Global Bio-Based Ethyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Source (Sugar Cane, Cornstarch, and Others), By End-user (Pharmaceutical, Food Industry, Flexible Packaging, Coatings, Adhesives, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Bio-Based Ethyl Acetate Market Size Insights Forecasts to 2035

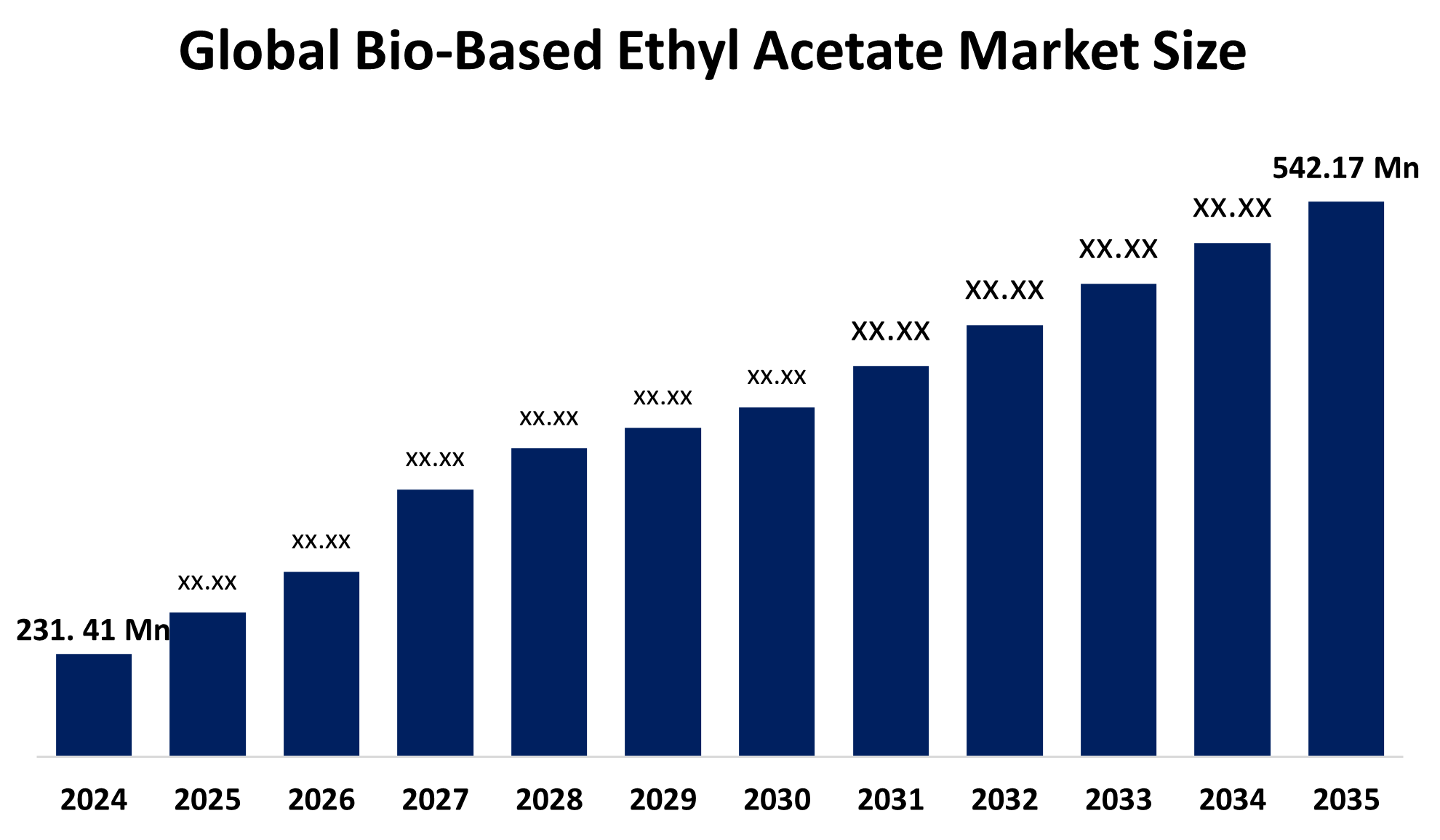

- The Global Bio-Based Ethyl Acetate Market Size Was Estimated at USD 231.41 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.05% from 2025 to 2035

- The Worldwide Bio-Based Ethyl Acetate Market Size is Expected to Reach USD 542.17 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Bio-Based Ethyl Acetate Market Size was worth around USD 231.41 Million in 2024 and is Predicted to Grow to around USD 542.17 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 8.05% from 2025 to 2035. The worldwide bio-based ethyl acetate market is witnessing growth due to factors such as growing environmental awareness, increasing government regulations supporting sustainable alternatives, and a rise in demand for eco-friendly goods.

