Global Beverage Container Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastic, Metal, Glass, and Paperboard), By Container Type (Bottles & Jars, Cartons, Cans, Bag-In-Boxes, and Pouches), By Application (Alcoholic Beverages [Beer, Wine, Spirit], Non-Alcoholic Beverages [Carbonated Soft Drinks, Bottled Water, Dairy, Juices, and Sports Drinks Enhanced Water]), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Beverage Container Market Insights Forecasts to 2032

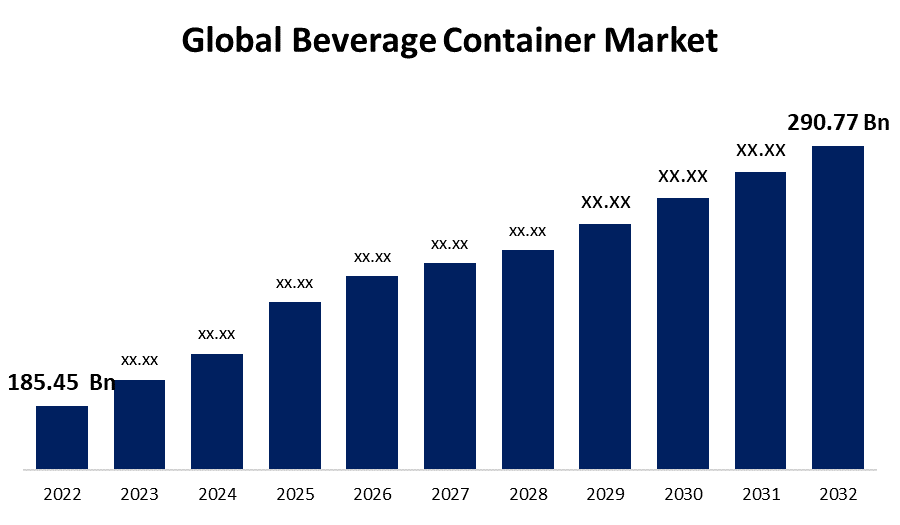

- The Beverage Container Market Size was valued at USD 185.45 Billion in 2022.

- The Market Size is growing at a CAGR of 4.6% from 2023 to 2032

- The worldwide beverage container market Size is expected to reach USD 290.77 Billion by 2032

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global Beverage Container Market Size is expected to reach USD 290.77 Billion by 2032, at a CAGR of 4.6% during the forecast period 2022 to 2032.

Market Overview

A beverage container is a specialized vessel designed for the storage and transportation of various liquid refreshments, including water, soft drinks, juices, alcoholic beverages, and more. These containers come in a wide range of materials, shapes, and sizes, each tailored to specific beverage types and consumption preferences. Common materials for beverage containers include glass, plastic, aluminum, and stainless steel, with each offering unique advantages such as durability, portability, and temperature retention. The design and functionality of these containers have evolved over the years, incorporating features like resealable caps, insulation, and eco-friendly materials to cater to changing consumer demands and environmental concerns. Beverage containers play a pivotal role in preserving the freshness and quality of beverages while ensuring convenience and accessibility for consumers across the globe.

Report Coverage

This research report categorizes the market for beverage container market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the beverage container market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the beverage container market.

Global Beverage Container Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 185.45 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.6% |

| 2032 Value Projection: | USD 290.77 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Material, By Container Type, By Application, By Region |

| Companies covered:: | Amcor Group GmbH, O-I Glass, Inc., Crown Holdings, Inc., Ardagh Group S.A., Verallia SA, Tetra Pak Group, Ball Corporation, Vidrala S.A., Toyo Seikan Group Holdings, Ltd., CPMC Holdings Limited, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The beverage container market is experiencing robust growth driven by a multitude of factors that cater to evolving consumer preferences, environmental concerns, and industry innovations, the global shift towards healthier lifestyles has increased the demand for convenient, on-the-go beverage options, boosting the market for single-serving containers such as PET (polyethylene terephthalate) bottles and aluminum cans. Additionally, the growing popularity of functional and energy drinks has led to an increased need for specialized packaging that can withstand unique storage requirements and maintain product freshness. Environmental awareness is another significant driver of change in the beverage container market. With a rising focus on sustainability, consumers are actively seeking eco-friendly packaging options. This has spurred the adoption of recyclable materials like aluminum and glass, which are infinitely recyclable and have a smaller environmental footprint compared to single-use plastics. Furthermore, initiatives promoting reduced plastic waste, such as bottle deposit systems and plastic bans in various regions, have influenced beverage companies to explore more sustainable packaging alternatives. Innovations in packaging technology and design are also driving the beverage container market. Manufacturers are constantly developing new materials and manufacturing processes to enhance the shelf life of beverages, improve packaging efficiency, and reduce production costs. For instance, the light-weighting of containers not only reduces materials used but also lowers transportation costs, making it an attractive option for businesses seeking cost-effective and sustainable solutions. E-commerce and the changing retail landscape have created a demand for packaging that is both durable and visually appealing. Beverage companies are investing in eye-catching, informative labels and packaging that can withstand the rigors of online shopping and home delivery. Additionally, the rise of premium and craft beverages has led to a surge in custom and artisanal packaging, targeting niche markets with unique and aesthetically pleasing container designs. The COVID-19 pandemic accelerated the shift towards online grocery shopping and home consumption of beverages, further increasing the need for convenient, safe, and sustainable packaging solutions. As consumer preferences and market dynamics continue to evolve, the beverage container market remains adaptable and responsive to these drivers, shaping the future of packaging in the beverage industry.

