Global Brewer’s Yeast Market Size, Share, and COVID-19 Impact Analysis, By Product (Dry, Fresh, Instant Dry, and Liquid), By Form (Powder, Tablet, Flake, and Liquid), By Application (Food and Feed), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Consumer GoodsGlobal Brewer’s Yeast Market Insights Forecasts to 2032

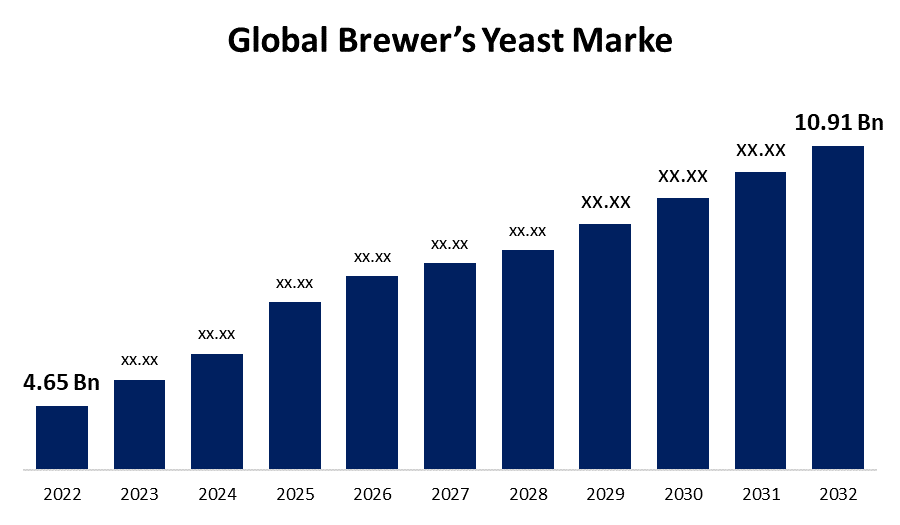

- The Global Brewer’s Yeast Market Size was valued at USD 4.65 Billion in 2022.

- The market is growing at a CAGR of 8.9% from 2023 to 2032

- The Worldwide Brewer’s Yeast Market Size is expected to reach USD 10.91 Billion by 2032

- Asia-Pacific is expected to grow significant during the forecast period

Get more details on this report -

The Global Brewer’s Yeast Market Size is expected to reach USD 10.91 Billion by 2032, at a CAGR of 8.9% during the forecast period 2023 to 2032.

Market Overview

Brewer's yeast, scientifically known as Saccharomyces cerevisiae, is a type of fungus commonly used in brewing beer and baking. This versatile microorganism is highly valued for its nutritional benefits and various health-promoting properties. Brewer's yeast is a rich source of protein, B-complex vitamins, and essential minerals such as selenium, zinc, and chromium. It also contains a significant amount of dietary fiber. Due to its high nutrient content, it is often used as a dietary supplement to support overall health and well-being. Brewer's yeast is known for its potential to boost the immune system, promote healthy digestion, and support energy production. Additionally, it may help regulate blood sugar levels and improve skin health. While primarily recognized for its role in brewing and baking, brewer's yeast offers a wide range of potential health benefits, making it a popular choice for individuals seeking a natural and nutrient-dense supplement.

Report Coverage

This research report categorizes the market for brewer’s yeast market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the brewer’s yeast market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the brewer’s yeast market.

Global Brewer’s Yeast Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.65 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.9% |

