Global Aviation Analytics Market Size, Share and Global Demand Statistics, by Function (Finance, Operation, Sales & Marketing, Others), by Application (Fuel Management, Flight Risk Management, Customer Analytics, Navigation Services, Others), by Product (Services, Solutions), by End User (Aftermarket, OEM), by Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Market Size & Forecasting To 2030

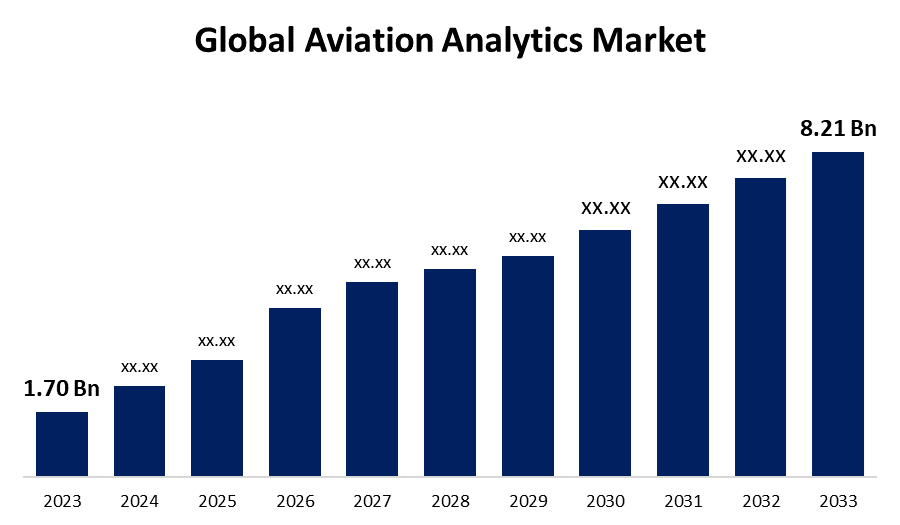

Industry: Aerospace & DefenseThe Global Aviation Analytics Market Size was valued at $1.70 billion in 2021 and is expected to reach at a CAGR of 11.40% from 2022 to 2030. The worldwide market to reach $8.21 Billion by 2030

Get more details on this report -

The market can streamline operations and increase market share with the aid of cutting-edge technologies. In the upcoming period, the Aviation Analytics Market Forecast market has exhibited growth of 11.20%. Insights of various kinds are anticipated to be common in 2028. The market is defined and expanded by the expansion of the aviation industry. Most businesses use aviation analytics because these solutions help them increase their operational effectiveness, profitability, and maintenance. Aviation analytics aids businesses in creating an analytical response to meet future demands, such as client needs, which will also aid businesses in maximizing their operating revenue.

Applications like fuel management, customer analytics, revenue management, and risk management are just a few of the uses for which aviation analytics systems are put to use in the aviation sector. Aviation analytics solutions assist businesses in measuring, monitoring, and analyzing their company objectives, risks, and potential future growth. All of these elements are helping the aviation analytics market to rapidly integrate and flourish.

Global Aviation Analytics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1.70 billion |

| Forecast Period: | 2022 - 2030 |

| Forecast Period CAGR 2022 - 2030 : | 11.40% |

| 2030 Value Projection: | USD 8.21 Billion |

| Historical Data for: | 2019 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | Function, Application, Product, End User, and Region |

| Companies covered:: | Airbus, Boeing, Collins Aerospace, General Electric, Honeywell International Inc., IBM, L3Harris Technologies, Inc., Lufthansa Technik, Oracle, SAP SE, Ramco Systems Limited, Accelya Group, OAG Aviation Worldwide Limited, IGT Solutions Pvt. Ltd. and Mu Sigma, Inc. |

| Growth Drivers: | In order to increase their companys profitability, the suppliers in the aviation analytics industry are currently concentrating on intelligence and analytics solutions. |

| Pitfalls & Challenges: | The lack of available analytical talent is the main obstacle that providers in the aviation analytics business must overcome. |

Get more details on this report -

Global Aviation Analytics Market Driving Factors

In order to increase their company’s profitability, the suppliers in the aviation analytics industry are currently concentrating on intelligence and analytics solutions. In turn, this is fueling the market for aviation analytics. Another factor boosting demand in the aviation analytics industry is the increased focus on managing jet fuel. Additionally, the demand for real-time analytics in the aviation sector is growing and has a favorable impact on the demand for aviation analytics. One of the main factors fueling the expansion of the aviation analytics market is also the aviation industry's growing centricity.

The value of the Aviation Analytics Market is driven by data management, cyber security risks, and the rising demand for process optimization and energy. The market has had a remarkable CAGR of 15.2% over the anticipated period. Real-time analytics and competitive intelligence are the main forces behind the development of the sector. A high use of analytics also drives up the Aviation Analytics Market Analysis by boosting profitability and revenue, lowering costs, and improving performance and maintenance. In 2019 Honeywell International, INC. released the cutting-edge Honeywell forge for the aviation sector. This cutting-edge analytical tool helps the airline run more efficiently and offer a better travelling experience.

