Global Automotive Network Testing Market Size, Share, and COVID-19 Impact Analysis, By Network Type (CAN Bus Test, Ethernet Test, and Others), By Application (Passenger Cars, and Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Automotive & TransportationGlobal Automotive Network Testing Market Insights Forecasts to 2035

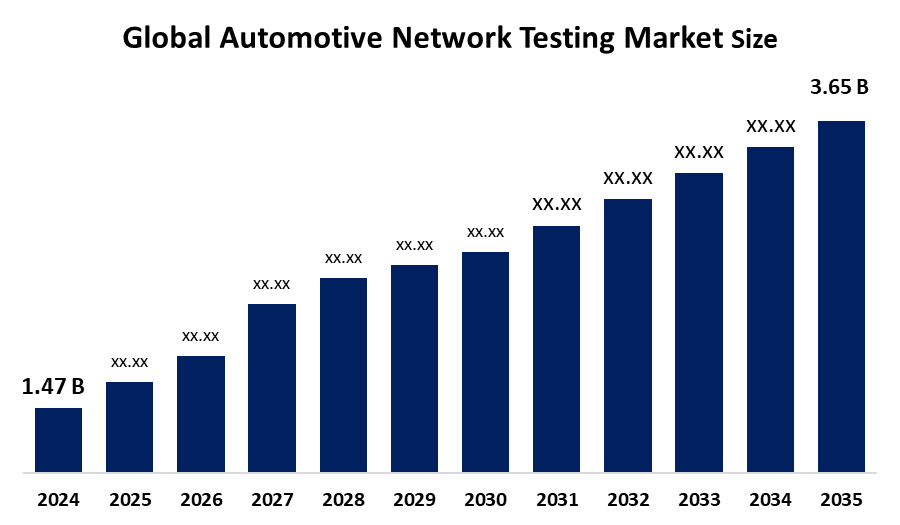

- The Global Automotive Network Testing Market Size Was Estimated at USD 1.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.62% from 2025 to 2035

- The Worldwide Automotive Network Testing Market Size is Expected to Reach USD 3.65 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global automotive network testing market size was worth around USD 1.47 billion in 2024 and is predicted to grow to around USD 3.65 billion by 2035 with a compound annual growth rate (CAGR) of 8.62% from 2025 to 2035. Opportunities in advanced vehicle communication validation, autonomous system dependability, cybersecurity evaluation, IoT integration, standard compliance testing, and creative diagnostic solutions for next-generation connected vehicles are all available in the automotive network testing market.

Market Overview

The industry devoted to assessing, verifying, and guaranteeing the dependability, efficiency, and security of communication networks inside contemporary automobiles is known as the automotive network testing market. One of the main reasons for the drastic rise in demand for elaborate testing solutions is the advanced electronic systems found in modern automobiles, which include Controller Area Networks (CAN), FlexRay, LIN, Ethernet, and wireless communication protocols. These solutions also comprise cybersecurity instruments that adhere to ISO/SAE 21434 and functional safety regulations such as ISO 26262, in addition to protocol analyzers for CAN, FlexRay, and Ethernet. AVL India's cell testing lab for EV battery validation in February 2025, and Horiba Group's MEXAcube emissions analyzer for Euro 7 compliance in March 2025. A fundamental transition from scattered control units to centralized computing platforms and zonal architectures necessitates thorough validation of complicated communication topologies and high-speed networks. Programs for driverless vehicles and advanced driver assistance systems require extremely dependable low-latency networks with stringent testing to guarantee safety-critical communication performance.

Report Coverage

This research report categorizes the automotive network testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive network testing market. Recent market developments and competitive strategies, such as expansion, network type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the automotive network testing market.

