Global Bio-based Polypropylenes Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Sugarcane, Corn, Cellulosic Biomass, and More), By Application (Injection Molding, Films, Textiles, and Other Applications), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Bio-based Polypropylene Market Insights Forecasts to 2035

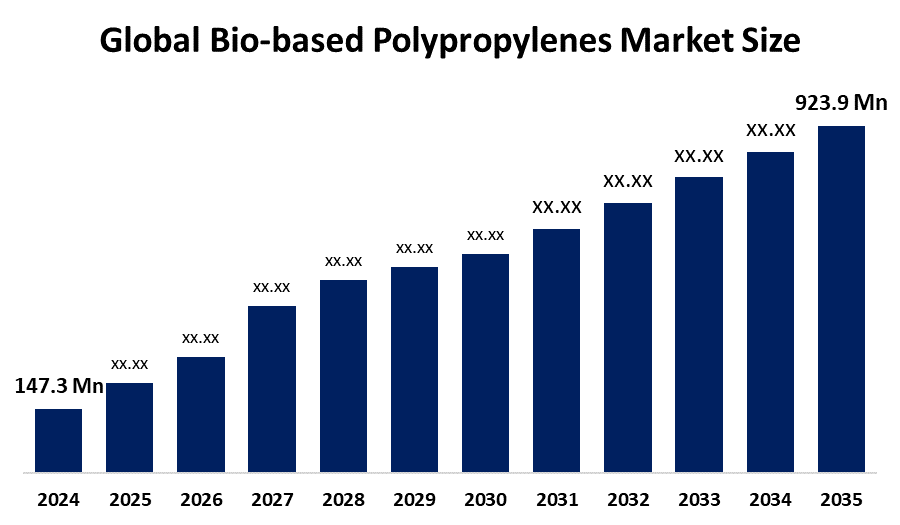

- The Global Bio-based Polypropylene Market Size Was Estimated at USD 147.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.17% from 2025 to 2035

- The Worldwide Bio-based Polypropylene Market Size is Expected to Reach USD 923.9 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Bio-based Polypropylene market size was worth around USD 147.3 million in 2024, grew to 174.1 million in 2025, and is predicted to grow to around USD 923.9 million by 2035 with a compound annual growth rate (CAGR) of 18.17% from 2025 to 2035. The expansion of the global bio-based polypropylene market is propelled by the expanding usage of eco-friendly plastic items across a range of sectors, including textiles, food, and medicine. As a result, the demand for alternative plastics has increased globally due to growing environmental concerns about the usage of petroleum-based plastics. Manufacturers are continuously innovating their current goods and creating new ones as their focus shifts to the development of bioplastics. The growing usage of eco-friendly plastics in the food and beverage, textile, and pharmaceutical industries is predicted to drive up demand for bio-based polypropylene globally in the upcoming years.

Global Bio-based Polypropylene Market Forecast and Revenue Outlook

- 2024 Market Size: USD 147.3 Million

- 2035 Projected Market Size: USD 923.9 Million

- CAGR (2025-2035): 18.17%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

Bio based polypropylene is a kind of polypropylene polymer in which the carbon originates from biological, renewable feedstocks plants, agricultural waste, or other biomass, as opposed to fossil fuels such as natural gas or crude oil. The existence of established companies such as Braskem, Biobent Polymers, SABIC, LyondellBasell Industries Holdings B.V., Nature Plast, Prime Polymer Co. Ltd., and FKuR Kunststoff GmbH does create some degree of consolidation in the marketplace. These companies have attempted to grow their market share by using many strategic methods such as partnerships, capacity increases, collaborations, and new product launches. However, Kikkoman Biochemifa Company, which in August 2023 reported they would be utilizing 100% biomass based polypropylene to supplant petroleum based polypropylene in produced materials. The shift to bio based polypropylene has been greatly aided by the automotive industry's move towards sustainability. Bio PP is less damaging to the earth as it uses renewable resources, and it also behaves materially the same as traditional polypropylene. Bio PP is being used not only to work toward creating greener vehicles it is also addressing the desires of consumers for sustainable products. Overall, this transition is a step towards making bio PP a key material to create greener vehicles in the future, which also has implications for a circular economy. Braskem and Mazda are leading the automotive industry's sustainable transition using bio PP from cellulosic biomass for bumpers and other interior parts.

