Global Behavioral and Mental Health Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Applications (Clinical, Administrative, and Financial), By End-user (Private Practices, Hospitals, and Community Clinics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Behavioral and Mental Health Software Market Insights Forecasts to 2035

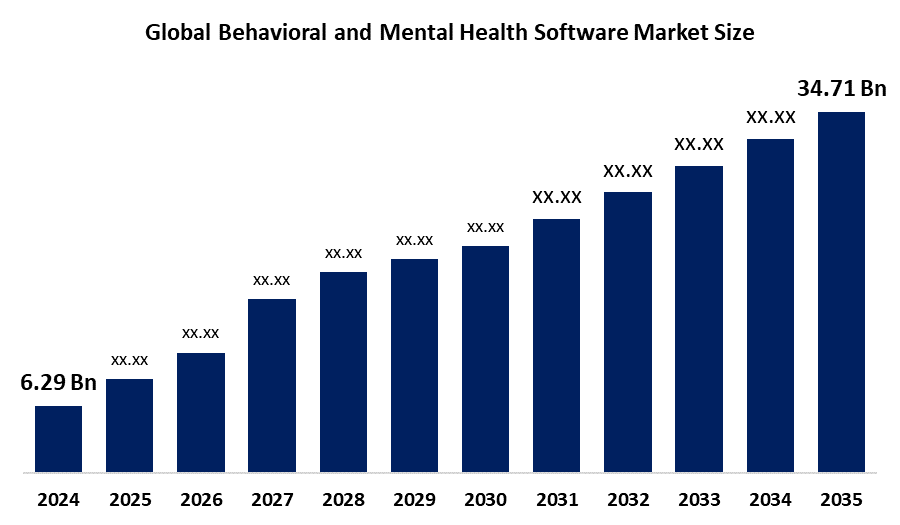

- The Global Behavioral and Mental Health Software Market Size Was Estimated at USD 6.29 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.8% from 2025 to 2035

- The Worldwide Behavioral and Mental Health Software Market Size is Expected to Reach USD 34.71 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global behavioral and mental health software market size was worth around USD 6.29 billion in 2024 and is predicted to grow to around USD 34.71 billion by 2035 with a compound annual growth rate (CAGR) of 16.8% from 2025 to 2035. The increasing prevalence of mental health disorders and growing awareness of them drive the demand for more accessible, tech-enabled treatment solutions, such as telehealth, EHRs, and mobile apps. This is why the behavioral and mental health software market is growing. Additionally, contributing to this are government initiatives and the need for efficiency in administration.

Market Overview

The Global Behavioral and Mental Health Software Market Size refers to digital platforms and solutions designed to manage, monitor, and improve mental health and behavioural disorders through electronic health records, telepsychiatry, clinical decision support, and therapy management tools. These systems are utilized in various settings, including hospitals, clinics, community centres, and private practices, to manage patient care and facilitate workflow while ensuring full regulatory compliance and allowing for treatment options to be data-driven. The growth of the market is driven mainly by an increase in the incidence of mental health disorders, including depression, anxiety, and substance abuse, along with growing awareness and decreased stigma associated with these disorders. The growing adoption of telehealth services and government initiatives aimed at integrating digital health solutions have further accelerated market growth.

AI, predictive analytics, and cloud-based platforms are revolutionising behavioural healthcare, offering better treatment plans tailored to the needs of each patient, monitoring patients in real time, and improving clinical outcomes. This opens up huge opportunities both for providers and investors in many countries, especially in emerging economies where the infrastructure for mental healthcare is still in its infancy. Major key players involved in innovation and competition include Cerner Corporation, Netsmart Technologies, Epic Systems Corporation, Qualifacts Systems, Welligent, Core Solutions, MindLinc, and AdvancedMD. These companies focus on product enhancement, strategic collaborations, and integration of advanced analytics as major strategies to strengthen their presence in the global market. WHO/Europe and the UK's Medicines and Healthcare products Regulatory Agency (MHRA) have jointly created a Knowledge Community, launched on September 30, 2025, which addresses the regulation of digital mental health technologies. This will be open to Member States, organizations, academia, the private sector, software engineers, and service users with the aim of encouraging collaboration and knowledge-sharing to advance global digital mental health regulation.

Report Coverage

This research report categorizes the behavioral and mental health software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the behavioral and mental health software market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the behavioral and mental health software market.

