Global Bioethanol Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Starch Based, Sugar Based, Cellulose Based, and Others), By Fuel Generation (First Generation, Second Generation, and Third Generation), By Fuel Blend (E5, E10, E15 TO E70, E75 TO E85, and Others), By End-Use (Transportation, Alcoholic Beverages, Cosmetics, Pharmaceuticals, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Bioethanol Market Insights Forecasts to 2032

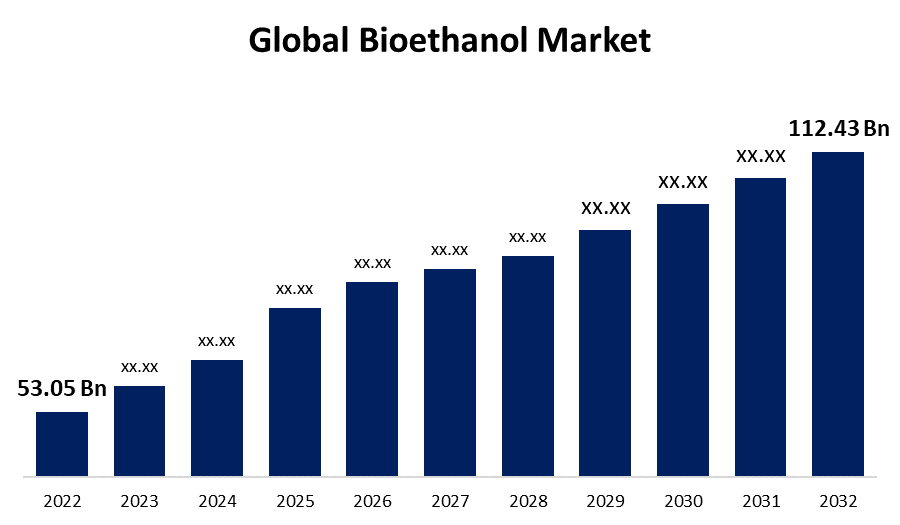

- The Global Bioethanol Market Size was valued at USD 53.05 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.8% from 2022 to 2032.

- The Worldwide Bioethanol Market Size is expected to reach USD 112.43 Billion by 2032

- Asia-Pacific is expected To Grow higher during the forecast period

Get more details on this report -

The Global Bioethanol Market Size is expected to reach USD 112.43 Billion by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

Market Overview

Bioethanol, also known as ethanol or ethyl alcohol, is a renewable and sustainable form of alcohol derived from biomass. It is primarily produced by fermenting sugars and starches found in crops such as corn, sugarcane, and wheat. Bioethanol is widely used as a biofuel, particularly in the transportation sector, as it offers a cleaner and more environmentally friendly alternative to fossil fuels. It can be blended with gasoline or used as a standalone fuel in flexible fuel vehicles (FFVs). Bioethanol production has several advantages, including reducing greenhouse gas emissions, promoting energy security, and supporting rural development through increased agricultural activities. However, there are also ethical considerations associated with bioethanol production, such as potential conflicts over land use, food security concerns, and the diversion of crops from food to fuel production. To mitigate these issues, sustainable and responsible bioethanol production practices are crucial, focusing on efficient crop cultivation, land management, and the utilization of non-food biomass sources.

Report Coverage

This research report categorizes the market for bioethanol market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bioethanol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the bioethanol market.

Global Bioethanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 53.05 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 112.43 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Feedstock, By Fuel Generation, By Fuel Blend, By End-Use, By Region. |

| Companies covered:: | POET LLC, Pacific Ethanol, The Anderson Inc., Flint Hills Resources, Abengoa Bioenergy, Archer Daniels Midland, Bioethanol Japan Kansai Co Ltd., BlueFire Ethanol Fuels Inc., Cremer Oleo GmbH & Co., CropEnergies AG, Green Future Innovations Inc., Green Plains, Nordzucker AG, Petrobras Biocombustiveis, Raizen Energia, Royal Dutch Shell PLC, Soufflet Group, Tereos, and Valero Energy Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bioethanol market is driven by several factors that contribute to its growth and increasing demand. First and foremost, environmental concerns and the need to reduce greenhouse gas emissions have propelled the adoption of biofuels like bioethanol as a cleaner alternative to fossil fuels. Government regulations and policies promoting renewable energy and biofuel blending mandates have also played a significant role in driving the market forward. Additionally, bioethanol's potential to enhance energy security by reducing dependence on imported fossil fuels has been a driving factor, especially for countries seeking to achieve energy independence. Rising crude oil prices and volatility in the global oil market have further stimulated the demand for bioethanol as a cost-effective and stable fuel option. Furthermore, the focus on rural development and the utilization of agricultural resources for energy production have led to increased investment and support for bioethanol production, driving market growth. Technological advancements and ongoing research and development efforts to improve the efficiency and sustainability of bioethanol production processes are additional drivers of the market.

Restraining Factors

The bioethanol market faces several restraints that can impede its growth and widespread adoption of the availability and accessibility of feedstock, such as corn or sugarcane, can be limited and subject to fluctuations in crop yields and prices. This can lead to concerns about competition between food and fuel production, as the diversion of crops for bioethanol production may impact food security. Additionally, the energy-intensive nature of bioethanol production processes and the requirement for large-scale infrastructure investments pose challenges. Furthermore, the reliance on government policies and subsidies, which can be subject to changes and uncertainties, can affect the market's stability and long-term viability. Overall, the development and commercialization of alternative renewable energy sources, such as electric vehicles, may present competition and restrain the growth of the bioethanol market.

