Global Air Cargo Container Market Size, Share, and COVID-19 Impact Analysis, By Container Type (Refrigerated, Non-Refrigerated), By Material (Metal, Composite), By End-User (New Sales, Maintenance & Repair), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Aerospace & DefenseGlobal Air Cargo Container Market Insights Forecasts to 2032

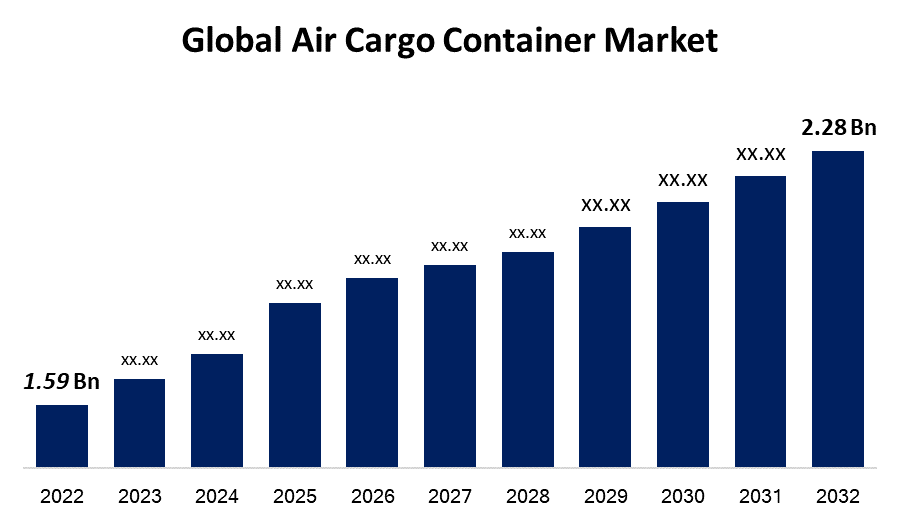

- The Global Air Cargo Container Market Size was valued at USD 1.59 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.7% from 2022 to 2032

- The Worldwide Air Cargo Container Market Size is expected to reach USD 2.28 Billion by 2032

- North America is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Air Cargo Container Market Size is anticipated to exceed USD 2.28 Billion by 2032, Growing at a CAGR of 3.7% from 2022 to 2032. The increasing pharmaceutical item exports around the world are projected to propel industry demand.

Market Overview

Air cargo containers, also known as Unit Load Devices (ULD), are solid vessels used to transport luggage, freight, or other cargo. It consists of refrigerated and non-refrigerated containers that can hold a large amount of cargo as a single unit. Container shape and size vary depending on consumer requirements and cargo type. These containers must be compatible with cargo handling systems and be designed to fit within the aircraft's cargo hold. The growth of the e-commerce industry has put pressure on various sales channels to provide faster delivery and a more efficient supply chain. Many third-party logistics providers are expanding their services to include air cargo as a critical mode of goods transportation. In general, perishable and high-value goods transported by air include foods and beverages, pharmaceuticals, biological products, computers, and consumer electronics, which are also the fastest-growing trade flows among various countries. The expansion of overall cross-border trade is expected to drive demand for the air cargo market.

Report Coverage

This research report categorizes the market for the global air cargo container market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the air cargo container market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the air cargo container market.

Global Air Cargo Container Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.59 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.7% |

| 2032 Value Projection: | USD 2.28 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Container Type, By Material, By End-User, By Region. |

| Companies covered:: | Nordisk Aviation, Granger Plastics, Air Cargo Containers LLC, Royal DSM N.V, DokaSch GmbH, Zodiac AirCargo Equipment, Envirotainer, Safran Aerosystems, VRR Aviation, ACL Airshop, Unilode, CHEP, Jettainer, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In response to ever-increasing air cargo demand, emerging countries are converting and upgrading existing airports into cargo terminals, which will drive the development of the air cargo container market. Nairobi previously developed on-airport refrigerated storage facilities, which were operated and maintained by Kenya Airways' ground handling subsidiary. This makes it easier to transport and screen food cargo, which typically has a short shelf life. Such trends are expected to fuel the global demand for ULD containers.

The air cargo container market from freighter aircraft generated around USD 700 million in 2020, owing to its widespread use in air cargo transportation. The growing popularity of online shopping, as well as the presence of a large number of manufacturing facilities for electronic products and other commercial goods in countries such as Vietnam, Thailand, China, Japan, Taiwan, and India, are driving growth in the air cargo market. SpiceJet, Garuda Indonesia, and ANA Cargo are expected to deploy more freighter aircraft, driving demand throughout the forecast period.

Restraining Factors

Aviation fuel price fluctuations are a significant restraint on the air cargo container market. Air cargo containers are directly related to aviation fuel prices, which can be highly volatile due to geopolitical factors, supply-demand imbalances, and economic uncertainties. Sharp increases in oil prices can increase airline operating costs, affecting profitability and potentially reducing air travel demand.

Market Segmentation

The Global Air Cargo Container Market share is classified into container type, material, and end-user.

