-term oil and gas production.

- In November 2022, Strohm, a leading producer of Thermoplastic Composite Pipes (TCP), has received a contract from ECOnnect to supply more than 11 kilometres of TCP for the TES Wilhelmshaven Green Gas Terminal in Germany.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Composites In Oil & Gas Industry Market based on the below-mentioned segments:

Global Composites In Oil & Gas Industry Market, By Resin Type

- Epoxy

- Composites

- Polyester

- Phenolic

Global Composites In Oil & Gas Industry Market, By Fiber Type

- Carbon

- Glass

- Others

Global Composites In Oil & Gas Industry Market, By Application

- Pipes

- Tanks

- Top Side Applications

- Pumps & Compressors

Global Composites In Oil & Gas Industry Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?