Global Aviation Analytics Market Restraining Factors

The lack of available analytical talent is the main obstacle that providers in the aviation analytics business must overcome. Additionally, the aviation analytics business faces challenges with data collecting due to the fact that more than two lakh aircraft run on some days. Since there are more flights than data can be collected quickly, aviation analytics will find it challenging to use the data in the future. Currently, both large and small-to-medium-sized businesses employ different data types and store them in secure locations. The aviation sector makes use of formats including text, speech, videos, and photographs and then analyses and extrapolates from them to understand the aviation analytics market.

Global Aviation Analytics Market Covid 19 Impact

Aviation Analytics Market Trends have had an effect on the dynamics and decreased the manufacturing and sales rates during the COVID-19 period. The Covid-19 has had an effect on the entire sector, decreasing market competition and the worldwide supply chain. The corona outbreak caused a sharp decline in revenue, which has now started to rise in 2021. The COVID-19 altered the Aviation Analytics Market Trends' entire financial aspect and affected the supply chain.

In order to survive and outperform the competition, businesses started refining their operations and strategies this year. The Aviation Analytics Market Outlook sector is growing and acquiring new chances thanks to the strategic moves made by key market players and governmental regulatory authorities.

Segmentation

The global Aviation Analytics market is segmented into function, application, product, end user, and region.

Global Aviation Analytics Market, By Function

Based on function, the global aviation analytics market is segmented into Finance, Operation, Sales & Marketing, Others. The sales and marketing segment is dominating the market over the forecast period. The finance segment holds the second largest position over the forecast period. Airport finance analytics mainly deals with the costs, revenues, payables, profitability, assets, receivables, key financial ratios, and expenses. Due to all these factors, airports are making huge investment in this segment.

Global Aviation Analytics Market, By Application

On the basis of application, the global aviation analytics market is segmented into Fuel Management, Flight Risk Management, Customer Analytics, Navigation Services, Others. Among these the navigation services holds the highest CAGR over the forecast period. The navigation software offers cockpit optimization solutions, ground vehicle tracking, post flight tracking functions, and monitor flight movement that help the air traffic management and airport for better operational service. On the other hand, the fight risk management is estimated to witness a moderate growth over the forecast period owing to enhance safety and reduction in operational issues which increases the demand for flight risk management software. The fuel management type segment also holds significant share which help airlines efficiently track fuel consumption and control operating costs.

Global Aviation Analytics Market, By Product

On the basis of product, the global aviation analytics market is segmented into services and solutions. The services segment is anticipated to dominate the market owing to the increasing demand for supply chain planning as well as inventory management services from airlines and airports. Not only this but also the key market players provide various services to aircraft operators and airlines like maintenance consulting, light data management, and customer analytics.

Global Aviation Analytics Market, By End User

Based on end user, the global aviation analytics market is segmented into aftermarket and OEM. Among these, the OEM segment is anticipated to dominate the market owing to the rising demand for aviation software, increase in the number of air travellers, and rising number of airports which need data analytics.

Global Aviation Analytics Market, By Region

On the basis of region, the global aviation analytics market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Due to the widespread use of industrial aviation analytics by medium and large size businesses to enhance their operational efficiency, North America is anticipated to lead all other regions in the aviation analytics market during the forecast period. Additionally, the integration of the same is being accelerated by the significant presence of aircraft operators and important aviation analytics manufacturers.

Recent Developments in Global Aviation Analytics Market

- July 2021: Brazil's WDG Automation was acquired by IBM Corporation. By integrating WDG's cutting-edge AI capabilities in enterprise automation, this strategic initiative aims to boost IBM's services.

- June 2021: A deal was signed between Capgemini and Airbus to create and offer airlines data services using the Skywise platform.

List of Key Market Players

- Airbus (France) Boeing (U.S.)

- Collins Aerospace (U.S.)

- General Electric (U.S.)

- Honeywell International Inc. (U.S.)

- IBM (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Lufthansa Technik (Germany)

- Oracle (U.S.)

- SAP SE (Germany)

- Ramco Systems Limited,

- Accelya Group (Vista Equity Partners),

- OAG Aviation Worldwide Limited,

- IGT Solutions Pvt. Ltd. and

- Mu Sigma, Inc.

Segmentation

By Function

- Finance

- Operation

- Sales & Marketing

- Others.

By Application

- Fuel Management

- Flight Risk Management

- Customer Analytics

- Navigation Service

- Others

By Products

- Services

- Solutions

By End Use

- Aftermarket

- OEM

By Region:

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Function

- North America, by Application

- North America, by Product

- North America, by End User

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Function

- Europe, by Application

- Europe, by Product

- Europe, by End User

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Function

- Asia Pacific, by Application

- Asia Pacific, by Product

- Asia Pacific, by End User

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Function

- Middle East & Africa, by Application

- Middle East & Africa, by Product

- Middle East & Africa, by End User

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Function

- South America, by Application

- South America, by Product

- South America, by End User

Need help to buy this report?