Global Automotive Cyber Security Market Size, Share, and COVID-19 Impact Analysis, By Security Type (Endpoint, Application, and Wireless Network), By Vehicle Type (Passenger Car, Commercial Vehicle, and Electrical Vehicle), By Application (ADAS & Safety System, Infotainment, Body Electronics, Powertrain, and Telematics), By Service (In-Vehicle Services and External Cloud Services), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Information & TechnologyGlobal Automotive Cyber Security Market Insights Forecasts to 2032

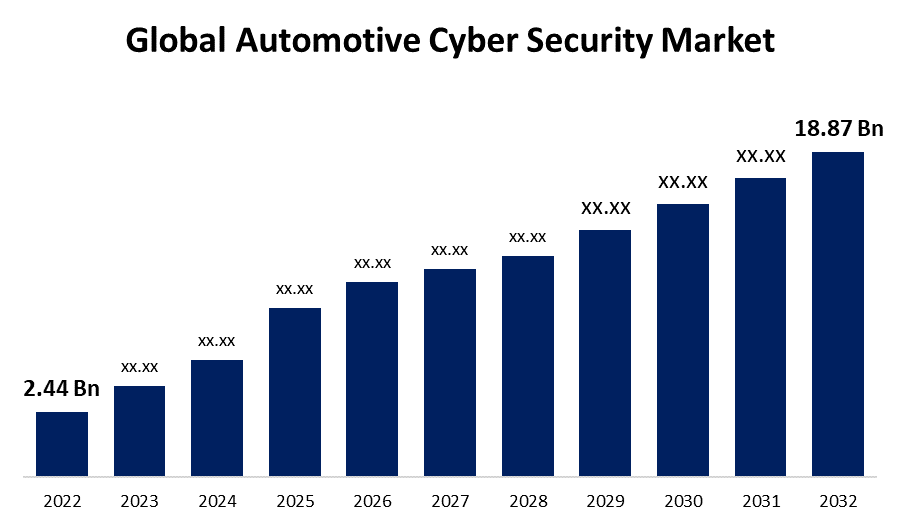

- The Automotive Cyber Security Market was valued at USD 2.44 Billion in 2022.

- The Market is growing at a CAGR of 22.7% from 2023 to 2032

- The Worldwide Automotive Cyber Security Market is expected to reach USD 18.87 Billion by 2032

