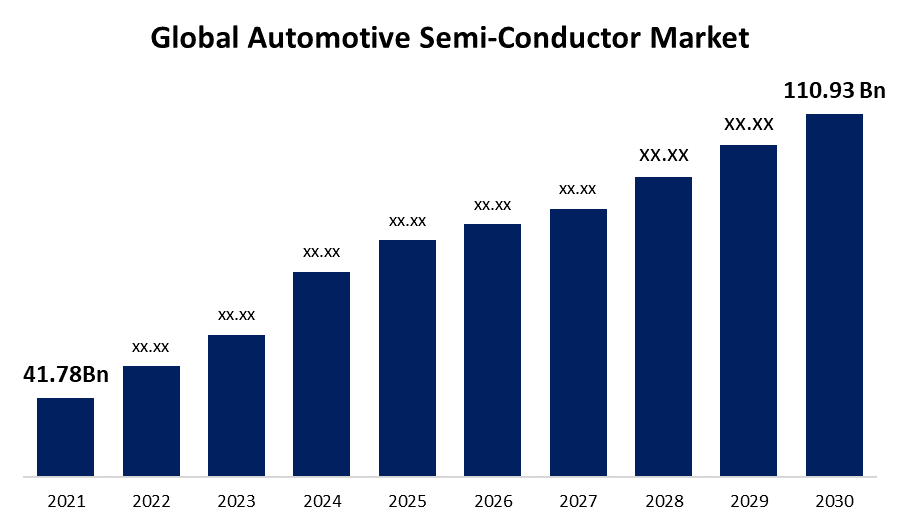

Global Automotive Semi-Conductor Market Size, Share By Component (Processor, Sensor, Memory), By Vehicle Type (Passenger Vehicle, LCV, HCV), By Application (Chassis, Powertrain, Safety, Telematics & Infotainment, Body Electronics), By Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) Analysis and Forecast 2021 - 2030.

Industry: Semiconductors & ElectronicsThe Global Semi-Conductor Market size was valued at USD 41.78 billion in 2021 and is expected to USD 110.93 billion 2030, reach at a CAGR of 6.2% from 2021.

Get more details on this report -

Over the course of the forecast period, rising demand for electronic content per automobile is anticipated to support market expansion. In addition, it is anticipated that over the coming few years, the use of electronic components in both luxury and mass-produced vehicles would increase, resulting in consistent market growth. The development of connected cars, infotainment systems, automotive safety systems, and fuel efficiency rules are some other factors influencing the market's growth.

Driving Factors

Vehicle collisions claim the lives of around 1.3 million people annually. Additionally, there are more young people who pass away from injuries they incurred in auto accidents. The demand for various safety features has clearly increased as a result of the increase in traffic collisions that have happened around the globe. These features include airbags, traction control, electronic stability control, lane departure warnings, parking assistance, collision avoidance systems, tyre pressure monitors, and telematics.

Restraining Factors

The main constraint limiting the market for automotive semiconductors is the operational failures of automotive semiconductors in extreme climatic conditions, such as extremely cold and excessive heat. Due to semiconductors' propensity to melt or shatter, which increases resistance and makes the signal too weak, failures can happen when there is intense heat. Failures have this as their primary cause. On the other hand, when the system is heated to the ideal level, the resistance decreases and the system stabilises. Additionally, too much cold damages semiconductors because it prevents them from operating properly.

Global Automotive Semi-Conductor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 41.78 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 6.2% |

| 2030 Value Projection: | USD 110.93 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Component, By Vehicle Type, By Application, By Region |

| Companies covered:: | Infineon Technologies AG, Robert Bosh GmbH, NXP Semiconductors, STMicroelectronics, ROHM Co. Ltd., Toshiba Corporation, Texas Instruments Incorporated, Denso Corporation, On Semiconductor Corporation |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

COVID 19 Impact

The COVID-19 pandemic outbreak and the subsequent actions adopted to reduce the infection rate caused major commercial volatility, which had a detrimental effect on sectors around the world. The pandemic has caused significant setbacks across many businesses, including the semiconductor market for automobiles. Sales of semiconductors for automotive applications are primarily influenced by the number of vehicles sold as well as the degree of electrification and digitization of those vehicles. The COVID-19 pandemic outbreak has caused a dramatic decrease in car sales. The expansion of the automotive semiconductor market was adversely affected by the declining sales of both passenger and commercial cars. Additionally, due to impending delays in international export and import shipments, the electric car industry also experienced delays in production and the supply of raw materials.

Segmentation

The global automotive semiconductor market is segmented into component, vehicle type, application, and region.

