Global Cell Banking Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Type (Master Cell Banking, Working Cell Banking, and Viral Cell Banking), By Cell Type (Stem Cell and Non-stem Cell), By Phase (Bank Storage, Bank Characterization & Testing, and Bank Preparation), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: HealthcareGlobal Cell Banking Outsourcing Market Insights Forecasts to 2032

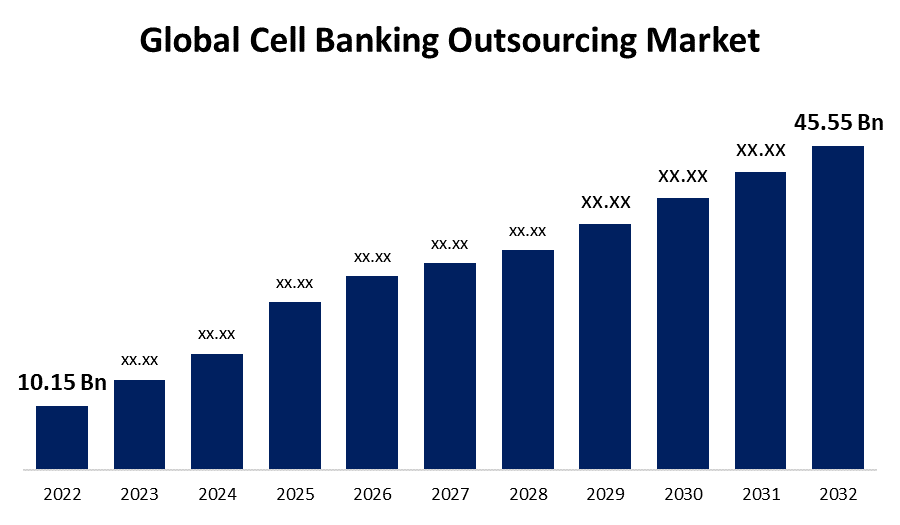

- The Global Cell Banking Outsourcing Market Size was valued at USD 10.15 Billion in 2022.

- The Market is Growing at a CAGR of 16.2% from 2023 to 2032

- The Worldwide Market Size is expected to reach USD 45.55 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global Cell Banking Outsourcing Market Size is expected to reach USD 45.55 Billion by 2032, at a CAGR of 16.2% during the forecast period 2023 to 2032.

Market Overview

Cell banking outsourcing refers to the practice of delegating the establishment and maintenance of cell banks to external service providers. Cell banks are repositories of cell lines used in research, development, and production of biopharmaceutical products. Outsourcing this process offers several benefits to pharmaceutical and biotech companies, including cost savings, enhanced efficiency, and access to specialized expertise. Cell banking outsourcing providers offer services such as cell line development, characterization, storage, and distribution, ensuring compliance with regulatory standards. By partnering with these providers, companies can focus on their core competencies while leveraging the expertise and infrastructure of the outsourcing partner. This approach enables accelerated timelines, reduced risks, and increased flexibility in the cell banking process, supporting the advancement of innovative therapies in the biopharmaceutical industry.

Report Coverage

This research report categorizes the market for cell banking outsourcing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cell banking outsourcing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the cell banking outsourcing market.

Global Cell Banking Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 10.15 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.2% |

| 2032 Value Projection: | USD 45.55 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Cell Type, By Phase, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | The Procter & Gamble Company, The 3M Company, S. C. Johnson & Son, Inc., Reckitt Benckiser Group PLC., Newell Brands, Circle E Candles, Esteban Paris, Broken Top Candle Company, Bridgewater Candle Company, The Copenhagen Candle Company Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The cell banking outsourcing market is driven by several factors that contribute to its growth and adoption, cost savings and operational efficiencies are key drivers, as outsourcing allows companies to reduce infrastructure and labor costs associated with in-house cell banking operations. Additionally, outsourcing provides access to specialized expertise and cutting-edge technologies, enabling companies to leverage the best practices and advanced capabilities of outsourcing providers. Regulatory compliance is another driver, as outsourcing providers are well-versed in industry regulations and can ensure adherence to stringent quality standards. Moreover, the increasing complexity and diversity of cell lines used in biopharmaceutical research and production create a demand for outsourcing, as it offers access to a wider range of cell banking services and capabilities. The growing focus on innovation and accelerated timelines in the biopharmaceutical industry further drives the cell banking outsourcing market. Outsourcing allows companies to streamline their processes, reduce development time, and expedite the progression of innovative therapies to market. Finally, the global expansion of the biopharmaceutical sector and the increasing demand for personalized medicine contribute to the growth of the cell banking outsourcing market, as companies seek scalable and flexible solutions to meet their evolving needs.

Restraining Factors

While the cell banking outsourcing market presents numerous opportunities, it also faces certain restraints. One major restraint is the concern over data security and intellectual property protection. Companies may be reluctant to outsource their cell banking operations due to the potential risks associated with the transfer of sensitive information and proprietary knowledge. Additionally, regulatory complexities and compliance challenges can pose a restraint, as outsourcing providers must adhere to various regulations and quality standards specific to the biopharmaceutical industry. Furthermore, the lack of standardization in cell banking processes and varying quality levels across outsourcing providers can create uncertainty and hinder widespread adoption.

