Brazil Polybutylene Terephthalate Market Size, Share, By Sales Channel (Direct/Institutional Sales, Retail Sales, and Other), By End-Use (Electronics and Appliances, Automotive and Others), Brazil Polybutylene Terephthalate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsBrazil Polybutylene Terephthalate Market Insights Forecasts to 2035

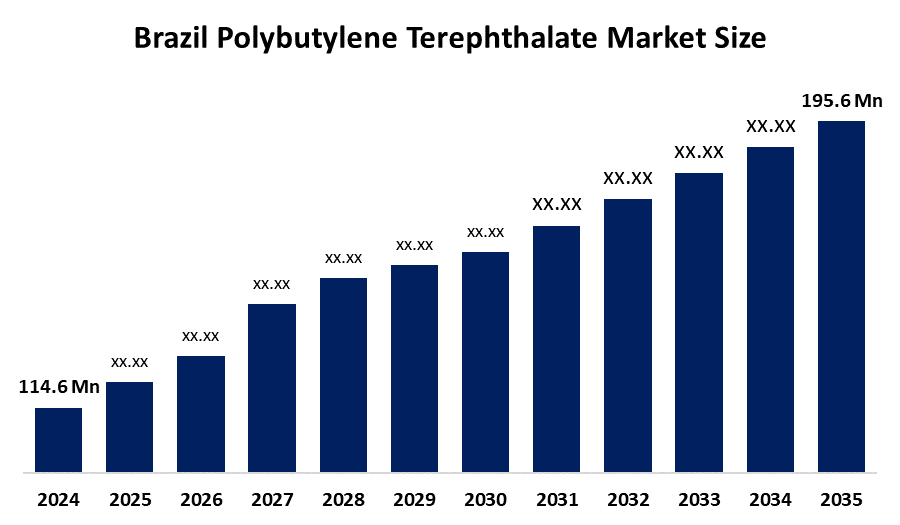

- Brazil Polybutylene Terephthalate Market Size 2024: USD 114.6Mn

- Brazil Polybutylene Terephthalate Market Size 2035: USD 195.6Mn

- Brazil Polybutylene Terephthalate Market CAGR 2024: 4.98%

- Brazil Polybutylene Terephthalate Market Segments: Sales Channel and End-Use

Get more details on this report -

Polybutylene terephthalate (PBT) is a thermoplastic polymer that engineers select from the polyester family. The material exhibits high strength, along with the ability to provide electrical insulation and chemical protection, while retaining its original size. Brazilian industries use PBT materials to manufacture automotive components and electrical connectors, electronic housings, switches, appliance parts and industrial machinery because PBT materials provide durability and heat resistance benefits. Stainable PBT compound line, which used bio-circular 1,4-butanediol (BDO) as its foundation.

The federal government announced R$ 425.5 million of investments and programs, which include initiatives to strengthen cooperatives and associations dedicated to catadoras and cat adores de reciclaveis.

Brazil's PBT market will grow rapidly because of electric vehicle adoption, electronics manufacturing expansion, lightweight engineering plastic demand, Make-in-Brazil initiatives, and high-performance recyclable polymer material usage.

Brazil Polybutylene Terephthalate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 114.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.98% |

| 2035 Value Projection: | 195.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 136 |

| Segments covered: | By Sales Channel,By End-Use |

| Companies covered:: | BASF SE, SABIC, Celanese Corporation, DuPont de Nemours, Inc., Lanxess AG, Toray Industries, Inc., Mitsubishi Chemical Group, Polyplastics Co., Ltd., Chang Chun Group, Entec Polimeros Brazil,and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Brazil Polybutylene Terephthalate Market:

The Brazil polybutylene terephthalate market is driven by the automotive, electrical and electronics industries, which require the material because it provides outstanding mechanical strength, thermal stability and chemical resistance. The market experiences growth from three factors, which include industrialization activities, the rising production of vehicles, the growth of consumer electronics manufacturing and the market acceptance of lightweight engineering plastics, which deliver high performance.

The Brazil polybutylene terephthalate market is restrained by the instability of raw material costs, together with the industry's need for oil-based raw materials and the entry of new engineering plastic materials into the market. The solution faces environmental problems, together with recycling difficulties, which prevent people from using it more often.

The future of the Brazil polybutylene terephthalate (PBT) market is bright and promising, with the domestic manufacturing sector needing engineering plastics that offer lightweight and high-performance capabilities because electric vehicles, consumer electronics and renewable energy components are becoming more popular.

Market Segmentation

The Brazil polybutylene terephthalate market share is classified into sales channels and end-use.

By Sales Channel:

The Brazil polybutylene terephthalate market is divided by sales channel type into direct/institutional sales, retail sales, and other. Among these, the direct/institutional sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Direct/Institutional Sales segment is dominant because OEMs and industrial buyers purchase products in bulk and establish long-term supply agreements while achieving cost savings through their strong partnerships with manufacturers.

By End-Use:

The Brazil polybutylene terephthalate market is divided by end-use into electronics and appliances, automotive and others. Among these, the electronics and appliances segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The combination of rising demand for consumer electronics, rapid urbanization and, and increased adoption of household appliances and ongoing technological advancements leads to regular product consumption throughout the year.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Brazil polybutylene terephthalate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Brazil Polybutylene Terephthalate Market:

- BASF SE

- SABIC

- Celanese Corporation

- DuPont de Nemours, Inc.

- Lanxess AG

- Toray Industries, Inc.

- Mitsubishi Chemical Group

- Polyplastics Co., Ltd.

- Chang Chun Group

- Entec Polimeros Brazil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Brazil, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Brazil polybutylene terephthalate market based on the below-mentioned segments:

Brazil Polybutylene Terephthalate Market, By Sales Channel

- Direct/Institutional Sales

- Retail Sales

- Other

Brazil Polybutylene Terephthalate Market, By End-Use

- Electronics and Appliances

- Automotive

- Others

Need help to buy this report?