Global Automotive Interior Materials Market Size, Share, and COVID-19 Impact Analysis, By Product (Leather, Composite, Plastic, Metals, Fabric), By Application (Dashboard, Seats, Airbags & Seat Belts, Door Panel & Trims, Carpet & Headliners), By Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) Analysis and Forecast 2021 - 2030

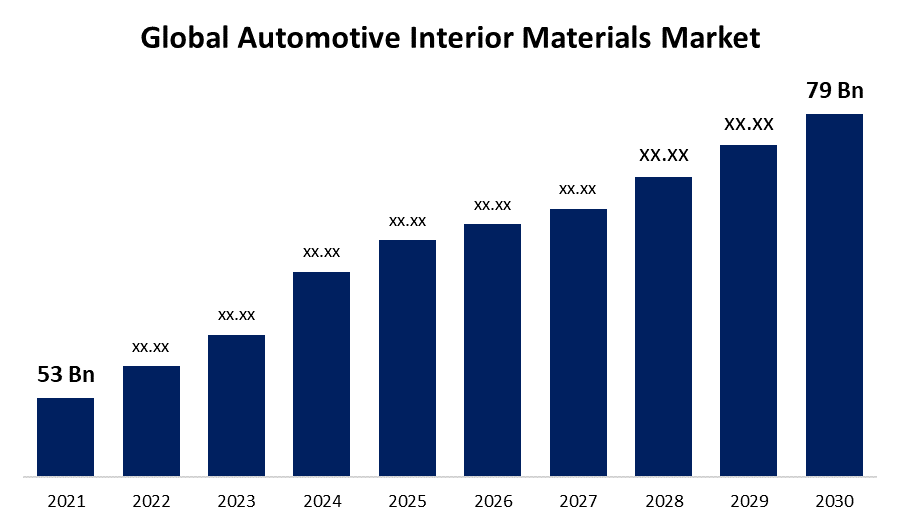

Industry: Automotive & TransportationThe Global Automotive Interior Materials Market size was valued at USD 53 billion in 2021 and is expected to reach USD 79 billion in 2030 at a CAGR of 3% from 2021 to 2030.

Get more details on this report -

The interior of a car, which includes things like headliners, cockpit modules, door panels, auto seats, and other things, is made with the goal of providing comfort, grip, and sound insulation inside the car. The interior cloth, trimmings, and other embellishments are extremely important to a car's marketability. New vehicle types necessitate adaptive designs, connectivity and HMI improvements that change how users interact with the vehicle, next-generation comfort features, greater demand for sustainability, and an emphasis on cost effectiveness. Spending only where it is necessary. If this is to occur, regions as markers of interior value must be addressed strategically by OEMs and suppliers by 2029 while evaluating predicted advancements.

The HMI revolution in cars began when dashboard screens took the place of buttons. Later, voice commands were introduced, and cars started to absorb information from their drivers. Drivers can engage with vehicle components in a number of ways thanks to human-machine interfaces. Manufacturers and IT companies are increasingly working together to create more ground-breaking and innovative HMI. HMIs will also make reference to passengers. Everyone in the car will have access to the activities they want while also being connected to the outside world thanks to in-car infotainment systems. The market for automotive interiors is being driven by these educators.

Driving Factors

Some of the key reasons driving the growth of the global automotive interior materials market include the increasing need for private vehicles, rising consumer standards of living, rising disposable income, rising desire for opulent vehicles, and expanding popularity of electric vehicles internationally. The demand for improved car interiors is being driven by both the developments in technology and the growing safety concerns. The market is expanding as a result of the rising demand for light-weight commercial vehicles for the transportation of commodities. The worldwide automobile interior market is expanding at a significant rate thanks to the adoption of smart lighting systems, cutting-edge seating systems, and increased investments in the creation of comfortable and convenient interiors.

The use of lightweight materials to give the interiors of cars cutting-edge aesthetics and finishing is a key motivating factor. Government laws on carbon emissions, safety, and energy efficiency are driving up investments in the use of lightweight and cutting-edge materials to make vehicles lighter, which would boost their energy efficiency and play a critical part in the market's expansion. A 10% weight decrease of a vehicle can save between 5% and 7% of the fuel. Additionally, the OEMs are being encouraged to produce lightweight interior components for a variety of automobile vehicles by the simple availability and adaptability of plastics like polyvinyl chloride and acrylonitrile butadiene styrene.

