Canada Secondary Wood Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Furniture, Cabinets, Millwork, Flooring, and Others), By Application (Residential, Commercial, and Industrial), and Canada Secondary Wood Products Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsCanada Secondary Wood Products Market Insights Forecasts to 2035

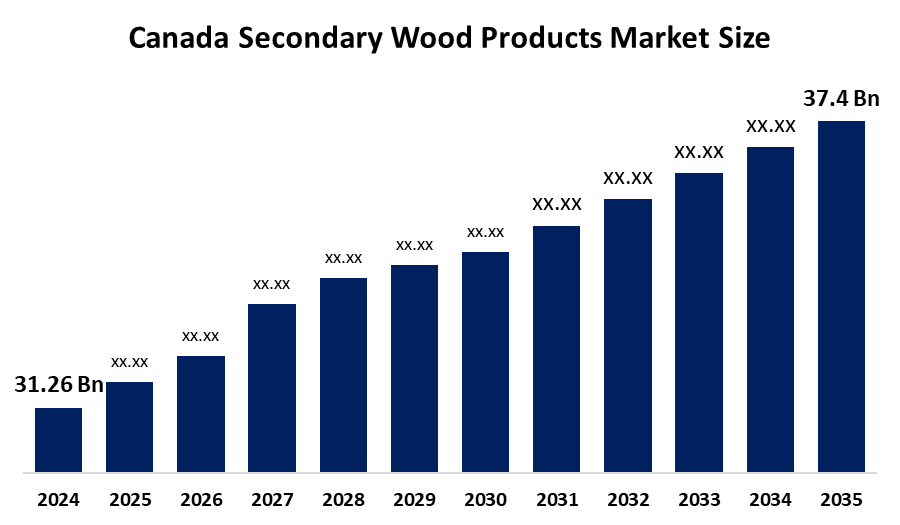

- The market for Secondary Wood Products was estimated to be worth USD 31.26 Billion in 2024.

- The market is going to expand at a CAGR of 1.64 % between 2025 and 2035.

- The Canada Secondary Wood Products market is anticipated to reach USD 37.4 Billion by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Canada Secondary Wood Products Market is anticipated to Hold USD 37.4 Billion by 2035, Growing at a CAGR of 1.64 % from 2025 to 2035. Growing demand for sustainable, value-added wood goods (furniture, engineered products) plus digital/custom manufacturing, circular economy practices, and export expansion offer strong opportunities for innovative producers.

Market Overview

The Canada secondary wood products market includes value-added goods such as furniture, cabinetry, engineered wood, mouldings, and flooring. The market is projected to grow steadily during 2025–2033, driven by rising demand for sustainable and eco-friendly wood products. Increasing consumer preference for premium and customized furniture, along with advancements in digital manufacturing and woodworking technology, are fueling market expansion. Moreover, the adoption of circular economy practices and growing exports of finished wood products are creating new opportunities. However, the market faces challenges from raw material cost fluctuations and competition from low-cost imports, requiring innovation and efficiency to sustain growth.

Report Coverage

This research report categorizes the market for the Canada secondary wood products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada secondary wood products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada secondary wood products market.

Canada Secondary Wood Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.64 % |

| 2035 Value Projection: | USD 37.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product Type and By Application |

| Companies covered:: | G. Romano, Amisco Industries, BSG Inc., BG Furniture, Herman Miller, and Weyerhaeuser Company |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Canada secondary wood products market is driven by rising consumer demand for eco-friendly and sustainable furniture and building materials. Increasing urbanization and renovation activities are boosting the need for high-quality wood products. Technological advancements in digital manufacturing and automation enhance production efficiency and product design. Additionally, government initiatives promoting sustainable forestry and value-added exports support market expansion. Growing awareness of circular economy practices and preference for locally sourced, customized wood goods further contribute to the industry’s long-term growth.

Restraining Factors

The Canada secondary wood products market faces restraints such as fluctuating raw material costs, limited availability of high-quality timber, and rising production expenses. Intense competition from low-cost imports and substitute materials also hampers growth. Additionally, environmental regulations and labor shortages in skilled woodworking further challenge market expansion.

Market Segmentation

The Canada secondary wood products market share is classified into product type and application.

- The furniture segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada secondary wood products market is segmented by product type into furniture, cabinets, millwork, flooring, and others. Among these, the furniture segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is driven by rising consumer demand for sustainable, customized, and premium-quality furniture, supported by expanding residential and commercial construction activities. Additionally, advancements in design technology and the increasing trend of eco-friendly interiors are further fueling the adoption of wood-based furniture, making it the dominant and fastest-growing segment in the market.

- The residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Canada secondary wood products market is segmented by application into residential, commercial, and industrial. Among these, the residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is primarily driven by increasing housing construction, renovation, and remodeling activities across urban and suburban regions. Rising consumer preference for sustainable, aesthetically appealing, and durable wood-based furniture and interiors also contributes to segment expansion. Additionally, government support for energy-efficient and green housing further enhances demand for secondary wood products in the residential sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada secondary wood products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- G. Romano

- Amisco Industries

- BSG Inc.

- BG Furniture

- Herman Miller

- Weyerhaeuser Company

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Canada secondary wood products market based on the following segments:

Canada Secondary Wood Products Market, By Product Type

- Furniture

- Cabinets

- Millwork

- Flooring

- Others

Canada Secondary Wood Products Market, By Application

- Residential

- Commercial

- Industrial

Need help to buy this report?