China Waste Management Market Size, Share, By Source (Residential, Commercial, and Others), By Service (Collection, and Disposal, and Others), By Waste Type (Municipal Solid Waste, Industrial Hazardous Waste, and Others), and China Waste Management Market Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsChina Waste Management Market Insights Forecasts to 2035

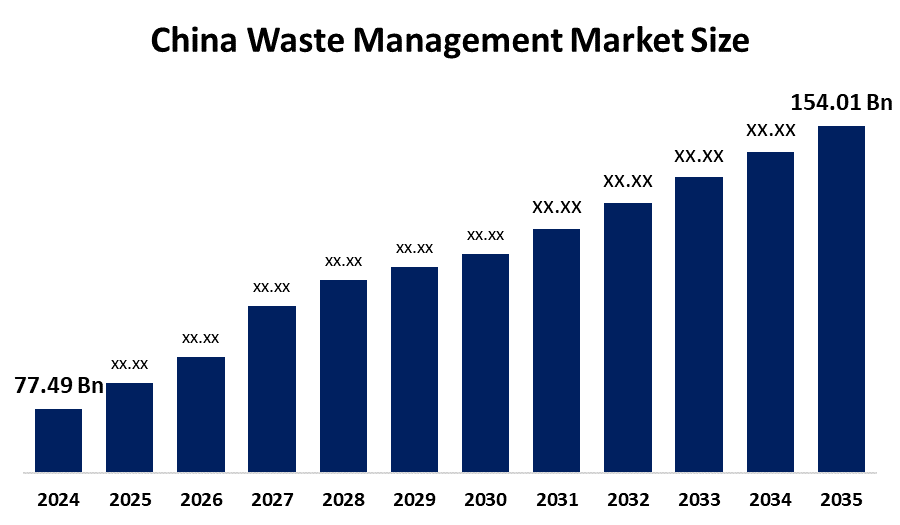

- China Waste Management Market Size 2024: USD 77.49 Billion

- China Waste Management Market Size 2035: USD 154.01 Billion

- China Waste Management Market CAGR 2024: 6.44%

- China Waste Management Market Segments: Source, Service, and Waste Type.

Get more details on this report -

The waste management industry in China consists of collecting, transporting and treating municipal, industrial, hazardous, medical, and electronic waste. The sector includes government agencies; privatisation of landfills, incinerators, composting and recovery of materials; some companies operate as contractors for local governments. The driving force behind this industry are urbanization increasingly strict environmental regulations; and a transition to a circular economy and pollution prevention. China’s rapid urbanization is increasing municipal and industrial waste volumes. The government has implemented strong regulations on waste sorting and recycling, and is encouraging organized waste services. With an increase in waste to energy plants, the introduction of circular economy targets, and the increased amount of ecommerce packaging waste, there is considerable demand for these services. As a result of these factors, smart collection systems and advanced recycling technologies are being adopted at an increasing pace to further enhance market growth and investment.

China's government is making changes to the way it manages its waste by improving its waste separation laws, creating a circular economy, and implementing zero waste city pilot projects. The government is also expanding its recycling network, trying to eliminate single-use plastic products, and developing projects to convert waste into energy. The overall goal of the national solid-waste management action plan is to increase recycling and safely dispose of solid waste so that it can be used as a resource rather than as a burden on landfills.

China's waste management practices have evolved from simply disposing of waste to retrieving materials from waste. Municipalities across the nation have begun implementing mandatory separation of household waste into the four designated categories and building new recycling collection facilities within neighbourhoods. Waste to energy plants is being established to reduce the use of landfills by converting municipal solid waste to energy. Many companies are utilizing artificial intelligence for product sorting and installing smart bins to increase their operational efficiencies. Lastly, the introduction of laws aimed at reducing plastic waste and laws encouraging a circular economy are resulting in a shift by businesses toward recyclable and reusable forms of packaging.

China Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 77.49 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.44% |

| 2035 Value Projection: | USD 154.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Source, By Service, By Waste Type |

| Companies covered:: | China Everbright Environment Group Limited, Veolia Environnement S.A., SUEZ SA, Beijing Enterprises Environment Group Ltd, Beijing OriginWater Technology Co Ltd, China Tianying Inc, Zhejiang Weiming Environmental Protection Co Ltd, Shanghai Environment Group Co Ltd, Dynagreen Environmental Protection Group Co Ltd, Tus-Sound Environmental Resources Co Ltd, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Waste Management Market:

China's waste management market is booming, driven by a desperate need to tackle massive urban garbage production and strict new green government policies. As cities grow rapidly, people are buying more, resulting in huge waste volumes that now require modern recycling and waste to energy technologies, turning the industry from a quiet, informal sector into a high tech, essential service to protect urban life.

Rapid urbanization, as well as massive amounts of inappropriate and illegal disposal of side waste matter in rural areas, provide significant challenges with respect to managing waste in China's cities. Urban areas are improving, while rural areas continue to experience relatively low levels of mandatory trash sorting participation. Due to the high cost of needed updates to public facilities such as transfer stations and recycling facilities, limited access to new technologies for the efficient collection and processing of recyclable materials, and dependence on an informal and less-regulated segment of the economy, establishing efficient, nationwide recycling systems is a major obstacle in developing a cleaner circular economy.

In China, the transition to a circular economy is creating tremendous potential for businesses involved with recycling, recovering materials from waste, and converting waste into energy. Demand for modern treatment facilities within smaller cities will continue to be fueled through the expansion of zero waste city programs. The increase in e-commerce and electronics is creating a strong need for e-waste management solutions. Additionally, new opportunities for growth exist for private operators and technology providers via smart waste tracking, automation, and issuance of carbon credits.

Market Segmentation

The China waste management market share is classified into source, service, and waste type

By Source:

The China waste management market is divided by source into residential, commercial, and others. Among these, the residential segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is mainly due to high daily household waste generation, strict municipal sorting rules, and rising urban population in China requiring frequent collection and processing services.

By Service:

The China waste management market is divided by service into collection, disposal, and others. Among these, the collection segment is projected to hold the largest share during the forecast period. The dominance is driven by everyday household waste generation, mandatory sorting compliance, expanding door to door pickup coverage, and recurring service contracts across cities in China, making collection the most consistent and revenue-generating activity.

By Waste Type:

The China waste management market is divided by waste type into municipal solid waste, industrial hazardous waste, and others. Among these, the municipal solid waste segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment leads due to increasing household waste volumes, rapid urban expansion, strict government sorting regulations, and continuous daily collection requirements. Growing consumption patterns and higher packaging waste in China further strengthen demand for organized municipal solid waste management and treatment services.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China waste management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Waste Management Market

- China Everbright Environment Group Limited

- Veolia Environnement S.A.

- SUEZ SA

- Beijing Enterprises Environment Group Ltd

- Beijing OriginWater Technology Co Ltd

- China Tianying Inc

- Zhejiang Weiming Environmental Protection Co Ltd

- Shanghai Environment Group Co Ltd

- Dynagreen Environmental Protection Group Co Ltd

- Tus-Sound Environmental Resources Co Ltd

- Others

Recent Developments in China Waste Management Market:

In October 2024, China everbright environment group limited partnered with a municipal authority in China to launch an AI-based smart waste sorting and recycling platform that improves collection efficiency, enables real-time monitoring, and helps cities reduce landfill usage and operational costs.

In July 2024, Dynagreen environmental protection group co ltd introduced a high-efficiency waste to energy incineration technology designed to boost electricity generation, enhance combustion stability, and significantly lower emissions in large urban solid-waste treatment plants across major municipalities.

In April 2024, China tanying Inc signed a cooperation agreement with a provincial government to build a circular economy industrial park combining waste treatment, biomass energy generation, recycling operations, and integrated resource recovery facilities for sustainable development.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insigts has segmented the China waste management market based on the below-mentioned segments

China Waste Management Market, By Source

- Residential

- Commercial

- Others

China Waste Management Market, By Service

- Collection

- Disposal

- Others

China Waste Management Market, By Waste Type

- Municipal Solid Waste

- Industrial Hazardous Waste

- Others

Need help to buy this report?