Global Automotive Interior Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 53 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 3% |

| 2030 Value Projection: | USD 79 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Lear Corporation (US), DRAXLMAIER Group (Germany), Asahi Kasei Corporation (Japan), DK Leather Corporation Berhad (Malaysia), Grupo Antolin (Spain), Toyota Boshoku Corporation (Japan), Grupo Antolin (Spain), Faurecia (France), Yangfeng Automotive Interiors (China), Seiren Co. Ltd. (Japan) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

Advanced automotive interior electronic components continue to be increasingly expensive even though their prices have dropped in recent years. For instance, the percentage of an automobile's electronic system, which was once only 1-2% of the whole cost of the vehicle, has now climbed to 8-12% of the total vehicle cost due to the rising demand for greater user experience and convenience features. High-tech features and solutions are now only found in high-end luxury vehicles due to their high price. Eight and ten-way adjustable front row seats are available, as are middle row captain seats with reclining capabilities, multi-information displays, and infotainment systems with cameras, gesture controls, dual-zone climate control, ventilated seats, and massage seats. Massaging seats are one of the characteristics that have high development costs and are typically featured in passenger automobiles in the premium market. This is due to the fact that buyers of luxury automobiles are willing to spend more for comfort and innovation. Because of this, these cutting-edge technology won't be widely used in low-end or economy class automobiles unless their price is reduced. This would hinder the development of all cutting-edge and cutting-edge car interior components on the market.

COVID 19 Impact

Due to disruptions in the worldwide supply chain, the global pandemic has had an impact on the market for vehicle interior materials. The refinery & petrochemical, chemical, metal, and other power generation industries play a critical role in the running of the worldwide market. The implementation of stringent lockdowns in the country's important provinces had an impact on industrial activities because China is a vital market for exports and industrial production. The first quarter of 2020 saw a sharp fall in the booming demand for industrial equipment, primarily as a result of the COVID-19 outbreak, which was followed by the introduction of limitations and a lockdown. One of the world's top makers of autos is China. However, several interruptions in the raw material supply have reduced the nation's ability to produce automobile interior materials.

Segmentation

The global automotive interior materials market is segmented into Product, Application, and Region.

Global Automotive Interior Materials Market, By Product

In terms of sales in 2021, plastic accounted for 44% of the market for automobile interior materials. Modern plastic interiors have the appearance and feel of luxury materials as a result of scientific improvements in blended polymers, design, and production methods. The demand for plastics in automotive interiors will rise throughout the predicted period as a result of the rising demand for aesthetically pleasing interiors in cars. Leather is the costliest material, and it takes a lot longer to stitch and trim than fabric. As a result of its affordability, aesthetic appeal, and other advantages, fake leather is increasingly being used by auto makers. Over the projection period, this is anticipated to increase demand for synthetic leather.

Global Automotive Interior Materials Market, By Application

With a 34.0% sales share in 2021, dashboard held the market for automobile interior materials by application. The automobile industry is significantly impacted by advancements made to car dashboards and the materials used in them because modern dashboards are supposed to be safe for the environment and devoid of harmful substances. The market is predicted to develop as a result of increased manufacturing of dashboards that make use of innovative technology, design, and materials. In the automotive business, ventilated seats are a popular trend because they improve passenger comfort. These days, many entry-level and middle-segment vehicles also come with ventilated seats. Over the forecast period, a high demand for ventilated seats is anticipated to propel segment expansion.

Global Automotive Interior Materials Market, By Vehicle Type

The market for automobile interior materials saw a revenue share of 76% for passenger vehicles in 2021. The segment has benefited from consumers' increased willingness to spend money on durable, high-quality goods. This has inspired manufacturers to create cutting-edge gadgets with premium features at affordable prices. Over the projection period, a rise in demand for commercial transportation services, particularly taxis, is anticipated to drive demand for light commercial vehicles. Demand is also projected to be boosted by improved road infrastructure globally, growing urbanisation, and favourable regulatory regulations.

