Global Biocomposites Market Size By Fiber (Wooden Fiber and Non-wood Fiber), By End-User (Building & Construction, Automotive, Consumer Goods), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Biocomposites Market Size Insights Forecasts to 2033

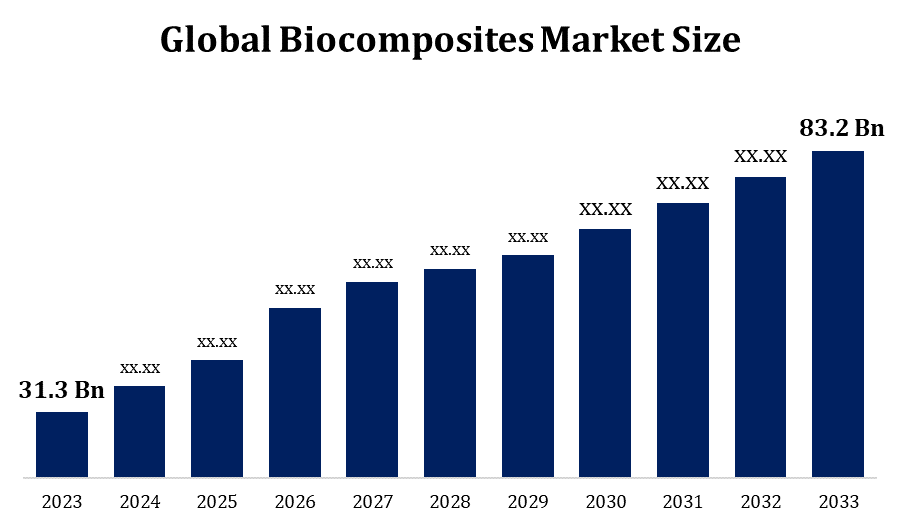

- The Global Biocomposites Market Size was valued at USD 31.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.27% from 2023 to 2033

- The Woridwide Biocomposites Market Size is expected to reach USD 83.2 Billion by 2033