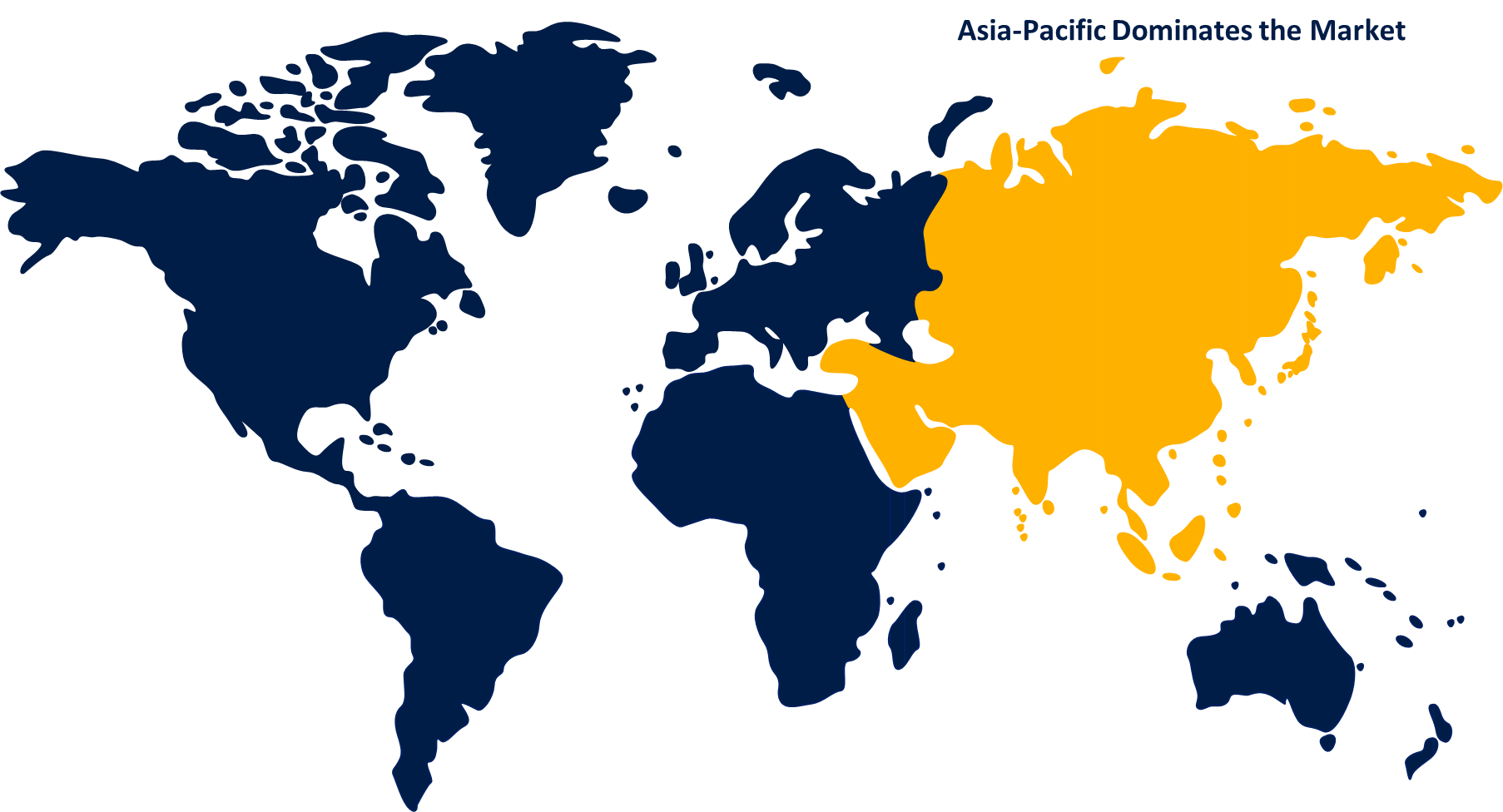

- Asia-Pacific is expected to grow the highest during the forecast period

Get more details on this report -

The Global Automotive Cyber Security Market is expected to reach USD 18.87 Billion by 2032, at a CAGR of 22.7% during the forecast period 2022 to 2032.

Market Overview

Automotive cybersecurity refers to the measures taken to protect vehicles from cyber threats and unauthorized access. With the increasing connectivity and integration of advanced technologies in modern vehicles, the risk of cyberattacks has grown substantially. Automotive cybersecurity aims to safeguard the critical systems and networks within a vehicle, including the infotainment system, engine control unit, and autonomous driving features. It involves implementing robust security protocols, encryption techniques, intrusion detection systems, and secure communication protocols to prevent unauthorized access, data breaches, and potential risks to passenger safety. Additionally, continuous monitoring, threat intelligence, and vulnerability assessments are crucial for identifying and addressing emerging threats. The automotive industry and regulatory bodies are increasingly focusing on improving cybersecurity standards to ensure the safety and privacy of vehicle users.

Report Coverage

This research report categorizes the market for automotive cyber security market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the automotive cyber security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the automotive cyber security market.

Global Automotive Cyber Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.44 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 22.7% |

| 2032 Value Projection: | USD 18.87 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Security Type, By Vehicle Type, By Application, By Service, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Vector Informatik GmbH, Broadcom Inc., Denso Corporation, Honeywell International, Inc., Guard Knox Cyber-Technologies Ltd., Karamba Security, Synopsys, Upstream Security, Sectigo Limited, ESCRYPT, RunSafe Security, Inc., Trend Micro, Harman International, Trillium Secure Inc., STMicroelectronics, Infineon Technologies AG, NXP Semiconductors, Bosch Mobility Solutions, Microchip Technology, and others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive cybersecurity market is driven by several factors, such as the increasing adoption of connected and autonomous vehicles has raised concerns about cyber threats, prompting the need for robust security solutions. The stringent government regulations and industry standards mandating the implementation of cybersecurity measures in vehicles have fueled market growth. The growing number of cyberattacks on vehicles, such as remote hacking and unauthorized access, has raised awareness among automakers and consumers, driving the demand for automotive cybersecurity solutions. Additionally, the integration of advanced technologies like Internet of Things (IoT) and Artificial Intelligence (AI) in vehicles has increased the attack surface, necessitating enhanced cybersecurity. Moreover, the rising trend of mobility services and shared transportation requires secure and protected vehicle networks, further driving the market for automotive cybersecurity solutions.