Global Automotive Network Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.47 Billion |

| Forecast Period: | 2025 – 2035 |

| Forecast Period CAGR 2025 – 2035 : | CAGR of 8.35% |

| 025 – 2035 Value Projection: | USD 3.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Formulation,By Method |

| Companies covered:: | AESwave, Allion Labs, Anritsu, Avnet, Elektrobit, Excelforce, FEV Group, Keysight, Kyowa Electronic, Molex, NextGig Systems, Primatec, Rohde & Schwarz, Spirent Communications, and Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The quick development of automotive technology and the growing intricacy of in-car communication systems are the main drivers of the automotive network testing market. New testing requirements for high-voltage network isolation, battery management communication, and charging protocol validation across several standards are being created by the rapid use of electric vehicles. Solution providers are creating integrated platforms that combine hardware test equipment, protocol analysis software, and automated test frameworks to speed up validation cycles while guaranteeing thorough coverage of network functionality, performance boundaries, and security vulnerabilities throughout the vehicle lifecycle. The market is defined by the convergence of automotive engineering, telecommunications testing expertise, and cybersecurity assessment capabilities.

Restraining Factors

The market for automotive network testing is restricted by high implementation costs, difficult integration of various communication protocols, a shortage of qualified personnel, and changing technological standards that make widespread adoption difficult and complicate operations and maintenance for automakers and suppliers.

Market Segmentation

The automotive network testing market share is classified into network type and application.

- The ethernet test segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the network type, the automotive network testing market is divided into CAN bus test, Ethernet test, and others. Among these, the ethernet test segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The foundation of next-generation car architectures is Ethernet. Bandwidth needs for high-resolution cameras, lidar sensors, and centralized computer platforms handling enormous amounts of data are driving rapid adoption. Growing complexity with various Ethernet variations, including 100BASE-T1, 1000BASE-T1, and emerging multi-gigabit standards, requires specialist test equipment.