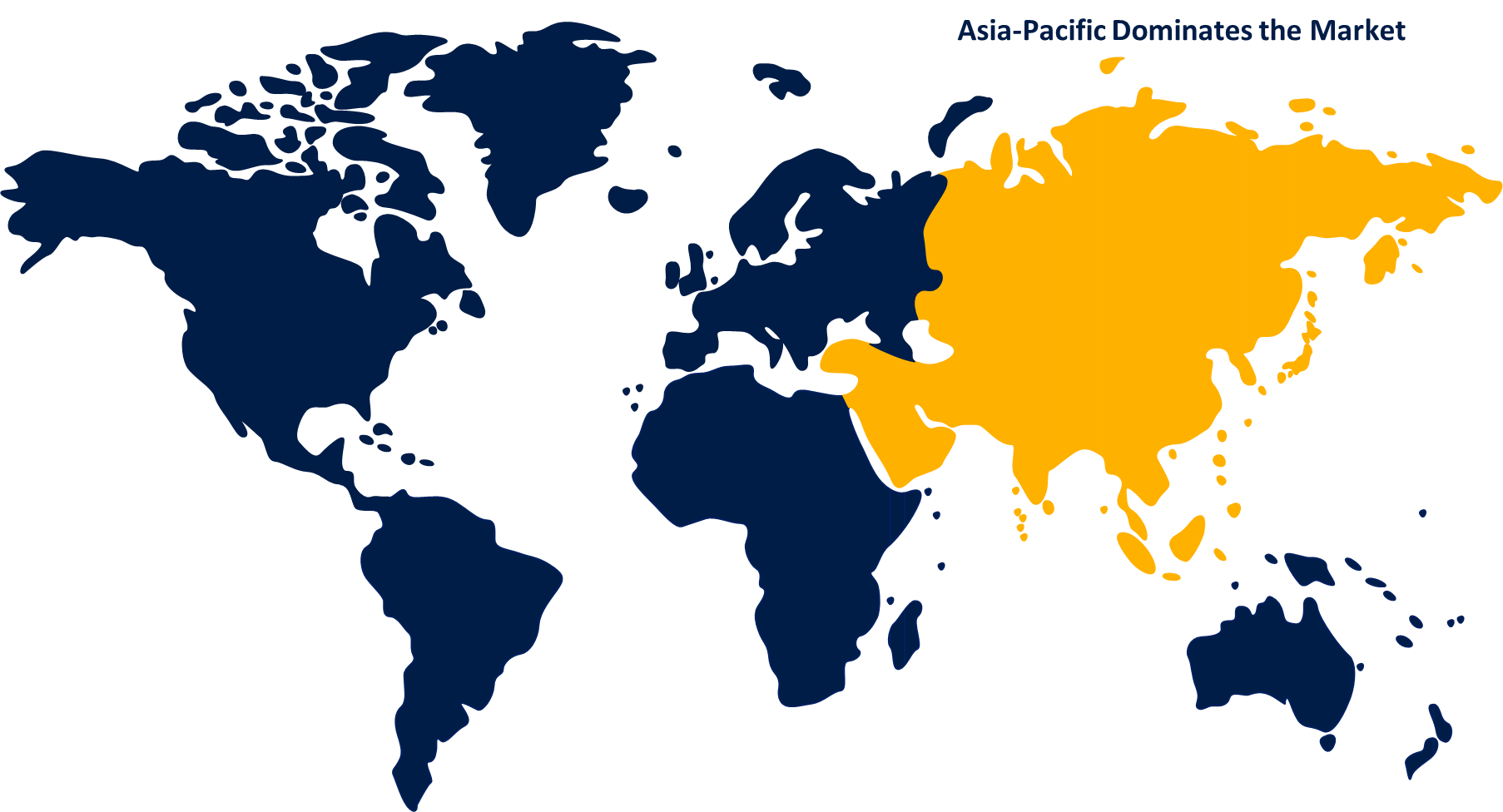

- Asia Pacific is Expected to row the Fastest during the Forecast period

Get more details on this report -

The Global Biocomposites Market is expected to reach USD 83.2 Billion by 2033, at a CAGR of 10.27% during the Forecast period 2023 to 2033.

Biocomposites are materials composed of natural fibres with a biodegradable polymer. They're gaining traction as a more environmentally friendly alternative to typical composites consisting of synthetic fibres and petroleum-based polymers. These bio-based materials are used in a variety of industries, ranging from automotive and construction to packaging and consumer goods. The desire for more eco-friendly and renewable materials, particularly as we seek ways to lessen our reliance on non-renewable resources, is driving the trend towards Biocomposites. Biocomposites are predicted to expand in popularity as technology and research continue to improve their qualities, making them more versatile and competitive with traditional choices.

Biocomposites Market Value Chain Analysis

The cultivation and harvesting of natural fibres such as jute, hemp, flax, or kenaf begin the process. Biodegradable polymers made from renewable sources, such as PLA (polylactic acid) or PHA (polyhydroxyalkanoates), are manufactured. Compounding is the technique of combining natural fibres and biodegradable polymers to make biocomposite pellets or granules. Using methods such as injection moulding or compression moulding, the biocomposite material is formed into the required shape. Transporting biocomposite materials from manufacturing plants to end users or intermediate distributors. Management and coordination of the whole supply chain to ensure timely and efficient delivery. Biocomposites are used in sustainable packaging solutions to replace standard plastic packaging.

Biocomposites Market Opportunity Analysis

Expansion in important industries such as automotive, construction, packaging, and consumer products creates a significant market opportunity. In these industries, Biocomposites provide lightweight, long-lasting, and eco-friendly alternatives. Consumers' growing knowledge of the environmental impact of items creates a need for sustainable alternatives. Businesses can capitalise on this trend by producing biocomposite products and emphasising their environmental friendliness. Biocomposites, particularly those containing biodegradable polymers, offer waste management opportunities. Products that are easy to dispose of and recycle contribute to a circular economy. Manufacturing process improvements and economies of scale can lead to cost-competitive biocomposite products. This makes them more appealing to enterprises looking for sustainable solutions without sacrificing cost-effectiveness.

Global Biocomposites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 31.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.27% |

| 2033 Value Projection: | USD 83.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Fiber, By End-User, By Region, By Geographic Scope And Forecast to 2033 |

| Companies covered:: | UPM (Finland), Trex Company, Inc. (U.S.), Fiberon (U.S.), Flexform SpA (U.S.), UFP Industries, Inc., (U.S.), Meshlin Composites ZRT (Hungary), Tecnaro GmbH (Germany), Anhui Guofeng Wood-Plastic Composite Co., Ltd. (China), B.COMPOSITES PVT.LTD. (India), Green Dot Corporation (U.S.), Hualong New Material Lumber Co. Ltd. (China), Kudoti Pty Ltd (South Africa), Bcomp (Switzerland), Nanjing Xuha Sundi New Building Materials, Ltd. (China), Lingrove Inc,, (U.S.), DEVOLD AMT (Norway), Taiyuan Heavy Industry Co., Ltd (China), STRUCTeam (U.K.), RTP Company (U.S.), G. Angeloni s.r.l (Italy), Talon Technology Co., Ltd (U.S.), Rock West Composites, Inc (U.S.), COLAN AUSTRALIA, (Australia), and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Biocomposites Market Dynamics

Global waste issues are driving market growth

Biocomposites, particularly those made using biodegradable polymers, have the potential to alleviate end-of-life issues. They provide a sustainable alternative to traditional materials by spontaneously decomposing, reducing the accumulation of non-biodegradable trash. Biocomposites contribute to the circular economy concept by utilising renewable resources and minimising reliance on finite raw materials. This is consistent with global initiatives to reduce waste output and increase resource efficiency. Consumer decisions are influenced by increased knowledge of waste issues. Biocomposite manufacturers can gain from teaching consumers about the environmentally friendly elements of their products, thereby creating a market in which sustainability is a key purchasing factor. Biocomposite products can be designed with end-of-life considerations in mind by manufacturers. This involves easy disassembly, recycling, or composting to reduce environmental effects.

