Global Biotechnology Instruments Market Size, Share, and COVID-19 Impact Analysis, By Product (Analytical Instruments, Cell Culture Instruments, Cell Separation Instruments, Immunoassay Instruments, Clinical Chemistry Analyzers, Others), By End-Users (Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Academic & Research Institutes, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Biotechnology Instruments Market Insights Forecasts to 2032

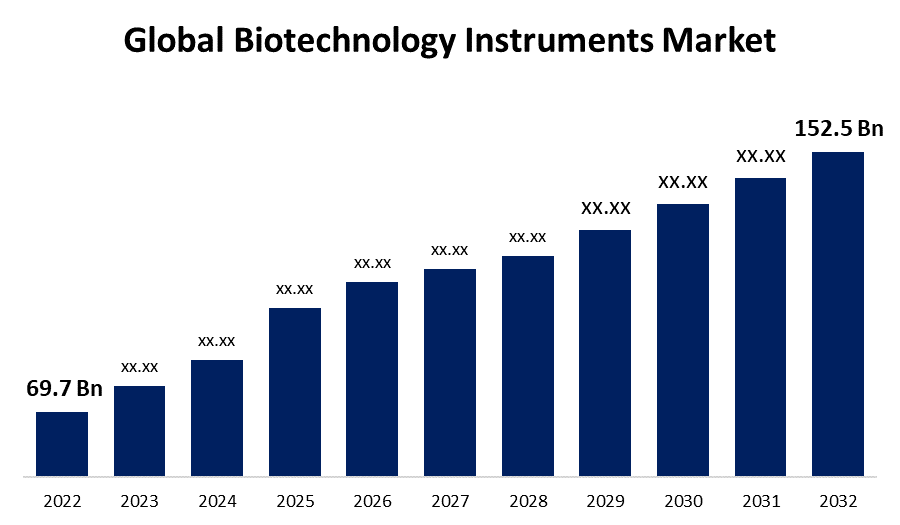

- The Global Biotechnology Instruments Market Size was valued at USD 69.7 Billion in 2022.

- The market is Growing at a CAGR of 8.1% from 2022 to 2032

- The Worldwide Biotechnology Instruments Market Size is expected to reach USD 152.5 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Biotechnology Instruments Market Size is expected to reach USD 152.5 Billion by 2032, at a CAGR of 8.1% during the forecast period 2022 to 2032.

Biotechnology encompasses an industry and a technology field that has been adopted by many industries. Biotechnology, in general, employs cellular and biomolecular processes to create new technologies and products. These can include genetically modified organisms as well as new medications and drugs. Depending on the aim of the lab, biotechnology utilizes a variety of equipment or instruments. A vaccination lab will require different equipment than a lab that changes crops to be more pest or drought-resistant. These instruments include spectroscopy, microscopy, chromatography, incubators, cryostorage equipment, biosafety equipment, injecting devices, centrifuges, filtration systems, and many others. These advanced biotechnology instruments are used for the creation of vaccines, the development of new therapies and diagnostic procedures, and gene modifications, and are almost used in every life science-related field, thereby promoting the expansion of the biotechnology instruments market throughout the forecast. The utilization of biotechnology in agriculture has resulted in the creation of transgenic crops with high yields and pest and disease resistance. Furthermore, biotechnology instruments can be used to break down hazardous or harmful substances and compounds in order to tackle environmental problems, hence supporting the growth of the biotechnology instruments market over the projection period. Furthermore, rising demand for biotechnology instruments and an aging population are likely to drive market expansion.

Global Biotechnology Instruments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 69.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.1% |

| 2032 Value Projection: | USD 152.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Users, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Zeiss Group, Abbott Laboratories, Thermo Fisher Scientific, Inc., Illumina, Inc., Mettler Toledo, Endress+Hauser, Bruker Corp., PerkinElmer, Inc., Eppendorf SE, Danaher, bioMérieux SA, Bruker Corp., Sartorius AG, Waters Corp., Avantor, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche AG, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for biotechnology instruments has increased drastically as a result of technological improvements and an increased understanding of the biotechnology industry. In addition, biotechnology has accelerated the creation and discovery of advanced medications, treatments, diagnostics, and vaccines for medicinal and pharmaceutical applications. Furthermore, advances in biotechnological techniques have resulted in the development of new medicines for patients diagnosed with growth diseases, metabolic diseases, multiple sclerosis (MS), rheumatoid arthritis (RA), cancer, and Alzheimer's disease, fueling the growth of the biotechnology instruments market during the forecast time frame.

Moreover, the adoption of nanotechnology in the research and creation of new medications has been recognized as a major supporting technology capable of providing novel and inventive medical solutions to unmet medical requirements. In some cases, nanoparticles such as gold and silver have been used in biomedical and diagnostic applications to identify viral particles. Nanotechnology has been shown to aid in the treatment of viral infection through a variety of processes. As a result, offering instruments required for nanotechnological processes is a critical potential for market participants.

