China Defence Market Size, Share, and COVID-19 Impact Analysis, By Type (Aircrafts, Ships, Vehicles, Equipment, and Services), By Application (Air, Sea, and Land), and China Defence Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseChina Defence Market Insights Forecasts to 2035

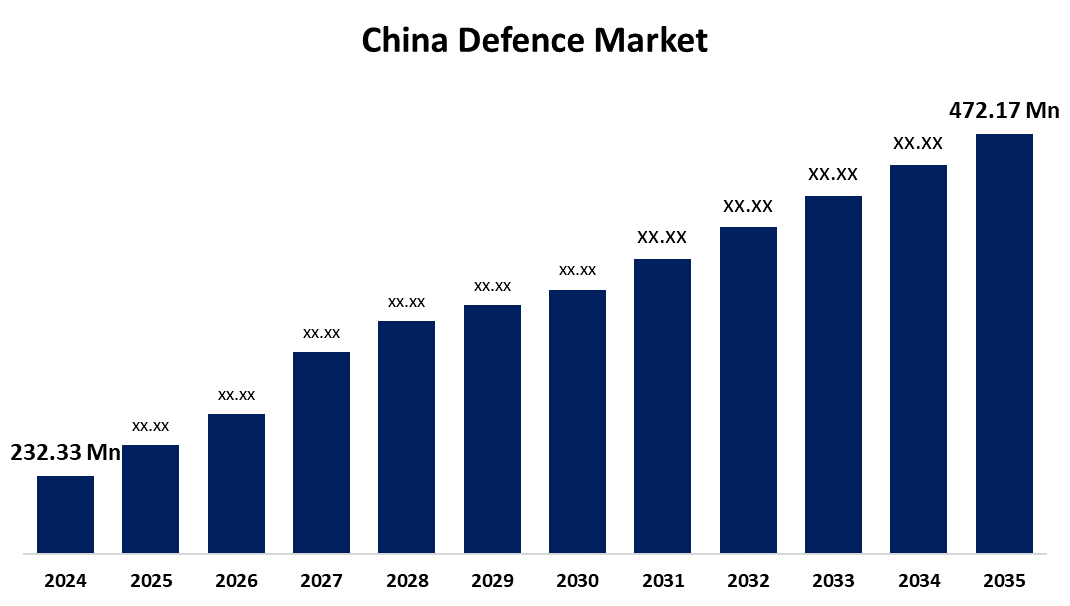

- The China Defence Market Size Was Estimated at USD 232.33 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.66% from 2025 to 2035

- The China Defence Market Size is Expected to Reach USD 472.17 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the China Defence Market Size is Anticipated to Reach USD 472.17 Million by 2035, Growing at a CAGR of 6.66% from 2025 to 2035. The China defence market is driven by increasing defense budgets, the aging military and commercial aircraft fleets, and technological advancements such as predictive maintenance and automation

Market Overview

The China defense market refers to the industry encompassing military equipment, defense technology, and security solutions developed and procured by China. One of the main drivers of market expansion in China's defense industry is the noticeable rise in the production of advanced military-related technology. The nation's desire to improve its strategic deterrent capabilities and military production self-reliance is reflected in this trend. For instance, in February 2023, the new long-range DF-27 hypersonic intermediate-range ballistic missile (IRBM) was successfully tested by China's People's Liberation Army (PLA) in mid-February 2024 as part of this effort. This missile is thought to have the ability to get past American ballistic missile defense systems, providing a major strategic edge. China's long-range strike capabilities are further enhanced by the DF-27, which represents a significant advancement in missile technology with an estimated strike range of around 8,000 kilometers.

Report Coverage

This research report categorizes the market for the China defence market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China defence market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China defence market.

China Defence Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 232.33 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.66% |

| 2035 Value Projection: | USD 472.17 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Aviation Industry Corporation of China (AVIC), China North Industries Group Corporation Limited (Norinco Group), China South Industries Group Corporation (CSGC), China Aerospace Science and Technology Corporation (CASC), China Aerospace Science and Industry Corporation (CASIC), China Electronics Technology Group Corporation (CETC), China Shipbuilding Industry Corporation (CSIC), China State Shipbuilding Corporation (CSSC), China National Nuclear Corporation (CNNC), China National Aero-Technology Import & Export Corporation (CATIC), and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The China defense market is driven by increasing government support and rising spending on the defense sector, reflecting the country's efforts to enhance military capabilities. With growing investments in advanced weapon systems, cybersecurity, and aerospace defense, China continues to expand its defense infrastructure to strengthen national security and global military positioning. For instance, the National People's Congress indicated that China's defense budget for 2025 will increase by 7.2% to CNY1.784665 trillion (USD249 billion). For the eleventh year in a row, defense spending has increased by single digits. Additionally, the aggressive military modernization strategy implemented by China in response to increasing geopolitical tensions, particularly in the South China Sea, Taiwan Strait, and wider Indo-Pacific area, is one of the main factors fueling the rise of the country's defense system. A strategic transition is underway to make the People's Liberation Army (PLA) a completely modernized force by 2035, with the ultimate objective of becoming a "world-class" force by 2049. China was the world's second-largest defense spender in 2023, according to the Stockholm International Peace Research Institute (SIPRI). Its military spending reached USD 296 billion, up 63% over the previous ten years and 6% from 2022. China has made a concerted effort to improve its military capabilities in the air, sea, land, and cyber sectors, as evidenced by this steady increase in defense spending. China's defense industry is likely to spend more, which will fuel market expansion.

Restraining Factors

China's arms exports are severely constrained by geopolitical concerns and a lack of confidence among key international purchasers, notwithstanding improvements in defense technology. China's entry into profitable international defense markets is hampered by stringent arms trade laws and the inclination of many nations toward Western or Russian-made equipment. Additionally, quality concerns remain a key issue, as some buyers hesitate to purchase Chinese defense equipment due to reported reliability issues and performance gaps compared to Western alternatives. For instance, in 2022, structural flaws and radar issues forced Myanmar's air force to ground 11 JF-17 fighter jets built in China.

Market Segmentation

The China defence market share is classified into type and application.

- The aircrafts segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The China defence market is segmented by type into aircrafts, ships, vehicles, equipment, and services. Among these, the aircrafts segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. China is making significant investments in next-generation combat aircraft, such as the J-20 stealth fighters, J-31, and upcoming 6th-generation platforms, to catch up to the United States and regional superpowers like Japan and India.

- The air segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The China defence market is segmented by application into air, sea, and land. Among these, the air segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. China's dominance of the air domain is further reinforced by the significant portion of its defense R&D budget that is allocated to next-generation flight systems, advanced avionics, and artificial intelligence integration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China defence market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aviation Industry Corporation of China (AVIC)

- China North Industries Group Corporation Limited (Norinco Group)

- China South Industries Group Corporation (CSGC)

- China Aerospace Science and Technology Corporation (CASC)

- China Aerospace Science and Industry Corporation (CASIC)

- China Electronics Technology Group Corporation (CETC)

- China Shipbuilding Industry Corporation (CSIC)

- China State Shipbuilding Corporation (CSSC)

- China National Nuclear Corporation (CNNC)

- China National Aero-Technology Import & Export Corporation (CATIC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China defence market based on the below-mentioned segments:

China Defence Market, By Type

- Aircrafts

- Ships

- Vehicles

- Equipment

- Services

China Defence Market, By Application

- Air

- Sea

- Land

Need help to buy this report?