Global Aviation Market Size, Share, and COVID-19 Impact Analysis, By Offering (Aircraft Type (Commercial Aircraft, Business Jets, General Aviation Aircraft, Military Aircraft, Helicopters, UAVs/Drones, and Cargo Aircraft/Freighters), Systems / Components (Airframes, Engines, Avionics Systems, Cabin Interiors, Landing Gear, Aircraft Lighting, Flight Control Systems, Electrical Systems, Fuel Systems, Propulsion Systems, and Navigation & Communication Systems), Services (Maintenance, Repair & Overhaul (MRO), Engineering & Technical Services, Leasing & Fleet Management, Training & Simulation, Ground Handling, Aircraft Modifications & Upgrades, and Aviation IT Services)), By Technology (Conventional Aircraft, Electric & Hybrid-Electric Aircraft, SAF-Compatible (Sustainable Aviation Fuel), Autonomous / Remote Piloted, and Hydrogen Aircraft (Emerging)), By Payload / Capacity (Narrow-body, Wide-body, Regional Jets, Light & Very Light Jets, Heavy Cargo Aircraft, Medium & Light Cargo Aircraft, and Single-Engine vs Twin-Engine), By Application (Passenger Transportation, Cargo Transportation, Surveillance & Reconnaissance, Search & Rescue, Training, Aerial Survey & Mapping, and Tourism & Charter), By End User (Commercial Airlines, Business Aviation Operators, Military & Defense Forces, General Aviation Pilots/Owners, Cargo & Logistics Operators, Aircraft Leasing Companies, MRO Providers, and Airports & Ground Service Providers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Aviation Market Insights Forecasts to 2035

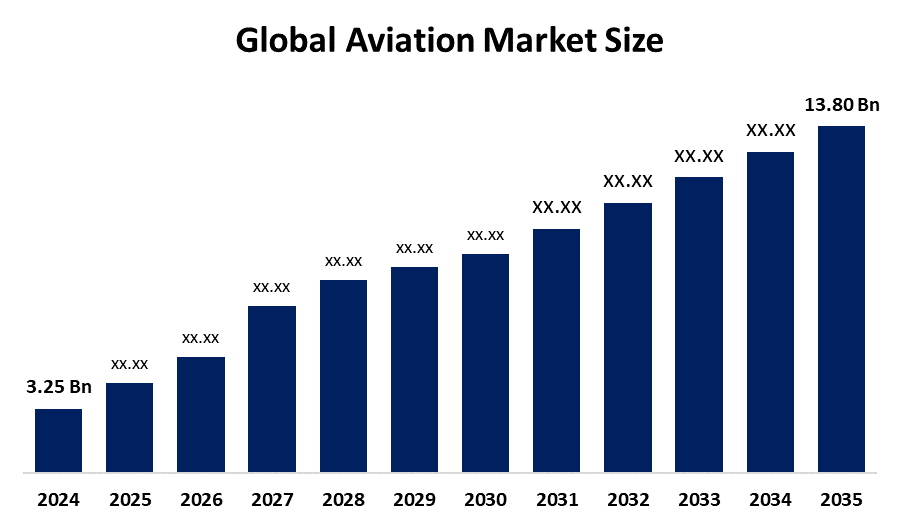

- The Global Aviation Market Size Was Estimated at USD 3.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.05% from 2025 to 2035

- The Worldwide Aviation Market Size is Expected to Reach USD 13.80 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global aviation market size was worth around USD 3.25 billion in 2024 and is predicted to grow to around USD 13.80 billion by 2035 with a compound annual growth rate (CAGR) of 14.05% from 2025 to 2035. Opportunities in the aviation market include growing demand for international travel, technological advancements like advanced aircraft and sustainable aviation fuels, growing demands for cargo transportation, the expansion of emerging economies, increased digitalization, and greater international connectivity, all of which promote economic growth and higher industry operational efficiency.

Market Overview

The design, manufacture, operation, maintenance, and auxiliary services that support the use of airplanes for passenger, freight, and business travel are all encompassed in the global ecosystem of mechanical air transportation, which is the aviation market. It incorporates fixed-wing, rotary-wing, and new urban air mobility platforms to enable seamless connection. It is governed by both national and international organizations, including the U.S. Federal Aviation Administration (FAA) and the International Civil Aviation Organization (ICAO). For Instance, in September 2025, the Ministry of Defence launched a major defence procurement by finalizing a contract with HAL for 97 Tejas Mark-1A aircraft, including 68 fighters and 29 twin-seaters. Deliveries, along with associated equipment, will be completed over six years starting in 2027-28. The aviation industry's growth trajectory and operating dynamics are driven by a wide range of economic, technological, regulatory, and demographic issues. One of the primary factors is the steadily rising demand for air travel worldwide, which is driven by rising disposable incomes, growing middle-class populations, and a growing desire among consumers for quick and effective transportation.

