Brazil Tire Market Size, Share, By Vehicle Type (Passenger Cars, Light & Medium Commercial Vehicle, Heavy Commercial Vehicle, Two-Wheeler and Other), By Road Application (All-Season Tire, Summer Tire, Winter Tire and Other), By Construction (Radial Tire and Bias Ply Tire), By Tire Type (Tubeless Tire and Tubbed Tire), Brazil Tire Market Insights, Industry Trend, Forecasts to 2035.

Industry: Advanced MaterialsBrazil Tire Market Insights Forecasts to 2035

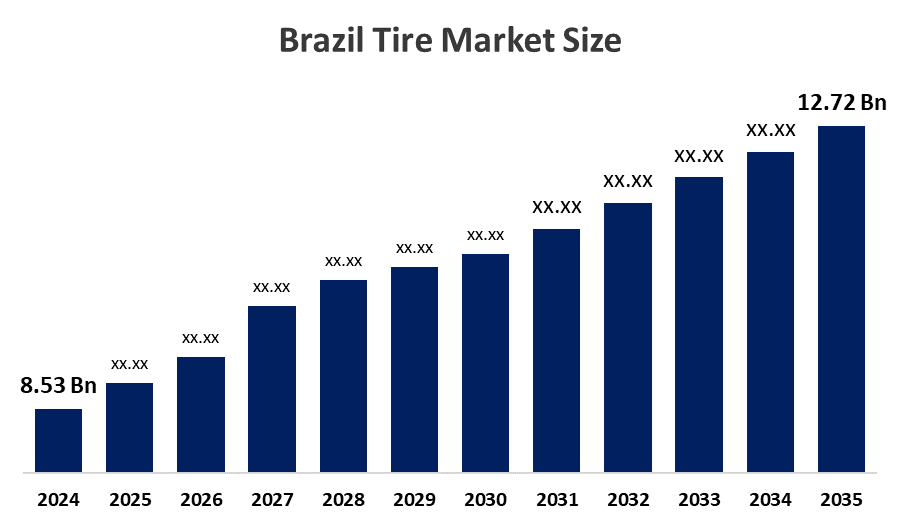

- Brazil Tire Market Size 2024: USD 8.53 Bn

- Brazil Tire Market Size 2035: USD 12.72 Bn

- Brazil Tire Market CAGR 2024: 3.7%

- Brazil Tire Market Segments: Vehicle Type, Road Application, Construction, Tire Type

Get more details on this report -

A tire is a circular rubber part that is placed around a vehicle's wheel. It is a multi-functional component of a car, as it not only carries the machine's weight but also provides traction with the road, and absorbs impacts while ensuring smooth motion, safe steering, effective braking, and stability, as well as comfort in driving. Besides that, as a consequence of rising vehicle ownership, automotive production expansion, infrastructure development, increased replacement tire demand, logistics and transportation growth, higher disposable income, and rising preference for durable, fuel-efficient, and premium tires, the Brazil tire market is booming.

Innovations in technology used in the manufacturing and designing of tires have been instrumental in the growth of the Brazil tire market. Technological developments made it possible to come up with new materials for tires, better patterns of treads, and more efficient methods of construction of tires, thus resulting in ever-improving, high-performing, economical, and durable tires. These are a few of the many technological enhancements that ensure that the major issues of safety, performance, and cost, which concern most consumers, are well addressed. As one example, the integration of smart tire technology, which allows for monitoring the pressure and temperature of the tires, is a way to improve vehicle safety and precision. Subsequently, as the consumers and businesses in Brazil get acquainted with such developments, the market demand for technologically advanced tires will be higher.

With the rise of the middle class and an improved standard of living, car sales have skyrocketed, which would naturally lead to a huge market for tires. Part of this is that, as of October 2024, Brazil's new vehicle market had a massive expansion in September 2024, with sales increasing by 19.57 percent compared to the previous year. The National Federation of Motor Vehicle Distribution (ANFAVEA) reported 236, 353 units sold. The increasing number of car owners, as more Brazilians can afford cars, will create a demand for new tires as well as replacement ones. Therefore, this trend is a constant source of demand for tire manufacturing companies and distributors, thus forming a stable market base. The increase in the number of vehicles guarantees a continuously growing market for both the original equipment and replacement tires

Market Dynamics of the Brazil Tire Market:

The Brazil tire market is driven by rising vehicle ownership, growth in automotive production, and increasing demand for replacement tires. Expansion of road infrastructure and logistics activities supports higher commercial vehicle usage, boosting tire consumption. A key trend driving the market is the growing preference for fuel-efficient, durable, and high-performance tires. Technological advancements, including smart tires and eco-friendly materials, are also shaping demand. Additionally, increasing consumer awareness of safety, better road connectivity, and the expansion of online tire sales channels further contribute to steady market growth across passenger and commercial vehicle segments.

The Brazil tire market faces restraints from fluctuating raw material prices, especially natural rubber and oil-based inputs, which increase production costs. Economic uncertainty and inflation can reduce vehicle sales and delay tire replacements. Additionally, intense competition and the presence of low-cost imports put pressure on pricing and profit margins for manufacturers.

