Australia Nitric Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Disposable Suction Canisters, Reusable Suction Canisters), By Application (Fertilizers, Nitrobenzene, Adipic Acid, Toluene Di-isocyanate, Others), and Australia Nitric Acid Market Insights Forecasts to 2032

Industry: Chemicals & MaterialsAustralia Nitric Acid Market Insights Forecasts to 2032

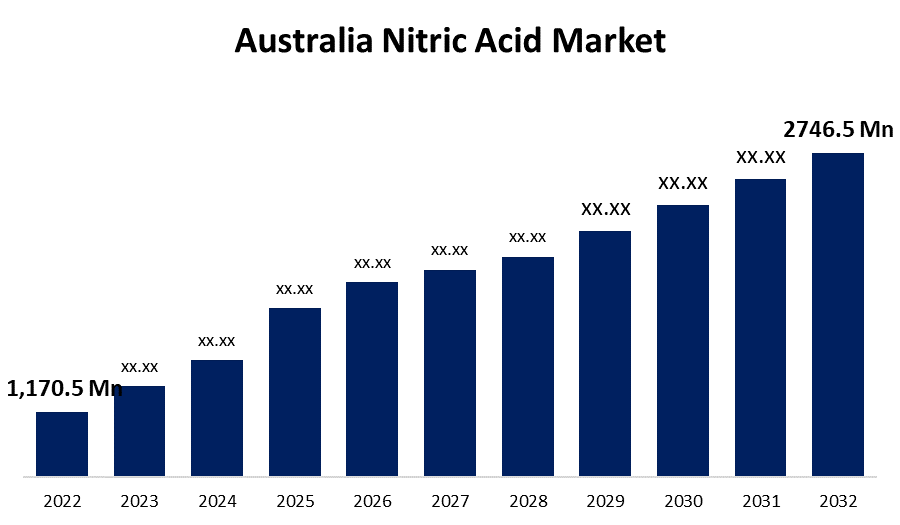

- The Australia Nitric Acid Market Size was valued at USD 1,170.5 Million in 2022.

- The Market Size is Growing at a CAGR of 8.9% from 2022 to 2032.

- The Australia Nitric Acid Market Size is Expected to Reach USD 2746.5 Million by 2032.

Get more details on this report -

The Australia Nitric Acid Market Size is Expected to Reach USD 2746.5 Million by 2032, at a CAGR of 8.9% during the forecast period 2022 to 2032.

Market Overview

Nitric acid is an important raw material used in the production of ammonium nitrate (AN) and calcium ammonium nitrate, both of which are used in the production of fertilizers. Nitric acid is also used in the production of nitrobenzene, which is then used in the manufacture of explosives. Other important nitric acid applications include adipic acid, nitrochlorobenzenes, and toluene diisocyanate (TDI), which is used in the chemical industry for uranium processing, metal treatment, and as a precursor for many chemical compounds. Other nitric acid-derived compounds include potassium nitrates and nitro phosphates, which are then used to make phosphate fertilizers. Nitric acid is available in two major forms: fuming (above 90% concentration) and non-fuming (below 90% concentration). Nitric acid is mostly available in industrial grade for the chemical industry. Specialty grades are commonly used in laboratories and pharmaceuticals.

Report Coverage

This research report categorizes the market for the Australia nitric acid market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia nitric acid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia nitric acid market.

Driving Factors

Nitric acid is widely used in agriculture, where it is used to produce fertilizers such as ammonium nitrate, potassium nitrate, calcium ammonium nitrate, and nitro phosphate. Fertilizers are used to increase crop yield in order to meet the rising food demand of the consumers. Furthermore, rising consumer disposable income has increased demand for organic and high-quality foods, resulting in the use of bio-based fertilizers and Australia nitric acid market growth. Toluene di-isocyanate (TDI) and HNO3 intermediate are used in the production of polyurethane foams, wood and floor coatings, and insulation materials, which boosts Australia nitric acid market growth. Furthermore, improving consumer lifestyles, increased renovation activities, and new governmental infrastructure projects drive HNO3 market growth. Furthermore, the dye manufacturing product is a driving factor for Australia nitric acid market growth during forecast period. High demand for dye in the textile industry can be linked to growth in the fashion industry.

Restraining Factors

Nitric acid is emitted by chemical manufacturing plants, vehicle exhaust fumes, and polluted wastewater from farming areas. When inhaled, this environmental pollution causes respiratory problems. Government regulations aimed at environmental protection and reducing industrial waste are stifling market growth. Furthermore, growing concerns about CO2 emissions from vehicles are hamper the Australia nitric acid market.

Market Segment

- In 2022, the concentrated nitric acid segment is expected to hold the largest share of the Australia nitric acid market during the forecast period.

Based on the type, the Australia nitric acid market is classified into dilute nitric acid, and concentrated nitric acid. Among these, the concentrated nitric acid segment is expected to hold the largest share of the Australia nitric acid market during the forecast period. Nitric acid is used in the production of fertilizers such as ammonium nitrate and calcium ammonium nitrate, which provide extensive and high-quality crop yields. During the forecast period, the growing demand for nitrogen-based fertilizers has driven market growth.

- In 2022, the fertilizers segment accounted for the largest revenue share over the forecast period.

Based on the application, the Australia nitric acid market is segmented into fertilizers, nitrobenzene, adipic acid, toluene Di-isocyanate, and others. Among these, the fertilizers segment has the largest revenue share over the forecast period. The growth can be attributed to the rising agricultural activities to fulfill the growing population demand. Nitric acid is used to make fertilizers like ammonium nitrate and calcium ammonium nitrate, which provide high crop yields. The increasing demand for nitrogen-based fertilizers has driven market growth over the years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia nitric acid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Orica Limited

- Intec Pivot Limited

- Wesfarmers Chemicals

- Energy & Fertilizers.

- Yara International ASA

- CSBP Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2020, Wesfarmers Chemicals, Energy & Fertilisers (WesCEF) announced a long-term supply agreement for ammonia, a key ingredient in the production of nitric acid, with Yara Pilbara Fertilizers. The agreement is expected to support WesCEF's long-term nitric acid supply to the Australian market.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Australia nitric acid market based on the below-mentioned segments:

Australia Nitric Acid Market, By Type

- Disposable Suction Canisters

- Reusable Suction Canisters

Australia Nitric Acid Market, By Application

- Fertilizers

- Nitrobenzene

- Adipic Acid

- Toluene Di-isocyanate

- Others

Need help to buy this report?