Report Coverage

This research report categorizes the aviation market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aviation market. Recent market developments and competitive strategies, such as expansion, Offering launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aviation market.

Global Aviation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.25 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 14.05% |

| 024 – 2035 Value Projection: | USD 13.80 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Technology |

| Companies covered:: | Airbus SE, The Boeing Company, Embraer S.A., Bombardier Inc., Textron Aviation, Gulfstream Aerospace, Dassault Aviation, COMAC, Mitsubishi Aircraft Corporation, Pilatus Aircraft, Bell Helicopter, General Electric Aerospace, Rolls-Royce Holdings, Honeywell Aerospace, Collins Aerospace, Pratt & Whitney, CFM International, Airbus Helicopters, Leonardo Helicopters, Robinson Helicopter Company, and Other Regional Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

International trade and globalization are also essential factors driving the aviation industry. Air travel continues to be the quickest way to carry freight over great distances, facilitating international supply chains, the growth of e-commerce, and time-sensitive logistics. Sustainable aviation fuels (SAFs), electric propulsion systems, and digital technologies, including improved air traffic management systems, predictive maintenance, and artificial intelligence, all contribute to the aviation market. Investments in aircraft fleets and cargo-handling infrastructure are fueled by the growing need for dependable air freight services as companies continue to expand internationally. The expansion of the aviation market is also significantly driven by laws and regulations.

Restraining Factors

The aviation industry is restricted by high operating costs, volatile fuel prices, strict regulations, infrastructure constraints, environmental issues, and unstable economic conditions. In the international aviation sector, supply chain interruptions and geopolitical conflicts may restrict fleet growth, operational effectiveness, and long-term strategic planning.

Market Segmentation

The aviation market share is classified into offering, technology, payload/capacity, application, and end user.

- The systems/components segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the offering, the aviation market is divided into aircraft type (commercial aircraft, business jets, general aviation aircraft, military aircraft, helicopters, uavs/drones, and cargo aircraft/freighters), systems/components (airframes, engines, avionics systems, cabin interiors, landing gear, aircraft lighting, flight control systems, electrical systems, fuel systems, propulsion systems, and navigation & communication systems), services (maintenance, repair & overhaul (mro), engineering & technical services, leasing & fleet management, training & simulation, ground handling, aircraft modifications & upgrades, and aviation it services). Among these, the systems/components segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The importance of these parts in guaranteeing aircraft performance, safety, and operational effectiveness in the commercial, military, and general aviation sectors is the reason for the systems/components category. Fleet modernization, technological improvements, and strict safety rules are driving up demand for key components, such as airframes, engines, avionics, flight control systems, propulsion systems, and navigation and communication systems.

- The conventional aircraft segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the aviation market is divided into conventional aircraft, electric & hybrid-electric aircraft, SAF-compatible (sustainable aviation fuel), autonomous/remote piloted, and hydrogen aircraft (emerging). Among these, the conventional aircraft segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The extensive usage of conventional jet and turboprop aircraft in commercial, freight, general aviation, and military activities is the main factor driving the conventional aircraft segment. The category is the favored option for airlines and defense operators due to its established manufacturing processes, compatibility with global infrastructure, and demonstrated operational reliability.

- The narrow-body segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the payload/capacity, the aviation market is divided into narrow-body, wide-body, regional jets, light & very light jets, heavy cargo aircraft, medium & light cargo aircraft, and single-engine vs twin-engine. Among these, the narrow-body segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Narrow-body aircraft are ideal for both developed and emerging markets due to the high demand for short- and medium-haul commercial flights as well as their affordability, operational efficiency, and lower fuel consumption. Due to fleet expansions, replacement cycles, and a growth in global air passenger volume, the narrow body category is anticipated to grow.

- The passenger transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the aviation market is divided into passenger transportation, cargo transportation, surveillance & reconnaissance, search & rescue, training, aerial survey & mapping, and tourism & charter. Among these, the passenger transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growing middle-class populations, increased disposable incomes, expanding air travel demand worldwide, and improved connectivity between domestic and international destinations are the main drivers of the passenger transportation market. Fleet growth, low-cost carrier operations, and the global renovation of commercial aviation infrastructure all contribute to the segment's success.

