Global Automotive Software and Electronics Market Size, Share, and COVID-19 Impact Analysis, By Components (Sensors, Electronic Control Unit, Current Carrying Devices, Integration, Verification and Validation Services, Power Electronics, Software, and Others), By Application (ADAS, Unexpected Services, Infotainment, Autonomous Driving, HMI, Safety Systems, Camera, LiDAR, RADAR, Body, Chassis, and Powertrain), By Sales Channel (Original Equipment Market, Aftermarket, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: Automotive & TransportationGlobal Automotive Software and Electronics Market Insights Forecasts to 2033.

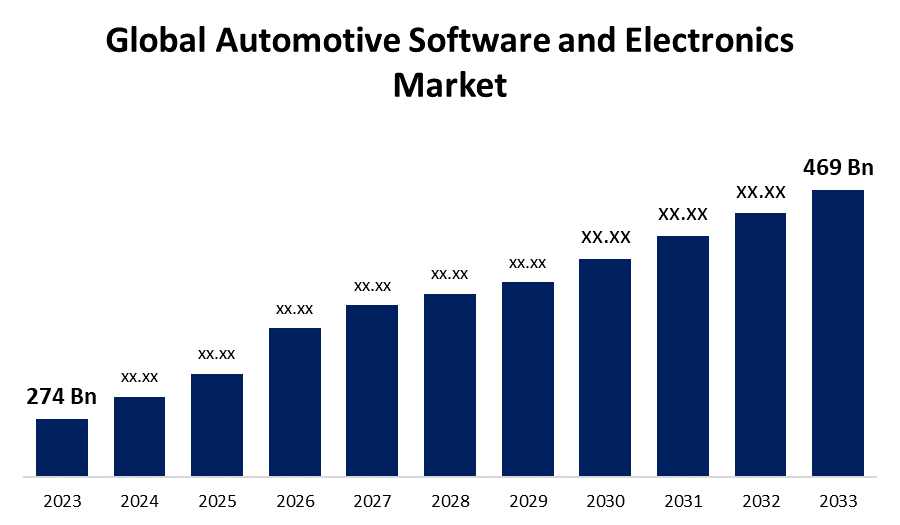

- The Global Automotive Software and Electronics Market Size was Valued at USD 274 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.5% From 2023 to 2033.

- The Worldwide Automotive Software and Electronics Market Size is Expected to Reach USD 469 Billion by 2033.

- North America is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global Automotive Software and Electronics Market Size is Anticipated to Exceed USD 469 Billion by 2033, Growing at a CAGR of 5.5% from 2023 to 2033.

Market Overview

The automobile industry is experiencing a substantial transition as a result of the integration of electronics and software in automotive engineering, which has improved vehicle performance, reduced emissions, and increased fuel efficiency. They are in charge of managing the engine, gearbox, braking, steering, safety, navigation, entertainment, and networking, among other aspects of the vehicle. The complexity of vehicle systems, shifting customer preferences, and shifting government requirements have all contributed to a major increase in the demand and supply of automotive software and electronics in the automobile sector in recent years. The growing inclinations of consumers to have cutting-edge amenities and connection options in their cars are being addressed by automakers. These automakers are adding a variety of state-of-the-art electronic parts and software systems to their cars to satisfy this demand. The goal of this connection is to guarantee that customers enjoy a more advanced driving experience. Information-based technologies are projected to be crucial to the automotive industry's future. The automotive industry is rapidly embracing cutting-edge technologies and incorporating these innovations into its operations on a larger scale. Electronic devices that are installed in automobiles to provide safety, such as airbags, are used to improve performance. The automotive industry's expanding tendencies toward electrification, automation, and connection have increased demand for high-performance electronics and software. The number of software and electronics suppliers offering specialized products and services to the automobile sector has grown exponentially on the supply side.

Report Coverage

This research report categorizes the market for the global automotive software and electronics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive software and electronics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive software and electronics market.

Global Automotive Software and Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 274 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.5% |

| 2033 Value Projection: | USD 469 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Components, By Application, By Sales Channel, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Blackberry, Wind River, Microsoft, Continental AG, DENSO Corporation, MontaVista Software, Mentor Graphics, Infineon Technologies AG, Robert Bosch GmbH, Valeo Inc., Visteon Corporation, Xilinx, Inc., ZF Friedrichshafen AG, ATEGO SYSTEMS INC., Autonet, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of autonomous vehicles will cause a significant change in routine transportation tasks. Since autonomous vehicles are so effective at lowering the number of accidents caused due to driver exhaustion or incompetence, using them for transportation will offer a comparatively safer option. One of the main factors driving the global automotive electronics and software market is safety. Advancements in safety systems technology have resulted in the development of driver assistance systems that guarantee seamless car operations, lowering the number of collisions, injuries, and even fatalities. Automotive electronics and software advancements have led to the creation of more sophisticated airbags, braking systems, and blind-spot detection, among other features.