Global Behavioral and Mental Health Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.29 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 34.71 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By End User |

| Companies covered:: | AdvancedMD Inc. Teladoc Health Lyra Health Headspace Health Advanced Data Systems Talkspace Inc Epic Systems Valant Cerner Corporation Netsmart Meditab Software Inc. Qualifacts Nextgen Healthcare Core Solutions Allscripts Healthcare Solutions others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The driving factors for the global behavioral and mental health software market size include rising prevalence of mental health disorders, increasing awareness and destigmatization of mental illness, and growing demand for efficient patient management systems. Government initiatives promote the digitization of mental healthcare and the adoption of telehealth. Advances in technology, including AI, analytics, and cloud-based platforms, help manage treatment with more personalization and accessibility. Surging use of smartphones and digital health applications enables remote monitoring and therapy. Increasing healthcare expenditure, combined with a focus on integrated care models, further supports the wide-scale adoption of behavioral and mental health software solutions within healthcare settings.

Restraining Factors

Major growth restraining factors for the behavioral and mental health software market size include significant data privacy and security concerns. Other major barriers include high software, implementation, and maintenance costs, which affect smaller practices. Besides, partial or no interoperability with existing EHR systems, shortage of mental health IT professionals, and general stigma associated with mental illness--all these can be named among the causes that impede broader adoption.

Market Segmentation

The behavioral and mental health software market share is classified into component, applications, and end-user.

- The software segment dominated the market in 2024, approximately 84% and is projected to grow at a substantial CAGR during the forecast period.

Based on the component, the behavioral and mental health software market is divided into software and services. Among these, the software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is growing owing to the rising adoption of software in psychiatric clinics for the streamlining of patient care and administrative functions. Growth is driven by demand for electronic solutions managing both clinical and business processes. Tools such as EHR facilitate access to patient data while behavioral and mental health software handle operational functions related to billing, appointments, and bed availability, among others.

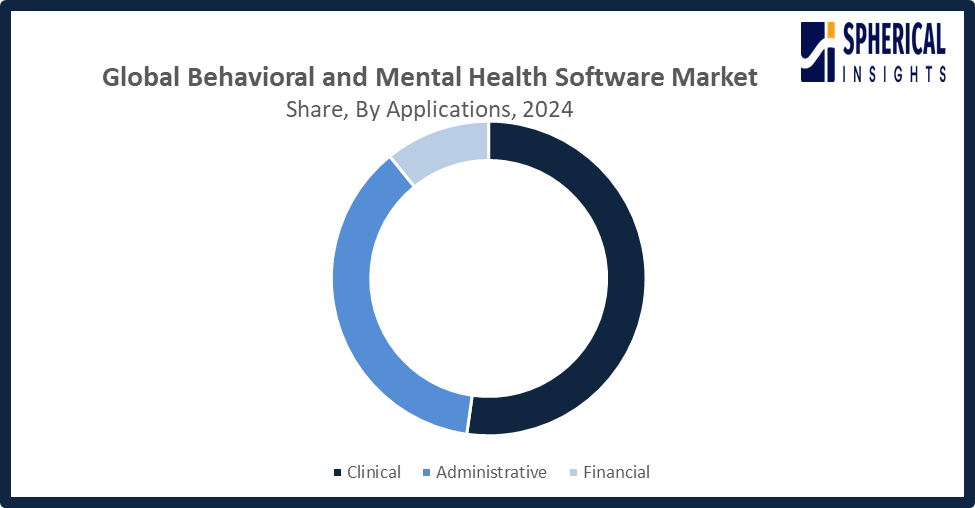

- The clinical segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the applications, the behavioral and mental health software market size is divided into clinical, administrative, and financial. Among these, the clinical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The rise in the utilization of behavioral and mental health software in clinics for administrative purposes is one of the main factors driving the market. These solutions facilitate documentation, billing, claims, coding, and appointment scheduling. The growing incidence of psychiatric disorders, coupled with an increasing patient pool, acts as a driver for growing demand, as the clinics require software for efficient management and smooth functioning in order to deliver effective service, thus accelerating growth in the behavioral and mental health software market.