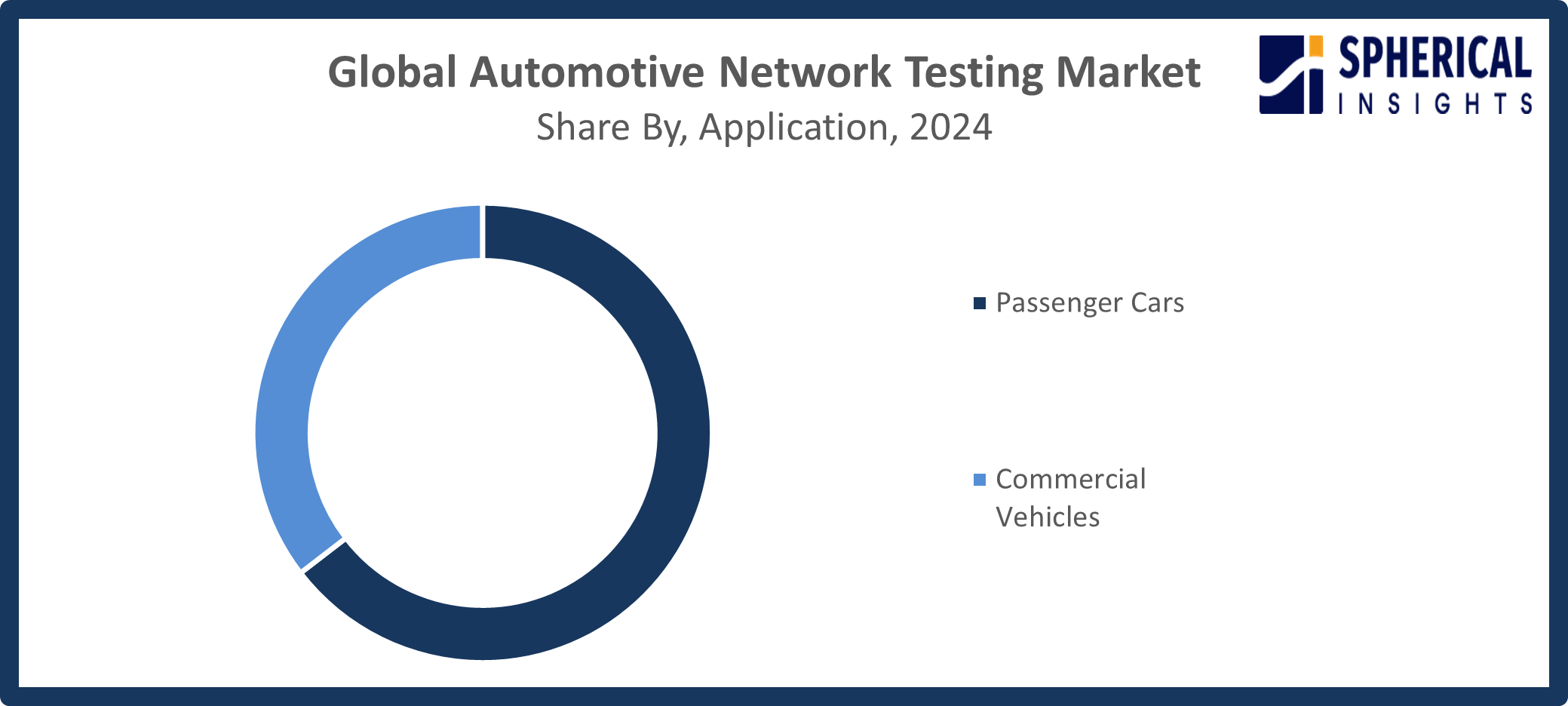

- The passenger cars segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the automotive network testing market is divided into passenger cars and commercial vehicles. Among these, the passenger cars segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Passenger cars with the highest levels of automation, electrification, and connection are the main factor driving market expansion. Testing requirements include field issue investigation to support warranty and recall efforts, production testing to ensure manufacturing quality, and development validation during the design process.

Get more details on this report -

Regional Segment Analysis of the Automotive Network Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the automotive network testing market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the automotive network testing market over the predicted timeframe. The rapid expansion of the automobile manufacturing industry in nations like China, Japan, and India is the main driver of the Asia Pacific. Growing software skills among Chinese automotive businesses increase demand for continuous integration and testing automation technologies. The establishment of engineering centers in India by foreign automotive suppliers needs testing capability to support worldwide program development efforts. The area benefits from large expenditures in connected vehicle infrastructure, autonomous driving technologies, and electric cars (EVs), all of which call for sophisticated network testing solutions. HIL testing for linked fleets is improved by IPG Automotive's August 2025 extension of simulation distribution via AVeTS across ASEAN. ISO/SAE 21434 compliance is standardized by China's November 2025 state-level automotive chip testing platform, whereas Toyota's September 2025 Woven City debut near Mt.

North America is expected to grow at a rapid CAGR in the automotive network testing market during the forecast period. North America's growth is mostly driven by the region's significant emphasis on technological innovation, particularly in autonomous driving systems, connected automobiles, and electric vehicle platforms. The creation and implementation of state-of-the-art network testing technologies is made easier by the presence of top automakers, technology suppliers, and academic institutions in the US and Canada. Together, these elements support the Automotive Network Testing market's strong development trajectory in North America, which reflects both growing need for vehicle network reliability and technical advancement. U.S. Department of Energy estimates), incorporates cybersecurity suites, protocol analyzers, and simulation tools for Ethernet, FlexRay, and V2X protocols, supporting fault-tolerant, high-bandwidth architectures in EVs and ADAS in the face of EPA's 2027 emissions regulations and NHTSA's FMVSS 208 safety requirements.

Get more details on this report -

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the automotive network testing market, along with a comparative evaluation primarily based on their network type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes network type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AESwave

- Allion Labs

- Anritsu

- Avnet

- Elektrobit

- Excelforce

- FEV Group

- Keysight

- Kyowa Electronic

- Molex

- NextGig Systems

- Primatec

- Rohde & Schwarz

- Spirent Communications

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Maruti Suzuki signs an MoA with the Tamil Nadu government to automate driving test tracks using advanced Automotive Network Testing technologies, enhancing transparency, efficiency, uniformity, and road safety across the state.

- In August 2025, Maruti Suzuki launched an initiative with the Rajasthan Transport Department to establish 21 automated driving license test tracks across 20 cities, funded via CSR, formalized on August 31, 2025, with state leadership present.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automotive network testing market based on the below-mentioned segments:

Global Automotive Network Testing Market, By Network Type

- CAN Bus Test

- Ethernet Test

- Others

Global Automotive Network Testing Market, By Application

- Passenger Cars

- Commercial Vehicles

Global Automotive Network Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Need help to buy this report?