Market Segmentation

By Product Insights

The analytical instruments segment is dominating the market with the largest revenue share over the forecast period.

On the basis of product, the global biotechnology instruments market is segmented into the analytical instruments, cell culture instruments, cell separation instruments, immunoassay instruments, clinical chemistry analyzers, and others. Among these, the analytical instruments segment is dominating the market with the largest revenue share of 54.7% over the forecast period. These instruments, featuring technologies like mass spectrometry, chromatography, and spectroscopy, are critical in performing accurate evaluation and identification of biological samples, which supports applications ranging from drug development to research on genetics. Their broad use emphasizes their importance in propelling breakthroughs in the biotechnology industry, greatly contributing to research, development, and innovation. Furthermore, during the projected period, the cell structure segment is expected to develop the fastest. The expanding importance of cell-based therapeutics and the growing need for customized medicine are driving the rapid growth of this market, making cell culture instruments an essential propellant of technological advancement and innovation in the field of biotechnology.

By End-Users Insights

The pharmaceutical & biotechnology companies segment accounted for the largest revenue share of more than 41.5% over the forecast period.

On the basis of end-users, the global biotechnology instruments market is segmented into pharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, academic & research institutes, and others. Among these, the pharmaceutical & biotechnology companies segment is dominating the market with the largest revenue share of 41.5% over the forecast period. These businesses rely heavily on a wide range of instruments to drive drug discovery, development, and production processes, such as gene sequencers, protein analyzers, and high-throughput screening systems. The constant pursuit of breakthrough medicines, precision medicine, and sophisticated research methods fuels the need for cutting-edge biotechnology equipment, reaffirming their vital significance in influencing the development of scientific and healthcare developments. Furthermore, the category of academic and research institutions is predicted to increase at the most quickly CAGR during the projection period. This expansion has been prompted by an increase in multidisciplinary research, collaborations, and an ongoing search for ground-breaking discoveries in domains such as genomics, proteomics, and the study of synthetic biology.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 42.7% market share over the forecast period. This is due to the region's higher incidence of target diseases, growing elderly population, widespread adoption of point-of-care diagnostic tests/devices, and growing need for intravenous drug instruments. In addition, increased R&D activities and expanding public-private research investments boost demand, leading to market expansion. Additionally, ongoing discoveries and expanding government investments in biotechnology instruments, together with the inexpensive adoption of novel systems, strengthen the United States' position as the world's most profitable market. Furthermore, numerous firms in this region are working together on addressing socioeconomic and environmental concerns, hence driving the growth of the North American biotechnology instruments market over the forecast period.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The swift development of biotechnology sectors in rising economies such as China, Japan, South Korea, Australia, and India is primarily attributable to this trend. These countries' strong government support for biotechnology also drives industry growth. Continuous R&D investments enhance the demand for biotechnology instruments even more. Furthermore, rising research expenditures and government investments are expected to drive market expansion in the Asia Pacific region.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. The increasing use of biotechnology-derived methodologies in the production of medicines, genetically modified crops, and advanced laser technologies for the treatment of malignancies and other neurological disorders are key factors driving the growth of the biotechnology instruments market during the forecast period. Furthermore, increased government investment in the advancement of the biotechnology sector, as well as the existence of globally recognized health institutes, are contributing to market expansion in this region.

List of Key Market Players

- Zeiss Group

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Mettler Toledo

- Endress+Hauser

- Bruker Corp.

- PerkinElmer, Inc.

- Eppendorf SE

- Danaher

- bioMérieux SA

- Bruker Corp.

- Sartorius AG

- Waters Corp.

- Avantor, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

Key Market Developments

- On August 2023, Roche unveiled a new addition to their Cobas connection modules (CCM), the CCM Vertical, which allows samples to be transported on overhead conveyors. This design enables CCM conveyors to traverse walkways, linking different work areas and maintaining access to (emergency) exits.

- On May 2023, HiMedia Laboratories Pvt Ltd, a biosciences pioneer, and Advanced Instruments LLC, a laboratory instrumentation company, have joined forces to showcase their latest breakthrough in microbiology research, the Anoxomat III Anaerobic Culture System. The Anoxomat III combines Advanced Instruments' expertise in anaerobic technology with HiMedia's mindset to bring the most recent innovation in Microbiology to customers' doorsteps in order to provide a seamless and efficient anaerobic culture experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Biotechnology Instruments Market based on the below-mentioned segments:

Biotechnology Instruments Market, Product Analysis

- Analytical Instruments

- Cell Culture Instruments

- Cell Separation Instruments

- Immunoassay Instruments

- Clinical Chemistry Analyzers

- Others

Biotechnology Instruments Market, End-Users Analysis

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Others

Biotechnology Instruments Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?