- The refrigerated segment is expected to grow at the highest CAGR in the global air cargo container market during the forecast period.

The global air cargo container market is categorized by container type into refrigerated and non-refrigerated. Among these, the refrigerated segment is expected to grow at the highest CAGR in the global air cargo container market during the forecast period. The worldwide market for pharmaceuticals is today's most specialized, regulated, and fragile cargo market to deal with. Temperature-controlled medicinal products and biological products necessitate refrigerated containers capable of maintaining temperatures ranging from 2oC to 8oC or well below 0oC, based on the pharmaceutical product to be carried. As reported by IATA, overall airline cargo revenue for medicinal products crossed USD 1.4 billion in 2018 and is projected to increase further due to the airline's ability to transport products in a short period of time while also preserving and maintaining fragile cargo.

- The metal segment is expected to hold the largest share of the global air cargo container market during the forecast period.

Based on the material, the global air cargo container market is divided into metal and composite. Among these, the metal segment is expected to hold the largest share of the global air cargo container market during the forecast period. Depending on the requirements, ULD containers are typically made of aluminum or steel. Aluminum is widely used because of its lightweight properties and lack of corrosion. Aluminum extrusions, a relatively thick base sheet, and aluminum side and roof panels make up an air cargo container.

- The new sales segment is expected to grow at the highest pace in the global air cargo container market during the forecast period.

Based on the end-user, the global air cargo container market is divided into new sales, maintenance & repair. Among these, the new sales segment is expected to grow at the highest pace in the global air cargo container market during the forecast period. The growing aircraft fleet will fuel the supremacy of new ULD containers.

Regional Segment Analysis of the Global Air Cargo Container Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

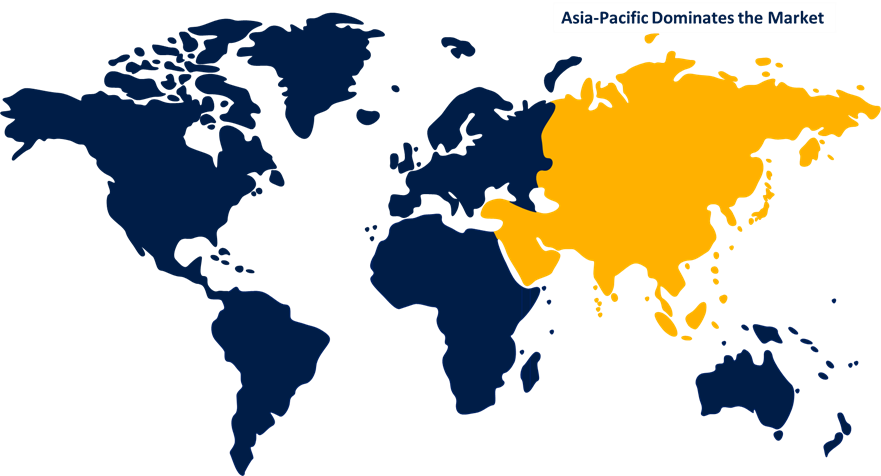

Asia Pacific is anticipated to hold the largest share of the global air cargo container market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global air cargo container market over the predicted years. Expanding trade operations, such as cargo and transport of goods for the pharmaceutical, FMGC, and electronics sectors, are fueling the market explosion in this region. Major competitors are present in this region, with creative approaches for pharmaceutical product transportation throughout the region.

North America is expected to grow at the fastest pace in the global air cargo container market during the forecast period. This region has the most active and largest network of B2B buyers. Increased aircraft deliveries and the widespread use of wide-body aircraft are expected to boost air cargo container demand in this region's aviation industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global air cargo container along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nordisk Aviation

- Granger Plastics

- Air Cargo Containers LLC

- Royal DSM N.V

- DokaSch GmbH

- Zodiac AirCargo Equipment

- Envirotainer

- Safran Aerosystems

- VRR Aviation

- ACL Airshop

- Unilode

- CHEP

- Jettainer

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, The European Union Aviation Safety Agency has approved VRR's collapsible air cargo container for use. The collapsible AAX has the same shape capacity and durability as the standard AAX and was created to address the world's ULD imbalance by allowing carriers to transport more empty containers on a return flight.

- In October 2022, Sonoco ThermoSafe disclosed an explosive growth of the Pegasus ULD fleet, which is available for direct lease from Sonoco or through the company's growing global network of strategic partner airlines and freight forwarders. The only advanced passive aircraft-certified temperature-controlled container (TCC) is the Pegasus unit load device (ULD).

- In August 2022, Firms transporting pharmaceuticals have been offered Envirotainer's Releye RAP temperature-controlled container by Lufthansa Cargo. The RAP version of the Releye container is the largest model and can hold five pallets, as opposed to the previous 2021 model's three pallets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Air Cargo Container Market based on the below-mentioned segments:

Global Air Cargo Container Market, By Container Type

- Refrigerated

- Non-Refrigerated

Global Air Cargo Container Market, By Material

- Metal

- Composite

Global Air Cargo Container Market, By End-User

- New Sales

- Maintenance & Repair

Global Air Cargo Container Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?