Global Cold Milling Machine Market Size, Share, and COVID-19 Impact Analysis, By Type (Crawler and Wheel), By Power (Below 300 kW, 300 kW to 500 kW, and Above 500 kW), By Application (Concrete Rehabilitation and Asphalt Rehabilitation), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Machinery & EquipmentGlobal Cold Milling Machine Market Insights Forecasts to 2032

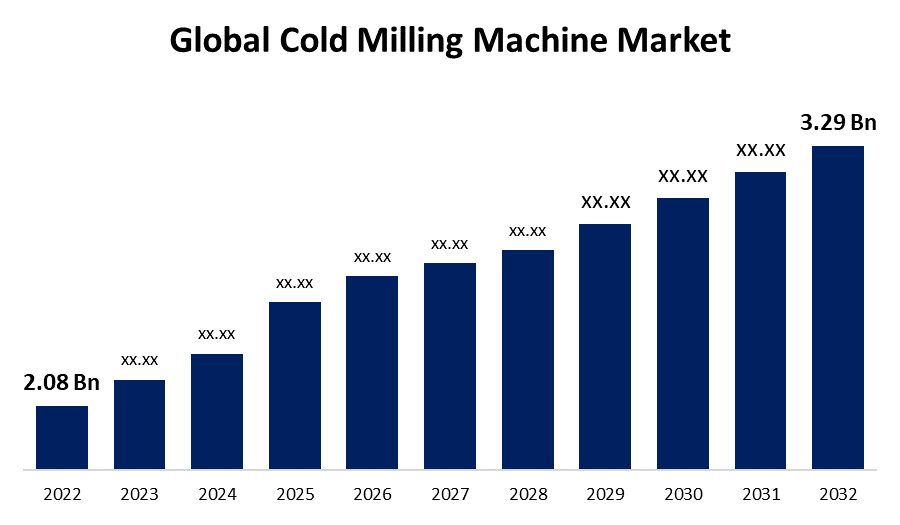

- The Global Cold Milling Machine Market Size was valued at USD 2.08 Billion in 2022.

- The Global Cold Milling Machine Market market Size is growing at a CAGR of 4.7% from 2023 to 2032

- The Worldwide Cold Milling Machine Market Size is expected to reach USD 3.29 Billion by 2032

- Europe is expected to grow significant during the forecast period

Get more details on this report -

The Global Cold Milling Machine Market Size is expected to reach USD 3.29 Billion by 2032, at a CAGR of 4.7% during the forecast period 2023 to 2032.

Market Overview

A cold milling machine, also known as a pavement profiler, is a heavy-duty construction equipment used to remove the top layer of asphalt or concrete surfaces in preparation for resurfacing or repair work. It is equipped with a large rotating drum that contains numerous cutting teeth or bits, which efficiently grind and remove the pavement material. The machine's cutting depth can be adjusted to remove specific thicknesses of the surface, allowing for precise control over the milling process. Cold milling machines are commonly used in road construction and maintenance projects to improve the surface quality, restore proper drainage, and create a smooth and even base for new pavement layers. They offer high productivity, versatility, and accuracy, enabling efficient removal of old pavement while minimizing disruptions to traffic flow. Additionally, modern cold milling machines often feature advanced technology, such as automated controls and GPS systems, to enhance precision and efficiency during operation.

Report Coverage

This research report categorizes the market for cold milling machine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cold milling machine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the cold milling machine market.