Restraining Factors

The automotive cybersecurity market faces certain restraints that impact its growth. The high cost associated with implementing robust cybersecurity measures in vehicles poses a significant barrier, especially for smaller automakers and budget-conscious consumers. The complex and constantly evolving nature of cyber threats requires continuous investment in research and development, which can strain resources for automotive companies. Additionally, the lack of standardized cybersecurity regulations across different regions and countries creates challenges in implementing consistent security measures. Moreover, the interoperability issues between different vehicle systems and the potential impact on performance and user experience can hinder the widespread adoption of automotive cybersecurity solutions.

Market Segmentation

- In 2022, the wireless network segment accounted for around 38.5% market share

On the basis of the security type, the global automotive cyber security market is segmented into endpoint, application, and wireless network. The wireless network segment has emerged as the largest market share holder in the automotive cybersecurity sector. This can be attributed to the increasing connectivity and integration of wireless technologies in vehicles have expanded the attack surface for potential cyber threats. With features like Wi-Fi, Bluetooth, and cellular networks, vehicles are more vulnerable to unauthorized access and data breaches. Consequently, there is a growing need for robust cybersecurity solutions to secure wireless networks within vehicles. The rise of connected and autonomous vehicles heavily relies on wireless communication for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) connectivity, as well as over-the-air updates. This further emphasizes the importance of protecting wireless networks from cyberattacks. Additionally, regulatory initiatives and industry standards mandate the implementation of cybersecurity measures for wireless networks, driving the demand for related solutions. As a result, the wireless network segment holds the largest market share in the automotive cybersecurity market.

- In 2022, the infotainment segment dominated with more than 35.2% market share

Based on the type of application, the global automotive cyber security market is segmented into ADAS & safety system, infotainment, body electronics, powertrain, and telematics. The infotainment segment has emerged as the largest market share holder in the automotive cybersecurity sector. There are several factors contributing to its dominance due to modern vehicles increasingly integrate advanced infotainment systems that provide a wide range of functionalities, including entertainment, navigation, communication, and connectivity. These systems often rely on complex software and communication protocols, making them susceptible to cyber threats. As a result, automakers and consumers alike are prioritizing cybersecurity measures for infotainment systems to safeguard sensitive personal and vehicle data. The infotainment segment is more exposed to external connections, such as Bluetooth, Wi-Fi, and cellular networks, which increases the risk of unauthorized access and potential cyberattacks. Thus, the need to protect these systems against vulnerabilities and breaches has fueled the demand for robust cybersecurity solutions, making the infotainment segment the largest market share holder in the automotive cybersecurity market.

Regional Segment Analysis of the Automotive Cyber Security Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 34.1% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant market in the automotive cybersecurity sector. There are several key factors contributing to its market dominance because North America is home to some of the world's leading automotive manufacturers and technology companies, driving innovation and investment in cybersecurity solutions. The region has witnessed a higher adoption rate of connected and autonomous vehicles, which increases the demand for robust cybersecurity measures. The stringent government regulations and industry standards in North America mandate the implementation of cybersecurity protocols in vehicles, further boosting the market. Additionally, the presence of a highly developed automotive infrastructure, a mature cybersecurity ecosystem, and a strong focus on consumer safety and privacy contribute to North America's market dominance. Furthermore, the region benefits from a robust research and development landscape and collaborations between automakers, technology companies, and cybersecurity firms, fostering advancements in the field.

Recent Developments

- In January 2023, the international centre for automotive technology (ICAT), which certifies autos for security and compliance with local regulations, has announced that it intends to invest in a facility that will develop cyber security skills.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive cyber security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Vector Informatik GmbH

- Broadcom Inc.

- Denso Corporation

- Honeywell International, Inc.

- Guard Knox Cyber-Technologies Ltd.

- Karamba Security

- Synopsys

- Upstream Security

- Sectigo Limited

- ESCRYPT

- RunSafe Security, Inc.

- Trend Micro

- Harman International

- Trillium Secure Inc.

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- Bosch Mobility Solutions

- Microchip Technology

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global automotive cyber security market based on the below-mentioned segments:

Automotive Cyber Security Market, By Security Type

- Endpoint

- Application

- Wireless Network

Automotive Cyber Security Market, By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Electrical Vehicle

Automotive Cyber Security Market, By Application

- ADAS & Safety System

- Infotainment

- Body Electronics

- Powertrain

- Telematics

Automotive Cyber Security Market, By Service

- In-Vehicle Services

- External Cloud Services

Automotive Cyber Security Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?