Global Biologics Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Mode of Manufacturing (Contract Manufacturing and In-House Manufacturing), By Modality (Monoclonal Antibodies (MAbs), Biosimilar & Recombinant Proteins, Vaccines, Cell & Gene Therapies, RNA-Based Therapeutics, and Others), By Disease Indication (Oncology, Autoimmune Disorders, Infectious Diseases, Neurological Disorders, Cardiovascular Disorders, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Biologics Manufacturing Market Size Insights Forecasts to 2035

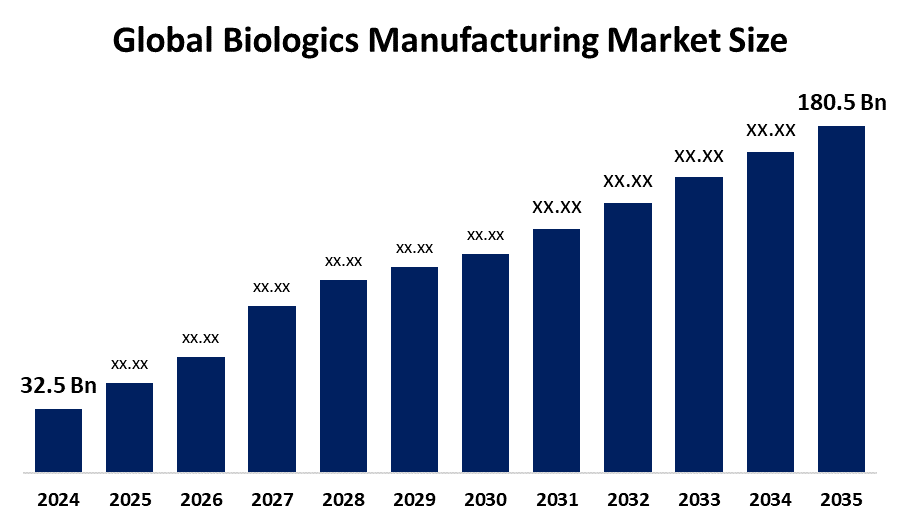

- The Global Biologics Manufacturing Market Size Was Estimated at USD 32.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.87% from 2025 to 2035

- The Worldwide Biologics Manufacturing Market Size is Expected to Reach USD 180.5 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Biologics Manufacturing Market Size was worth around USD 32.5 Billion in 2024 and is predicted to Grow to around USD 180.5 Billion by 2035 with a compound annual growth rate (CAGR) of 16.87% from 2025 and 2035. The market for biologics manufacturing has a number of opportunities to grow due to the increasing advancements in cell and gene therapy manufacturing technologies, with the growing biopharmaceutical sector.

Market Overview

The global industry of biologics manufacturing is focused on the production of complex medicines, called biologics, that are derived from living organisms. Biologics manufacturing involves the production of large molecule drugs, such as antibodies and enzymes, from living cells. Biotech and pharma companies are manufacturing biologics such as mAbs (monoclonal antibodies) or mRNA vaccines by means of living organisms, both at small and large scales, bringing several advantages over traditional small-molecule drug products. An increasing demand for biopharmaceutical products, with increasing medical advancements and prevalence of chronic diseases, are several factors that are driving the efficiency in biologics manufacturing. Single-use technologies in the evolving biopharmaceutical industry facilitate the drug manufacturing that fulfills the increasing needs while maintaining increased standards of safety and quality. For instance, in April 2025, contract development and manufacturing (CDMO) AGC Biologics is adding two 5,000 L single-use bioreactors (SUB) at its Yokohama, Japan plant.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and expanding partnerships. For instance, in March 2025, AstraZeneca announced that it is planning to invest $2.5 billion in Beijing over the next five years to establish a new strategic R&D center. Several breakthrough technologies, such as 3D bioprinting, gene editing & synthetic biology, artificial intelligence & machine learning, are driving a huge surge in the global biologics manufacturing market.

Report Coverage

This research report categorizes the biologics manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the biologics manufacturing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the biologics manufacturing market.