Governments around are implementing more incentives, policies, and regulatory frameworks to hasten the transition to low carbon, renewable plastics, such as bio based polypropylene. Bio based polymers are in high demand in the European Union due to laws like the Packaging and Packaging Waste Directive and its revisions, which set aggressive goals for waste reduction and recycled content. Bio-based materials are supported in the United States by federal procurement programs such as the USDA BioPreferred Program, R&D subsidies, and labeling/certification initiatives. Through initiatives like Made in China 2025 and other green materials strategies, Asian nations like China and Japan are coordinating their industrial policies with sustainability goals, promoting the use of bioplastics like Bio PP.

Key Market Insights

- North America is expected to account for the largest share in the Bio based Polypropylene Market during the forecast period.

- In terms of feedstock, the sugarcane segment is projected to lead the Bio based Polypropylene Market throughout the forecast period

- In terms of application, the injection molding segment captured the largest portion of the market

Bio-based Polypropylene Market Trends

- Shift toward non food feedstocks & waste residue materials

- Stronger regulatory & sustainability pressures

- Rising demand from the packaging & automotive sectors

- Technological advancements & scale up efforts

- Volatile raw material & cost challenges

Report Coverage

This research report categorizes the global bio based polypropylene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the global bio based polypropylene market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the global bio based polypropylene market.

Global Bio-based Polypropylenes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 147.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.17% |

| 2035 Value Projection: | USD 923.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Feedstock, By Application, By Regional Analysis |

| Companies covered:: | Braskem, Biobent Polymers, LyondellBasell Industries Holdings B.V., NaturePlast, Prime Polymer Co., Ltd, CITRONIQ, LLC., BiologiQ, Inc., Trellis Bioplastics, LyondellBasell Industries N.V., SABIC, Neste Corporation, Mitsui Chemicals, Inc., Trinseo, Borealis AG, Danimer Scientific, Futerro, FKuR Kunststoff GmbH, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The global bio based polypropylene market is driven by PE and PP, which are two of the most common plastics used in consumer goods and industry worldwide. One of the main factors driving the demand for bio based polypropylene (Bio PP) is the growing global focus on lowering the carbon footprint of polymers derived from fossil fuels. More than 20% of the plastic manufactured worldwide is made of PP. PP has a carbon footprint of 1.4 3.5 kg CO2 for every kilogram of plastic produced. Producers are spending money on environmentally friendly substitutes like bio based polypropylene (bio PP), which is derived from renewable resources like corn and sugarcane. Because Bio PP emits less greenhouse gases and has a smaller carbon footprint, it is a good option for industries looking for low materials that are both robust and adaptable.

Restraining Factor

One of the main factors restraining the global bio based polypropylene market is the absence of feedstock is a major impediment to the development of bio based polypropylene production facilities. Most feedstock for Bio PP is renewable, such as corn, sugarcane, vegetable oils, and used cooking oil (UCO). In addition, there is a high demand for these feedstocks for food, biofuels, and other biopolymers, which can add uncertainties to the supply chain and also price fluctuations.

Market Segmentation

The global bio-based polypropylene market is divided into feedstock and application.

Global Bio-based Polypropylenes Market, By Feedstock:

- The sugarcane segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on feedstock, the global bio-based polypropylene market is segmented into sugarcane, corn, cellulosic biomass, and more. Among these, the sugarcane segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because of its well-established fermentation infrastructure, which converts sucrose to ethanol and then to bio-propylene. Sugarcane will still account for 61% of feedstock in 2024. Despite feedstock seasonality, the geographical proximity of cane plantations to production centres in Brazil and Thailand supports supply stability and anchors a competitive cost base.The cellulosic biomass segment in the bio based polypropylene market is expected to grow at the fastest CAGR over the forecast period, because it employs forest trash, non food agricultural wastes, and energy crops, it avoids food rivalry, provides a plentiful supply, and drastically lowers carbon emissions. Its appeal is further enhanced by legislative assistance and technology advancements.

