Global Cold Chain Transportation Market Size, Share, and COVID-19 Impact Analysis, By Type (Storage, Transportation, Monitoring Components), By Application (Fruits & Vegetables, Fish, Meat, and Seafood, Dairy & Frozen Desserts, Bakery & confectionery, Processed Food, Pharmaceuticals, Others), By Equipment (Storage Equipment, Transportation Equipment), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: Automotive & TransportationGlobal Cold Chain Transportation Market Insights Forecasts to 2030

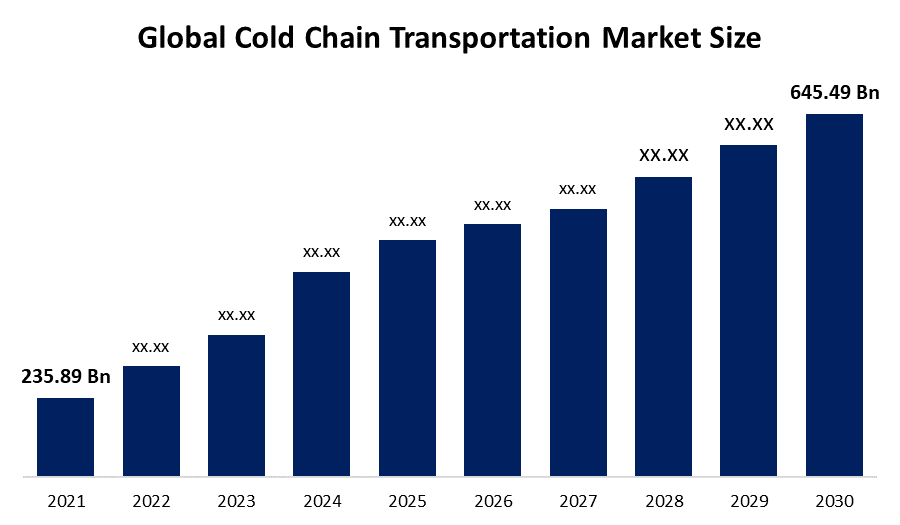

- The Global Cold Chain Transportation Market was valued at USD 235.89 billion in 2021

- The market is growing at a CAGR of 11.87% from 2022 to 2030

- The Global Cold Chain Transportation Market size is expected to reach USD 645.49 billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Cold Chain Transportation Market is expected to reach USD 645.49 billion by 2030, at a CAGR of 11.87% during the forecast period 2022 to 2030. This expansion is primarily due to increased demand for temperature-controlled storage and transportation in various industries such as food, chemicals, and pharmaceuticals. The globalization of trade has increased the movement of goods across borders. This has fueled the demand for cold chain logistics, which ensures that temperature-sensitive products remain at the required temperature during transportation and storage, regardless of distance or time. The pandemic has emphasised the importance of the cold chain market, especially in the distribution of vaccines and other medical supplies. As a result, the market is expected to expand further during the study period, with significant investments in technology and infrastructure aimed at improving cold chain logistics and ensuring the safe and efficient distribution of temperature-sensitive products.

Market Overview

The cold chain refers to the process of controlling the temperature of perishable goods from the point of origin through the distribution network to the final consumer in order to ensure quality and safety. The major types of cold chains are refrigerated transport and refrigerated warehousing. Refrigerated warehousing, also known as cold storage, is a facility where temperature-controlled products are cooled or stored in order to prevent decay or noncompliance with applicable laws and regulations. Reefer freight and refrigerated transport is the vehicle transporting products using a built-in refrigeration system that helps maintain a desired temperature during the transportation process. The diverse temperature changes used in the cold chain include chilled and frozen. Cold chain storage is used in a variety of industries, including pharmaceutical, healthcare, food and beverage, chemical, and others.

