Global Biometric Payment Market Size, Share, and COVID-19 Impact Analysis, By Technology (Single Factor Authentication, Fingerprint Recognition, Iris Recognition, Palm Recognition, Face Recognition, Signature Recognition, Voice Recognition, Biometric Smart Card, and Multimodal), By Type (Contact-Based, Contactless, and Hybrid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Electronics, ICT & MediaGlobal Biometric Payment Market Insights Forecasts to 2032

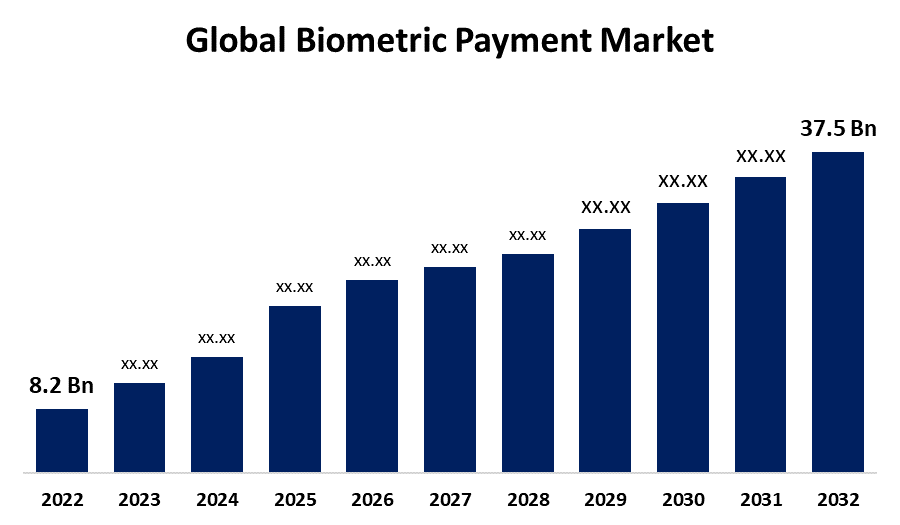

- The Global Biometric Payment Market Size was Valued at USD 8.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 11.8% from 2022 to 2032

- The Worldwide Biometric Payment Market Size is Expected to Reach USD 37.5 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Biometric Payment Market Size is Anticipated to Exceed USD 37.5 Billion by 2032, Growing at a CAGR of 11.8% from 2022 to 2032.

Market Overview

The biometric payment is an innovative digital transaction mechanism that can help users make payments through the validation of specific bodily attributes, such as fingerprints, face photos, or iris scans. Biometric payment becoming more and more popular because this technology removes the need for consumers to memorize complex usernames and passwords. Additionally, it is the most secured method of making payment because each user's biometric data is unique. The less chances of data getting stolen and misused because of the unique information of each user and the impossible to copy, which can decrease the possibilities of chargebacks, fraudulent transactions, and other financial losses. The introduction of Mastercard's biometric identification system, which enables customers to authenticate their identity using a selfie or fingerprint while making online transactions, is one prominent example of how businesses are embracing online biometric payments. The widespread usage of Google Pay and Apple Pay enables safe and easy online transactions by using biometric verification such as fingerprint or facial recognition. Moreover, Amazon unveiled Amazon One, a palm-reading system that enables users to safely connect their fingerprints to their accounts for quicker and more convenient online transactions.

Report Coverage

This research report categorizes the market for the global biometric payment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global biometric payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global biometric payment market.

Global Biometric Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 11.8% |

| 2032 Value Projection: | USD 37.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Type, By Region |

| Companies covered:: | Apple Inc., Google LLC, Mastercard Incorporated, Visa Inc., PayPal Holdings, Inc., Fingerprint Cards AB, Alibaba Group Holding Limited, Samsung Electronics Co., Ltd., Tencent Holdings Limited, Paytm, Ant Group, Network International Holdings plc, PayTabs and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers are becoming more concerned about the security of conventional payment methods, including passwords and PINs, because of their susceptibility to hackers and illegal access. This is because identity theft and fraudulent activities are becoming a bigger problem for both individuals and organizations. Because biometric payment uses unique biological characteristics that are extremely difficult to copy or counterfeit, it offers a robust and secure option. The method by which people make payments has changed as a result of the increasing use of smartphones and other mobile devices. Contactless payment methods and mobile wallets are becoming more and more popular because of how quick and easy they are. By integrating with these devices, biometric payment technology allows users to easily authorize transactions using their fingerprints, face recognition, or other biometric data, doing away with the need for physical cards or PINs. This simplifies the payment process and improves user satisfaction overall. The increasing reliance of customers on mobile devices for daily transactions is anticipated to drive a surge in demand for the biometric payment market.

