Global Cannabis Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Product (Makeup & Haircare, Skincare, Fragrances, and Others), By Source (Marijuana and Hemp), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Cannabis Cosmetics Market Size Insights Forecasts to 2035

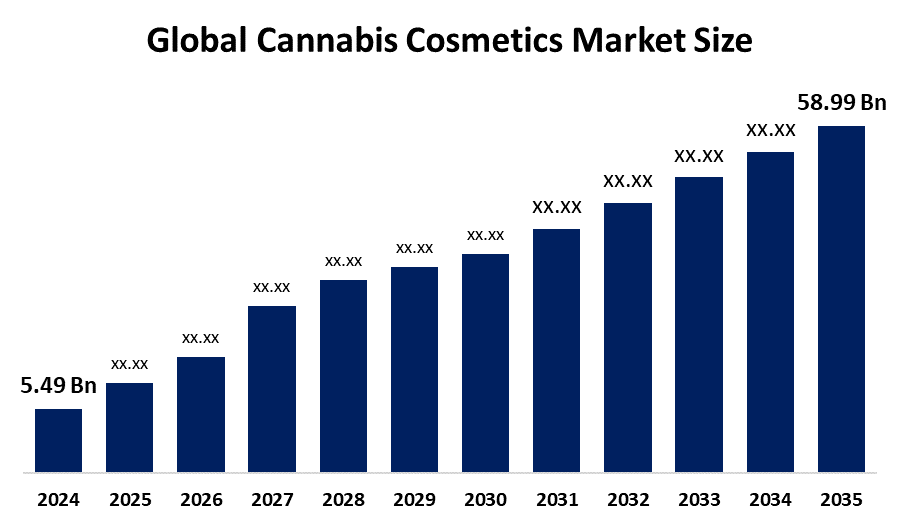

- The Global Cannabis Cosmetics Market Size Was Estimated at USD 5.49 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 24.09% from 2025 to 2035

- The Worldwide Cannabis Cosmetics Market Size is Expected to Reach USD 58.99 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Cannabis Cosmetics Market Size was worth around USD 5.49 Billion in 2024 and is predicted to Grow to around USD 58.99 Billion by 2035 with a compound annual growth rate (CAGR) of 24.09% from 2025 and 2035. The market for cannabis cosmetics has a number of opportunities to growth driven by better formulations and delivery, growing wellness and clean beauty trends, regulatory relaxations surrounding hemp and CBD, increased consumer desire for natural and organic skincare, expanding ecommerce reach, and brand innovation.

Market Overview

Cannabis cosmetics are cosmetics and personal care products that contain cannabis based ingredients, primarily cannabinoids like hemp seed oil. Recent and pending changes to regional laws around the use of cannabis and its derivatives can facilitate the global cannabis cosmetics market. As a case in point, New York State in the U.S. legalized adult use recreational marijuana in June 2021. The new law allows New Yorkers aged 21 and over to possess up to three ounces of marijuana for recreational use. In 2022, the Thai Food & Drugs Administration unit voted to remove marijuana and hemp from the Category 5 narcotics list. This was the action that enabled the decriminalization of these substances. Germany legalized the recreational use of cannabis for adults over the age of 18 in February 2024. As regional governments continue to shift their positions on cannabis, market participants will have more chances to grow.

Governments in nations like Thailand have made it easier to obtain licenses for the production, extraction, and cultivation of hemp and low THC cannabis ingredients in cosmetics, e.g., restricting THC to 0.2%. Canada is working on a suggested regulatory strategy that would better define and control cosmetics containing cannabis derived substances under standards pertaining to licensing, labeling, packaging, and promotion in order to guarantee consistency and safety.

Report Coverage

This research report categorizes the cannabis cosmetics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cannabis cosmetics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cannabis cosmetics market.

Global Cannabis Cosmetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.49 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 24.09% |

| 2035 Value Projection: | USD 58.99 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 153 |

| Tables, Charts & Figures: | 147 |

| Segments covered: | By Product, By Source and COVID-19 Impact Analysis |

| Companies covered:: | Hempz, Lord Jones, High Beauty, Milk Makeup, Cannuka, Saint Jane Beauty, Josie Maran, Leef Organics, CBD for Life, Herb Essntls, The Body Shop, Kush Queen, MGC Derma, Vertly, Kiehl’s, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cannabis cosmetics market is driven because it may benefit from recent and planned changes to regional regulations governing the use of cannabis and its derivatives. For instance, in June 2021, New York State legalized the recreational use of marijuana by adults. New Yorkers who are 21 years of age or older are permitted to possess up to three ounces of marijuana for recreational purposes under the new law. In 2022, Thailand's Food & Drugs Administration unit decided to take hemp and marijuana off the list of Category 5 narcotics. This action allowed the narcotics to be decriminalized. In February 2024, Germany made it legal for adults over the age of 18 to use cannabis recreationally.

Restraining Factors

The cannabis cosmetics market is restricted by factors like the production and consumption of cannabis in any form being prohibited in several nations worldwide. Regulations about compliance with cannabis and its derivatives are constantly changing. It varies from one area to another, even within the same nation. Complying with intricate regulatory frameworks can be challenging.

Market Segmentation

The cannabis cosmetics market share is classified into product and source.

