Global Bioequivalence Studies Market Size, Share, and COVID-19 Impact Analysis, By Molecule Type (Small Molecule and Large Molecule), By Dosage Form (Solid Oral Dosage, Parenteral Formulations, Topical Products, and Others), By Therapeutic Area (Oncology, Neurology, Metabolic Disorders, Hematology, Immunology, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Bioequivalence Studies Market Insights Forecasts to 2032

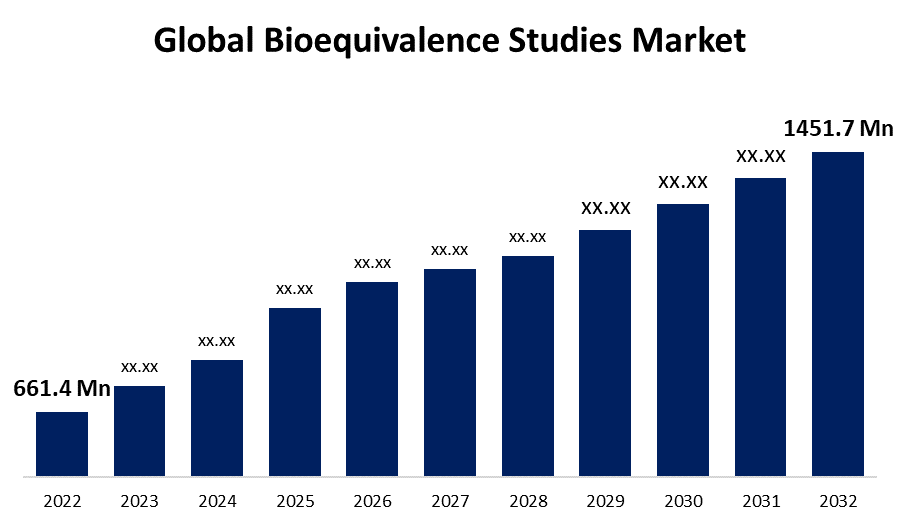

- The Global Bioequivalence Studies Market Size was valued at USD 661.4 Million in 2022.

- The Market is growing at a CAGR of 8.2% from 2022 to 2032.

- The Worldwide Bioequivalence Studies Market Size is expected to reach USD 1451.7 Million by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Bioequivalence Studies Market is expected to reach a value of USD 1451.7 Million by 2032, expanding at 8.2% CAGR between 2022 and 2032. The market for Bioequivalence Studies is a rapidly expanding sector of the pharmaceutical industry. These studies play an important role in determining the comparable quality of a generic drug to its reference product, ensuring patient safety and efficacy. The rising prevalence of chronic diseases, as well as the need for more affordable treatment options, have fueled demand for generic drugs, propelling the bioequivalence studies market forward.

Market Overview

Bioequivalence studies compare two drugs or two sets of formulations of the same drug to demonstrate that they have nearly equal bioavailability and PK/PD parameters. These studies are frequently performed for generic drugs or when a drug's formulation is changed during development. These studies typically compare the pharmacokinetic parameters of the generic and reference products, such as absorption, distribution, metabolism, and excretion. Bioequivalence studies compare the generic version to the innovator or reference product to assess the pharmacokinetic and pharmacodynamic properties of drugs. They are frequently used in the development of generic pharmaceuticals, biosimilars, or when a drug formulation is reformed. According to recent data, the demand for generic drugs has increased significantly in both developed and developing economies.

Report Coverage

This research report categorizes the market for the global bioequivalence studies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bioequivalence studies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bioequivalence studies market.

Global Bioequivalence Studies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 661.4 Million |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 8.2% |

| 022 – 2032 Value Projection: | USD 1451.7 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Molecule Type, By Dosage Form, By Therapeutic Area and By Region. |

| Companies covered:: | ProRelix Services LLP, ICON plc, Labcorp Drug Development, Veeda Clinical Research, CliniExperts, IQVIA, Charles River Laboratories, KYMOS Group, Notrox Research, NorthEast BioAnalytical Laboratories LLC, Malvern Panalytical Ltd, Synova Health and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for bioequivalence studies is increasing as a result of the rapid growth in the production and consumption of generic products, which is fueling the growth of the bioequivalence studies market. Generic drugs are generally less expensive than brand-name drugs, making them a popular choice among patients and healthcare providers. Bioequivalence studies ensure the safety and efficacy of generic drugs, increasing their market acceptance. Regulatory agencies such as the FDA, EMA, and WHO have implemented guidelines and regulations to streamline the generic drug approval process. Bioequivalence studies are a critical requirement for generic drug approval, resulting in a favorable market environment. The global market for generic drugs has been steadily growing, owing to rising healthcare costs and the expiration of patents on several blockbuster drugs. The expansion of the generic drug market directly affects the demand for bioequivalence studies. Analytical technique advancements, such as high-performance liquid chromatography (HPLC) and mass spectrometry, have improved the accuracy and efficiency of bioequivalence studies. These advancements have accelerated market growth.