Global Cold Milling Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.08 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.7% |

| 2032 Value Projection: | USD 3.29 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Power, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Deere & Company, Caterpillar Inc., Astec Industries Inc., SANY Group, Fayat Group, CMI Roadbuilding Limited, Sakai Heavy Industries Limited, Komatsu Ltd., CNH Industrial NV, Simex SRL, Kubota Corporation, Volvo Construction Equipment, Liugong Machinery Co., Ltd., and J C Bamford Excavators Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The cold milling machine market is driven by the growing need for infrastructure development and maintenance projects, particularly in emerging economies, fuels the demand for cold milling machines. These machines play a vital role in road construction and rehabilitation activities. The increasing emphasis on improving road quality and durability drives the market, as cold milling machines are used to remove damaged or deteriorated pavement layers. Moreover, the rising focus on sustainable practices and environmental regulations promotes the adoption of cold milling machines, as they offer efficient material recycling capabilities. Additionally, technological advancements in milling machine design, such as automated controls and GPS systems, enhance productivity and accuracy, driving market growth. Lastly, government initiatives and investments in transportation infrastructure further contribute to the expansion of the cold milling machine market.

Restraining Factors

The cold milling machine market also faces certain restraints that impact its growth, the high initial investment required to acquire cold milling machines acts as a barrier for small and medium-sized contractors, limiting market penetration. Additionally, the maintenance and operating costs associated with these machines can be substantial, further hindering their adoption. Moreover, the availability of alternative pavement removal methods, such as chemical treatments or hot milling, can limit the demand for cold milling machines. Furthermore, factors like unpredictable weather conditions and seasonal variations in construction activities can affect the market, as these machines are predominantly used in outdoor projects. Lastly, regulatory hurdles and compliance requirements related to emissions and noise pollution pose challenges for cold milling machine manufacturers and users.

Market Segmentation

- In 2022, the crawler segment accounted for around 70.2% market share

On the basis of the type, the global cold milling machine market is segmented into crawler and wheel. The crawler track type segment has emerged as a leader in the cold milling machine market. This segment is characterized by machines equipped with crawler tracks instead of wheels for mobility. Several factors contribute to its dominance, crawler track-type machines offer superior maneuverability and stability, especially in challenging terrains and uneven surfaces. The tracks distribute the machine's weight evenly, reducing ground pressure and minimizing the risk of sinking or getting stuck, making them ideal for road construction projects in various conditions. The crawler track-type machines provide better traction, allowing them to effectively navigate steep gradients and slippery surfaces. This capability is particularly crucial in hilly or mountainous regions where road construction often takes place. Furthermore, crawler track-type machines have the advantage of a larger surface area in contact with the ground, enabling enhanced stability and minimizing surface damage. This feature is particularly beneficial for delicate or sensitive surfaces like airport runways or bridge decks. Additionally, crawler track-type machines offer higher ground clearance, enabling them to work on rough terrain without obstruction. They can easily traverse obstacles like curbs, manholes, and debris, thereby improving efficiency and reducing downtime. Overall, the crawler track type segment leads the cold milling machine market due to its superior mobility, stability, and adaptability in diverse working environments.

- In 2022, the concrete rehabilitation segment dominated with more than 40.3% market share

Based on the application, the global cold milling machine market is segmented into concrete rehabilitation and asphalt rehabilitation. The concrete rehabilitation segment has emerged as the largest market share holder in the cold milling machine industry. This can be attributed to several significant factor, the aging infrastructure, particularly concrete roads and pavements, requires regular maintenance and rehabilitation to ensure safety and prolong their lifespan. Cold milling machines play a crucial role in concrete rehabilitation projects by removing the damaged or deteriorated surface layer efficiently and precisely. The concrete rehabilitation projects often involve the need for accurate and controlled milling depths to achieve the desired results. Cold milling machines offer adjustable cutting depths, allowing contractors to remove the precise thickness of concrete required for the rehabilitation process. This precision contributes to the segment's dominance in the market. Additionally, the increasing focus on sustainable construction practices has led to a rise in the demand for cold milling machines in concrete rehabilitation. These machines enable the recycling and reuse of milled materials, reducing waste and promoting environmental conservation. Moreover, the high durability and strength of concrete make it a preferred material for various infrastructural applications. As a result, the demand for concrete rehabilitation projects remains substantial, driving the market share of the segment. Overall, the need for efficient and precise concrete rehabilitation, combined with the advantages offered by cold milling machines, has positioned the concrete rehabilitation segment as the largest market share holder in the cold milling machine industry.

