Global Battery Binders Market Size, Share, and COVID-19 Impact Analysis, By Type (Anode Binder, Cathode Binder), By Battery Type (Lithium-ion Batteries, Ni-Cd Batteries), By Material (PVDF, CMC), By Application (Electric Vehicles, Consumer Electronics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Semiconductors & ElectronicsGlobal Battery Binders Market Insights Forecasts to 2032

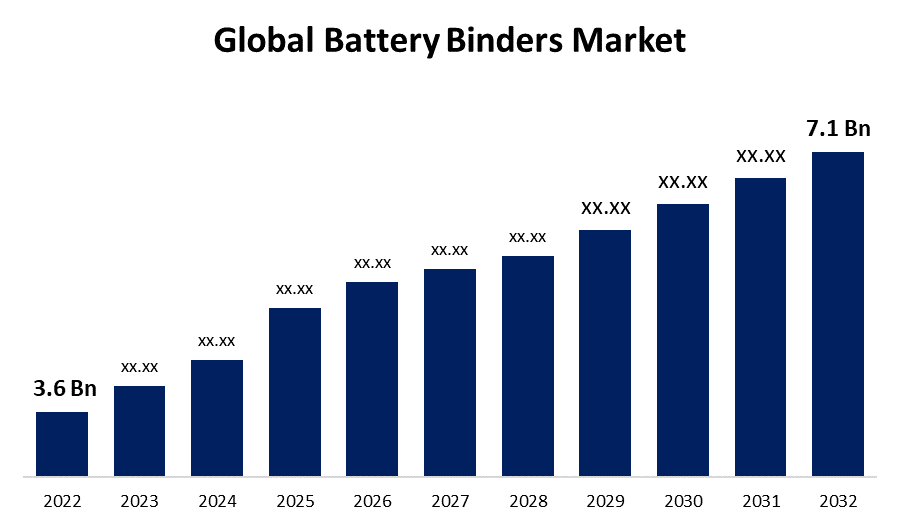

- The Global Battery Binders Market Size was valued at USD 3.6 Billion in 2022.

- The market is growing at a CAGR of 7.3% from 2022 to 2032

- The Worldwide Battery Binders Market is expected to reach USD 7.1 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Battery Binders Market Size is expected to reach USD 7.1 Billion by 2032, at a CAGR of 7.3% during the forecast period 2022 to 2032.

The increase in demand for multipurpose battery binders and the increasing usage of electric vehicles are driving the expansion of battery binders market. The stakeholders in the battery binders market can anticipate benefiting significantly from the technological developments in battery binders and the growing infrastructure for charging electric vehicles. The market's expansion could be somewhat constrained by the rising demand for solid-state lithium-ion batteries. The development of the battery binder industry is also anticipated to face difficulties because of the lack of infrastructure for electric vehicles.

Rising demand for multifunctional battery binders is another major element driving market revenue development. Due to their high energy densities, silicon-based materials have generated a lot of attention and anticipation. By binding the electrode's active components together and maintaining their adhesion to the current collector or separator membrane, battery binders play a critical function in lithium-ion batteries. In addition to adhesion, multifunctional binders offer a variety of other properties, including strong adhesion, ionic and electronic conductivity, self-healing, and others. However, the availability of binder-free electrodes is a critical aspect that may limit market expansion. There are several methods, including template-free and template-assisted processes, for producing binder-free electrodes. Binders frequently act as insulators and electrochemically inert substances, which reduce total energy density and impair cycle stability. With enhanced electronic conductivity and the ability to reverse electrochemical reactions, binder-free electrodes have a very high possibility of performing exceptionally well. Research is being done on binder-free electrodes because they can resolve concerns like weak interaction and interface problems between the binder and active material.

Global Battery Binders Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.3% |

| 2032 Value Projection: | USD 7.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Battery Type, By Material, By Region and COVID-19 Impact Analysis |

| Companies covered:: | The Lubrizol Corporation, Arkema, BASF SE, Daikin Industries, Ltd., Zeon Corporation, Targray, Industrial Summit Technology Corp., SYNTHOMER PLC, Trinseo S.A., UBE Corporation, Kureha Corporation, Sumitomo Chemical Co., Ltd, and Other Market Players. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Electric vehicles (EVs) are becoming more and more popular, and this is a major driver in the growing mechanical binding of battery binders. The market for electric automobiles is expanding rapidly, with over 10 million units sold in 2022, according to the International Energy Agency (IEA) (France). In 2022, about 14% of all new automobiles sold were electric, up from less than 5% in 2020 and roughly 9% in 2021. China led the way, with over 60% of global sales of electric vehicles. China now accounts for more than half of all-electric vehicles worldwide, and its 2025 goal for new energy vehicle sales has already been surpassed. In 2023, electric car sales in Europe, the second-largest market, climbed by over 15%, resulting in the sale of more than one in every five vehicles. In 2023, the third-largest market, the United States, saw a 55% growth in electric car sales. In order to mechanically stabilize and hold the active components of the electrodes together, battery binders also referred to as electrode binders, are employed in the production of rechargeable batteries. The manufacture of lithium-ion batteries, which are widely used in portable gadgets, electric vehicles (EVs), and energy storage systems, requires these batteries as key building blocks.

