Australia Freight and Logistics Market Size, Share, and COVID-19 Impact Analysis, By Logistics Function (Courier, Express, and Parcel, Freight Forwarding, Freight Transport, Warehousing and Storage, and Others), By End User (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Australia Freight and Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationAustralia Freight and Logistics Market Insights Forecasts to 2033

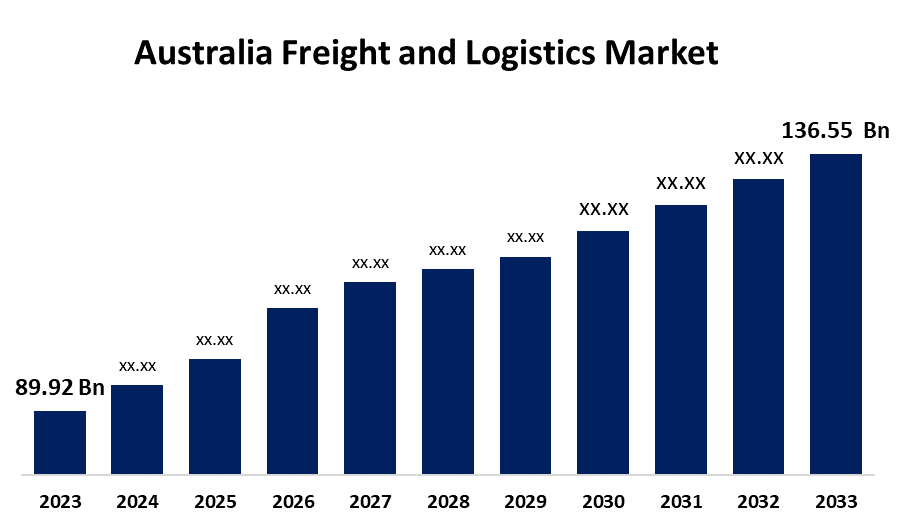

- The Australia Freight and Logistics Market Size was valued at USD 89.92 Billion in 2023.

- The Australia Freight and Logistics Market Size is Growing at a CAGR of 4.27% from 2023 to 2033

- The Australia Freight and Logistics Market Size is Expected to Reach USD 136.55 Billion by 2033

Get more details on this report -

The Australia Freight and Logistics Market Size is Anticipated to Exceed USD 136.55 Billion by 2033, Growing at a CAGR of 4.27% from 2023 to 2033. The freight and logistics market offers opportunities for e-commerce growth, automation, digitization, and sustainability. Blockchain, IoT, and AI innovations boost productivity, while global commerce expansion and green logistics drive industry expansion.

Market Overview

Transportation networks, supply chains, and distribution systems are all part of the worldwide movement, storage, and management of commodities that are included in the Australia freight and logistics market. It ensures an efficient movement from producers to consumers by utilizing a variety of transportation modes, including air, sea, rail, and road. This industry combines last-mile delivery, freight forwarding, inventory control, and warehousing to optimize operations for dependability and cost-effectiveness. Technological developments, automation, and sustainable business practices are influencing the direction of the sector, increasing productivity, lowering environmental impact, and promoting international commerce. Increasing focus on safety and compliance, the use of renewable energy sources for transportation operations, the growing adoption of electric vehicles (EVS), energy-efficient warehouses, and the growing demand for products from global online retailers are some of the factors driving the Australia freight and logistics market demand. Technology advancements in the logistics industry for quick delivery and supply chain, together with the expansion of trade-related agreements and international logistics infrastructure, are driving the Australia freight and logistics market.

Report Coverage

This research report categorizes the market for the Australia freight and logistics market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia freight and logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia freight and logistics market.

Australia Freight and Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 89.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.27% |

| 2033 Value Projection: | USD 136.55 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Logistics Function, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Qube Holdings Ltd., Aurizon Holdings Limited, Post Holdings Co., Ltd., DHL Group, Linfox Pty Ltd, and Others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing focus on environmentally friendly logistics methods as businesses try to lessen their carbon footprint is supporting the expansion of the freight and logistics sector in Australia. Large-scale infrastructure expenditures and modernization projects are driving a major transition in Australia's freight and logistics sector. Investments in more contemporary, effective, and secure logistics operations are being fueled by the emphasis on safety and regulatory compliance, which helps to preserve the integrity of the supply chain and foster market expansion. One of the primary factors driving the rise in the freight and logistics market value is the expansion of infrastructure and building.

Restraining Factors

Variable fuel prices, complicated regulations, limited infrastructure, a lack of workers, geopolitical upheavals, and environmental issues are some of the challenges impacting the freight and logistics market.

Market Segmentation

The Australia freight and logistics market share is classified into logistics function and end user.

- The freight transport segment accounted for the largest share of the Australia freight and logistics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of logistics function, the Australia freight and logistics market is divided into courier, express, and parcel, freight forwarding, freight transport, warehousing and storage, and others. Among these, the freight transport segment accounted for the largest share of the Australia freight and logistics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growing use of sustainable transportation options, such as the USD 20 million Hume hydrogen highway project that connects Sydney and Melbourne, is another factor driving the expansion of the freight transport industry.

- The wholesale and retail trade segment accounted for the largest share of the Australia freight and logistics market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of end user, the Australia freight and logistics market is divided into agriculture, fishing, and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others. Among these, the wholesale and retail trade segment accounted for the largest share of the Australia freight and logistics market in 2023 and is anticipated to grow at a rapid pace during the projected period. The wholesale and retail trade segment's development is boosted by the increased acceptance of internet shopping, with over 80% of Australian households choosing digital purchases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia freight and logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Qube Holdings Ltd.

- Aurizon Holdings Limited

- Post Holdings Co., Ltd.

- DHL Group

- Linfox Pty Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, in Australia, FedEx launched its Dynamic Drive-through Pallet (DTP) Dimensioning Systems. The Drive-through Pallet technology was first implemented in the country at the recently built Adelaide plant in South Australia. The improved capabilities of the new facility would meet the expanding demand for e-commerce in the South Australia region. FedEx's processing capabilities have been enhanced since the DTP system was put into place.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia freight and logistics market based on the below-mentioned segments:

Australia Freight and Logistics Market, By Logistics Function

- Courier, Express, and Parcel

- Freight Forwarding

- Freight Transport

- Warehousing and Storage

- Others

Australia Freight and Logistics Market, By End User

- Agriculture, Fishing, and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

Need help to buy this report?