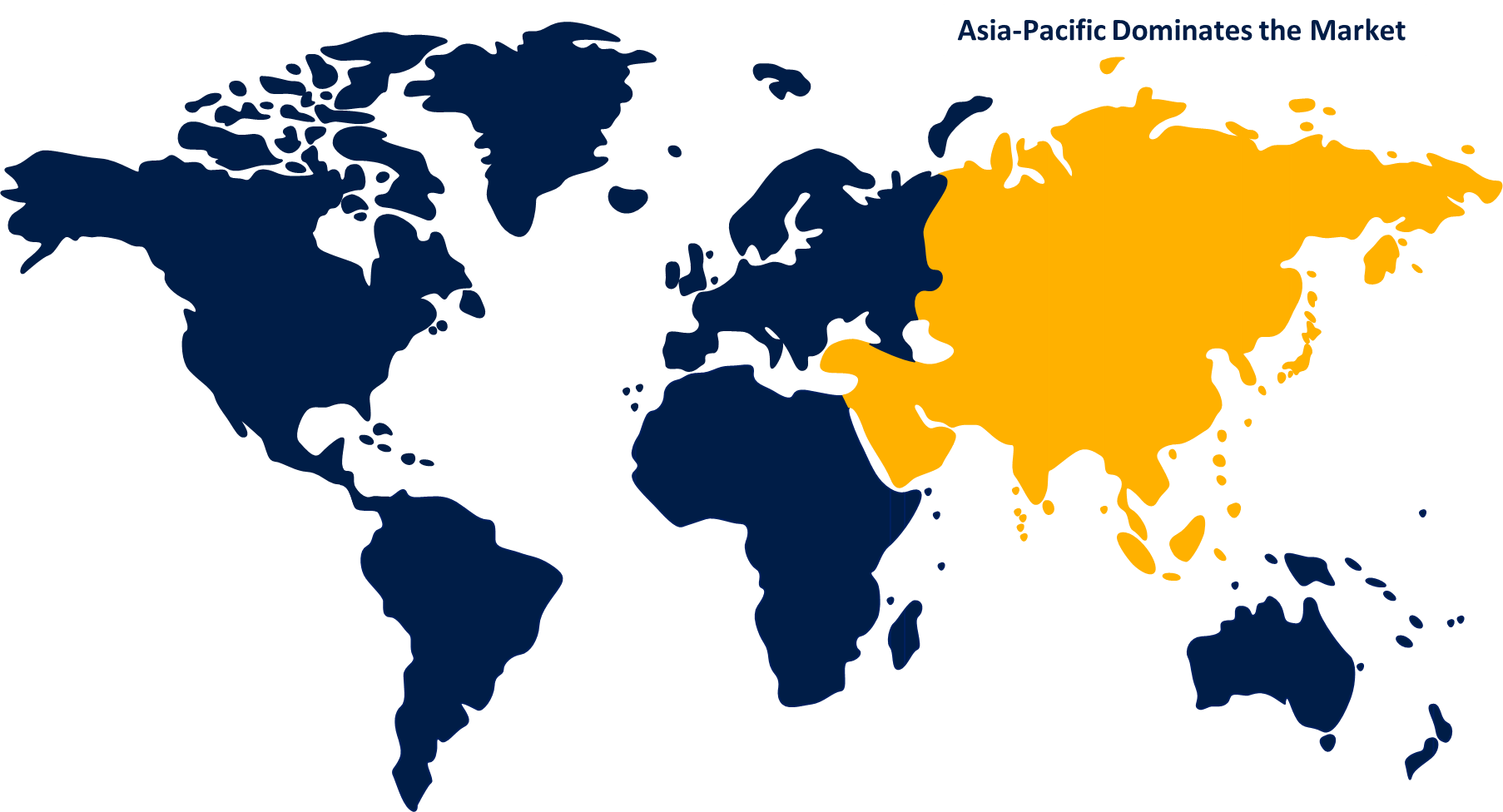

Global Automotive Interior Materials Market, By Region

Get more details on this report -

From 2021 to 2030, Asia Pacific is projected to see a CAGR of 7%. Government support in the form of subsidies and favourable regulations is anticipated to entice automakers to locate factories in the area, which is anticipated to fuel the expansion of the APAC market for car interior materials.

Recent Developments in Global Automotive Interior Materials Market

- Lear Corporation and Gentherm (NASDAQ: THRM), the market leader in the world for automotive interior materials and a leading creator of cutting-edge thermal management technologies, jointly announced a strategic joint development partnership to advance passenger thermal seating solutions in 2019.

List of Key Market Players

- Lear Corporation (US)

- DRAXLMAIER Group (Germany)

- Asahi Kasei Corporation (Japan)

- DK Leather Corporation Berhad (Malaysia)

- Grupo Antolin (Spain)

- Toyota Boshoku Corporation (Japan)

- Grupo Antolin (Spain)

- Faurecia (France)

- Yangfeng Automotive Interiors (China)

- Seiren Co. Ltd. (Japan)

Segmentation

By Product

- Leather

- Composite

- Plastic

- Metals

- Fabric

By Application

- Dashboard

- Seats

- Airbags & Seat Belts

- Door Panel & Trims

- Carpet & Headliners

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Product

- North America, by Application

- North America, by Vehicle Type

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Product

- Europe, by Application

- Europe, by Vehicle Type

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Product

- Asia Pacific, by Application

- Asia Pacific, by Vehicle Type

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Product

- Middle East & Africa, by Application

- Middle East & Africa, by Vehicle Type

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Product

- South America, by Application

- South America, by Vehicle Type

Need help to buy this report?