Restraining Factors

The high cost of the infrastructure required for 5G and wireless connectivity is impeding the growth of the global automotive electronics and software market. One of the main concerns will remain to be the large expenditure required to develop the necessary cloud, data analytics, and Internet of Things (IoT) software interaction platforms. With the complicated safety and regulatory requirements in the automotive sector, building software and electronics for vehicles might be costly. Due to these factors, the global automotive software and electronics market will suffer significantly.

Market Segmentation

The Global Automotive Software and Electronics Market share is classified into components, application, and sales channel.

- The electronic control unit segment is expected to hold the largest share of the global automotive software and electronics market during the forecast period.

Based on the components, the global automotive software and electronics market is divided into sensors, electronic control units, current carrying devices, integration, verification and validation services, power electronics, software, and others. Among these, the electronic control unit segment is expected to hold the largest share of the global automotive software and electronics market during the forecast period. This is because vehicles are becoming more and more electrified, which is driving up demand for the electronic control unit segment in the global automotive and electronics market that can regulate and control the vehicle's electric power. This also contains battery management technologies that can extend the life and perform better than batteries used in electric vehicles.

- The ADAS segment is expected to grow at the fastest pace in the global automotive software and electronics market during the forecast period.

Based on the application, the global automotive software and electronics market is divided into ADAS, unexpected services, infotainment, autonomous driving, HMI, safety systems, camera, lidar, radar, body, chassis, and powertrain. Among these, the ADAS segment is expected to grow at the fastest pace in the global automotive software and electronics market during the forecast period. This is due to ADAS increases road and vehicle safety through human-machine interface. ADAS segment includes technologies that assist drivers with the safe operation of a vehicle. These factors are propelling the ADAS segment in the global automotive software and electronics market over the forecast period.

- The original equipment market segment is expected to grow at the greatest pace in the global automotive software and electronics market during the forecast period.

Based on the sales channel, the global automotive software and electronics market is divided into the original equipment market, aftermarket, and others. Among these, the original equipment market segment is expected to grow at the greatest pace in the global automotive software and electronics market during the forecast period. This is a result of the genuine and long-lasting electronic components offered by the original equipment market. The original equipment market is a reliable source for customers to obtain an original component for their vehicle, original equipment market segment is expanding rapidly in the global automotive software and electronics market.

Regional Segment Analysis of the Global Automotive Software and Electronics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global automotive software and electronics market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global automotive software and electronics market over the predicted timeframe. This is due to the growing need for connected services, particularly in China, South Korea, and Japan, the global automotive software and electronics market in the Asia Pacific is being driven. Asia Pacific holds the greatest market share because it produces the majority of vehicles. Asia-Pacific countries are focusing on manufacturing automobiles and car parts. For example, the Chinese government is developing "Made in China 2025," a program that helps native automakers compete with foreign automakers. Modern technologies will be able to be integrated as a result, including telematics, linked services, autonomous driving, infotainment, powertrain management, V2X, ADAS, and vehicle diagnostics.

North America is expected to grow at the fastest pace in the global automotive software and electronics market during the forecast period. This is because there are a lot of automakers and big tech companies. Additional factors driving market expansion include growing vehicle production, a rise in connected vehicles, rapidly changing in-car electronics design, advancements in C-V2X technology, and the growth of leading original equipment manufacturers. Furthermore, the North American region provides a regulatory framework that is favorable to autonomous vehicles, allowing companies to test them. To create optimal procedures and a legislative framework for self-driving cars, Canadian regulators, on the other hand, are actively monitoring autonomous advancements in American markets. The global automotive software and electronics market is expanding in the North America region as a result of several factors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive software and electronics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blackberry

- Wind River

- Microsoft

- Continental AG

- DENSO Corporation

- MontaVista Software

- Mentor Graphics

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

- ATEGO SYSTEMS INC.

- Autonet

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Robert Bosch Gmbh debuted the Vehicle Dynamics Control 2.0 at IAA Mobility 2023. This program will decrease stopping distance and countersteering while enhancing car handling and safety by interfering with the electric engine, electric steering system, and braking system.

- In May 2023, BlackBerry Limited enabled IoT system developers and automakers to create more potent solutions at lower prices while maintaining the unparalleled standards of safety, security, and dependability of QNX technology with the release of QNX Software Development Platform (SDP)8.0.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Automotive Software and Electronics Market based on the below-mentioned segments:

Global Automotive Software and Electronics Market, By Components

- Sensors

- Electronic Control Unit

- Current Carrying Devices

- Integration

- Verification and Validation Services

- Power Electronics

- Software

- Others

Global Automotive Software and Electronics Market, By Application

- ADAS

- Unexpected Services

- Infotainment

- Autonomous Driving

- HMI

- Safety Systems

- Camera

- LiDAR

- RADAR

- Body

- Chassis

- Powertrain

Global Automotive Software and Electronics Market, By Sales Channel

- Original Equipment Market

- Aftermarket

- Others

Global Automotive Software and Electronics Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?