Market Overview

The Global Bio-Based Ethyl Acetate Market Size involving the manufacturing and usage of ethyl acetate that is bio-based, including bio-ethanol. There is a significant need for substitutes to petrochemical-based solvents. As it is less toxic, has a pleasant aroma, as well as being biodegradable, it finds applications as a solvent in paint, adhesives, printing ink, pharmaceuticals, cosmetics, as well as food industry. This is predominantly being fueled by stringent environmental policies, as well as awareness regarding green chemistry.

In May 2024, the Circular Bio-based Europe Joint Undertaking signed 31 grant agreements worth nearly USD 230 million, involving a total of 396 beneficiaries across 34 European countries. This initiative aims to strengthen Europe’s bio-based economy, enhance competitiveness, reduce dependence on imports, and promote the development of sustainable products and circular value chains.

Industrialization and growth in the pharmaceutical and packaging industries, along with government incentives supporting bio-based products, are creating significant opportunities—particularly in emerging markets such as developing nations. Key players in the global bio-based solvent market, including Eastman Chemical Company, Celanese Corporation, Sekab, Jubilant Ingrevia, and Anhui Tiger Chemical, have played a vital role in the global supply chain. These companies have leveraged collaborative development, capacity expansion, and technological innovation to strengthen their market positions.

Report Coverage

This research report categorizes the Global Bio-Based Ethyl Acetate Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the bio-based ethyl acetate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the bio-based ethyl acetate market.

Global Bio-Based Ethyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 231.41 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.05% |

| 2035 Value Projection: | USD 542.17 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Source, By End-user |

| Companies covered:: | IOL Chemicals and Pharmaceuticals Limited, Viridis Chemical, LLC, Eastman Chemical Company, Godavari Biorefineries Limited, BASF SE, SEKAB BioFuels & Chemicals AB, CropEnergies AG, Vertec Biosolvents Inc, Solvay S.A., INEOS Group, Celanese Corporation, Anhui Tiger Chemical, Daicel Corporation, Jubilant Pharmova Ltd., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The driving factors in the Global Bio-Based Ethyl Acetate Market Size include the growing focus on sustainability and environmental protection. The increasing challenge from regulations to lower the emission of volatile organic compounds (VOC) and carbon footprint is pushing the use of bio-based and sustainable solvents. The growing demands in the paints and coatings, adhesives, printing inks, pharmaceutical, and food processing industries are also supporting the market growth. The accessibility to bio-ethanol feedstock, government support to develop the bio-economy, and sustainability initiatives taken by companies are also fueling the market. The preference for sustainable products and the developments in green chemistry and fermentation technology are also improving the production efficiency and market penetration in the global market.

Restraining Factors

The Global Bio-Based Ethyl Acetate Market Size hampered in the global arena due to the relatively higher production cost of bio-based products as opposed to traditional counterparts, the unavailability of sources for bio-based products, and the price volatility of agri-products. The production infrastructure, scalability issues, and lack of awareness in cost-conscious markets might create hurdles.

Market Segmentation

The bio-based ethyl acetate market share is classified into source and end-user.

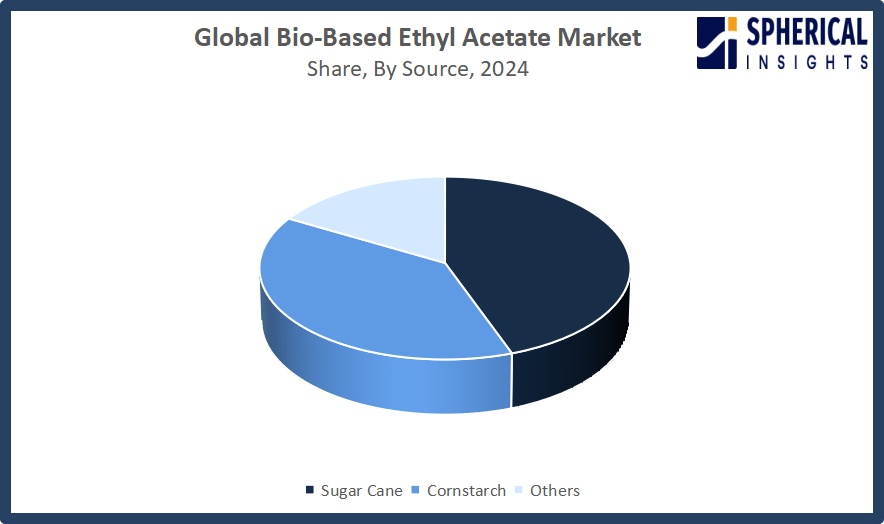

- The sugar cane segment dominated the market in 2024, approximately 44% and is projected to grow at a substantial CAGR during the forecast period.

