Global Automotive Tire Market for OE & Replacement Size, Share, and COVID-19 Impact Analysis, By Rim (13-15, 16-18, 19-21,>21”), By Aspect Ratio (<60, 60-70, >70), By Season (Summer, Winter-Studded Non-Studded & All Season), By Vehicle Type (Passenger Vehicle, Commercial Vehicle, and Electric vehicle), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Automotive & TransportationGlobal Automotive Tire Market Insights Forecasts to 2032

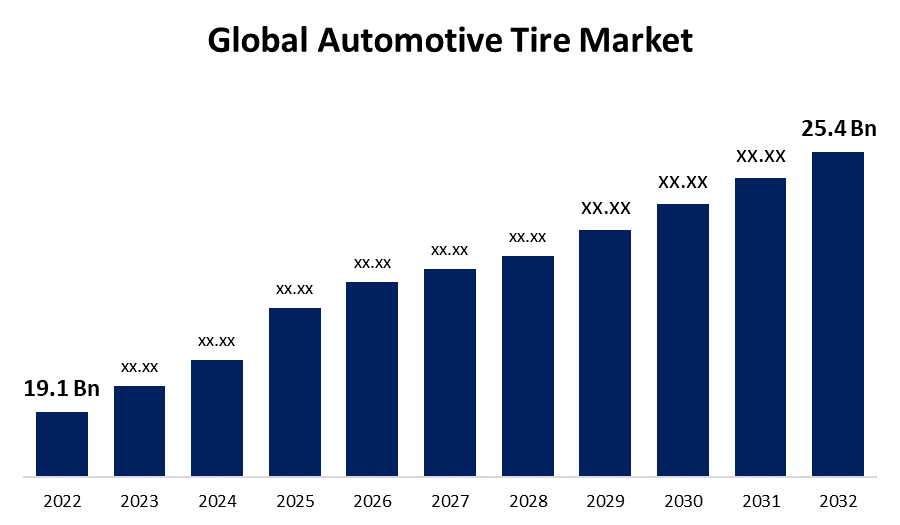

- The Global Automotive Tire Market Size was valued at USD 19.1 Billion in 2022.

- The Market Size is Growing at a CAGR of 2.8% from 2022 to 2032

- The Worldwide Automotive Tire Market Size is expected to reach USD 25.4 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Automotive Tire Market size is anticipated to exceed USD 25.4 Billion by 2032, Growing at a CAGR of 2.8% from 2022 to 2032. The primary factors driving the automotive tire market are the vehicle's increased life and the miles driven each year as a result of regular maintenance, customer awareness, and advancement in new tire technology, which has resulted in longer tire life.

Market Overview

The Automotive Tires Market is a vital segment of the global automotive industry that focuses on the production, distribution, and sale of tires for various types of vehicles, including passenger cars, trucks, buses, and motorcycles. Tires are essential components of vehicles, directly impacting safety, handling, and overall performance. This market encompasses various aspects, including the manufacturing of tires, tire design and innovation, distribution networks, and sales channels. It caters to both the original equipment (OE) sector, where tires are supplied to automakers for new vehicle assembly, and the replacement sector, where consumers and businesses purchase tires to replace worn-out or damaged ones on existing vehicles. In the OE segment, tire manufacturers collaborate with automakers to create tires that meet specific requirements, such as load-bearing capacity, speed rating, and compatibility with the vehicle's design and performance characteristics. The replacement tire market is driven by factors like tire wear, punctures, seasonal tire changes, and consumer preferences. Customers choose replacement tires based on criteria like tread life, durability, fuel efficiency, handling capabilities, and suitability for specific road and weather conditions. The Automotive Tires Market is influenced by various factors, including global automotive production trends, consumer demand, regulatory standards for tire safety and emissions, and advancements in tire technology, such as run-flat tires, eco-friendly compounds, and smart tire systems. It plays a critical role in ensuring road safety, vehicle performance, and driving comfort for millions of vehicles worldwide.

Report Coverage

This research report categorizes the market for the global automotive tire market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the automotive tire market.

