Global CNG Dispenser Market Size, Share & Trends Analysis Report Market by Type (Fast Fill and Time Fill), Flow Rate (Up to 15, Up to 50, and Up to 100 Kg/Min), Distribution (Company Owned & Company Run, Company Owned & Dealer Run, and Dealer Owned & Dealer Run), By Region (APAC, North America), And Segment Forecasts, 2021 - 2030

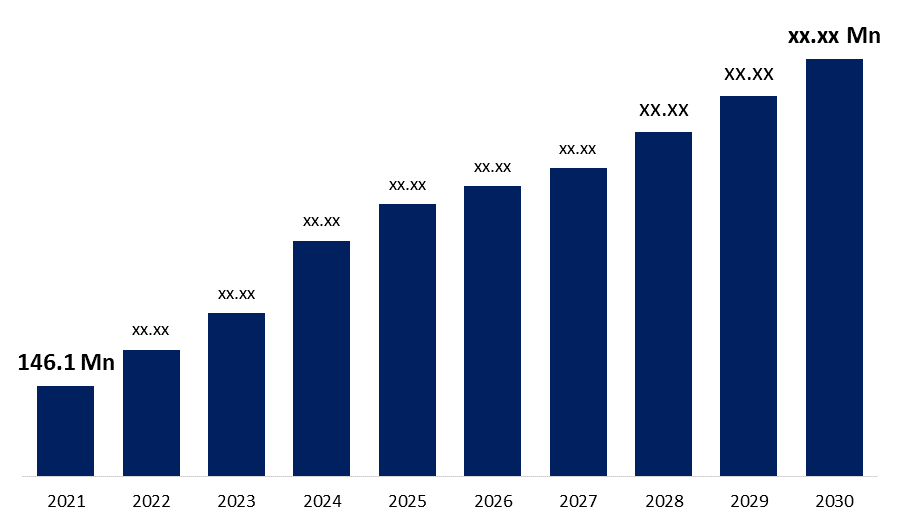

Industry: Energy & PowerThe Global CNG Dispenser Market Size was estimated at USD 146.1 Mn in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.6% from 2021 to 2030. CNG is minimal in contaminants, has a high calorific value and heat yield, is inexpensive, and is widely available worldwide. CNG dispensers will be widely used. As a result of CNG's growing popularity and increased awareness. A pipeline is installed from the city gate station where natural gas is pushed at a pressure of 15 bars or even lower for transportation of natural gas within a city. CNG stations are located around the country to dispense gas to CNG vehicles. The gas is compressed up to 250 bars before being delivered to automobiles at a pressure of 200 bars. Compressors, dispensers, cascades, pipelines, tubing, and other components make up a CNG dispensing system.

Get more details on this report -

The expansion of CNG stations around the country is likely to drive the global CNG dispensers’ market over the forecast period. There were roughly 32000 natural gas stations in the world in 2019 for around 27 million natural gas vehicles (NGV). Moreover, 80% of the total natural gas stations were CNG, with the remainder being liquefied natural gas (LNG). As a result, the increased number of CNG stations around the world is likely to enhance the CNG dispensers market.

The escalation for alternative and cleaner energy sources in automobiles is the key market driver for the worldwide CNG dispenser system market. Furthermore, rising awareness about the need of reducing carbon footprints is propelling the CNG dispenser system market forward. The unpredictable crude oil costs are a major market limitation for the worldwide CNG dispenser system industry. Global trade sanctions and tariff barriers may raise crude oil prices, making CNG expensive to the general people.

CNG dispensers are compounds that are derived from both coal products and crude oil. Some CNG dispensers are widely used, such as toluene, benzene, and xylene. These are generally employed in a wide range of consumer products that give both personal and environmental benefits due to characteristics such as increased durability, safety enhancements, and anti-pollution capabilities. CNG dispensers are also lightweight and easy to use. The lightweight design that supports it well is the major reason for its wide tolerance, acceptability, and demand.

Global CNG Dispenser Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 146.1 Million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 7.6% |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type |

| Companies covered:: | Bennett (US), Fortive (US), Sanki (China), Parker (US), Compac (New Zealand), Tatsuno (Japan), Dover (US), Censtar (China), FTI (Canada), Kraus (Canada), Scheidt & Bachmann (Germany), Tulsa (India), Lanfeng (China), Ebara Corporation. |

| Growth Drivers: | 1)The time-fill segment dominated the global CNG dispenser market 2)The up to 100 kg/min segment dominated the global CNG dispenser market |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Type Insights

The time-fill segment dominated the global CNG dispenser market in 2021 owing to the time-fill stations being used by fleets, while fast-fill stations are used by retail establishments. CNG stations are located around the country to dispense gas to CNG vehicles. The gas is compressed up to 250 bars before being delivered to automobiles at a pressure of 200 bars. Compressors, dispensers, cascades, pipelines, tubing, and other components make up a CNG dispensing system.