Global Biologics Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 32.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.87% |

| 2035 Value Projection: | USD 180.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Mode of Manufacturing, By Modality and COVID-19 Impact Analysis |

| Companies covered:: | Novartis AG, Pfizer Inc, Amgen Inc., Novo Nordisk A/S, AbbVie Inc., Johnson & Johnson (Johnson & Johnson Services, Inc.), Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann La-Roche Ltd., Wuxi Biologics, FUJIFILM Holdings Corporation (FUJIFILM Diosynth Biotechnologies), Boehringer Ingelheim International GmbH, Lonza, and Samsung Biologics |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biologics manufacturing market is primarily driven by an expanding biopharmaceutical industry. For instance, in June 2025, UCB, a global biopharmaceutical company, announced plans for a significant investment in a new, state-of-the-art biologics manufacturing facility in the US. Advancements in cell and gene therapy manufacturing technology, along with favourable government policies and investments, aid in propelling market growth. Additionally, the growing prevalence of chronic diseases, contributing to the need for biologic therapies as efficient treatment options, is anticipated to promote market growth. As per a case study by IQVIA, the proportion of biologicals prescribed for diseases CD/UC (Crohn’s disease and ulcerative colitis), RA (rheumatoid arthritis), and PSO (psoriasis) increased from 16.3% to 21.3%, 12.4% to 16.0%, and 3.2% to 7.7% respectively, over 4 years between April 2015 and December 2018.

Restraining Factors

The biologics manufacturing market is restricted by factors like increased manufacturing costs and complexity associated with the production process. Further, the complexity of biologics and the integration of emerging technologies are challenging the market growth.

Market Segmentation

The biologics manufacturing market share is classified into mode of manufacturing, modality, and disease indication.

- The contract manufacturing segment dominated the market with the largest share, nearly 10% to 30% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the mode of manufacturing, the biologics manufacturing market is divided into contract manufacturing and in-house manufacturing. Among these, the contract manufacturing segment dominated the market with the largest share, nearly 10% to 30% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Due to the complexity and risks of contamination, pharmaceutical innovators are increasingly outsourcing their fill-finish services to specialized CMOs. With the growing need for outsourcing services, an increasing demand for biologics & biosimilars is driving the market in the contract manufacturing segment.

- The monoclonal antibodies segment accounted for the largest share of about 40.37% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the modality, the biologics manufacturing market is divided into monoclonal antibodies (mAbs), biosimilar & recombinant proteins, vaccines, cell & gene therapies, RNA-based therapeutics, and others. Among these, the monoclonal antibodies segment accounted for the largest share of about 40.37% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. About 25,000 mAb are listed in Linscott’s Directory, and most of these are produced in small quantities (less than 0.1g) for bench-related research purposes. An increasing pipeline of antibody-based therapeutics is contributing to driving the market demand in the monoclonal antibodies segment.

- The oncology segment accounted for the largest share of 38.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the disease indication, the biologics manufacturing market is divided into oncology, autoimmune disorders, infectious diseases, neurological disorders, cardiovascular disorders, and others. Among these, the oncology segment accounted for the largest share of 38.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Increasing R&D efforts and manufacturing capabilities for offering affordable biologics to cancer patients are contributing to driving the market growth. For instance, in February 2021, Biocon Biologics Ltd., a fully integrated ‘pure play’ biosimilars has, signed an agreement with the Clinton Health Access Initiative for expanding accessibility to lifesaving cancer biosimilars as a part of the Cancer Access Partnership (CAP).

Regional Segment Analysis of the Biologics Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the biologics manufacturing market over the predicted timeframe.

North America is anticipated to hold the largest share of about 34% to 41.8% in the biologics manufacturing market over the predicted timeframe. The market ecosystem in North America is strong, with the presence of cutting-edge startups like KBI Biopharma, Oxford Biomedicine, Avid Bioservices, Bionova Scientific, and Aldevron that have secured A+ funding. The demand for biologics manufacturing has been driven by the region's increased prevalence of chronic diseases and presence of leading biopharmaceutical companies. For instance, in June 2025, UCB to expand biologic manufacturing capacity in the US, expected to create $5 billion in economic value. The United States is leading the biologics manufacturing in the North America region, with 48.1% revenue share in 2024, due to the adoption of bioprocessing technologies, the expansion of biosimilars, and AI integration in manufacturing.