| 2032 Value Projection: | USD 10.91 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Form, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Associated British Food PLC, Lesaffre Group, Alltech, Leiber GmbH, Angel Yeast Co., Ltd., Lallemand, Inc., F.L. Emmert, Nutreco N.V., Biomin, Shandong Bio Sunkeen Co., Ltd., Archer Daniels Midland Company, And Other Key venders |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The brewer's yeast market is influenced by several key drivers, the growing demand for natural and organic products in the food and beverage industry is a significant driver. Brewer's yeast is a natural ingredient, rich in nutrients, and aligns with the increasing consumer preference for clean-label and health-conscious products. The rising popularity of craft beer and home brewing has fueled the demand for brewer's yeast. As more individuals engage in brewing their own beer, the need for quality yeast strains, including brewer's yeast, has surged. The increasing awareness of the health benefits associated with brewer's yeast, such as immune system support and improved digestion, has expanded its applications in the dietary supplement and nutraceutical industries. Furthermore, the growing vegan and vegetarian population has also contributed to the demand for Brewer's yeast as a natural source of protein and B vitamins. Overall, these drivers are propelling the growth of the brewer's yeast market and are expected to continue shaping its trajectory in the coming years.

Restraining Factors

The brewer's yeast market also faces several restraints that impact its growth, the limited availability of high-quality brewer's yeast strains can pose challenges in meeting the increasing demand. Maintaining consistent quality and ensuring reliable supply can be a constraint for manufacturers. The stringent regulations and standards imposed by regulatory authorities on the production and distribution of yeast-based products can add complexities and compliance costs for market players. Additionally, the potential allergenicity of Brewer's yeast can restrict its usage for individuals with yeast allergies. Overall, the volatility in raw material prices, such as malt or barley, which are used in the brewing process, can impact the cost of brewer's yeast and subsequently affect market dynamics. These restraints highlight the need for effective quality control measures, regulatory compliance, and strategic supply chain management in the brewer's yeast market.

Market Segmentation

- In 2022, the dry segment accounted for around 35.3% market share

On the basis of the product, the global brewer’s yeast market is segmented into dry, fresh, instant dry, and liquid. The dry product segment has emerged as the dominant force in the brewer's yeast market, capturing a significant share of the overall market. Several factors contribute to the dominance of the dry product segment because the dry brewer's yeast offers various advantages over its liquid counterpart. Dry yeast has a longer shelf life and better stability, making it easier to store, transport, and use in large-scale brewing and baking operations. The extended shelf life reduces the risk of spoilage and wastage, enhancing cost-effectiveness for manufacturers and end-users. Additionally, dry yeast can be easily rehydrated and activated, providing convenience and flexibility in application. Furthermore, the dry product segment is witnessing technological advancements and innovations. The development of specialized drying techniques, such as spray drying and vacuum drying, helps preserve the nutritional properties and integrity of brewer's yeast during the drying process. This ensures that the dry product retains its high nutritional value, including protein, B-complex vitamins, and minerals, which are sought-after attributes by consumers. Another significant factor driving the dominance of the dry product segment is its versatility. Dry brewer's yeast finds applications not only in beer brewing but also in various food and beverage formulations, dietary supplements, animal feed, and pharmaceuticals. The wide range of applications and adaptability of dry brewer's yeast expands its market potential and appeal to different industries. Moreover, the growing trend of home brewing and DIY food production has fueled the demand for dry brewer's yeast.

- In 2022, the food segment dominated with more than 70.4% market share

Based on the application, the global brewer’s yeast market is segmented into food and feed. The food application has established dominance in the brewer's yeast market, emerging as the leading segment. Several factors contribute to the significant market share of brewer's yeast in the food industry, because the brewer's yeast is widely recognized for its nutritional value and health benefits. It is rich in protein, B-complex vitamins, and minerals, making it a valuable ingredient for fortifying various food products. As consumers increasingly seek healthier and more nutritious food options, brewer's yeast finds extensive use in baked goods, snacks, cereals, soups, sauces, and spreads, adding both flavor and nutritional value. Brewer's yeast aligns with the growing demand for natural and clean-label ingredients. As consumers become more conscious of the ingredients they consume, brewer's yeast serves as a natural, non-GMO, and additive-free ingredient, meeting the clean-label trend. Its versatility allows it to be used in both conventional and specialty food products, catering to a wide range of consumer preferences. Furthermore, the rising adoption of vegetarian, vegan, and plant-based diets has fueled the demand for brewer's yeast in food applications. It serves as a valuable source of plant-based protein and B vitamins, making it an ideal ingredient for meat substitutes, plant-based protein products, and vegetarian-friendly food formulations. Additionally, brewer's yeast enhances flavor profiles, adding a nutty, savory, and umami taste to food products. This flavor enhancement property contributes to its extensive use in seasonings, sauces, and savory snacks. Moreover, the growing popularity of functional foods and beverages that offer health benefits beyond basic nutrition has further propelled the demand for brewer's yeast in the food industry.