Flow Rate Insights

The up to 100 kg/min segment dominated the global CNG dispenser market in 2021 owing to the concept of light-duty cars is taking off, and the market is recognizing a gap that must be filled quickly. The CNG dispenser's flow rate is set based on station requirements and the type of cars serviced.

Regional Insights

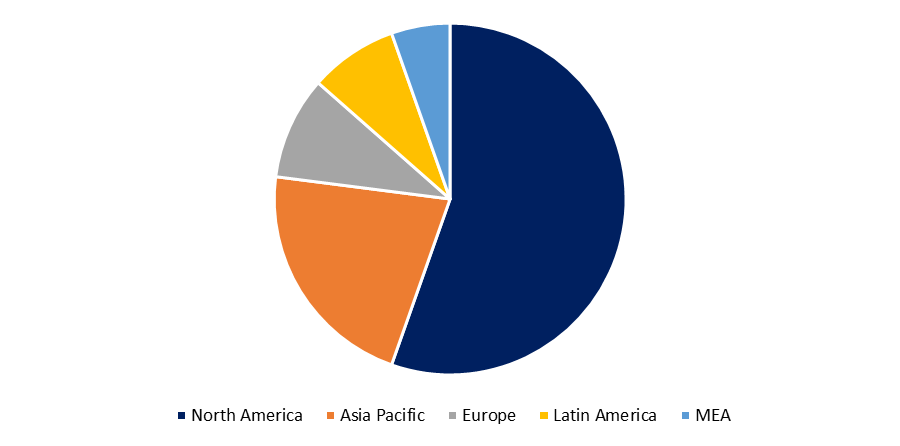

North America dominated the global CNG dispenser market in 2021 due to the increased use of CNG automobiles in the United States may provide consistent demand for CNG dispenser systems. The legislative drive in China and Europe toward alternative energy sources is projected to boost CNG dispenser systems. Because of the increased popularity of CNG in developing nations such as India and Bangladesh due to higher mileage at a lower cost, the sale of CNG dispenser systems has increased. Retrofitting CNG systems into classic autos is also becoming more common.

Get more details on this report -

Key Companies & Market Share Insights

Generic strategies adopted by the companies usually include mergers & acquisitions, distribution network expansion, and product portfolio expansion. For instance, Yantai CIMC Raffles Shipyard (CIMC Raffles) was awarded a contract by Australia's Global Energy Ventures (GEV) to build up to eight compressed natural gas (CNG) carriers in July 2019. The agreement includes a firm order for four CNG Optimum 200 million standard cubic feet ships, as well as an option to build four more. The largest compressed natural gas (CNG) filling station in Estonia, with 48 refuelling units, will open in July 2019 in Tartu, Estonia, to feed the city's new CNG-powered bus fleet. The station, run by the Estonian energy provider AS Alexela, will refill buses operated by the Go Bus transportation operator.

Some prominent players in the global CNG dispenser market include WEH GmbH, Kraus Global Ltd., FTI International Group Inc., Tatsuno Europe a.s., Wayne Fueling Systems, Gilbarco Veeder-Root, Tokheim, Parker, Tulsa Gas Technologies, Nirmal Industrial Controls Pvt Ltd (NICPL), Hitachi Automotive Systems Measurement, Ltd., Compac Industries, Allport, Greka Engineering, Fornovo Gas Srl, and Bennett Pump Company.

By Type

- Fast fill

- Time fill

By Flow rate

- Up to 15 kg/min

- Up to 50 kg/min

- Up to 100 kg/min

By Distribution

- Company owned & company run

- Company owned & dealer run

- Dealer owned & dealer run

By Region

- The Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Key Players

- Bennett (US)

- Fortive (US)

- Sanki (China)

- Parker (US)

- Compac (New Zealand)

- Tatsuno (Japan)

- Dover (US)

- Censtar (China)

- FTI (Canada)

- Kraus (Canada)

- Scheidt & Bachmann (Germany)

- Tulsa (India)

- Lanfeng (China)

Need help to buy this report?