China Aerospace and Defense MRO Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Engine Maintenance, Component Maintenance, Line Maintenance, Airframe Maintenance, and Modifications), By Application (Commercial Aviation, Military Aviation, and Business & General Aviation), and China Aerospace and Defense MRO Market Insights, Industry Trend, Forecasts to 2035.

Industry: Aerospace & DefenseChina Aerospace and Defense MRO Market Insights Forecasts to 2035

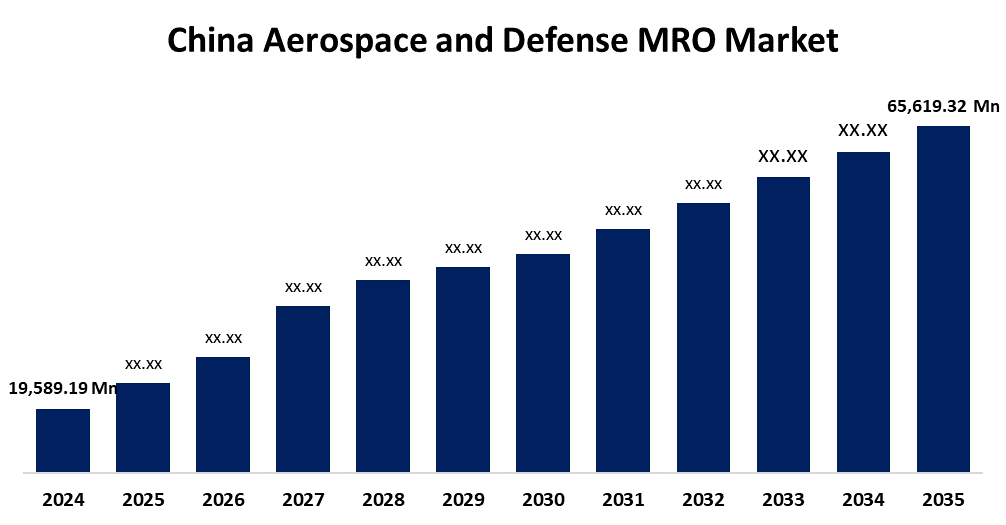

- The China Aerospace and Defense MRO Market Size Was Estimated at USD 19,589.19 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.62% from 2025 to 2035

- The China Aerospace and Defense MRO Market Size is Expected to Reach USD 65,619.32 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the China Aerospace and Defense MRO Market is anticipated to reach USD 65,619.32 million by 2035, growing at a CAGR of 11.62% from 2025 to 2035. The China aerospace and Defense MRO market is driven by increasing defense budgets, the aging military and commercial aircraft fleets, and technological advancements such as predictive maintenance and automation

Market Overview

The China aerospace and defense MRO market refers to the industry focused on maintenance, repair, and overhaul (MRO) services for military and commercial aircraft, defense systems, and aerospace components in China. In China, market trends are also greatly influenced by the growing focus on sustainability and the incorporation of eco-friendly procedures into MRO services, as companies work to enhance operational efficiency while meeting environmental standards. Chinese aerospace firms are actively establishing strategic alliances with global providers of Maintenance, Repair, and Overhaul (MRO) services in order to gain access to cutting-edge technologies and industry best practices. These partnerships support the expansion of China's aerospace and defense MRO business in addition to facilitating knowledge and technology transfer. For instance, in October 2024, a memorandum of understanding was struck by HAECO and Comac to increase MRO services for airframes, engines, and components. With its headquarters located in Hong Kong, the MRO provider has stated that it intends to expand its capabilities for both ARJ21 landing gear MRO and engine MRO for the GE Aerospace CF34-10A engines that power the aircraft.

Report Coverage

This research report categorizes the market for the China aerospace and defense MRO market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China aerospace and defense MRO market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China aerospace and defense MRO market.

China Aerospace and Defense MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19,589.19 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.62% |

| 2035 Value Projection: | USD 65,619.32 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Service Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | China CSSC Holdings Ltd, AVIC Shenyang Aircraft Company Ltd, China Shipbuilding Industry Company Ltd, AECC Aviation Power Co., Ltd, Yangzijiang Shipbuilding (Holdings) Ltd, China Avionics Systems Co., Ltd, Avicopter Plc, China Aerospace Times Electronics Co., Ltd, CSSC Offshore & Marine Engineering (Group) Company Ltd, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing complexity of military platforms, the growing need for cost-effective maintenance solutions, and technical improvements are the primary drivers of the China aerospace and defense MRO market's growth. China's aviation industry is growing quickly, and by 2030, it is expected to overtake all other air travel markets worldwide. More MRO services are required as a result of this expansion in order to maintain and service the growing fleet of commercial aircraft. China's focus on modernizing its military capabilities has resulted in an expanding fleet of advanced aviation platforms, such as fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs), all of which require advanced maintenance, repair, and overhaul (MRO) services. Additionally, the number of joint ventures, partnerships, and collaborations among MRO service providers is increasing in the China Aerospace and Defense MRO Market. The increasing need for effective maintenance solutions, technical developments, and the requirement for localized expertise are the key drivers of this trend. For instance, in August 2023, the maintenance, repair, and overhaul (MRO) facility for Beijing Aero Engine Services Company Limited (BAESL), a 50/50 joint venture (JV) with Air China, began construction, according to a statement released by Rolls-Royce. The MRO facility is anticipated to start operations in 2026, and the groundbreaking event is an important milestone for the project.

Restraining Factors

There are a number of obstacles preventing the China aerospace and defense MRO market from expanding and developing. Economic uncertainty and geopolitical concerns have caused foreign businesses to make cautious investment choices, which has an impact on the growth of MRO facilities in China.

Market Segmentation

The China aerospace and defense MRO market share is classified into service type and application.

- The engine maintenance segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The China aerospace and defense MRO market is segmented by service type into engine maintenance, component maintenance, line maintenance, airframe maintenance, and modifications. Among these, the engine maintenance segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The demand for engine maintenance services is being driven by the increasing number of older aircraft, especially in the commercial aviation industry. The efficiency and efficacy of engine maintenance are being improved by technological developments, such as the creation of more fuel-efficient engines and the application of predictive maintenance methods.

- The commercial aviation segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The China aerospace and defense MRO market is segmented by application into commercial aviation, military aviation, and business & general aviation. Among these, the commercial aviation segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This segment is primarily driven by the expansion of airline fleets and the ongoing growth in air passenger traffic. Airlines are making significant investments in MRO services to guarantee the effectiveness, dependability, and safety of their operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China aerospace and defense MRO market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China CSSC Holdings Ltd

- AVIC Shenyang Aircraft Company Ltd

- China Shipbuilding Industry Company Ltd

- AECC Aviation Power Co., Ltd

- Yangzijiang Shipbuilding (Holdings) Ltd

- China Avionics Systems Co., Ltd

- Avicopter Plc

- China Aerospace Times Electronics Co., Ltd

- CSSC Offshore & Marine Engineering (Group) Company Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Aerospace and Defense MRO Market based on the below-mentioned segments:

China Aerospace and Defense MRO Market, By Service Type

- Engine Maintenance

- Component Maintenance

- Line Maintenance

- Airframe Maintenance

- Modifications

China Aerospace and Defense MRO Market, By Application

- Commercial Aviation

- Military Aviation

- Business & General Aviation

Need help to buy this report?