Restraints & Challenges

Compared to standard materials, Biocomposites may have greater production costs. Obtaining cost competitiveness while retaining sustainability continues to be a problem for mainstream adoption. Due to variances in natural fibres and the biodegradable polymers utilised, ensuring consistent material performance and quality can be difficult. To meet industry guidelines and requirements, standardisation activities are critical. There is a need for enhanced industry awareness and education regarding the benefits and applications of Biocomposites. Lack of understanding can stymie wider adoption. When compared to conventional materials, Biocomposites may confront scepticism regarding their long-term durability. It is critical to overcome these misconceptions in order to get acceptance in industries with strict performance criteria. The Biocomposites market may be impacted by economic uncertainty. Factors like as raw material price variations or global economic downturns may have an impact on the industry's growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Biocomposites Market from 2023 to 2033. Consumers and businesses alike are more concerned about environmental sustainability. This awareness is fueling demand for environmentally friendly materials, such as Biocomposites, as alternatives to standard plastics. The automotive industry in North America is thriving, and Biocomposites are gaining popularity for applications such as interior components, panels, and structural parts. To satisfy sustainability goals, automakers are investigating these materials. Biocomposites are being used in decking, fencing, and other structural components in the building industry. The increased emphasis on environmentally friendly building materials is fueling the expansion of Biocomposites in the construction industry. The area is home to significant participants in the Biocomposites industry, ranging from natural fibre makers to biodegradable polymers. Biocomposites are becoming increasingly used in the manufacture of consumer goods like as furniture and electrical casings.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area is rapidly industrialising, fueling demand for sustainable materials. Biocomposites are gaining popularity as environmentally friendly solutions in a variety of production processes. The area is abundant in agricultural resources, ensuring a stable supply of natural fibres such as jute, kenaf, and bamboo. This abundance aids in the expansion of biocomposite manufacture. The utilisation of Biocomposites in the automotive sector is increasing as vehicle manufacturing increases. Interior components, panels, and structural elements are made from these materials. Biocomposites are being used in a variety of construction applications, including decking and cladding. As the region's infrastructure develops, so does the demand for sustainable building materials. The growing middle class and growing consumer awareness of environmental effect drive demand for sustainable consumer goods.

Segmentation Analysis

Insights by Fiber

The wood fiber segment accounted for the largest market share over the forecast period 2023 to 2033. Wood fibres contribute to Biocomposites' mechanical strength and stiffness. The mix of biodegradable polymers and wood fibres improves the material's overall performance. Wood fiber-reinforced Biocomposites are used in a variety of industries such as automotive, construction, furniture, and consumer goods. Wood fibres' adaptability allows for a wide range of applications in a variety of end-use sectors. Wood fibres provide biocomposite goods a natural and visually pleasant appearance. This is especially useful in situations that require a wood-like look without the environmental drawbacks of real wood. Biodegradability is common in Biocomposites made of wood fibres. This property is advantageous in end-of-life settings, when the material can naturally degrade, lowering the environmental footprint.

Insights by End Use

The automotive segment accounted for the largest market share over the forecast period 2023 to 2033. Biocomposites, such as those reinforced with natural fibres, are a lighter alternative to typical materials. This is critical for increasing vehicle fuel efficiency and lowering carbon emissions. Interior components such as door panels, dashboards, and seats are made using Biocomposites. The use of sustainable materials improves the interior's eco-friendliness, fulfilling consumer demands for environmentally conscientious decisions. Biocomposites are used in external components and panels, which contributes to the vehicle's total weight reduction. This has the potential to improve performance and energy efficiency. Some biocomposite materials used in cars are made to be recyclable.

Recent Market Developments

- In July 2021, Biocomposites, a global medical device company that develops and manufactures leading technologies for the treatment of bone and soft tissue infections, has announced a new Canadian approval for the combination of antibiotics with its STMULAN products, vancomycin, gentamycin, and tobramycin.

Competitive Landscape

Major players in the market

- UPM (Finland)

- Trex Company, Inc. (U.S.)

- Fiberon (U.S.)

- Flexform SpA (U.S.)

- UFP Industries, Inc., (U.S.)

- Meshlin Composites ZRT (Hungary)

- Tecnaro GmbH (Germany)

- Anhui Guofeng Wood-Plastic Composite Co., Ltd. (China)

- B.COMPOSITES PVT.LTD. (India)

- Green Dot Corporation (U.S.)

- Hualong New Material Lumber Co. Ltd. (China)

- Kudoti Pty Ltd (South Africa)

- Bcomp (Switzerland)

- Nanjing Xuha Sundi New Building Materials, Ltd. (China)

- Lingrove Inc, (U.S.)

- DEVOLD AMT (Norway)

- Taiyuan Heavy Industry Co., Ltd (China)

- STRUCTeam (U.K.)

- RTP Company (U.S.)

- G. Angeloni s.r.l (Italy)

- Talon Technology Co., Ltd (U.S.)

- Rock West Composites, Inc (U.S.)

- COLAN AUSTRALIA, (Australia)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Biocomposites Market, Fiber Analysis

- Wooden Fiber

- Non-wood Fiber

Biocomposites Market, End Use Analysis

- Building & Construction

- Automotive

- Consumer Goods

Biocomposites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?