Global Bio-based Polypropylenes Market, By Application:

- The injection molding segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global bio-based polypropylene market is segmented into injection molding, films, textiles, and other applications. Among these, the injection molding segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because injection moulding works well for intricate, thin-wall items that require precise dimensions, and it accounted for 65% of the bio-based polypropylene market in 2024. Films are still popular in stand-up pouches, snack food wraps, and personal care overwraps. Manufacturers take advantage of bio-PP's barrier parity with PP derived from fossil fuels, which allows downgauging without sacrificing moisture or fragrance retention.The film segment in the bio-based polypropylene market is expected to grow at the fastest CAGR over the forecast period, due to the growing demand for environmentally friendly packaging, particularly in the food and beverage industry, its superior barrier, moisture resistance, and flexibility, pressure from regulations to limit plastic waste, and advancements in technology that cut manufacturing costs and improve film quality.

Regional Segment Analysis of the Global Bio-based Polypropylene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Bio-based Polypropylenes Market Trends

North America is expected to hold the largest share of the global bio-based polypropylene market over the forecast period.

The United States and Canada, in particular, are two of the largest sources of renewable feedstock in North America. The availability of corn and sugarcane played a significant role in the development of the bio-PP market. Brazil produced 45.5 million tonnes of sugarcane in 2024 as the largest producer of sugarcane, while the US produced more than 34.8 million tonnes. These regions are further bolstered by their status as leading producers on the world stage, which supports a reliable raw materials supply chain. Additionally, companies such as Danimer Scientific, LyondellBasell Industries N.V., and Braskem are increasing capacities to produce biopolymers for consumer goods, automotive, and packaging sectors in the region.

Asia Pacific Bio-based Polypropylenes Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the Bio-based Polypropylenes market during the forecast period. In the Asia Pacific market, the rise is rising due to the legislative frameworks of the area, particularly China's Five-Year Plan provisions for green materials and Japan's Bio-strategy Roadmap, which encourage capital deployment into bio-attributed propylene assets. Domestic converters gain from easy access to agricultural leftovers, especially in Southeast Asia, which improves plant utilisation rates and reduces outbound feedstock logistics costs.

Europe Bio-based Polypropylenes Market Trends

Europe's bio-based polypropylene market is driven by strict environmental regulations and sustainability goals. The green deal outlines that the EU targets climate neutrality by 2050, while the Circular Economy Action Plan sets waste reduction and resource reuse as key priorities. The EU has provided significant support to the development of bio-based polymers via Horizon 2020 research and innovation initiative, which has put ambitious collaborative research.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global bio-based polypropylene market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in the bio-based polypropylenes market Include

- Braskem

- Biobent Polymers

- LyondellBasell Industries Holdings B.V.

- NaturePlast

- Prime Polymer Co., Ltd

- CITRONIQ, LLC.

- BiologiQ, Inc.

- Trellis Bioplastics

- LyondellBasell Industries N.V.

- SABIC

- Neste Corporation

- Mitsui Chemicals, Inc.

- Trinseo

- Borealis AG

- Danimer Scientific

- Futerro

- FKuR Kunststoff GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Recent development

- In January 2024, Shell and Braskem announced a strategic collaboration to develop and scale sustainable polypropylene, focusing on lowering the carbon footprint of industrial polymer production.

- In February 2024, Citroniq Chemicals announced plans to establish a bio-polypropylene conversion plant in Nebraska. This facility will enhance the domestic production capacity of sustainable PP and strengthen North America's bio-polymer supply chain.

- In December 2024, Gevo and LG Chem extended their agreement to develop and commercialize bio-based propylene, aiming to advance renewable chemical solutions for a variety of applications, including bioplastics and sustainable packaging.

- In January 2023, Braskem announced a project to evaluate an investment in producing carbon-negative bio-based polypropylene (PP) in the U.S. The project would make use of Braskem's proven, proprietary technology to convert bioethanol into physically segregated bio-based polypropylene. The company explored collaboration prospects for this initiative with several clients, brand owners, and suppliers.

- In August 2023, Neste, LyondellBasell Industries Holdings B.V., Biofibre, and Naftex Internacional developed a value chain that combines bio-based polymers, including polypropylene (PP) with natural fiber to produce construction elements. The use of PP with detectable bio-based content and natural fiber in construction elements results in carbon storage, which can help combat climate change.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the bio-based polypropylene market based on the following segments:

Global Bio-based Polypropylenes Market, By Feedstock

- Sugarcane

- Corn

- Cellulosic Biomass

- More

Global Bio-based Polypropylenes Market, By Application

- Injection Molding

- Films

- Textiles

- Other Applications

Global Bio-based Polypropylenes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?