Global Cell Therapy Biomanufacturing Market Size, Share, Trend, Analysis, Insights, Price and Covid 19 Impact Analysis, By Product Type (Consumables, Equipment, and Systems & Software), By End User (Biopharmaceutical Biotechnology Companies, Research Institutes, Cell Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Cell Therapy Biomanufacturing Market Insights Forecasts to 2035

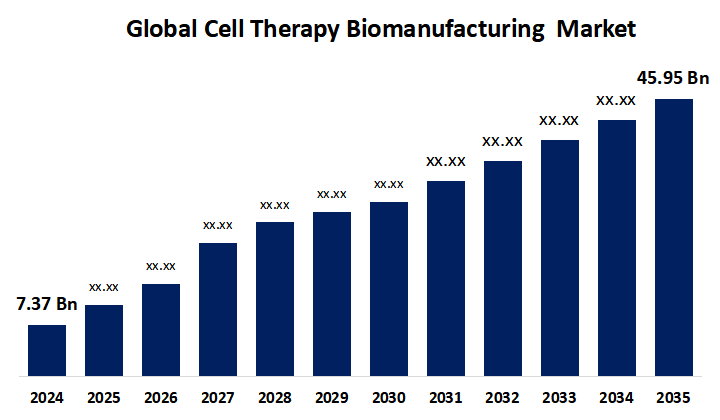

- The Global Cell Therapy Biomanufacturing Market Size Was Estimated at USD 7.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.10% from 2025 to 2035

- The Worldwide Cell Therapy Biomanufacturing Market Size is Expected to Reach USD 45.95Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global cell therapy biomanufacturing market size was worth around USD 7.37 billion in 2024 and is predicted to grow to around USD 45.95 billion by 2035 with a compound annual growth rate (CAGR) of 18.10% from 2025 and 2035. The development of automatic and closed-system manufacturing facilities to increase scalability and lower costs, the use of artificial intelligence and data analytics for better production, and improvements in technology for gene editing, like CRISPR, to improve cell therapies are some of the future trends in the growth of the cell therapy biomanufacturing market.

Market Overview

The global industry that develops, produces, and markets living cell-based medicines for the treatment of different illnesses is known as the cell therapy biomanufacturing market. It includes all of the infrastructure, technology, and procedures needed to grow, alter, and scale therapeutic cells while adhering to strict quality and regulatory requirements. The cell therapy biomanufacturing market includes contract manufacturing services, specialized equipment and reagents, and autologous and allogeneic cell treatments. The development, optimization, and mass manufacture of therapeutic cell products that guarantee quality, regulatory compliance, and effective delivery for clinical and commercial use are the primary goals of the cell therapy biomanufacturing market.

Increased demand for chimeric antigen receptor (CAR) T cell therapy, an increase in the prevalence of cardiovascular diseases, and ongoing advancements in stem cell therapy techniques are the main drivers of the expansion of the cell therapy biomanufacturing market. Consumers and other interested parties are working with biomanufacturing firms to enhance clinical studies and commercial production of these medications. As a result, the market for cell therapy biomanufacturing is anticipated to expand.

Report Coverage

This research report categorizes the cell therapy biomanufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cell therapy biomanufacturing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cell therapy biomanufacturing market.

Global Cell Therapy Biomanufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.10% |

| 2035 Value Projection: | USD 45.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By End User, By Region |

| Companies covered:: | BD, Lonza, Sartorius AG, Bio-Techne., Merck KGaA, Miltenyi Biotec, Eppendorf SE, PBS Biotech, Inc., Repligen Corporation, Corning Incorporated, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Bharat Biotech International Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased investment from biotech and pharmaceutical companies, advancements in cell processing technologies, the growing number of clinical trials for treatments using cells, and the growing demand for regenerative and personalized drugs are all factors driving the cell therapy biomanufacturing market. The increasing number of clinical trials is one of the primary drivers of the market expansion for cell therapy biomanufacturing, as it increases the demand for high-volume, high-quality therapeutic cell production. The increasing need for targeted, advanced therapies that might potentially address the root causes of genetic diseases is driving growth in the cell therapy biomanufacturing market.

Restraining Factors

Cell therapy biomanufacturing market growth is restricted by manufacturers' bottlenecks during commercialization, the high prices of cell therapies, and a lack of skilled workers to operate complex equipment.

Market Segmentation

The cell therapy biomanufacturing market share is classified into product type and end user.

- The consumables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the cell therapy biomanufacturing market is divided into consumables, equipment, and systems & software. Among these, the consumables segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Consumables segments have the largest market share in cell therapy biomanufacturing because consumables like growth factors, reagents, cell culture media, and single-use bioreactors are used continuously throughout the manufacturing process, generating repeat business and steady demand.

- The biopharmaceutical biotechnology companies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the cell therapy biomanufacturing market is divided into biopharmaceutical biotechnology companies, research institutes, cell banks, and others. Among these, the biopharmaceutical biotechnology companies segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cell therapy is operated by biopharmaceutical and biotechnology companies, leading to the discovery, clinical testing, and marketing of cell therapies, resulting in large-scale production and significant expenditures in manufacturing infrastructure.

Regional Segment Analysis of the Cell Therapy Biomanufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cell therapy biomanufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cell therapy biomanufacturing market over the predicted timeframe. The North American region is recognized for its sophisticated healthcare infrastructure and strong regulatory backing. In addition, the United States controls 89.5% of the region's commerce due to Medicare and government funding programs. Canada, on the other hand, contributes 11% of its regional output. The USPTO study also found that 70% of cell treatment patents worldwide originate in Boston and San Diego, which are concentrated industrial areas that benefit the region.

Asia Pacific is expected to grow at a rapid CAGR in the cell therapy biomanufacturing market during the forecast period. the Asia-Pacific region as a result of growing government spending, regenerative medicine breakthroughs, and an increase in the incidence of chronic illnesses. In addition, the area is home to powerful nations like China, India, Japan, and South Korea, which are at the vanguard of this growth trajectory owing to robust regulations and significant R&D spending. Government programs encouraging biotechnology innovation also contribute to the region's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cell therapy biomanufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BD

- Lonza

- Sartorius AG

- Bio-Techne.

- Merck KGaA

- Miltenyi Biotec

- Eppendorf SE

- PBS Biotech, Inc.

- Repligen Corporation

- Corning Incorporated

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Bharat Biotech International Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Bharat Biotech International Limited (BBIL), a leader in economically viable domestic vaccine development and production, announced its entry into the fields of cell and gene therapy (CGT) and viral vector production at Genome Valley. The announcement broadens the company's expertise beyond vaccine innovation to include cutting-edge regenerative and personalized therapies that hold out hope for millions of people.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cell therapy biomanufacturing market based on the below-mentioned segments:

Global Cell Therapy Biomanufacturing Market, By Product Type

- Consumables

- Equipmen

- Systems & Software

Global Cell Therapy Biomanufacturing Market, By End User

- Biopharmaceutical Biotechnology Companies

- Research Institutes

- Cell Banks

- Others

Global Cell Therapy Biomanufacturing Market, By Regional Analysis

North America

- US

- Canada

- Mexico

Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

South America

- Brazil

- Argentina

- Rest of South America

Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?