Regional Segment Analysis of the Cold Milling Machine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

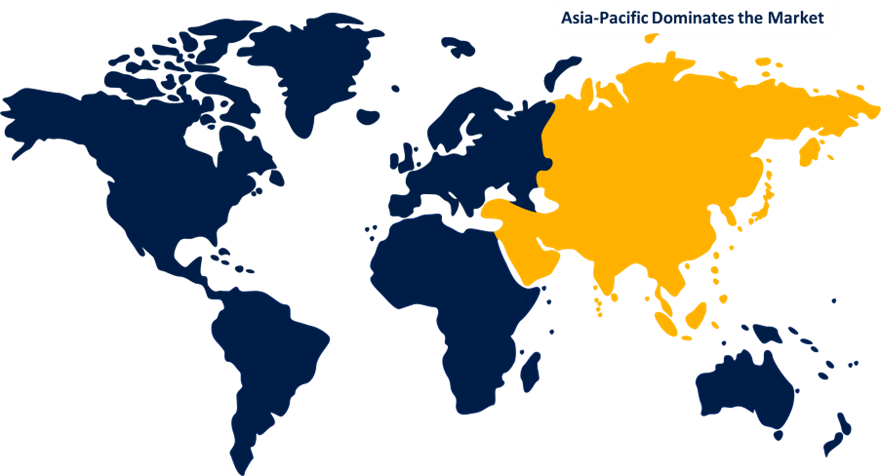

Asia-Pacific dominated the market with more than 38.5% revenue share in 2022.

Get more details on this report -

Based on region, the Asia Pacific region has emerged as a leading market for cold milling machines. Several factors contribute to this prominent position, the region is witnessing rapid urbanization and infrastructural development, leading to an increased demand for road construction and rehabilitation projects. As cold milling machines are essential for such activities, their demand has surged in the region. The governments in countries like China, India, and Southeast Asian nations have implemented extensive transportation infrastructure development plans, resulting in significant investments in road construction. Additionally, the availability of a vast labor force and lower manufacturing costs in the region have attracted major cold milling machine manufacturers to set up production facilities, further driving the market. Moreover, the presence of a large number of road contractors and construction companies in the region contributes to the substantial demand for cold milling machines. Overall, these factors have positioned Asia Pacific as a key player in the cold milling machine industry.

Recent Developments

- In March 2023, Astec Industries, Inc. debuted its most recent asphalt cold planer at the CONEXPO-CON/AGG convention in Las Vegas, Nevada, the U.S. RX-405 cold planer is ideal for contractors searching for smaller equipment. Because of its adaptability and flexibility, the RX-405 machine is employed for a variety of applications.

- In January 2022, Wirtgen Group has released three new one-meter compact cold milling machine types for European customers. The new Wirtgen W100 Fi, W120 Fi, and W130 Fi models have working widths of 1.0 m, 1.2 m, and 1.3 m, respectively. Each of the three variants features a Stage V-compliant 265kW John Deere diesel engine.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cold milling machine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Deere & Company

- Caterpillar Inc.

- Astec Industries Inc.

- SANY Group

- Fayat Group

- CMI Roadbuilding Limited

- Sakai Heavy Industries Limited

- Komatsu Ltd.

- CNH Industrial NV

- Simex SRL

- Kubota Corporation

- Volvo Construction Equipment

- Liugong Machinery Co., Ltd.

- J C Bamford Excavators Ltd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global cold milling machine market based on the below-mentioned segments:

Cold Milling Machine Market, By Type

- Crawler

- Wheel

Cold Milling Machine Market, By Power

- Below 300 kW

- 300 kW to 500 kW

- Above 500 kW

Cold Milling Machine Market, By Application

- Concrete Rehabilitation

- Asphalt Rehabilitation

Cold Milling Machine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?