Global Blockchain Interoperability Market Size, Share, And Covid-19 Impact Analysis, By Solution (Cross-Chain Bridging, Cross-Chain APIs, Federated or Consortium Interoperability), By Application (dApps, Digital Assets/Nfts, Cross-Chain Trading & Exchange, Others), By End User (BFSI, Healthcare, Gaming & Entertainment, IT & Telecommunication, Food & Agriculture, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Information & TechnologyGlobal Blockchain Interoperability Market Insights Forecasts to 2032

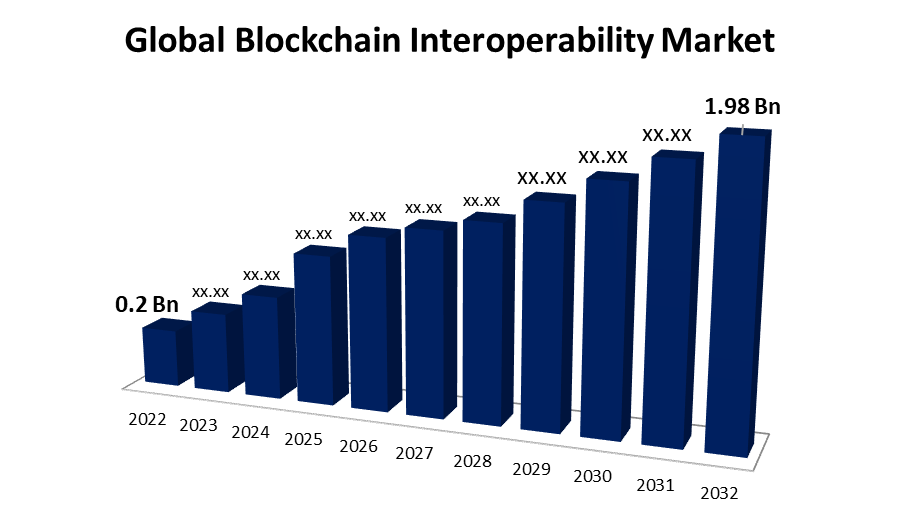

- The Global Blockchain Interoperability Market Size was valued at USD 0.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 25.77% from 2022 to 2032

- The Worldwide Blockchain Interoperability Market Size is expected to reach USD 1.98 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Blockchain Interoperability Market Size is expected to reach USD 1.98 Billion by 2032, at a CAGR of 25.77% during the forecast period 2022 to 2032.

Blockchain interoperability is the concept of allowing different blockchain networks to interact and integrate, communicating seamlessly, and allowing data to be shared between chains. Blockchain technology has demonstrated potential in a variety of businesses, including the management of identities, supply chains, and banking. However, for many use cases to be successful, different blockchain networks must be combined. Because of interoperability, blockchain applications can be used in a broader range of complex, multi-network use cases. The increasing adoption of dApps across industries, the demand for cross-chain asset transfers, and the growing importance of regulatory compliance and standardized practices in the blockchain ecosystem are the key drivers for market growth. One of the most significant benefits of blockchain interoperability is the ability to conduct cross-chain transactions. Since the different blockchains frequently use different protocols and standards, it may be difficult for them to communicate with one another and exchange value or data. Interoperability solutions bridge these gaps, allowing users to easily transact across multiple blockchains. Consider the following scenario: a user wishes to exchange a digital asset from one blockchain to another without the use of a centralized exchange. Interoperability facilitates the secure and trustless exchange of assets between multiple blockchains by making it easier for consumers to access and use various blockchain networks, increasing the utility of blockchain technology. Furthermore, the growth of new markets and the volume of cross-border transactions are driving up demand for blockchain interoperability solutions.

Global Blockchain Interoperability Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 0.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 25.77% |

| 2032 Value Projection: | USD 1.98 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Solution, By Application, By End User and By Region |

| Companies covered:: | Oracle, Quant Network, Band Protocol, Polyhedra Networks, SupraOracles, Orb Labs, ChainPort, LiquidApps, LI.FI, Biconomy, Datachain, R3, GAVS Technologies, Ontology, Inery, Fusion Foundation, RioDeFi, and Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The improved collaboration and ecosystem development drive demand for blockchain interoperability. The need for seamless communication and data exchange between blockchains becomes critical as organizations seek to foster partnerships and create interconnected networks. The growing interconnectedness of the Internet of Things fuels the demand for blockchain interoperability by enabling secure and efficient communication between IoT devices across different blockchain networks. Furthermore, a recession would also have a significant impact on the blockchain interoperability market. A recession's impact on the blockchain interoperability market is likely to be mixed. A recession may result in decreased investments and budget cuts in technology-related projects, potentially slowing the adoption and implementation of blockchain interoperability solutions. Companies may prioritize cost-cutting measures over new technology exploration. However, recessions frequently drive innovation and the pursuit of more efficient solutions, and blockchain interoperability can provide cost-saving benefits as well as improved operational efficiency.