The Brazil tire market offers strong opportunities through growing demand for replacement tires driven by an expanding vehicle fleet and longer vehicle usage. Rising adoption of electric and hybrid vehicles creates opportunities for specialized, low-rolling-resistance tires. Increasing focus on sustainable and eco-friendly tires made from recyclable materials also presents growth potential. Additionally, the expansion of e-commerce platforms and smart tire technologies enables manufacturers to reach wider customers and offer value-added products, supporting long-term market expansion.

Brazil Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 8.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.7% |

| 2035 Value Projection: | 12.72 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Vehicle Type, By Road Application, By Construction, By Tire Type |

| Companies covered:: | Pirelli & C. S.p.A., Michelin Group, Bridgestone Americas Tire Operations, LLC, The Goodyear Tire & Rubber Company, Continental AG, Rinaldi Tires, Maggion Indústria de Pneus e Máquinas Ltda., Maxxis International, Kenda Rubber Industrial Co., Ltd., Technic Tires, and and others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Brazil Tire Market share is classified into vehicle type, road application, construction, and tire type.

By Vehicle Type:

The Brazil Tire market is divided by vehicle type into passenger cars, light & medium commercial vehicles, heavy commercial vehicles, two-wheeler, and other. Among these, the passenger cars segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The passenger cars segment dominates due to the large and growing passenger vehicle fleet across the country. Rising urbanization, increasing disposable income, and greater reliance on personal vehicles boost car ownership. Additionally, passenger cars require more frequent tire replacements because of regular usage, varying road conditions, and growing awareness of safety and performance, which further increases tire demand in this segment.

By Road Application:

The Brazil Tire market is divided by road application into all-season tire, summer tire, winter tire, and other. Among these, the all-season tire segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The all-season tire segment dominates because Brazil experiences predominantly warm and mild weather throughout the year, with little need for winter-specific tires. All-season tires provide a balanced combination of durability, comfort, and road grip for both dry and wet conditions, which suits local driving needs. They are also cost-effective, require fewer replacements, and are widely available across passenger and commercial vehicles, making them the most practical and preferred choice for Brazilian consumers and fleet operators.

By Construction:

The Brazil Tire market is divided by construction into radial tires and bias ply tire. Among these, the radial tires segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The radial tires segment dominates due to its superior performance and durability. Radial tires provide better fuel efficiency, improved handling, and longer tread life compared to bias-ply tires. They also offer greater comfort and safety on highways and urban roads, which suits Brazil’s growing passenger car and commercial vehicle fleet. Additionally, most modern vehicles are designed to use radial tires, further supporting their widespread adoption.

By Tire Type:

The Brazil Tire market is divided by tire type into tubeless tires and tubbed tires. Among these, the tubeless tires segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The tubeless tires segment dominates due to its superior safety, performance, and convenience. Unlike tubed tires, tubeless tires reduce the risk of sudden air loss and punctures, provide better fuel efficiency, and require less maintenance. They also offer longer durability and improved ride comfort, making them ideal for passenger cars, commercial vehicles, and two-wheelers. As consumers increasingly prioritize safety and efficiency, tubeless tires have become the preferred choice across the Brazilian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil tire market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Tire Market:

- Pirelli & C. S.p.A.

- Michelin Group

- Bridgestone Americas Tire Operations, LLC

- The Goodyear Tire & Rubber Company

- Continental AG

- Rinaldi Tires

- Maggion Indústria de Pneus e Máquinas Ltda.

- Maxxis International

- Kenda Rubber Industrial Co., Ltd.

- Technic Tires

- Others

Recent Developments in Brazil Tire Market:

In September 2022, Bridgestone Brazil announced an additional investment in its tire production plant in Camacari, in the state of Bahia. The company has invested more than USD 14.7 million in the modernization and expansion of the factory, which brings the company's total investments announced since 2021 to more than USD 53.1 million for the Bahia plant.

In 2023, Mitas introduced its AGRITERRA 02 SP “Soil Protector” tire to the Brazilian market at Agrishow 2023, designed for modern agricultural vehicles. Featuring Very High Flexion (VF) technology, it boosts load capacity by 40% while minimizing soil compaction. The tire’s low inflation pressure improves traction, ground protection, and durability, aided by hexa-core construction and steel breakers. Alongside, Mitas also showcased the AGRITERRA 04 for non-driven wheels and the HC 3000 range with Cyclical Field Operation (CFO) technology, both popular in Brazil’s agricultural sector for enhancing performance, fuel efficiency, and reducing wear in demanding field conditions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical insights sors has segmented the Brazil tire market based on the below-mentioned segments:

Brazil Tire Market, By Vehicle Type

- Passenger Cars

- Light & Medium Commercial Vehicle

- Heavy Commercial Vehicle

- Two-Wheeler

- Other

Brazil Tire Market, By Road Application

- All-Season Tire

- Summer Tire

- Winter Tire

- Other

Brazil Tire Market, By Construction

- Radial Tire

- Bias Ply Tire

Brazil Tire Market, By Tire Type

- Tubeless Tire

- Tubbed Tire

Need help to buy this report?