Restraining Factors

Advanced security measures are required for the protection of biometric data during collection, storage, and transmission to avoid unwanted access or data breaches. Biometric data is particularly sensitive and personal due to its uniqueness. There are serious repercussions from compromising biometric data security, including the possibility of identity theft. The possible risks of improper handling of biometric data contribute to consumer anxiety about biometric payment systems and hinder their widespread adoption. Regulations about the collection, storage, and use of biometric data vary between nations and legal systems. Adhering strictly to legal frameworks and making sure that privacy laws, data protection rules, and industry standards are followed can potentially make biometric payment solutions more complex and take longer to deploy and be accepted in some regions.

Market Segmentation

The Global Biometric Payment Market share is classified into technology and type.

- The single factor authentication segment is expected to hold the largest share of the global Biometric Payment market during the forecast period.

The Biometric Payment market is categorized by technology into single-factor authentication, fingerprint recognition, iris recognition, palm recognition, face recognition, signature recognition, voice recognition, biometric smart card, and multimodal. The single-factor authentication market is anticipated to hold the largest market share at the beginning of the forecast due to factors like rising convenience, reasonably priced solutions, and prompt functional responses, to mention a few.

- The hybrid segment is expected to hold the largest share of the global biometric payment market during the forecast period.

Based on the type, the global biometric payment market is divided into contact-based, contactless, and hybrid. Among these, the hybrid sector is expected to hold the greatest market share at the beginning of the projection. Depending on the deployment methodology, the global biometric payment market can be divided into hardware and software segments. Due to several factors, including the growing popularity of cloud-based services and adoption strategies involving artificial intelligence in the biometrics device space, the software category is anticipated to hold the biggest market share at the beginning of the forecast.

Regional Segment Analysis of the Global Biometric Payment Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