Restraining Factors

Bioequivalence studies necessitate substantial investment in infrastructure, analytical equipment, and skilled personnel. Because of the high development costs, small and medium-sized pharmaceutical companies may be hindered from entering the market. Regulatory requirements for bioequivalence studies vary by region and country. Companies that operate in multiple jurisdictions may face difficulties in meeting the various regulatory standards, limiting market expansion.

Market Segmentation

The Global Bioequivalence Studies Market share is classified into molecule type and dosage form.

- The small molecule segment accounted for the largest share of the global bioequivalence studies market in 2022.

The global bioequivalence studies market is categorized by molecule type into small molecule and large molecule. Among these, the small molecule segment accounted for the largest share of the global bioequivalence studies market in 2022. The segment is being driven by the growing global demand for novel pharmaceuticals and generics that require bioequivalence testing. One of the major factors supporting the segment's robust revenue shares during the analysis period is the growing pipeline of small molecules.

- The solid oral dosage segment is expected to hold the largest share of the global bioequivalence studies market during the forecast period.

Based on the dosage form, the global bioequivalence studies market is divided into solid oral dosage, parenteral formulations, topical products, and others. Among these, the solid oral dosage segment is expected to hold the largest share of the global bioequivalence studies market during the forecast period. The segmental growth can be attributed due to drug developers' increasing investments in bulk production of oral solids, which require bioequivalence research for optimal equivalence in drug compositions. Furthermore, many common medicines and consumer generics are available in oral solid dose (OSD) forms such as pills, tablets, capsules, and so on. These OSD drugs are experiencing numerous benefits related to formulation concepts, novel technologies, and other manufacturing innovations, which are frequently aimed at cost reduction. Technological advancements in the field of oral solids are expected to support the market's robust demand for solid oral dosage forms for bioequivalence studies.

Regional Segment Analysis of the Global Bioequivalence Studies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global bioequivalence studies market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global bioequivalence studies market over the predicted years. This is primarily due to an increase in the number of clinical trials in the United States, which also includes bioequivalence and bioavailability testing. The presence of major players in the country, such as IQVIA, Charles River Laboratories, and others, has increased the region's revenue share in the bioequivalence studies market. Pharmaceutical manufacturers are increasingly outsourcing bioequivalence studies to specialized contract research organizations (CROs) in order to capitalize on their expertise and resources.

Asia Pacific is expected to grow at the fastest pace in the global bioequivalence studies market during the forecast period. The presence of multiple pharmaceutical manufacturing hubs, including India, China, and Japan, has contributed to the region's significant growth. Furthermore, the generics market in Asian economies has been thriving in recent years. For example, India is one of the largest generic drug exporters in the pharmaceutical industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bioequivalence studies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ProRelix Services LLP

- ICON plc

- Labcorp Drug Development

- Veeda Clinical Research

- CliniExperts

- IQVIA

- Charles River Laboratories

- KYMOS Group

- Notrox Research

- NorthEast BioAnalytical Laboratories LLC

- Malvern Panalytical Ltd

- Synova Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, Inhibikase Therapeutics, Inc., a clinical-stage pharmaceutical company, disclosed the first three subjects in its '501' bioequivalence study of IkT-001Pro for the treatment of Chronic Myelogenous Leukemia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Bioequivalence Studies Market based on the below-mentioned segments:

Global Bioequivalence Studies Market, By Molecule Type

- Small Molecule

- Large Molecule

Global Bioequivalence Studies Market, By Dosage Form

- Solid Oral Dosage

- Parenteral Formulations

- Topical Products

- Others

Global Bioequivalence Studies Market, By Therapeutic Area

- Oncology

- Neurology

- Metabolic Disorders

- Hematology

- Immunology

- Others

Global Bioequivalence Studies Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?