Regional Segment Analysis of the Brewer’s Yeast Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

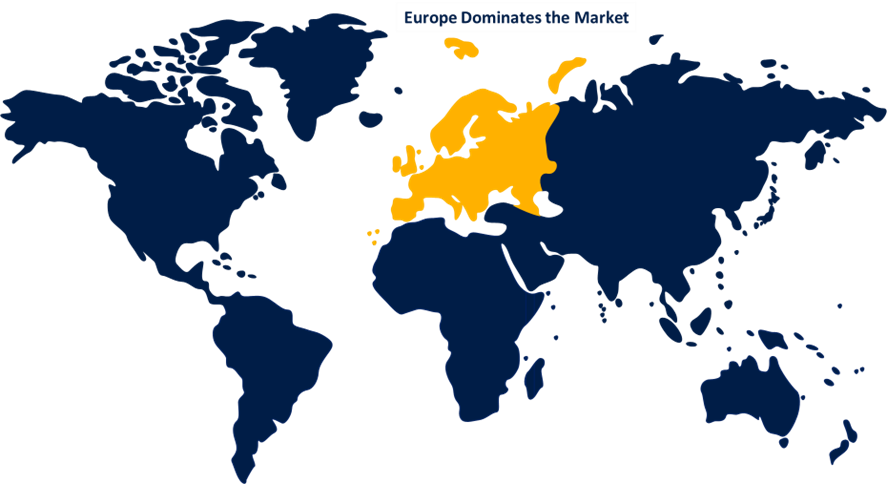

Europe dominated the market with more than 33.1% revenue share in 2022.

Get more details on this report -

Based on region, Europe is a dominant player in the Brewer's Yeast market, holding a significant share of the market. Europe has a long-standing tradition and strong culture of brewing, making it a major hub for the beer industry. The region is home to renowned breweries and a large consumer base for beer products. This established brewing industry creates a consistent demand for brewer's yeast. Europe has a well-developed food and beverage sector, emphasizing quality and natural ingredients. Brewer's yeast, being a natural and nutrient-rich ingredient, aligns well with European consumer preferences for clean-label and health-conscious products. Additionally, Europe has a robust infrastructure for research and development, leading to innovations in yeast strains and brewing techniques, further bolstering its market share. These factors collectively contribute to Europe's dominance in the brewer's yeast market.

Recent Developments

- In May 2023, AB Biotek, a global business branch of AB Mauri, will expand its dry yeast range for consumer alcohol under the premium Pinnacle brand for craft and home brewers worldwide at the 2023 Craft Brewers Conference. Country Malt Group will be the only distributor of the range in North America.

- In August 2021, Angel Yeast, a China-based worldwide yeast and yeast extract company, paid $15.4 million for Bio Sunkeen's Yeast. The company wants to maximise its manufacturing capacity while consolidating and enhancing its industry position through this purchase. Bio Sunkeen's Yeast is a Chinese company that produces yeast products for human and animal nutrition.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global brewer’s yeast market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Associated British Food PLC

- Lesaffre Group

- Alltech

- Leiber GmbH

- Angel Yeast Co., Ltd.

- Lallemand, Inc.

- F.L. Emmert

- Nutreco N.V.

- Biomin

- Shandong Bio Sunkeen Co., Ltd.

- Archer Daniels Midland Company

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global brewer’s yeast market based on the below-mentioned segments:

Brewer’s Yeast Market, By Product

- Dry

- Fresh

- Instant Dry

- Liquid

Brewer’s Yeast Market, By Form

- Powder

- Tablet

- Flake

- Liquid

Brewer’s Yeast Market, By Application

- Food

- Feed

Brewer’s Yeast Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?