Global Coiled Tubing Market Size, Share, and COVID-19 Impact Analysis, By Application (Well Intervention, Drilling, and Others), By Operation (Pumping, Circulation, Logging, and Others), By Location (Onshore and Offshore), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Coiled Tubing Market Insights Forecasts to 2030

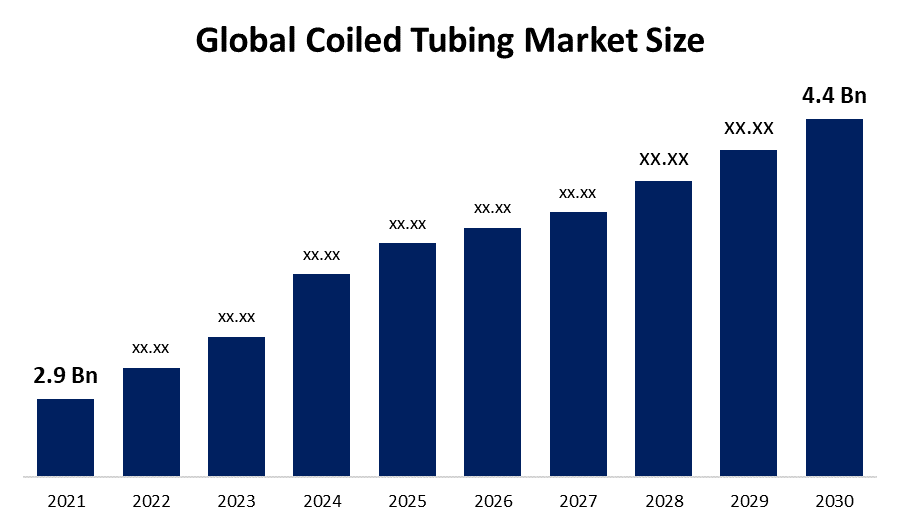

- The Global Coiled Tubing Market Size was valued at USD 2.9 billion in 2021

- The market is growing at a CAGR of 4.7% from 2022 to 2030

- The Global Coiled Tubing Market size is expected to reach USD 4.4 billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Coiled Tubing Market Size is expected to reach USD 4.4 billion by 2030, at a CAGR of 4.7% during the forecast period 2022 to 2030. Upstream companies' increased efforts to improve production from mature fields are driving the coiled tubing industry. The product's ability to lower overall costs in oil and gas exploration is expected to drive market growth during the forecast period. Coiled tubing has several advantages over conventional operations, including faster mobilization, less time spent on pipeline handling while running in and out of the hole, higher work performance, balanced well control, and increased safety. These advantages are expected to propel market growth during the forecast period.

Market Overview

Coiled tubing is a long material pipe and surface equipment that was originally intended to be used in the producing of (live) wells. The use of coiled tubing has expanded beyond traditional applications such as well cleaning and acid stimulation. It is becoming increasingly popular in applications such as coiled tubing drilling, fracturing, subsea, deeper wells, pipelines, and others. This expansion can be attributed to technological advances that have increased the use of coiled tubing in good intervention, drilling, and completion applications. Coiled tubing improves well and reservoir performance. Coiled tubing is used in a variety of applications such as mechanical isolation, milling, drilling, rock fracturing, side-tracking, production tubing, low bottom hole pressure drilling, wellbore cleanout, and tube logging and perforating. Favourable regulatory policies and growing government initiatives and support are also driving the industry. Growing demand from emerging economies, technological advancements, and a significant increase in R&D investments are expected to propel the industry forward during the study period.

The United States dominates the North American coiled tubing market. Because of the conflict between Ukraine and Russia, the country intends to increase its oil and gas production. The United States government is attempting to reduce gas prices by planning new public land for drilling. The government announced in April 2022 that it intends to auction off the lease to drill on 146,319 acres of public land across the country. This decision is projected to increase the country's oil and gas production, resulting in increased use of coiled tubing in the upcoming years.

Report Coverage

This research report categorizes the market for the global coiled tubing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the coiled tubing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the coiled tubing market.

Global Coiled Tubing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2.9 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.7% |

| 2030 Value Projection: | USD 4.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Application, By Operation, By Location, By Region |

| Companies covered:: | Stewart & Stevenson, T&H Lemont, Tenaris, John Lawrie Group, Trident Steel Corporation, Gautam Tube Corporation, HandyTube, National Oilwell Varco, John Lawrie Group, Sandvik AB, Forum Energy Technologies, Inc., Schlumberger, Baker Hughes Company, The Abu Dhabi National Oil Company, CALFRAC WELL SERVICES LTD, Halliburton, Weatherford |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Coiled tubing services are most commonly used in oil well intervention applications because they allow for operations like stimulation, re-perforation, fluid pumping, fishing, sand control, and zonal isolation. NOCs and integrated oil companies have started to increase their global upstream and operational spending. Furthermore, with the rising demand for oil and gas, the oil and gas upstream sector is improving operational activities and increasing output. All of these factors are propelling the coiled tubing market forward.

To meet the rising demand for oil and gas, the United States and the Organization of Petroleum Exporting Countries (OPEC) are expected to increase their investment in exploration and production activities, creating a lucrative market for the energy and power sector. Tubing services will become increasingly popular as a result of the low cost of domestic feedstock and the United States' growing market share in new energy sources. Coiled tubing has several advantages over traditional drilling and workover techniques.

Restraining Factors

Crude oil prices are sensitive to policy changes, volatility in demand and supply, and changes in the global market environment. Crude oil prices have been influenced by the growing awareness of the importance of environmental protection in both developing and developed economies. The maintenance costs associated with providing coiled tubing services are relatively high. As a result, the market's growth is hampered by the volatility of crude oil prices and the high maintenance costs.