Market Segmentation

- In 2022, the E10 segment accounted for around 45.2% market share

On the basis of blend type, the global bioethanol market is segmented into E5, E10, E15 TO E70, E75 to E85, and others. The E10 segment has emerged as the dominant player, holding the largest market share in the bioethanol industry. E10 refers to a blend of 10% ethanol and 90% gasoline, which is widely used and accepted in many countries as a standard bioethanol fuel blend. Its popularity can be attributed to its compatibility with most existing gasoline engines without requiring any significant modifications or infrastructure changes. Moreover, E10 offers a balance between ethanol content and gasoline, providing improved octane ratings and reducing harmful emissions. It offers a cleaner-burning fuel option compared to pure gasoline, making it a preferred choice for many consumers and fleet operators concerned about environmental impact. Furthermore, government policies and regulations promoting biofuel blending, coupled with the availability and affordability of ethanol, have contributed to the widespread adoption of E10. These policies often mandate a minimum blending percentage of bioethanol, with E10 being the most common and readily available option. Overall, the E10 segment has secured the largest market share due to its compatibility, environmental benefits, and strong support from regulatory bodies, making it the preferred choice for bioethanol blending in gasoline and driving the growth of the bioethanol market.

- The pharmaceuticals segment is expected to grow at a higher CAGR of around 7.6% during the forecast period

Based on the end-use industry, the global bioethanol market is segmented into transportation, alcoholic beverages, cosmetics, pharmaceuticals, and others. The pharmaceuticals segment is projected to experience robust growth during the forecast period. Several key factors contribute to this anticipated growth, such as the increasing global healthcare expenditure and a growing emphasis on research and development activities in the pharmaceutical industry are driving demand for innovative drugs and therapies. The rising prevalence of chronic diseases, aging populations, and expanding access to healthcare services in emerging economies further contribute to the growth of the pharmaceuticals segment. Additionally, advancements in technology and biopharmaceutical research have led to the development of novel drug formulations, precision medicine, and targeted therapies, opening up new avenues for pharmaceutical companies. The expanding scope of personalized medicine, driven by genetic testing and advancements in genomic research, is also expected to drive growth in the pharmaceuticals segment. Furthermore, the COVID-19 pandemic has highlighted the importance of pharmaceutical products, including vaccines, antiviral medications, and therapies. This has accelerated research and development efforts in the sector, as well as investments in pharmaceutical manufacturing infrastructure and supply chain resilience. Moreover, favorable government policies and regulatory frameworks, intellectual property protections, and increasing healthcare awareness among the population are contributing to the growth of the pharmaceuticals segment.

Regional Segment Analysis of the Bioethanol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 42.5% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the leader in the bioethanol market, holding the largest market share. The region has a well-developed agricultural sector, particularly in the United States and Canada, which provides abundant feedstock for bioethanol production, mainly from corn and sugarcane. Moreover, North America has been proactive in implementing renewable energy policies and biofuel blending mandates, creating a favorable regulatory environment for bioethanol adoption. Additionally, the region has a robust transportation sector with significant demand for clean and sustainable fuels, driving the growth of the bioethanol market. Furthermore, technological advancements and investments in research and development have enhanced the efficiency and production capacity of bioethanol plants in North America. These factors, combined with increasing environmental awareness and a push for energy independence, have propelled North America to the forefront of the bioethanol market.

Recent Developments

- In January 2022, Wolf Carbon Solutions and the Archer Daniels Midland Company (US) have teamed together to hasten the decarbonization of ethanol production. The goal of this alliance is to create and put into use cutting-edge technologies and procedures that lower carbon emissions all throughout the value chain of ethanol production. Wolf Carbon Solutions and Archer Daniels Midland Company work together to advance a more ecologically responsible and sustainable ethanol sector.

- In April 2023, POET LLC. (US) has announced an exclusive collaboration deal with Midwest Commodities in Detroit, Michigan. Midwest Commodities will exclusively supply DDGS truck-to-container transload services to the firm in order for the company to better serve its worldwide client base.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bioethanol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- POET LLC

- Pacific Ethanol

- The Anderson Inc.

- Flint Hills Resources

- Abengoa Bioenergy

- Archer Daniels Midland

- Bioethanol Japan Kansai Co Ltd.

- BlueFire Ethanol Fuels Inc.

- Cremer Oleo GmbH & Co.

- CropEnergies AG

- Green Future Innovations Inc.

- Green Plains

- Nordzucker AG

- Petrobras Biocombustiveis

- Raizen Energia

- Royal Dutch Shell PLC

- Soufflet Group

- Tereos

- Valero Energy Corporation

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global bioethanol market based on the below-mentioned segments:

Bioethanol Market, By Feedstock

- Starch Based

- Sugar Based

- Cellulose Based

- Others

Bioethanol Market, By Fuel Generation

- First Generation

- Second Generation

- Third Generation

Bioethanol Market, By Fuel Blend

- E5

- E10

- E15 TO E70

- E75 TO E85

- Others

Bioethanol Market, By End-Use

- Transportation

- Alcoholic Beverages

- Cosmetics

- Pharmaceuticals

- Others

Bioethanol Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?