China Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and Pet Veterinary Diets), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Channel, and Others), and China Pet Food Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsChina Pet Food Market Insights Forecasts to 2033

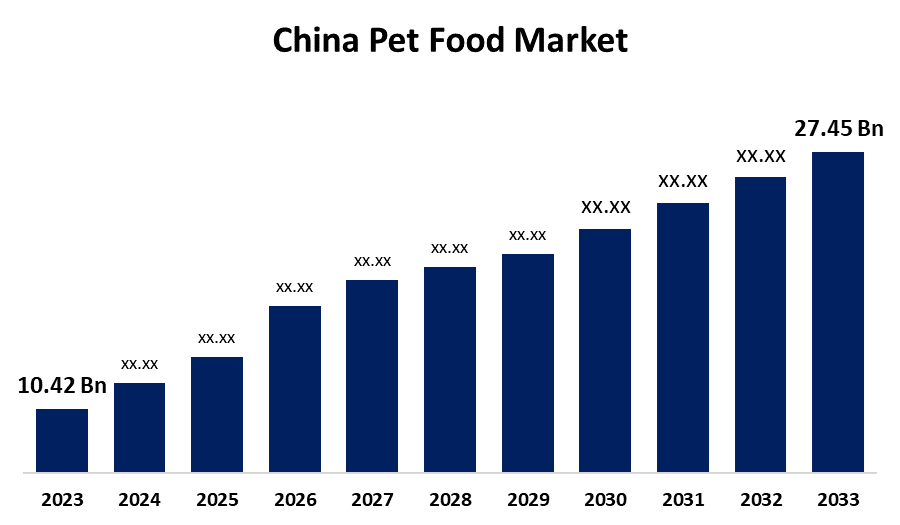

- The China Pet Food Market Size was valued at USD 10.42 Billion in 2023.

- The Market is Growing at a CAGR of 10.17% from 2023 to 2033

- The China Pet Food Market Size is Expected to Reach USD 27.45 Billion by 2033

Get more details on this report -

The China Pet Food Market is Anticipated to Reach USD 27.45 Billion by 2033, growing at a CAGR of 10.17% from 2023 to 2033.

Market Overview

Pet food is a specialty meal designed to meet the nutritional requirements of domesticated animals. Meat, meat byproducts, cereals, grains, vitamins, and minerals are typically found in pet food. Pet food products come in a variety of types, including snack treats, wet, and dry. These products can be derived from plants or animals. The Ministry of Agriculture China defines feeds as industrially processed products for animal nutrition, including various formulations, while feed additives are small quantities of substances incorporated during feed production and use. The China pet food market is driven due to the rising demand for dry and wet foods, as well as the availability of pet foods that can be customized by different firms. Probiotics and antioxidants, two essential nutrients, as well as the growing variety of tastes provided by organic products, are expected to benefit positively to the growth of the China pet food market.

Report Coverage

This research report categorizes the market for the China pet food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China pet food market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China pet food market.

China Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.42 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.17% |

| 2033 Value Projection: | USD 27.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Pet Food Product, By Distribution and COVID-19 Impact Analysis |

| Companies covered:: | ADM, General Mills Inc., Mars Incorporated, Nestle (Purina), Virbac, and Others, key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological developments in pet food production and packaging are driving significant industry trends and profitable opportunities. The primary driver of the pet food business in China is the growing popularity of expensive food products. The Chinese pet food market is expanding due to consumer awareness of pet nutrition and health as well as the growing demand for high-quality, natural pet food products. One of the key factors driving the China pet food market is the growing demand from pet owners for food that is high in protein and nutrients.

Restraining Factors

The resistance of some developing economies to adopt overpriced or expensive products is a primary factor that can restrict growth in China pet food market.

Market Segmentation

The China pet food market share is classified into pet food products and distribution channel.

- The food segment is expected to hold the largest market share through the forecast period.

The China pet food market is segmented by pet food products into food, pet nutraceuticals/supplements, pet treats, and pet veterinary diets. Among these, the food segment is expected to hold the largest market share through the forecast period. Food involves pet food, both wet and dry, which is essential to a pet's diet and is in great demand as the number of pet owners rises.

- The supermarket/hypermarket segment is expected to dominate the China pet food market during the forecast period.

Based on the distribution channel, the China pet food market is divided into supermarket/hypermarket, specialty stores, online channel, and others. Among these, the supermarket/hypermarket segment is expected to dominate the China pet food market during the forecast period. Supermarkets and hypermarkets have a larger part of the market as consumers find them more convenient, with more options for different brands and pricing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China pet food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- General Mills Inc.

- Mars Incorporated

- Nestle (Purina)

- Virbac

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, New cat snacks under the Friskies "Friskies Playfuls - treats" brand was launched by Nestle Purina. For mature cats, these spherical snacks come in tastes like chicken and liver as well as salmon and shrimp.

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China pet food market based on the below-mentioned segments:

China Pet Food Market, By Pet Food Product

- Food

- Pet Nutraceuticals/Supplements

- Pet Treats

- Pet Veterinary Diets

China Pet Food Market, By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online Channel

- Others

Need help to buy this report?