Coiled tubing is a subtle piece of equipment, and the tubing has a thin wall. Because the tubing is constantly bent and straightened, often at high internal pressure, a small flaw, whether caused by corrosion or mechanically, can occur, increasing the likelihood of operational damage. According to surveys, corrosion, mechanical damage, human error, and string manufacturing issues caused 80-90% of coiled tubing string failures in the last two decades.

Market Segmentation

The Global Coiled Tubing Market share is segmented into application, operation, and location.

- The well intervention segment is expected to hold the largest market over the predicted period.

On the basis of application, the global coiled tubing market is categorized into well intervention, drilling, and others. Among these, the well intervention segment is anticipated to hold the largest market over the projected period. This is due to an increase in demand for oil and gas products globally in various end-use applications such as building and construction, transportation, power generation, and others, which leads to an increase in demand for well intervention services that improve the production of operational and abandoned oil and gas wells. In a well intervention, coiled tubing is preferred over conventional tubing because the latter must be screwed together. The former does not necessitate the use of a workover rig because it can be inserted directly during ongoing production. It is also relatively affordable and suitable for use in high-pressure wells.

- The pumping segment held the largest share of the coiled tubing market.

Based on the operation, the global coiled tubing market is classified into pumping, circulation, logging, and others. Among these, the pumping segment held the largest share of the coiled tubing market. The reason behind the growth is, as a result an increase in demand for coiled tubing from a variety of fluid pumping operations such as oil well cementing, pressure testing, solvent pumping, acidizing treatments, and others. Furthermore, there is an increased need for acid-pumping operations to open the pores of limestone layers, which is driving the market growth during the study period.

- The onshore segment is expected to grow at the fastest rate over the predicted period.

On the basis of location, the global coiled tubing market is differentiated into onshore and offshore. Among these, the onshore segment accounted for the largest market of the global market in terms of revenue. The segment is anticipated to maintain its dominance throughout the forecast period because it is more cost-effective and feasible to produce oil and gas from onshore wells rather than offshore wells. Furthermore, the increased use of fracturing and shale is expected to drive segment growth during the forecast period.

Regional Segment Analysis of the Global Coiled Tubing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

The North American region holds the largest share of the Global Coiled Tubing Market.

Get more details on this report -

In terms of volume and revenue, North America dominated the market, accounting for more than 29.32% of global revenue in 2021. The growing importance of the shale petrol industry has fueled regional market growth. Technological advancements to improve well efficiency are driving the use of coiled tubing in the region. North America is expected to be the largest market during the study period, owing to the expansion of unconventional resources in the United States and Canada. Furthermore, demand for coiled tubing processes in the maturing offshore fields of the Gulf of Mexico, as well as other onshore fields in the United States, is projected to propel market expansion.

Asia Pacific is anticipated to grow the fastest during the projected period. Oil and petrol demand from emerging economies like India, Vietnam, and China is increasing rapidly in the region. Countries in the region are vying to develop oil resources. Cairn Oil & Gas and the Vedanta group, for example, revealed in February 2022 that they had discovered a new oil well in Rajasthan, India. Demand for coiled tubing services in the well intervention market, particularly for completion and cleaning services, drives the market. The growing demand for large-diameter coiled tubing creates numerous growth opportunities in the Asia-Pacific coiled tubing market.

As GCC countries are major oil producers, the Middle East and Africa are expected to remain a significant region of the market during the forecast period. Furthermore, new projects in Africa are expected to drive market growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global coiled tubing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stewart & Stevenson

- T&H Lemont

- Tenaris

- John Lawrie Group

- Trident Steel Corporation

- Gautam Tube Corporation

- HandyTube

- National Oilwell Varco

- John Lawrie Group

- Sandvik AB

- Forum Energy Technologies, Inc.

- Schlumberger

- Baker Hughes Company

- The Abu Dhabi National Oil Company

- CALFRAC WELL SERVICES LTD

- Halliburton

- Weatherford

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, STEP Energy Services Ltd., a subsidiary of STEP Energy Services Ltd., has acquired ProPetro's Coiled Tubing assets, which were used for services such as frac plug mill-out, wellbore clean-out, tubing-conveyed perforating, and nitrogen pumping, according to ProPetro Holding Corp. ProPetro chose to receive consideration in the form of cash and STEP shares, demonstrating its belief in STEP's ability to grow the business and create value.

- In January 2022, Schlumberger announced a five-year contract for a coiled tubing drilling service to be deployed in a major Saudi gas field.

- In June 2022, At Montrose Port, John Lawrie Metals decided to expand its decommissioning facility. The leading metal recycling and processing company in the north and northeast of Scotland, John Lawrie Metals Ltd, has announced the expansion of its dedicated decommissioning facility at Montrose Port.

- In July 2021, The Abu Dhabi National Oil Company (ADNOC) has announced a USD 763.7 million investment in integrated rigless services on six of its artificial islands in the Upper Zakum and Satah Al Razboot fields. The contracts cover coiled tubing services with thru-tubing downhole tools, stimulation services (including equipment and chemicals/fluid systems), surface well testing, wireline and production logging services and tools, saturation monitoring, and well integrity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global coiled tubing market based on the below-mentioned segments:

Global Coiled Tubing Market, By Application

- Well Intervention

- Drilling

- Others

Global Coiled Tubing Market, By Operation

- Pumping

- Circulation

- Logging

- Others

Global Coiled Tubing Market, By Location

- Onshore

- Offshore

Global Coiled Tubing Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?