Market Segmentation

- In 2022, the master cell banking segment accounted for around 57.3% market share

On the basis of the type, the global cell banking outsourcing market is segmented into master cell banking, working cell banking, and viral cell banking. The master cell banking (MCB) segment has emerged as the leader, holding the largest market share in the cell banking outsourcing industry. This dominance can be attributed to several key factors, the establishment of a reliable MCB is crucial in biopharmaceutical development as it serves as a stable source for generating working cell banks (WCBs). Consequently, pharmaceutical and biotech companies place significant emphasis on outsourcing MCB services to ensure the production of consistent and high-quality cell lines. Additionally, the stringent regulatory requirements surrounding MCBs, including characterization, authentication, and quality control, drive the demand for outsourcing providers with expertise in this area. These providers possess the necessary facilities, equipment, and knowledge to develop and maintain MCBs in compliance with regulatory standards. Furthermore, the extensive experience and expertise of outsourcing providers in master cell banking, coupled with their ability to scale operations to accommodate the growing demand for biopharmaceuticals, contribute to their dominance in the market. Overall, the master cell banking segment plays a critical role in supporting the development and production of biopharmaceutical products, driving its position as the leading segment in the cell banking outsourcing market.

- In 2022, the bank storage segment dominated with more than 42.5% market share

Based on the type of phase, the global cell banking outsourcing market is segmented into bank storage, bank characterization & testing, and bank preparation. The bank storage segment has established its dominance and held the largest market share in the cell banking outsourcing industry. This can be attributed to several factors, the storage of cell banks is a critical aspect of the cell banking process, as it ensures the preservation, stability, and accessibility of valuable cell lines. Outsourcing providers specializing in bank storage offer state-of-the-art facilities, advanced cryopreservation techniques, and secure storage systems that meet regulatory requirements. Moreover, the bank storage segment caters to the increasing demand for long-term storage solutions, including master cell banks (MCBs) and working cell banks (WCBs), as well as the storage of specialized cell lines such as stem cells. These providers offer temperature-controlled environments, efficient inventory management systems, and comprehensive tracking mechanisms to ensure the integrity and traceability of stored cells. Furthermore, the complexity and cost associated with establishing and maintaining in-house storage facilities drive companies to outsource these services to specialized providers. This enables businesses to optimize their resources, minimize operational expenses, and leverage the expertise and infrastructure of the outsourcing partner. Overall, the bank storage segment's dominance is a result of its crucial role in ensuring the safe and reliable storage of cell banks for the biopharmaceutical industry.

Regional Segment Analysis of the Cell Banking Outsourcing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 41.6% revenue share in 2022.

Get more details on this report -

Based on region, North America has consistently held the largest market share in the cell banking outsourcing industry. There are several factors contributing to this dominant position, the region is home to a robust and mature biopharmaceutical sector, with numerous established pharmaceutical and biotech companies. These companies actively engage in research, development, and production of biopharmaceutical products, creating a high demand for cell banking services. Furthermore, North America has a strong regulatory framework and adherence to strict quality standards, which increases the need for outsourcing providers that specialize in regulatory compliance. The region also benefits from a well-developed infrastructure and access to advanced technologies, enabling efficient and reliable cell banking operations. Moreover, North America boasts a highly skilled workforce and a strong focus on innovation, driving the demand for specialized expertise in cell line development and characterization. The presence of leading research institutions and academic centers further contributes to the region's dominance in the cell banking outsourcing market.

Recent Developments

In May 2023, panCELLa and BioCentriq, Inc. have entered into a research agreement to assess the capacity of panCELLa's genetically modified iPSC-derived feeder cells to activate and positively affect the growth rate, total yield, and potency of produced NK cells.

In April 2022, Pluristyx, a biotechnology company focusing on innovative therapeutic tools and services, and Accelerated Biosciences, a regenerative medicine pioneer in the use of proprietary human trophoblast stem cells (hTSCs), have agreed to create clinical-grade hESC banks in accordance with Good Manufacturing Practises (GMP).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cell banking outsourcing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Global Cell Banking Outsourcing Market List of Companies:

- Bio Outsource

- BSL Bioservice

- Cryo-Cell International, Inc.

- Charles River Laboratories

- LifeCell

- Goodwin Biotechnology Inc.

- Lonza

- Texcell

- Perfectus Biomed Limited

- Cordlife Group Limited

- Clean Biologics

- Wuxi Apptec

Global Cell Banking Outsourcing Market Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global cell banking outsourcing market based on the below-mentioned segments:

Cell Banking Outsourcing Market, By Type

- Master Cell Banking

- Working Cell Banking

- Viral Cell Banking

Cell Banking Outsourcing Market, By Cell Type

- Stem Cell

- Non-stem Cell

Cell Banking Outsourcing Market, By Phase

- Bank Storage

- Bank Characterization & Testing

- Bank Preparation

Cell Banking Outsourcing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?