Global Automotive Semi-Conductor Market, By Component

On the basis of component, the global automotive semi conductor market is segmented into processor, sensor, discrete power, and memory. Among these, the other component sector, which in 2020 accounted for the largest revenue share of about 30%, is anticipated to grow at a CAGR of more than 3.0% over the forecast period. This segment includes analogue ICs and logic ICs. All component types are in high demand for semiconductors in the automobile sector. These elements improve connection, shared mobility services, and vehicle electrification. In the event of an accident or crash, the integrated automotive chip provides the driver with a warning and aids in helping them respond appropriately. Systems for navigation and infotainment frequently use logic integrated circuits.

Global Automotive Semi-Conductor Market, By Vehicle Type

Based on the vehicle type, the global automotive semi conductor market is segmented into passenger vehicle, LCV and HCV. Over 65% of the market in 2020 was accounted for by the passenger vehicle segment, which is predicted to hold the dominance over the forecast period. The significant increase in demand for passenger cars around the world is responsible for this surge. The category is also growing as more automotive infotainment systems are being installed in passenger cars to connect hands-free phones, provide navigation services, climate control, voice control, parking assistance, two-way communication tools, and internet access.

Global Automotive Semi-Conductor Market, By Application

On the basis of application insights, the global automotive semi conductor market is segmented into Chassis, Powertrain, Safety, Telematics & Infotainment, Body Electronics. Among these, body electronics segment holds the largest market share and going to hold the dominance over the forecast period. Telematics and infotainment, the powertrain, and safety are the applications using semiconductors in vehicles that are expanding at the highest rates. By the end of the forecast period, it is expected that the telematics & infotainment segment will have the most share and have had the greatest CAGR of more than 9.0%.

Global Automotive Semi-Conductor Market, By Region

Based on the region, the global automotive semi-conductor market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Among these, Asia Pacific region is dominating the market. In 2020, the region held a market share of nearly 40%. Due to the expansion of the automotive sector, particularly in developing nations like India, China, and Japan, the area is predicted to have the fastest growth rate during the projected period. China was the market leader in Asia Pacific in 2020, and it is anticipated that it would hold that position throughout the projected period. Additionally, it is projected that in the upcoming years, the region's expanding e-commerce sector would drive up demand for commercial cars.

Get more details on this report -

Over the forecast period, Europe is expected to have the second-highest CAGR of more than 5.3%. The market expansion in Europe is projected to be fueled by the rising demand for electric vehicles. Automakers continually concentrate on creating, developing, and innovating autonomous vehicles because they have attracted a substantial portion of buyers in key automobile producing nations. In the upcoming years, semiconductors are expected to play a crucial role in the developments in the automobile sector due to consumer desire for smart and completely autonomous cars.

Recent Developments In The Global Automotive Semi Conductor Market

- January 2022: Infineon Technologies has made an announcement to launch a new AURIX TC4x family of 28 nm for ADAS, e-Mobility, automotive E/E architectures and affordable AI apps.

- February 2022: STMicroelectronics has introduced a new automotive microcontrollers (MCUs) that is designed for electric vehicles and centralized electronic architectures. Its Stellar E MCUs are specifically designed for next generation software defined EVs and incorporate high speed control loop processing on chip.

- June 2022: ROHM has launched a new regulator (LDO) for primary power supplies in various apps which include ADAS, powertrain, car infotainment, and body which has a stable operation.

- February 2022: Robert Bosch is planning to invest in semi conductor production facility in Reutlingen by taking into consideration the current chip storage as well as increasing demand used in IoT and mobility apps.

List of Key Market Players

- Infineon Technologies AG

- Robert Bosh GmbH

- NXP Semiconductors

- STMicroelectronics

- ROHM Co. Ltd.

- Toshiba Corporation

- Texas Instruments Incorporated

- Denso Corporation

- On Semiconductor Corporation

Segmentation

By Component

- Processor

- Sensor

- Memory

By Vehicle Type

- Passenger Vehicle

- LCV

- HCV

By Application

- Chassis

- Powertrain

- Safety

- Telematics & Infotainment

- Body Electronics

By Region:

North America

- North America, by Country

- U.S.

- Canada

- North America, by Component

- North America, by Vehicle Type

- North America, by Application

Europe

- Europe, by Country

- Germany

- U.K.

- France

- Rest of Europe

- Europe, by Component

- Europe, by Vehicle Type

- Europe, by Application

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Asia Pacific, by Component

- Asia Pacific, by Vehicle Type

- Asia Pacific, by Application

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Component

- Middle East & Africa, by Vehicle Type

- Middle East & Africa, by Application

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Component

- South America, by Vehicle Type

- South America, by Application

Need help to buy this report?