China Metal Fabrication Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Cutting, Machining, Welding), By End-user (Oil & Gas, Manufacturing, Power & Utilities, Construction, Others), and China Metal Fabrication Equipment Market Insights Forecasts to 2033

Industry: Machinery & EquipmentChina Metal Fabrication Equipment Market Insights Forecasts to 2033

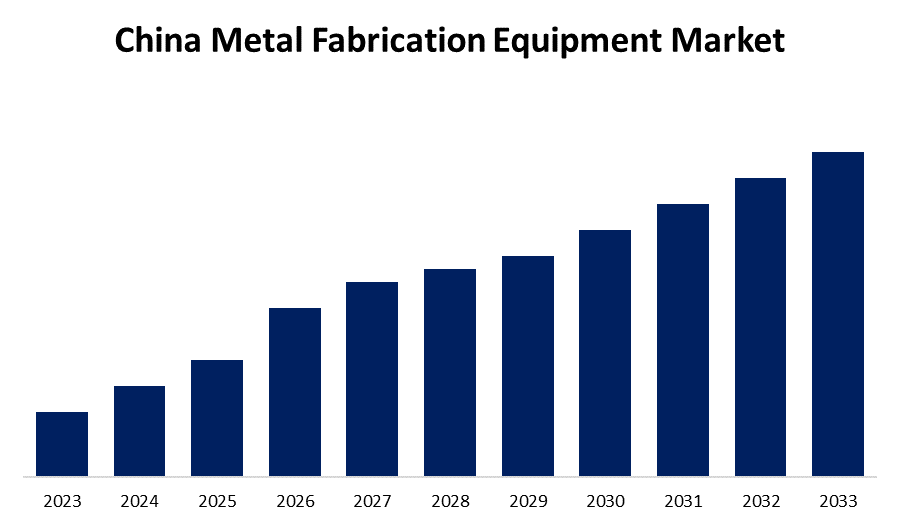

- The Market Size is Growing at a CAGR of 7.54% from 2023 to 2033.

- The China Metal Fabrication Equipment Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The China Metal Fabrication Equipment Market Size is expected to hold a significant share by 2033, at a CAGR of 7.54% during the forecast period 2023 to 2033.

Market Overview

Metal fabrication machinery, tools, and equipment are used in the process of shaping, cutting, joining, and assembling metal components and structures. With the help of this equipment, which is especially made to handle the different tasks involved in metal fabrication, raw metal materials can be transformed into finished products. Comprises equipment for cutting metal sheets or plates into the appropriate shapes and sizes, such as shearing machines, plasma cutters, and laser cutting machines. It also has forming tools for forming metal plates and sheets into various shapes. Furthermore, the Chinese economy is being boosted by strong growth in the industrial machinery and transportation equipment industries, as well as the electrical and electronics markets, as a result of metal cutting and the related equipment used to carry out various procedures in the fabrication process. Future value gains in the market also be aided by a persistent shift in the product mix toward higher-value product categories like multitasking machine equipment. Moreover, there will probably be a rise in demand for energy-efficient machining equipment as a result of tighter regulations about energy conservation. The product sales can be boosted further by rising demand for highly advanced and comprehensive metal cutting machines, primarily for machining centers and multitasking machines.

Report Coverage

This research report categorizes the market for China metal fabrication equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China metal fabrication equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the China metal fabrication equipment market.

China Metal Fabrication Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.54% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End-user and COVID-19 Impact Analysis. |

| Companies covered:: | Schuler, GF Machining Solutions, Coherent, Colfax, Nissan Tanaka, AMADA, DMG MORI Seiki, Yamazaki Mazak, TRUMPF, Emag and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the manufacturing and construction industries is anticipated to be the primary driver of the substantial growth of the Chinese metal fabrication equipment market. China has been a major contributor to the expansion of the automobile market, which in turn has helped metal forming equipment grow both in Asia and worldwide. Steel fabrication has become increasingly in demand as a result of China becoming a global manufacturing hub and home to an increasing number of industries. In the upcoming years, this might undoubtedly increase demand for metal fabrication equipment. The demand in this industry is also being boosted by it save economic growth.

Restraining Factors

The China market's growth has been hampered by a lack of qualified workers and advances in additive construction technology. Technology for additive manufacturing is developing quickly, which is cutting down on production time. With additive manufacturing, fabricators can effortlessly design and produce intricate items. It's a very adaptable manufacturing method that allows for a great deal of customization. In addition to these, changes in raw material prices hamper the expansion of the metal fabrication industry.

Market Segment

- In 2023, the welding segment accounted for the largest revenue share over the forecast period.

Based on the type, the China metal fabrication equipment market is segmented into cutting, machining, and welding. Among these, the welding segment has the largest revenue share over the forecast period. The ever-expanding industrial sector in developing countries is also expected to fuel the metal fabrication equipment market. Due to the large variety of welding equipment portfolios that are available, varying in size, power, and type, the segment holds a significant market share. Because it is operationally necessary to weld and form metals for various fabrication requirements, welding equipment is prevalent in every industry vertical.

- In 2023, the construction segment accounted for the largest revenue share over the forecast period.

Based on the end user, the China metal fabrication equipment market is segmented into oil & gas, manufacturing, power & utilities, construction, and others. Among these, the construction segment has the largest revenue share over the forecast period. A metal building has numerous advantages, including cost-efficiency, durability, design flexibility, quick assembly, and low maintenance. The benefits of owning a steel building are almost universal.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China metal fabrication equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schuler

- GF Machining Solutions

- Coherent

- Colfax

- Nissan Tanaka

- AMADA

- DMG MORI Seiki

- Yamazaki Mazak

- TRUMPF

- Emag

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the China metal fabrication equipment market based on the below-mentioned segments:

China Metal Fabrication Equipment Market, By Type

- Cutting

- Machining

- Welding

China Metal Fabrication Equipment Market, By End User

- Oil & Gas

- Manufacturing

- Power & Utilities

- Construction

- Others

Need help to buy this report?