Canada Mammography Market Size, Share, and COVID-19 Impact Analysis, By Type (Full-Field Digital Mammography, Film-Screen Mammogram, Breast Tomosynthesis), By End User (Hospitals & Clinics, Diagnostic Centers, Others), and Canada Mammography Market Insights Forecasts to 2033

Industry: HealthcareCanada Mammography Market Insights Forecasts to 2033

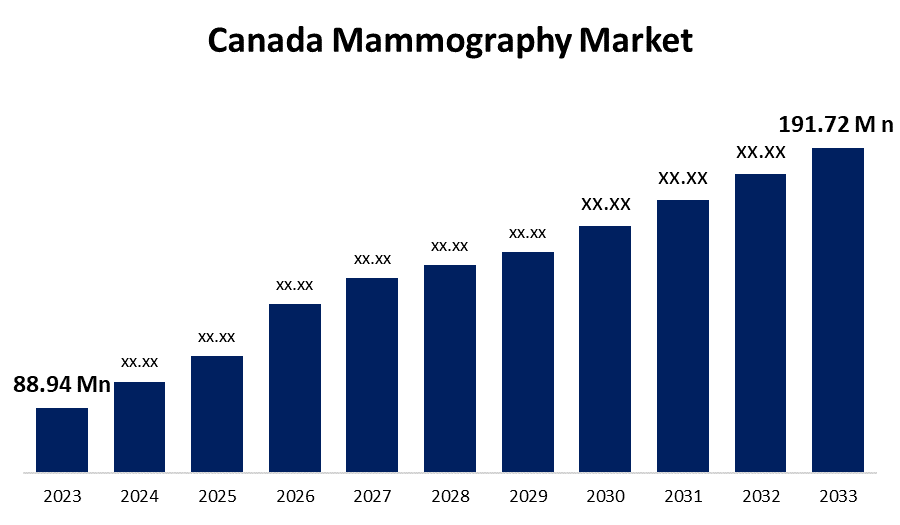

- The Canada Mammography Market Size was valued at USD 88.94 Million in 2023.

- The Market Size is Growing at a CAGR of 7.98% from 2023 to 2033.

- The Canada Mammography Market Size is Expected to Reach USD 191.72 Million by 2033.

Get more details on this report -

The Canada Mammography Market Size is expected to reach USD 191.72 Million by 2033, at a CAGR of 7.98% during the forecast period 2023 to 2033.

Market Overview

Mammography can be viewed as an X-ray of the breast. It functions as a breast cancer screening tool. Mammograms, in conjunction with routine clinical tests and monthly breast self-examinations, are an important aspect of the early detection of breast cancer. Mammograms must be conducted annually after the age of 40, even if the thought of them makes one nervous. The early detection of breast cancer by mammography screening has been found to enhance treatment outcomes and lower mortality rates. As a result, women in Canada are becoming more aware of the necessity of mammography screening, driving up demand for mammography machines in Canada. The Canadian government has taken many steps to expand access to mammography services, which has contributed to boosting demand for mammography machines. One important government project is the Canadian Breast Cancer Screening Project (CBCSI). This initiative funds mammography services across the country, increasing women’s access to screening. The CBCSI also funds research into breast cancer screening and therapy, which has improved the quality of mammography services. In addition to the CBCSI, the Canadian government supports breast cancer research and education. This financing has helped to raise awareness among women about the significance of mammography screening, increasing in demand for mammography machines.

Report Coverage

This research report categorizes the market for Canada mammography market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada mammography market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Canada mammography market.

Canada Mammography Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 88.94 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.98% |

| 2033 Value Projection: | USD 191.72 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User |

| Companies covered:: | Canon Medical Systems Corporation, Fujifilm Corporation, Siemens Healthcare, Toshiba Medical Systems, GE Healthcare, Metaltronica, Hologic Inc., Analogic Corporation, Koninklijke Philips N.V., Planmed Oy, and key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The increased awareness of breast cancer screening is a major driver of growth in the Canadian mammography devices industry. Women in Canada are more aware of the benefits of regular mammography screening in discovering breast cancer early, which improves treatment outcomes and lowers mortality rates. The Canadian Cancer Society recommends that women aged 50 to 74 get regular mammography screening every two years, while women aged 40 to 49 should evaluate the advantages and risks of screening with their doctor. This advice, together with the increased awareness of breast cancer screening, has caused a rise in the demand for mammography devices in Canada.

Restraining Factors

All mammography equipment contains wearing parts that need to be changed. If a part is difficult to find, it will nearly always cost more to buy. Some X-ray tubes, for example, are only available from their original maker. OEM parts are often the most expensive. As a result, the high cost of mammography equipment may hinder market expansion over the projection period.

Market Segment

- In 2023, the full-field digital mammography segment accounted for the largest revenue share over the forecast period.

Based on the type, the Canada mammography market is segmented into full-field digital mammography, film-screen mammogram, and breast tomosynthesis. Among these, the full-field digital mammography segment has the largest revenue share over the forecast period. Digital Systems have emerged as the leading category in the Canada mammography systems market. These systems have several advantages over classic film screens and analog systems. Digital mammography devices collect and store images electronically, resulting in faster image acquisition, higher image quality, and the capacity to enhance and edit images for greater diagnostic accuracy. Digital solutions also make it easier to store, share, and retrieve patient data, which contributes to more efficient workflows.

- In 2023, the hospitals & clinics segment accounted for the largest revenue share over the forecast period.

Based on end users, the Canada mammography market is segmented into hospitals & clinics, diagnostic centers, and others. Among these, the hospitals & clinics segment has the largest revenue share over the forecast period. Many multispecialty hospitals typically have in-house mammography facilities. This is expected to have a considerable impact on segment growth. In addition, increased hospital investments in innovative treatment services are expected to drive segment expansion in Canada. This has raised the need for mammography procedures for breast cancer screening, treatment planning, and prevention.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada mammography market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Medical Systems Corporation

- Fujifilm Corporation

- Siemens Healthcare

- Toshiba Medical Systems

- GE Healthcare

- Metaltronica

- Hologic Inc.

- Analogic Corporation

- Koninklijke Philips N.V.

- Planmed Oy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Lunit gained commercial approval in Canada for Lunit INSIGHT, the company's radiology AI solution suite. Health Canada, the Canadian medical device regulator, approved class 2 medical licenses for Lunit's AI solution for a chest x-ray, 'Lunit INSIGHT CXR' and 'Lunit INSIGHT MMG,' an AI solution for mammography.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Canada mammography market based on the below-mentioned segments:

Canada Mammography Market, By Type

- Full-Field Digital Mammography

- Film-Screen Mammogram

- Breast Tomosynthesis

Canada Mammography Market, By End User

- Hospitals & Clinics

- Diagnostic Centers

- Others

Need help to buy this report?