Restraining Factors

The inherent design and consensus mechanisms governing the operation of blockchain networks cause difficulties with scalability. As the number of participants and transactions grows, blockchain's decentralized nature necessitates resource-intensive and time-consuming consensus processes, resulting in bottlenecks and delays. Since the block size limits and congestion issues, public and permission-less blockchains such as Bitcoin and Ethereum face significant scalability challenges. To address these limitations, scaling solutions such as the Lightning Network and Ethereum 2.0 have been introduced. While progress has been made, scalability is still an issue for widespread use and smooth cross-chain asset and data exchange.

Market Segmentation

By Solution Insights

The cross-chain bridging segment is witnessing significant CAGR growth over the forecast period.

Based on the solution, the global blockchain interoperability market is segmented into cross-chain bridging, cross-chain APIs, and federated or consortium interoperability. Among these, the cross-chain bridging segment is witnessing significant growth over the forecast period. Cross-chain bridging solutions act as bridges, allowing for seamless interaction and transfer of assets while overcoming the challenges of siloed blockchains. Furthermore, by connecting disparate networks, cross-chain bridging solutions foster collaboration, interoperability, and data exchange, resulting in the adoption of blockchain technology across a wide range of industries. Furthermore, the need for seamless asset transfers, decentralized finance (DeFi) applications, and cross-border transactions has fuelled demand for these solutions, making it the largest segment in the blockchain interoperability market.

By Application Insights

The dApps segment is expected to hold the largest share of the global blockchain interoperability market during the forecast period.

Based on the application, the global blockchain interoperability market is classified into dApps, digital assets/nfts, cross-chain trading & exchange, and others. Among these, the dApps segment is expected to hold the largest share of the blockchain interoperability market during the forecast period. Solutions for blockchain interoperability are becoming increasingly popular in dApps due to their ability to transcend the constraints of single-chain ecosystems. These solutions promote cross-chain asset transactions and improve functionality and scalability by providing seamless connectivity between multiple blockchain networks. Interoperability allows decentralized applications to reach a larger user base by leveraging the benefits of different blockchains. This promotes innovation and allows developers to create more robust and diverse applications that offer a comprehensive and integrated user experience.

By End User Insights

The BFSI segment accounted for the largest revenue share over the forecast period.

On the basis of end-user, the global blockchain interoperability market is segmented into BFSI, healthcare, gaming & entertainment, it & telecommunication, food & agriculture, and others. Among these, the BFSI segment dominates the market with the largest revenue share over the forecast period. These solutions could improve patient data management, streamline interoperability between disparate systems, and boost medical record accuracy. Interoperability solutions potentially address major industrial concerns by ensuring accurate medical histories, facilitating research collaboration, and protecting patient privacy. They also enable the seamless integration of smart contracts and IoT devices, paving the way for improved administrative and patient care.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with the largest market share over the forecast period. North American businesses are drawn to interoperability's ability to unlock the full potential of blockchain networks, foster collaboration, and create competitive advantages, with a focus on innovation and technology adoption. The region's growing use of blockchain technology in a variety of industries, including healthcare, supply chain management, and finance, Furthermore, well-established vendors from North America, as well as government initiatives and investments, have contributed to the region's large market size. North America has positioned itself as a leading hub by taking a proactive approach to fostering innovation and collaboration.

Asia-Pacific is expected to grow the fastest during the forecast period. APAC is known for having a diverse blockchain ecosystem, with blockchain innovation hotspots such as China, Japan, Singapore, and South Korea. Interoperability solutions connect various networks and ecosystems. APAC countries place a high value on cross-border trade and logistics. Only if blockchain technology is interoperable will it be able to streamline and secure global commerce processes. Furthermore, China's blockchain interoperability market had the highest market share, while India's blockchain interoperability market was the fastest growing in the Asia-Pacific region.

List of Key Market Players

- Oracle

- Quant Network

- Band Protocol

- Polyhedra Networks

- SupraOracles

- Orb Labs

- ChainPort

- LiquidApps

- LI.FI

- Biconomy

- Datachain

- R3

- GAVS Technologies

- Ontology

- Inery

- Fusion Foundation

- RioDeFi

Key Market Developments

- In June 2023, Fujitsu introduced blockchain collaboration technology to help build Web3 services.

- In June 2023, Mastercard announced the launch of the Multi Token Network (MTN), a set of foundational capabilities designed to make transactions within digital asset and blockchain ecosystems secure, scalable, and interoperable, allowing for more efficient payment and commerce applications.

- In July 2023, Quant and Hedera Hashgraph announced a collaboration. Quant's Overledger technology will be usable on the Hedera Hashgraph as a result of this collaboration, allowing programmers to create interoperable applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global blockchain interoperability market based on the below-mentioned segments:

Blockchain Interoperability Market, Solution Analysis

- Cross-Chain Bridging

- Cross-Chain APIs

- Federated or Consortium Interoperability

Blockchain Interoperability Market, Application Analysis

- dApps

- Digital Assets/Nfts

- Cross-Chain Trading & Exchange

- Others

Blockchain Interoperability Market, End-User Analysis

- BFSI

- Healthcare

- Gaming & Entertainment

- IT & Telecommunication

- Food & Agriculture

- Others

Blockchain Interoperability Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?