Get more details on this report -

- The private practices segment accounted for the highest market revenue in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the behavioral and mental health software market is divided into private practices, hospitals, and community clinics. Among these, the private practices segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing burden of anxiety, depression, and PTSD contributes to segment growth due to the rise of private counsellors and professionals. Digital transformation of healthcare enables private practitioners to manage the increasing patient load with efficiency. Changes in lifestyle, sleeping, and eating habits, and work pressures have increased mental health disorders. Increased awareness among people motivates them to seek help from professionals and private practicing clinics.

Regional Segment Analysis of the Behavioral and Mental Health Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the behavioral and mental health software market over the predicted timeframe.

North America is anticipated to hold the largest share of the behavioral and mental health software market over the predicted timeframe. North America is expected to hold a 41% share in the behavioral and mental health software market during the forecast period, driven by the high prevalence of mental health disorders, growing awareness about mental health, and broad adoption of digital health solutions. This region is dominated by the United States, based on its highly developed healthcare infrastructure, supportive government initiatives related to telehealth and EHR integration, and venture capital investments in AI-enabled mental health platforms. Canada contributes due to the public digitization of healthcare and increased access to behavioral health services. Overall, these aspects are driving market growth in North America.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the behavioral and mental health software market during the forecast period. The Asia Pacific is rapidly growing in the behavioral and mental health software market during the forecast period, with an approximate 21% market share, driven by increasing awareness related to mental health, a rise in the prevalence rate of disorders, and increased digital healthcare infrastructure. Major countries contributing to market growth include China, India, and Japan. In these regions, China and India are seeing an increase in demand for tele-mental health services owing to large populations and limited access to traditional care, whereas Japan is adopting AI-enabled and cloud-based behavioral health software, thereby boosting overall market growth in the region.

In Europe, the behavioral and mental health software market witnesses growth supported by increasing governmental support for digital healthcare, raising awareness of mental health issues, and the adoption of advanced technologies, including AI and cloud-based platforms. Countries such as Germany continue to drive growth, especially with initiatives such as the Digital Healthcare Act, which allows the reimbursement of digital therapeutics. The UK and France also contribute with a robust digital health infrastructure and public-private collaborations that support efficient mental health service delivery and the adoption of software solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the behavioral and mental health software market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- AdvancedMD Inc.

- Teladoc Health

- Lyra Health

- Headspace Health

- Advanced Data Systems

- Talkspace Inc

- Epic Systems

- Valant

- Cerner Corporation

- Netsmart

- Meditab Software Inc.

- Qualifacts

- Nextgen Healthcare

- Core Solutions

- Allscripts Healthcare Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, AdvancedMD launched AdvancedMD Now, a cloud-based platform for small mental health practices with up to three providers. It integrates practice management, EHR, and engagement features, allowing management of patient demographics, clinical data, and billing, specifically tailored to meet the needs of small-scale mental health practices.

- In June 2025, Headspace launched Therapy by Headspace, a direct-to-consumer service providing affordable, evidence-based mental health care to over 90 million Americans nationwide. After a decade of offering therapy through employers and health plans, Headspace now makes its comprehensive mental health services accessible directly to consumers across all 50 states.

- In May 2025, Talkspace announced a collaboration with Amazon Pharmacy to simplify the pharmacy experience for members and streamline medication management and adherence support for providers, enhancing convenience and continuity of care for online behavioral health patients.

- In August 2024, Teladoc Health, in partnership with Brightline, launched a virtual mental healthcare service for children and adolescents. The platform connects users to specialized pediatric and adolescent providers, simplifies client management, and ensures a seamless transition into Teladoc’s broader care ecosystem as patients reach adulthood.

- In April 2024, Talkspace launched the Behavioral Health Consortium, a curated network including Charlie Health, Ria Health, and Bicycle Health. It allows clinicians to refer insured members to in-network, clinically vetted specialty providers for higher-acuity care, addressing conditions such as substance use, alcoholism, and eating disorders.

- In April 2024, Qualifacts, a leading behavioral health and human services EHR provider, announced the launch of Qualifacts iQ ahead of the National Council for Mental Wellbeing’s NatCon24 conference. The platform aims to enhance electronic health record capabilities and streamline service delivery for behavioral health organizations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the behavioral and mental health software market based on the below-mentioned segments:

Global Behavioral and Mental Health Software Market, By Component

- Software

- Services

Global Behavioral and Mental Health Software Market, By Applications

- Clinical

- Administrative

- Financial

Global Behavioral and Mental Health Software Market, By End-user

- Private Practices

- Hospitals

- Community Clinics

Global Behavioral and Mental Health Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?