Global Automotive Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 19.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.8% |

| 2032 Value Projection: | USD 25.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Rim, By Aspect Ratio, By Season, By Vehicle Type, By Region |

| Companies covered:: | Bridgestone Corp., Continental Automotive AG, Cooper Tire & Rubber Company, Goodyear Tire & Rubber Company, Hankook Tires Group, Michelin Tires, MRF (Madras Rubber Factory Limited), Pirelli & C SpA, Apollo Tires, Yokohama Rubber Co. Ltd, JK Tyre & Industries, And other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The production of new vehicles has a direct impact on tire demand in the original equipment (OE) segment. As global vehicle production continues to rise, particularly in emerging markets, so does demand for tires for new vehicles. The replacement tire market is significantly influenced by the need to replace worn-out or damaged tires. Tires have a limited lifespan, and as vehicles accrue mileage, the need for replacements becomes inevitable, providing a consistent demand driver. Stringent safety regulations and standards imposed by governments and regulatory bodies compel both vehicle manufacturers and consumers to invest in high-quality tires. These regulations drive the adoption of tires with advanced safety features, such as improved traction and braking capabilities. Consumer preferences for specific tire attributes, such as tread life, fuel efficiency, handling, and comfort, drive tire manufacturers to innovate and produce tires that meet these demands. Performance-oriented and eco-friendly tires are particularly in demand.

Restraining Factors

The cost of raw materials used in tire manufacturing, such as natural rubber and synthetic compounds, can be volatile due to factors like weather conditions, supply disruptions, and geopolitical tensions. Fluctuations in material costs can impact tire production and pricing. The tire industry is highly competitive, with numerous global and regional players. Competition often leads to price wars, making it challenging for manufacturers to maintain healthy profit margins.

Market Segmentation

The Global Automotive Tire Market share is classified into rim and vehicle type.

- The 16-18 segment is expected to hold the largest share of the global automotive tire market during the forecast period.

The global automotive tire market is categorized by rim into 13-15, 16-18, 19-21,>21. Among these, the 16-18 segment is expected to hold the largest share of the global automotive tire market during the forecast period. This is due to the fact that this size range encompasses a wide range of vehicles, including popular sedans, SUVs, and crossover models. They offer a balance between performance and comfort, appealing to a wide range of vehicle types and driving preferences. The versatility and widespread use of vehicles with 16–18-inch tires contributed to this segment's dominance.

- The Passenger Vehicle segment is expected to hold the largest share of the global automotive tire market during the forecast period.

Based on the vehicle type, the global automotive tire market is divided into Passenger Vehicle, Commercial Vehicle, and Electric vehicle. Among these, the Passenger Vehicle segment is expected to hold the largest share of the global automotive tire market during the forecast period. This is because passenger vehicles, including sedans, hatchbacks, SUVs, and sports cars, have traditionally dominated the global automotive market in terms of sales volume. Consequently, the demand for tires for passenger vehicles has consistently been the highest.

Regional Segment Analysis of the Global Automotive Tire Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America accounted for a significant share of the global automotive tire market in 2022.

Get more details on this report -

North America is projected to hold a significant share of the global automotive tire market over the predicted years. The United States is the largest automotive tire market in North America and one of the largest globally. It boasts a massive vehicle fleet, with millions of passenger cars, trucks, SUVs, and commercial vehicles on the road, contributing to a substantial demand for tires. The U.S. automotive market is diverse, encompassing a wide range of vehicle types and sizes. This diversity includes passenger cars, sports cars, luxury vehicles, pickup trucks, SUVs, and commercial trucks, each with unique tire needs.

Asia Pacific is expected to grow at the fastest pace in the global automotive tire market during the forecast period. China is a key player in the global automotive tire market. Its massive automotive industry, including the production of passenger vehicles, trucks, and buses, drives substantial tire demand. India's growing middle-class population and increasing vehicle ownership contribute to a significant automotive tire market. The demand for small passenger car tires is particularly high. Japan's automotive tire market is known for its premium and high-performance tires, catering to a domestic automotive industry that includes luxury vehicles and sports cars.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive tire along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bridgestone Corp.

- Continental Automotive AG

- Cooper Tire & Rubber Company

- Goodyear Tire & Rubber Company

- Hankook Tires Group

- Michelin Tires

- MRF (Madras Rubber Factory Limited)

- Pirelli & C SpA

- Apollo Tires

- Yokohama Rubber Co. Ltd

- JK Tyre & Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Bridgestone Corporation introduced the R192E, an electric bus tire designed specifically for electric buses. Because of their heavier battery packs and increased torque, electric buses have unique performance requirements. The R192E tire is designed to meet these requirements while also providing improved durability, traction, and energy efficiency for electric buses.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Automotive Tire Market based on the below-mentioned segments:

Global Automotive Tire Market, By Rim

- 13-15

- 16-18

- 19-21

- >21

Global Automotive Tire Market, By Aspect Ratio

- <60

- 60-70

- >70

Global Automotive Tire Market, By Season

- Summer

- Winter-Studded Non-Studded

- All Season

Global Automotive Tire Market, By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Electric vehicle

Global Automotive Tire Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?