Over the forecast period, the growing use of connected devices and the automation of refrigerated storage facilities around the world are expected to drive industry growth. The growing number of organized retail stores in emerging economies is driving up demand for cold chain solutions. Furthermore, trade liberalization, government initiatives aimed at reducing food waste, and multinational company retail chain expansion are expected to drive industry growth over the projected period. However, the high operational costs of cold chains may act as a market restraint during the forecast period. The operating costs involve energy, electricity, real estate, labour, and other expenses.

Report Coverage

This research report categorizes the market for the global cold chain transportation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cold chain transportation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cold chain transportation market.

Global Cold Chain Transportation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 235.89 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 11.87% |

| 2030 Value Projection: | USD 645.49 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Application, By Equipment, By Region |

| Companies covered:: | Americold Logistics LLC, Agro Merchant Group , Burris Logistics, Inc., Henningsen Cold Storage Company, Lineage Logistics, LLC, Nordic Logistics, Preferred Freezer, Wabash National, Cold Chain Technologies, Inc., Cryopak Industries Inc., Creopack, Cold Box Express, Inc., Intelsius, Nilkamal Limited, Sofrigam, Softbox Systems Ltd., Sonoco ThermoSafe, Valor Industries, va-Q-tec |

Get more details on this report -

Driving Factors

The advancement and development of retail chains and channels in the form of convenience stores, supermarkets, and hypermarkets is a major factor driving the market growth over the predicted period. Food security, food hygiene, economic and ecological sustainability, and limited food waste are massive focus areas in the food industry. Food loss and waste are caused due to different multiple reasons. For instance, perishable products are often exposed to fluctuating temperatures during transportation and handling, which results in food spoilage and wastage. To address this, global demand for refrigerated storage and transportation services has increased. Besides, trade liberalization, government efforts to reduce food waste, and expansion of the organized retail sector in emerging economies are anticipated to boost market growth in the coming years. Aside from food waste, food manufacturers and cold chain service providers must adhere to international standards and specific requirements for maintaining potentially hazardous food at specified temperatures.

Furthermore, rising government subsidies have enabled service providers to enter these emerging markets with innovative transportation solutions. Cold chain services are intended to provide temperature-sensitive products with ideal transportation and storage conditions. The increased demand for perishable products and the need for speed associated with the e-commerce-based food and beverage delivery market have resulted in a significant increase in cold chain operations.

Restraining Factors

The high operational costs of cold chains may act as a market restraint during the predicted period. The operating costs include energy costs, electricity, real-estate costs, labour costs, and others. Cold chain industry development places a substantial burden on the environment since refrigeration is a source of greenhouse gases and is energy-intensive. The food cold chain has implications for the environment and global climate change. Emissions from food cold chain equipment come from both indirect and direct sources. Indirect emissions are caused by the electricity used to power refrigeration equipment, as well as the fuel used to power refrigerated vehicles and generators. The leakage of refrigerant gases into the atmosphere causes direct emissions. As a result, environmental concerns about greenhouse gas emissions are expected to stymie the growth of the cold chain logistics market.

Market Segmentation

The Global Cold Chain Transportation Market share is segmented into type, application, and equipment.

- In 2021, the storage segment held the largest revenue share.

On the basis type, the global cold chain transportation market is categorized into storage, transportation, and monitoring components. Among these, the storage segment held the largest revenue share in 2021 and is anticipated to continue its dominance over the study period. Consumers' changing dietary habits and lifestyles are driving the demand for frozen foods. This is likely to increase demand for storage solutions.

Cold chain systems are essential for delivering food, beverages, and medical supplies. Over the forecast period, demand for high-cube refrigerated trailers, connected refrigerated trucks, insulated containers, and vehicles that favour cross-product transportation is expected to drive the transportation segment.

- The fish, meat, and seafood segment are expected to hold the largest global market over the forecast period.

Based on the application, the global cold chain transportation market is classified into fruits & vegetables, fish, meat, and seafood, dairy & frozen desserts, bakery & confectionery, processed food, pharmaceuticals, and others. Among these, the fish, meat, and seafood segment hold the global market witnessing the highest revenue share. The reason behind the growth is technological developments in the processing, packaging, and storage of seafood. Additionally, a rise in fish production is anticipated to boost segmental growth.