Restraining Factors

Rising demand for binder-free electrodes would hold back the development of lithium-ion battery binders. Binders are generally electrochemically inactive and insulating, which reduces the overall energy density and leads to poor cycling stability. Therefore, binder-free electrodes provide a great opportunity for high performance in terms of both improved electronic conductivity and electrochemical reaction reversibility. There is R&D on binder-free electrodes as it can solve problems such as weak interaction and interface problems between the binder and the active material. Thus, growth in demand for binder-free electrodes is expected to restrain the growth of lithium-ion battery binders.

Market Segmentation

By Type Insights

The anode binder segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global battery binders market is segmented into anode binder, cathode binder, and others. Among these, the anode binder segment dominates the market with the largest revenue share of 43.6% over the forecast period. due to the fact that anode electrodes are created by combining active material (Graphite), binder powder, solvent, and additives into a slurry and then pumping it into a coating machine. The coating machine paints both sides of the Artificial Intelligence (Al) foil for the cathode and the Cu foil for the anode with the combined slurry (paste). The coated foil is then calendared to improve the homogeneity of the electrode. In addition, a slicing operation is used to ensure optimum electrode size. For the next-generation lithium-ion batteries, silicon (Si) has been identified as the most promising anode material due to its high theoretical specific capacity, safety, and natural availability.

By Battery Type Insights

The lithium-ion batteries segment is witnessing significant CAGR growth over the forecast period.

On the basis of battery type, the global battery binders market is segmented into lithium-ion batteries and Ni-Cd batteries. Among these, the lithium-ion Batteries segment is witnessing significant CAGR growth over the forecast period. Electric vehicles, portable devices, and renewable energy storage systems all make extensive use of lithium-ion batteries. Lithium-ion batteries' safety and performance are influenced by the parts that keep the active ingredients, such as the cathode and anode, together as well.

By Material Insights

The polyvinylidene fluoride (PVDF) segment is expected to hold the largest share of the Global Battery Binders Market during the forecast period.

Based on the material, the global battery binders market is classified into polyvinylidene fluoride (PVDF), carboxymethyl cellulose (CMC), and others. Among these, the polyvinylidene fluoride segment is expected to hold the largest share of the battery Binders market during the forecast period. Polyvinylidene fluoride (PVDF) is a binder material used in batteries, most notably lithium-ion batteries (Li-ion). Known for its superior chemical resistance, mechanical strength, and thermal stability, PVDF is a high-performance polymer that fits the bill for demanding applications like battery binders.

By Application Insights

The electric vehicles segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the global battery binders market is segmented into electric vehicles and consumer electronics. Among these, the electric vehicles segment dominates the market with the largest revenue share of 57.2% over the forecast period. The electric vehicles (EVs), batteries play a crucial role as essential parts that are in charge of both storing and supplying electrical energy for the electric motor. Because they hold the electrode components, such as the cathode and anode, together for better battery performance, safety, and lifespan, battery binders are widely used in lithium-ion batteries. The increasing attention that scientists and battery makers are giving to investigating new binder materials will also contribute to the segment's growth.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. The expansion of this local market is driven by the existence of well-established battery binders all over the United States, an increase in the sales of electric vehicles, and rising investments in the installation of batteries in the renewable energy sector. Additionally, businesses are working harder to establish PVDF production facilities in the area for battery materials.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. A major factor in China's position as the world's top producer of lithium-ion batteries is the rise in demand for electric vehicles and renewable energy storage technologies. In China, polyvinylidene fluoride (PVDF), carboxymethyl cellulose (CMC), and styrene-butadiene rubber (SBR) are the three most often used battery binders. The Europe market is expected to register a substantial CAGR growth rate during the forecast period.

List of Key Market Players

- The Lubrizol Corporation

- Arkema

- BASF SE

- Daikin Industries, Ltd.

- Zeon Corporation

- Targray

- Industrial Summit Technology Corp.

- SYNTHOMER PLC

- Trinseo S.A.

- UBE Corporation

- Kureha Corporation

- Sumitomo Chemical Co., Ltd

Key Market Developments

- On May 2023, BASF invested in two new manufacturing facilities to produce Licity® and Basonal Power®, two high-performance anode binders for lithium-ion batteries.

- On March 2023, The Xydar liquid crystal polymers (LCP) portfolio of Solvay SA (Belgium) has added a new high-heat and flame-retardant grade that is intended to meet stringent safety requirements in EV battery components. The battery module plates of electric vehicle models that use higher voltage systems are specifically targeted by the new Xydar LCP G-330 HH material, which fulfills demanding thermal and insulation requirements.

- On May 2022, establish new manufacturing facilities in Thailand through its Thai subsidiary Zeon Chemicals Asia Co. Ltd., with the production of battery binders, a crucial component of Zeon's battery materials business, set to begin in 2024.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Battery Binders Market based on the below-mentioned segments:

Battery Binders Market, Type Analysis

- Anode Binder,

- Cathode Binder

Battery Binders Market, Battery Type Analysis

- Lithium-ion Batteries

- Ni-Cd Batteries

Battery Binders Market, Material Analysis

- PVDF

- CMC

Battery Binders Market, Application Analysis

- Electric Vehicles

- Consumer Electronics

Battery Binders Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?