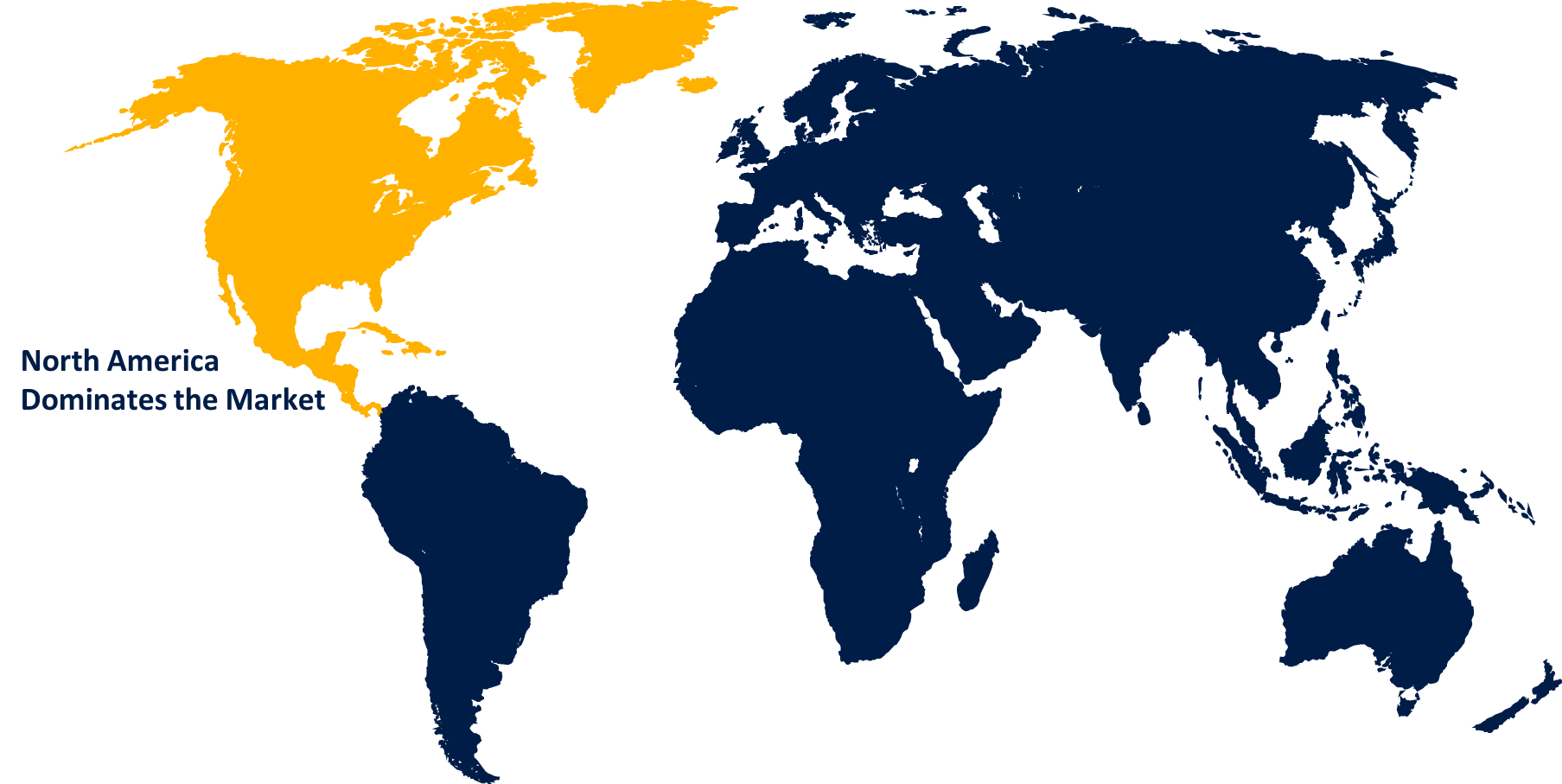

North America is anticipated to hold the largest share of the global biometric payment market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global biometric payment market over the predicted years. This is because there are a lot of companies offering biometric payment solutions and they are widely used in the area. The growth of the local market can be attributed to the presence of a considerable number of enterprises operating within the industry. By April 2021, more than 70% of Visa cards issued in New York will be able to accept biometric payments. The New York MTA's deployment of contactless on all buses and subways is encouraging such acceptance. Consequently, it is projected that the increasing adoption of biometrics as a mode of payment in North America would create opportunities for local industry growth.

Asia Pacific is expected to grow at the fastest pace in the global biometric payment market during the forecast period. This is due to there being fewer affordable options for these devices and consumers becoming more aware of the increased security benefits of biometric payment solutions, the biometric payment market is expected to grow throughout the projected period. The region's market for biometric payments will grow as a consequence of more government initiatives to boost the use of biometric payment systems and more biometric payment terminals being installed in public spaces like banks, ATMs, and airports. A substantial market share will be gained during the forecast period as a result of the expansion of international player penetration and the emergence of reliable vendors in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Biometric Payment along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apple Inc.

- Google LLC

- Mastercard Incorporated

- Visa Inc.

- PayPal Holdings, Inc.

- Fingerprint Cards AB

- Alibaba Group Holding Limited

- Samsung Electronics Co., Ltd.

- Tencent Holdings Limited

- Paytm

- Ant Group

- Network International Holdings plc

- PayTabs

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, in order to offer contactless biometric payment cards to India, Fingerprint Cards partnered with Transcorp and Mswipe. The company also released its financial results for 2021 and a future perspective that projects success in the biometric payment card market and with diversification.

- In September 2022, Leading providers of banking and financial solutions, Technical Equipment & Supplies Company (Tesco), and Fingerprint Cards AB (Fingerprints), a global leader in biometrics, joined forces to encourage and facilitate the use of contactless biometric payment cards in the Middle East.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Biometric Payment Market based on the below-mentioned segments:

Global Biometric Payment Market, By Technology

- Single Factor Authentication

- Fingerprint Recognition

- Iris Recognition

- Palm Recognition

- Face Recognition

- Signature Recognition

- Voice Recognition

- Biometric Smart Card

- Multimodal

Global Biometric Payment Market, By Type

- Contact-Based

- Contactless

- Hybrid

Global Biometric Payment Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?