Processed food is expected to be the fastest-growing application segment during the forecast period due to ongoing advancements in packaging materials. Increased shelf life of foods due to advancements and developments in packaging materials. This has increased the trading of processed foods in recent years.

- The storage equipment segment held the largest revenue share of the global market.

On the basis of equipment, the global cold chain transportation market is differentiated into storage equipment and transportation equipment. Among these, the storage equipment segment held the largest revenue share of the global market. The reason behind the growth is, storage equipment plays important role in the refrigerated storage industry as they ensure the quality of products and increase their shelf life. The equipment used includes deep freezers, refrigerators, vaccine carriers, and others. Storage equipment is further categorized into on-grid and off-grid.

Regional Segment Analysis of the Global Cold Chain Transportation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

The North American region holds the largest share of the Global Cold Chain Transportation Market.

Get more details on this report -

North America holds the largest revenue share of more than 37.63% in 2021 and is anticipated to dominate its position throughout the predicted period. Increasing penetration of connected devices and a large consumer base are also anticipated to drive market growth throughout the study period. According to the North American Sustainable Refrigeration Council 2021, HFCs are among the fastest-growing sources of greenhouse gas emissions due to rising global demand for cooling and refrigeration in the residential, commercial, industrial, and transportation sectors. Walmart Inc., for example, is the leading retail corporation in the United States, with nearly 12,127 stores and clubs under 48 banners in 24 countries and e-commerce websites. The growth of such large wholesalers and organised retailers, as well as their expanding regional and global trade operations, is creating growth opportunities for the refrigerated transportation and refrigerated warehousing markets.

However, Asia Pacific is expected to be the fastest-growing regional market throughout the forecast period owing to increasing government investments in logistics infrastructure development and penetration of warehouse management systems. China is a significant contributor to the APAC region's market. Factors such as technological advancements in the packaging, processing, and storage of seafood products are attributed to market growth in China. Rising demand and expanding cold chain infrastructure development have propelled China to the top of the cold chain market. China is currently undergoing a rapid transition from a construction and manufacturing led to a consumer led economy. Rising pharmaceutical innovation in China is also expected to boost demand for cold chain solutions. Another major factor driving market growth is the region's rapid expansion of biopharma. These factors are boosting the market of Asia Pacific during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cold chain transportation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Americold Logistics LLC

- Agro Merchant Group

- Burris Logistics, Inc.

- Henningsen Cold Storage Company

- Lineage Logistics, LLC

- Nordic Logistics

- Preferred Freezer

- Wabash National

- Cold Chain Technologies, Inc.

- Cryopak Industries Inc.

- Creopack, Cold Box Express, Inc.

- Intelsius, Nilkamal Limited

- Sofrigam, Softbox Systems Ltd.

- Sonoco ThermoSafe

- Valor Industries

- va-Q-tec

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, Lineage Logistics acquired Grupo Fuentes, a Spanish transport and cold-store operator. This expansion in Spain will strengthen Lineage's position in Europe's key fresh produce markets. This acquisition will expand Lineage's presence in cold storage distribution across Europe.

- In June 2021, Lineage Logistics, LLC announced plans to acquire Claus Sorensen's cold storage division, a Denmark-based cold storage company. This acquisition aimed to expand Lineage's warehouse network, which contributes to the company's supply chain offering for customers in the Nordic region.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global cold chain transportation market based on the below-mentioned segments:

Global Cold Chain Transportation Market, By Type

- Storage

- Transportation

- Monitoring Components

Global Cold Chain Transportation Market, By Application

- Fruits & Vegetables

- Fish, Meat, and Seafood

- Dairy & Frozen Desserts

- Bakery & confectionery

- Processed Food

- Pharmaceuticals

- Others

Global Cold Chain Transportation Market, By Equipment

- Storage Equipment

- Transportation Equipment

Global Cold Chain Transportation Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?