- The commercial airlines segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the aviation market is divided into commercial airlines, business aviation operators, military & defense forces, general aviation pilots/owners, cargo & logistics operators, aircraft leasing companies, MRO providers, and airports & ground service providers. Among these, the commercial airlines segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing demand for air travel, rising passenger traffic, and ongoing global airline fleet expansion are the main drivers of the commercial airlines market. Fleet modernization, the expansion of low-cost carriers, improved connectivity, and significant global expenditures in airport infrastructure and operational efficiency all contribute to the market.

Get more details on this report -

Regional Segment Analysis of the Aviation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the aviation market over the predicted timeframe.

North America is anticipated to hold the largest share of the aviation market over the predicted timeframe. The region's highly developed aviation infrastructure, which includes significant international airports, cutting-edge air traffic control systems, and a strong network of carriers, is largely responsible for North America's success. The market is still expanding because of high local and international passenger traffic as well as reliable cargo transportation systems. Additionally, the region's long-term leadership is supported by ongoing investments in technology advances like fuel-efficient aircraft, digitalized operations, and sustainable aviation solutions. The FAA launched its September 2025 eVTOL Integration Pilot Program under the U.S. Department of Transportation, advancing urban air mobility across 12 states in alignment with Executive Order 14307 on air traffic management.

Asia Pacific is expected to grow at a rapid CAGR in the aviation market during the forecast period. The demand for both domestic and international air travel is rising in the Asia-Pacific aviation market due to rapid urbanization, rising disposable incomes, and the growth of the middle class. Increased connectivity throughout the region is made possible by investments in airport infrastructure, such as building new airports and updating existing ones. The need for air freight services is also being driven by the expansion of e-commerce, international trade, and cargo transportation. In July 2025, ICAO launched the Asia-Pacific Air Navigation Plan modernization with 21 states, aiming to harmonize airspace management and achieve a 15% reduction in flight delays by 2030 via satellite-based navigation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aviation market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus SE

- The Boeing Company

- Embraer S.A.

- Bombardier Inc.

- Textron Aviation

- Gulfstream Aerospace

- Dassault Aviation

- COMAC

- Mitsubishi Aircraft Corporation

- Pilatus Aircraft

- Bell Helicopter

- General Electric Aerospace

- Rolls-Royce Holdings

- Honeywell Aerospace

- Collins Aerospace

- Pratt & Whitney

- CFM International

- Airbus Helicopters

- Leonardo Helicopters

- Robinson Helicopter Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, the Ministry of Defence (MoD) launched a contract with Hindustan Aeronautics Limited (HAL) for 97 Tejas Mark-1A light combat aircraft for the Indian Air Force, including 68 fighter jets, 29 twin-seaters, and associated equipment, with deliveries scheduled over six years beginning 2027-28.

- In February 2025, Embraer Executive Jets launched a major agreement with Flexjet, finalizing the purchase of 182 business jets, including Praetor 600, Praetor 500, and Phenom 300E models, along with an enhanced services package, with options for 30 additional aircraft, nearly doubling Flexjet’s fleet within five years.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aviation market based on the below-mentioned segments:

Global Aviation Market, By Offering

- Aircraft Type

- Commercial Aircraft

- Business Jets

- General Aviation Aircraft

- Military Aircraft

- Helicopters

- UAVs / Drones

- Cargo Aircraft / Freighters

- Systems / Components

- Airframes

- Engines

- Avionics Systems

- Cabin Interiors

- Landing Gear

- Aircraft Lighting

- Flight Control Systems

- Electrical Systems

- Fuel Systems

- Propulsion Systems

- Navigation & Communication Systems

- Services

- Maintenance, Repair & Overhaul (MRO)

- Engineering & Technical Services

- Leasing & Fleet Management

- Training & Simulation

- Ground Handling Services

- Aircraft Modifications & Upgrades

- Aviation IT Services

Global Aviation Market, By Technology

- Conventional Aircraft

- Electric & Hybrid-Electric Aircraft

- SAF-Compatible (Sustainable Aviation Fuel)

- Autonomous / Remote Piloted

- Hydrogen Aircraft (Emerging)

Global Aviation Market, By Payload / Capacity

- Narrow-body

- Wide-body

- Regional Jets

- Light & Very Light Jets

- Heavy Cargo Aircraft

- Medium & Light Cargo Aircraft

- Single-Engine vs Twin-Engine

Global Aviation Market, By Application

- Passenger Transportation

- Cargo Transportation

- Surveillance & Reconnaissance

- Search & Rescue

- Training

- Aerial Survey & Mapping

- Tourism & Charter

Global Aviation Market, By End User

- Commercial Airlines

- Business Aviation Operators

- Military & Defense Forces

- General Aviation Pilots/Owners

- Cargo & Logistics Operators

- Aircraft Leasing Companies

- MRO Providers

- Airports & Ground Service Providers

Global Aviation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?