Restraining Factors

The global push to reduce single-use plastics has compelled the industry to seek sustainable alternatives, which often come with higher production costs. The fluctuations in raw material prices, particularly for aluminum and glass, can impact the overall cost structure of beverage containers. Regulatory hurdles, such as varying recycling systems and deposit schemes across regions, can pose challenges for manufacturers seeking consistency in packaging solutions. Additionally, the market must contend with consumer perceptions of taste and safety associated with certain materials, such as concerns about the potential leaching of chemicals from plastics into beverages. Finally, the economic impact of the COVID-19 pandemic disrupted supply chains and created uncertainties in the market.

Market Segmentation

- In 2022, the glass segment accounted for around 40.6% market share

On the basis of the material, the global beverage container market is segmented into plastic, metal, glass, and paperboard. The dominance of the glass segment in the beverage container market can be attributed to the glass containers are favored for their inert and non-reactive nature, preserving the taste and quality of beverages while ensuring product safety. They align with the increasing consumer preference for eco-friendly packaging due to their recyclability and minimal environmental impact. Furthermore, glass containers have a premium and aesthetic appeal, making them the choice for high-end beverages, wines, and spirits. Stringent regulations in various regions promoting sustainable packaging practices have further boosted the glass segment's market share, solidifying its dominance in the industry.

- The bottles & jars segment held the largest market with more than 42.4% revenue share in 2022

Based on the container type, the global beverage container market is segmented into bottles & jars, cartons, cans, bag-in-boxes, and pouches. The dominance of the bottles and jars segment in the beverage container market is primarily driven by its versatility and wide-ranging applications. Bottles and jars serve as the preferred packaging for various beverage categories, including water, carbonated drinks, juices, and alcoholic beverages. Their popularity is rooted in their ability to preserve freshness, prevent contamination, and ensure convenient consumption. Furthermore, these containers are available in various sizes, shapes, and materials, catering to diverse consumer preferences and product requirements. This adaptability and ubiquity make the bottles and jars segment the largest and most essential component of the beverage container market.

- The alcoholic beverages segment held the largest market with more than 43.5% revenue share in 2022

Based on the application, the global beverage container market is segmented into alcoholic beverages and non-alcoholic beverages. The alcoholic beverages segment's prominence in the beverage container market is primarily driven by the enduring popularity of alcoholic drinks such as beer, wine, and spirits. These beverages require specialized containers like glass bottles and aluminum cans to maintain their taste and quality. Alcoholic beverages often come in various packaging sizes and designs, catering to a broad consumer base. Additionally, premium and craft alcohol brands emphasize unique packaging aesthetics, contributing to this segment's market leadership. As consumers continue to enjoy alcoholic beverages, the demand for suitable and appealing containers ensures the alcoholic beverages segment's dominance in the beverage container market.

Regional Segment Analysis of the Beverage Container Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe dominated the market with more than 44.5% revenue share in 2022.

Get more details on this report -

Based on region, Europe boasts the largest market share in the global beverage container industry and has a well-established and sophisticated beverage market with a strong demand for a wide range of products, including soft drinks, beer, wine, and premium beverages. Additionally, European consumers are increasingly environmentally conscious, driving the adoption of sustainable packaging solutions like glass and aluminum. Stringent regulations and recycling initiatives further encourage eco-friendly packaging practices. Moreover, the presence of leading beverage companies and a robust distribution network enhances market growth. Europe's combination of market maturity, sustainability focus, and consumer preferences contributes to its dominant position in the global beverage container market.

Asia-Pacific region is projected for the highest growth in the beverage container market during the forecast period, the region's rapidly expanding population, urbanization, and rising disposable incomes are driving increased consumption of beverages, including soft drinks, bottled water, and alcoholic beverages. Additionally, manufacturers are increasingly establishing production facilities in the Asia-Pacific to cater to this burgeoning demand, further boosting the market. Furthermore, growing environmental awareness and regulatory efforts to reduce plastic waste in countries like China and India are propelling the adoption of sustainable packaging solutions, contributing to the region's remarkable growth prospects in the beverage container industry.

Recent Developments

- In June 2022, Scholle IPN, a flexible packaging company, has been acquired by SIG, a Swiss aseptic packaging provider. In February of this year, SIG and Scholle IPN agreed to merge for an enterprise value of USD 1.53 billion and an equity value of USD 1.2 billion. Scholle IPN, headquartered in Northlake, Illinois, provides environmentally friendly packaging technologies and solutions to the food, beverage, retail, institutional, and industrial industries.

- In March 2021, Ardagh Group S.A. and Bragg Live Food Products collaborated to launch a new 16oz glass bottle for their apple cider vinegar beverage brand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global beverage container market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Amcor Group GmbH

- O-I Glass, Inc.

- Crown Holdings, Inc.

- Ardagh Group S.A.

- Verallia SA

- Tetra Pak Group

- Ball Corporation

- Vidrala S.A.

- Toyo Seikan Group Holdings, Ltd.

- CPMC Holdings Limited

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global beverage container market based on the below-mentioned segments:

Beverage Container Market, By Material

- Plastic

- Metal

- Glass

- Paperboard

Beverage Container Market, By Container Type

- Bottles & Jars

- Cartons

- Cans

- Bag-In-Boxes

- Pouches

Beverage Container Market, By Application

- Alcoholic Beverages

- Non-Alcoholic Beverages

Beverage Container Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?