Australia Veterinary Reference Laboratory Market Size, Share, and COVID-19 Impact Analysis, By Technology (Clinical Chemistry, Hematology, Immunodiagnostic, Molecular Diagnostics, and Others), By Application (Clinical Pathology, Virology, Bacteriology, Parasitology, Productivity Testing, Pregnancy Testing, Toxicology, and Others), and Australia Veterinary Reference Laboratory Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAustralia Veterinary Reference Laboratory Market Insights Forecasts to 2035

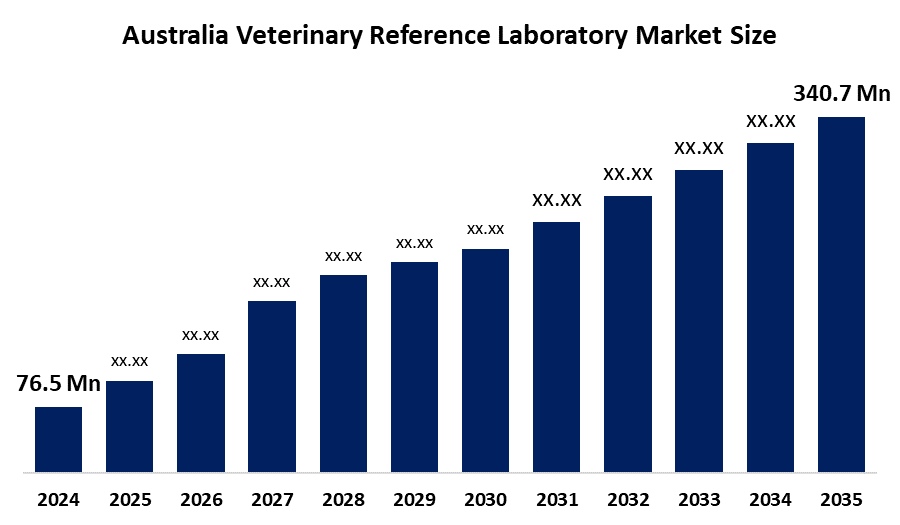

- The Australia Veterinary Reference Laboratory Market Size Was Estimated at USD 76.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 14.54% from 2025 to 2035

- The Australia Veterinary Reference Laboratory Market Size is Expected to Reach USD 340.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Australia veterinary reference laboratory market size is anticipated to reach USD 340.7 million by 2035, growing at a CAGR of 14.54% from 2025 to 2035. The veterinary reference laboratory market in Australia is driven by rising pet ownership, growing demand for sophisticated diagnostic testing, expanding livestock health monitoring, technological developments in molecular diagnostics, and increased awareness of preventive animal healthcare and biosecurity measures.

Market Overview

Veterinary reference laboratories in Australia provide specialized diagnostic services to conduct advanced laboratory tests which monitor animal health. The laboratories perform analysis of blood, tissue, urine, and other samples to identify diseases and infections and genetic disorders in both companion animals and livestock. The testing process involves various scientific fields which include clinical pathology and microbiology and molecular diagnostics and parasitology and toxicology testing. The organization provides disease management and prevention and surveillance support to veterinarians and livestock producers and research institutions and biosecurity agencies.

Animal health and diagnostics are supported by the Australian Government via the Biosecurity Innovation and Investment Fund (BIIF), which provides a total of AU$110 million to improve laboratory capacity, surveillance, and diagnostic capability. The Emergency Animal Disease Preparedness Fund also provides AU$13 million for rapid response capabilities. Additionally, states provide support for clinical research grant programs, which range from AU$5–10 million per year, to enhance Veterinary Testing Capacity, including improvements to reference laboratories and disease monitoring systems.

In 2025, Gribbles Veterinary Pathology expanded its reference lab services through the introduction of improved PCR and genomic testing capabilities for companion and production animals. Vet sense Pty Ltd developed diagnostic kits for in-house use through collaboration with research institutes. Australian veterinary labs will experience future growth because of increased funding for zoonotic disease surveillance and development of precise animal health test solutions.

Report Coverage

This research report categorizes the market for the Australia veterinary reference laboratory market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia veterinary reference laboratory market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia veterinary reference laboratory market.

Australia Veterinary Reference Laboratory Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 76.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 14.54% |

| 2035 Value Projection: | USD 340.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology,By Application |

| Companies covered:: | Gribbles Veterinary Pathology, Idexx Laboratories Australia, Zoetis Australia, Sydney University Veterinary Pathology Services, Animal Health Diagnostics Australia (AHDA), Pathology Queensland, Veterinary Diagnostic Laboratory, Regional Veterinary Diagnostic Services,and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The veterinary reference laboratory market in Australia is driven by the more people acquire pets and they spend more money on their pets' medical needs. The need for testing solutions rises because of increasing livestock production together with biosecurity laws without testing solutions which create production difficulties. The development of molecular diagnostics together with PCR technology and genomic testing produces more precise results and faster testing processes. The expansion of laboratory services across veterinary clinics and agricultural sectors receives support from increased understanding of zoonotic diseases and preventive healthcare measures and antimicrobial resistance monitoring activities.

Restraining Factors

The veterinary reference laboratory market in Australia is mostly constrained by the expensive diagnostic tests, the short supply of trained laboratory staff and the need to meet strict regulatory standards. The limited budget of smaller veterinary practices together with their lack of understanding about advanced testing leads to reduced market growth.

Market Segmentation

The Australia veterinary reference laboratory market share is classified into technology and application.

- The clinical chemistry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Australia veterinary reference laboratory market is segmented by technology into clinical chemistry, hematology, immunodiagnostic, molecular diagnostics, and others. Among these, the clinical chemistry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of clinical chemistry tests, including liver, kidney, glucose, and electrolyte analysis, are frequently employed in livestock and companion animals for the diagnosis, monitoring, and screening of diseases. The greatest revenue share is a result of their high testing volume, affordability, and extensive use in veterinary operations.

- The clinical pathology segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Australia veterinary reference laboratory market is segmented by application into clinical pathology, virology, bacteriology, parasitology, productivity testing, pregnancy testing, toxicology, and others. Among these, the clinical pathology segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of clinical pathology testing, which includes cytology, urinalysis, blood analysis, and biochemical profile, is frequently carried out for the diagnosis of diseases, screening for prevention, and treatment monitoring in livestock and companion animals. Its highest market share and robust predicted growth rate are a result of its high testing frequency, wide application across animal species, and rising awareness of preventive healthcare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia veterinary reference laboratory market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gribbles Veterinary Pathology

- Idexx Laboratories Australia

- Zoetis Australia

- Sydney University Veterinary Pathology Services

- Animal Health Diagnostics Australia (AHDA)

- Pathology Queensland

- Veterinary Diagnostic Laboratory

- Regional Veterinary Diagnostic Services

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, the AI platform Heidi Health joined forces with Green cross Vets to enter the veterinary industry, enhancing clinical workflow and thereby increasing the effectiveness of diagnostic service utilization.

- In June 2025, several ELISA tests were temporarily suspended because the kits were not available, illustrating the effects of the supply chain on reference lab services.

Market Segment

This study forecasts revenue at the Australia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Australia veterinary reference laboratory market based on the below-mentioned segments:

Australia Veterinary Reference Laboratory Market, By Technology

- Clinical Chemistry

- Hematology

- Immunodiagnostic

- Molecular Diagnostics

- Others

Australia Veterinary Reference Laboratory Market, By Application

- Clinical Pathology

- Virology

- Bacteriology

- Parasitology

- Productivity Testing

- Pregnancy Testing

- Toxicology

- Others

Need help to buy this report?