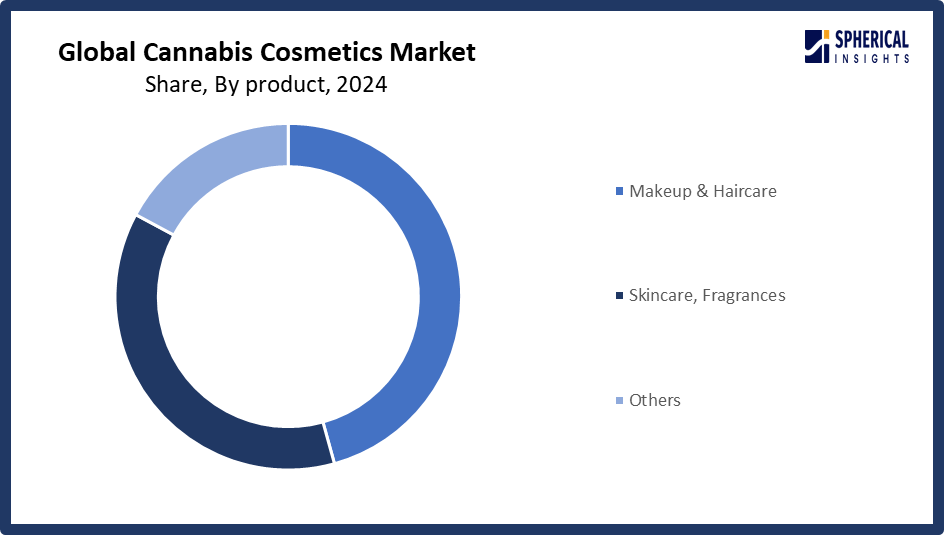

- The makeup & haircare segment dominated the market in 2024, accounting for approximately 46% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the cannabis cosmetics market is divided into makeup & haircare, skincare, fragrances, and others. Among these, the makeup & haircare segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by the rising number of makeup users globally, fueled by evolving consumer tastes and an increase in population. CBD content in cosmetics generally ranges between 0.1% to 2%. The scent segment has experienced steady growth during the forecast period. New product innovations are needed to generate revenue for the fragrance market over the next few years.

Get more details on this report -

- The hemp segment accounted for the largest share in 2024, accounting for approximately 56% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the cannabis cosmetics market is divided into marijuana and hemp. Among these, the hemp segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the legal status of the source in various parts of the world. Hemp content has a THC level that is less than 0.3%, which makes it a favorable ingredient in cosmetic formulation.

Regional Segment Analysis of the Cannabis Cosmetics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 42% of the cannabis cosmetics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 42% of the cannabis cosmetics market over the predicted timeframe. In the North America market, the market is rising as many US and Canadian states have legalized cannabis, making it easier for companies to use cannabis based compounds to develop cosmetics. Roughly 24 states in the US have legalized cannabis. There is also a well established cosmetics industry in both the US and Canada that serves as an additional trend in the region's market. In the US alone, there are a number of multinational brands, including Maybelline, Fenty Beauty, Glossier, and e.l.f. Cosmetics and Estee Lauder, which are global market leaders. The boom of cannabis research in North America will likely benefit business participants. An exciting partnership to promote cannabis research and study has been formed between the US based Cannabis Research Coalition and Sollum Technologies, which was announced in August 2024.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 16% in the cannabis cosmetics market during the forecast period. The Asia Pacific area has a thriving market for cannabis cosmetics due to the region's rise in consumer demand for natural and organic skincare products. The cannabis infused cosmetics market is developing. Other markets, similar to the trends noted in several countries, like South Korea, Japan, and others, are also seeing a heightened interest in skincare products that contain CBD as consumers are prioritizing the use of natural and organic ingredients. China could also provide opportunities, despite currently dealing with regulatory issues, as it is a large consumer market for wellness and beauty technologies.

The European cannabis cosmetics market is expanding because natural cosmetics are becoming more and more popular in the region, which will drive demand. Enhanced customer awareness, product innovation, and sales through regional ecommerce platforms are other elements driving revenue growth in Europe. Australia's Cann Global, a medical cannabis expert, launched FussPot in France in July 2022. Hemp and CBD based skin care products are available from the brand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cannabis cosmetics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hempz

- Lord Jones

- High Beauty

- Milk Makeup

- Cannuka

- Saint Jane Beauty

- Josie Maran

- Leef Organics

- CBD for Life

- Herb Essntls

- The Body Shop

- Kush Queen

- MGC Derma

- Vertly

- Kiehl's

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Glass House Brands partnered with the University of California, Berkeley to pursue hemp research around genetics, sustainability, regulation, and production innovation. This kind of research collaboration helps address supply chain issues and regulatory compliance, which are big challenges in cannabis cosmetics.

- In January 2025, Carolina Dream released a limited edition topical moisturizer named Magic Sauce, which combines CBD, CBC, and THC, using nanoemulsification technology for better absorption. It targets sore muscles, joints, and skin irritation.

- In November 2024, The Cannabist company & Veda Warrior launched a partnership in late 2024 to bring Ayurvedic inspired cannabis infused wellness products to New Jersey. Initial products include cannabis infused cooking oils, and then later topicals & edibles.

- In August 2024, Carmel Cosmetics Labs obtained authorization from Moroccan authorities to manufacture, distribute, and export cannabis based cosmetics and medical devices. This makes them the first company in Morocco with this approval.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cannabis cosmetics market based on the below mentioned segments:

Global Cannabis Cosmetics Market, By Type

- Makeup & Haircare

- Skincare, Fragrances

- Others

Global Cannabis Cosmetics Market, By Source

- Marijuana

- Hemp

Global Cannabis Cosmetics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?