Based on the source, the bio-based ethyl acetate market is divided into sugar cane, cornstarch, and others. Among these, the sugar cane segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The sugarcane product accounted for the major market share in the bio-based ethyl acetate market. This is because the production of ethanol from sugarcane is sustainable, efficient, and significantly inexpensive. The increasing demand for green solvents in the pharmaceutical sector, coatings, adhesives, and the food industry has significantly influenced the market.

Get more details on this report -

- The coatings segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the bio-based ethyl acetate market is divided into pharmaceutical, food industry, flexible packaging, coatings, adhesives, and others. Among these, the coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The coatings industry growth in the bio-based ethyl acetate market is owing to the increasing adoption of environment-friendly, low-VOC paints & coatings. Rising constructions, automotive, and industrial production, coupled with the strict enforcement of environmental regulations, are favoring the adoption of green solvents, leading to the great acceptance of bio-based ethyl acetate in high-performance, environment-friendly coating applications.

Regional Segment Analysis of the Bio-Based Ethyl Acetate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the bio-based ethyl acetate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Global Bio-Based Ethyl Acetate Market Size over the predicted timeframe. The Asia Pacific market is expected to have the 38% market share position in the bio-based ethyl acetate market due to the fast-paced growth of industries, pharmacological applications, coatings, adhesives, and packaging industries, as well as the ready availability of raw materials such as sugarcane and corn starches. Countries such as India, China, and Thailand have been leading players in this market, driven by the assistance of governments due to the production of bio-based chemical products, developing bio-refineries, and increased consciousness regarding bio-based and environmentally friendly solvents with lower VOCs. Domestic applications and exports have fueled market expansion and have made it the leader globally.

North America is expected to grow at a rapid CAGR in the Global Bio-Based Ethyl Acetate Market Size during the forecast period. The bio-based ethyl acetate market in North America is anticipated to have a 22% market share, owing to the increasing use of eco-friendly, low-VOC solvents in the pharmaceutical, painting, adhesives, and food industries. The prime drivers for this growth in the United States and Canadian bio-based ethyl acetate industries are strict regulations, intensive green chemistry-related R&D activities, and the use of bio-refineries. Incentives from the government regarding the production of renewable chemicals propel the market forward. In October 2024, the US Environmental Protection Agency awarded Viridis Chemical Company for manufacturing renewable-based ethyl acetate from corn ethanol based on environmentally positive aspects and promoting sustainable solvents across industries.

The European market is witnessing an increasing trend in the use of bio-based ethyl acetate, driven by stringent environmental regulations, rising demand for low-VOC solvents, and the growth of the bio-based economy. The major countries in the European market include Germany, France, and the Netherlands, which are primarily driven by the chemical industry, adaptation of green chemistry, and investments in biorefineries. To support the sustainable use of chemicals, the EU Chemical Industry Action Plan, adopted in July 2025, encouraged the use of bio-based chemicals, including bio-based ethyl acetate from biomass.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the bio-based ethyl acetate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IOL Chemicals and Pharmaceuticals Limited

- Viridis Chemical, LLC

- Eastman Chemical Company

- Godavari Biorefineries Limited

- BASF SE

- SEKAB BioFuels & Chemicals AB

- CropEnergies AG

- Vertec Biosolvents Inc

- Solvay S.A.

- INEOS Group

- Celanese Corporation

- Anhui Tiger Chemical

- Daicel Corporation

- Jubilant Pharmova Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Viridis Chemical announced relocating its renewable chemicals plant from Columbus, Nebraska, to Peoria, Illinois, co-locating with BioUrja Renewables’ alcohol facility. The plant will produce renewable ethyl acetate from corn-based alcohol, advancing low-carbon chemical production. Viridis is a 2024 U.S. EPA Green Chemistry Challenge Award recipient.

- In June 2023, CropEnergies announced its first renewable ethyl acetate plant at the Zeitz site in Germany, under its new Biobased Chemicals unit. Using sustainable bioethanol as feedstock, the EUR 130 million facility, set for 2025, aims to expand CropEnergies into biobased chemical markets beyond fuel applications.

- In March 2022, Viridis Chemical, LLC announced its first production of renewable ethyl acetate at its Columbus, Nebraska, plant. HELM U.S. Corporation, its exclusive marketing partner, has begun distributing samples and supplying the renewable solvent to customers across various industries.

- In January 2022, CropEnergies AG and Johnson Matthey announced an agreement to build a renewable ethyl acetate plant near Zeitz, Germany. Using sustainable ethanol and JM technology, the EUR 80-100 million project will reduce fossil carbon footprints and mark CropEnergies’ first step into biobased chemicals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Bio-Based Ethyl Acetate Market Size based on the below-mentioned segments:

Global Bio-Based Ethyl Acetate Market, By Source

- Sugar Cane

- Cornstarch

- Others

Global Bio-Based Ethyl Acetate Market, By End-user

- Pharmaceutical

- Food Industry

- Flexible Packaging

- Coatings

- Adhesives

- Others

Global Bio-Based Ethyl Acetate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?