Asia Pacific is expected to grow at a rapid CAGR in the biologics manufacturing market during the forecast period. The Asia Pacific area has a thriving market for biologics manufacturing due to its large population and expanding healthcare infrastructure. Due to increasing collaboration between government agencies and biopharma companies’ increasing research capabilities, to accelerate drug development and commercialisation. For instance, in May 2024, Merck signed a non-binding MoU with Korea Advanced Institute of Science and Technology (KAIST) to advance the R&D ecosystem in South Korea for industrial applications. China leads the Asia Pacific biologics manufacturing with a 30.5% share in 2023, driven by the growing biopharmaceuticals as well as expanding contract development and manufacturing organisations (CDMOs) and biologics contract manufacturing organizations (BCMOs).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the biologics manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- Pfizer Inc

- Amgen Inc.

- Novo Nordisk A/S

- AbbVie Inc.

- Johnson & Johnson (Johnson & Johnson Services, Inc.)

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann La-Roche Ltd.

- Wuxi Biologics

- FUJIFILM Holdings Corporation (FUJIFILM Diosynth Biotechnologies)

- Boehringer Ingelheim International GmbH

- Lonza

- Samsung Biologics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, FUJIFILM Biotechnologies, a world-leading contract development and manufacturing organization for biologics, vaccines, and advanced therapies, announced a significant expansion of its global partnership with argenx SE, a global immunology company.

- In September 2025, Mycenax Biotech Inc., a leading biologics CDMO based in Taiwan, announced a strategic alliance with SPERA PHARMA Inc., a Japan-based expert in pharmaceutical Chemistry, Manufacturing, and Controls (CMC).

- In July 2025, WuXi Biologics, a leading global Contract Research, Development, and Manufacturing Organization (CRDMO), announced construction has begun for a new modular Drug Product (DP) facility, which would become part of the company's CRDMO hub in Singapore.

- In May 2025, Recipharm, a leading global contract development and manufacturing organization (CDMO), and ProductLife Group (PLG), a global provider product development and regulatory affairs services, announced a strategic collaboration aimed at supporting (bio)pharmaceutical companies in accelerating time to clinical trials and market approval while reducing supply chain, compliance, and regulatory challenges during product development.

- In June 2025, Agenus Inc., a leader in immune-oncology innovation, announced it had signed definitive partnership agreements with Zydus Lifesciences Ltd., including its subsidiaries/affiliates, hereafter referred to as “Zydus,” designed to accelerate clinical development, scale global manufacturing, and expand patient access to botensilimab and balstilimab (BOT/BAL).

- In June 2025, Simtra BioPharma Solutions, a CDMO specializing in sterile injectables, formed a five-year strategic alliance with the Life Science business of Merck KGaA, Darmstadt, Germany, which operates as MilliporeSigma in the U.S. and Canada..

- In March 2025, Samsung Biologics expanded its contract manufacturing business, adding 17 of the world’s top 20 pharmaceutical companies as clients. As a contract development and manufacturing organization (CDMO), the company develops and produces biopharmaceuticals for global drugmakers.

- In November 2024, Henlius and SVAX forged a strategic partnership in the MENAT market. The two parties would establish joint ventures in Saudi Arabia to integrate Henlius’ leading capabilities in the research, development, and manufacturing of biologics with SVAX's local expertise in registration, market access, and commercialization.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biologics manufacturing market based on the below-mentioned segments:

Global Biologics Manufacturing Market, By Mode of Manufacturing

- Contract Manufacturing

- In-House Manufacturing

Global Biologics Manufacturing Market, By Modality

- Monoclonal Antibodies (MAbs)

- Biosimilar & Recombinant Proteins

- Vaccines

- Cell & Gene Therapies

- RNA-Based Therapeutics

- Others

Global Biologics Manufacturing Market, By Disease Indication

- Oncology

- Autoimmune Disorders

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disorders

- Others

Global Biologics Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?