Australia Coffee Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whole Bean, Ground Coffee, Instant Coffee, and Coffee Pods & Capsules), By Distribution Channel (Hypermarkets/ Supermarkets, Convenience/Grocery Stores, Online Retail Stores, and Others), and Australia Coffee Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesAustralia Coffee Market Insights Forecasts to 2033

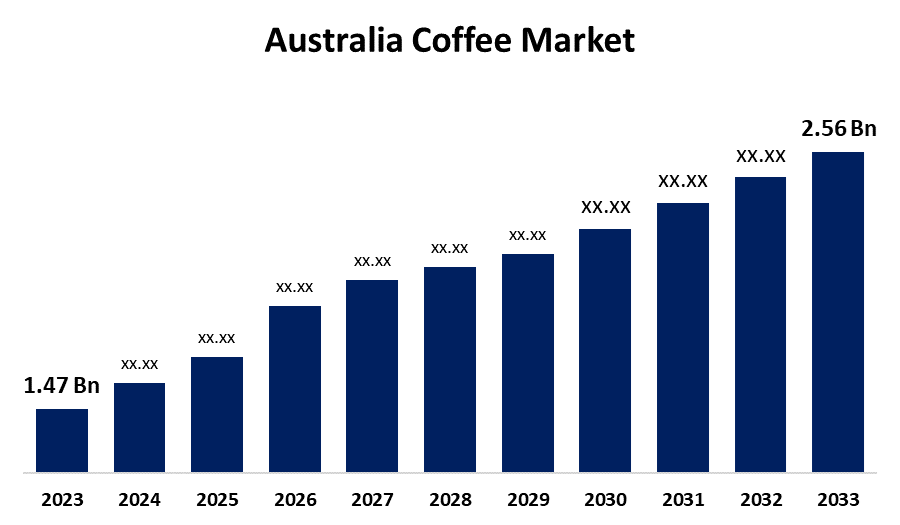

- The Australia Coffee Market Size Was Valued at USD 1.47 Billion in 2023.

- The Australia Coffee Market Size is Growing at a CAGR of 5.70% from 2023 to 2033

- The Australia Coffee Market Size is Expected to Reach USD 2.56 Billion by 2033

Get more details on this report -

The Australia Coffee Market Size is Anticipated to Exceed USD 2.56 Billion by 2033, Growing at a CAGR of 5.70% from 2023 to 2033. The rise of specialty coffee, sustainable sourcing, internet retail growth, café culture innovation, demand for premium products, ethical trade practices, and technology improvements in brewing and delivery are all opportunities presented by the Australia coffee market.

Market Overview

The industry that includes the production, distribution, and consumption of coffee and associated items in Australia is known as the "Australia coffee market." It includes coffee shops, eateries, the production of coffee-making equipment, and the retail selling of coffee beans and ground coffee. Growing café culture, rising specialty coffee demand, and customer preference for products supplied ethically are the main factors driving the Australia coffee market. The growing popularity of specialty coffee, ecologically friendly and sustainable coffee processes, the rise in online coffee sales and subscription services, and the development of café culture are some of the main topics of the Australia coffee market. The growing consumer knowledge and desire for high-end, certified coffee products are driving a major shift in the Australia coffee market. A growing coffee culture among consumers worldwide, shifting lifestyles, and rising disposable incomes are all driving the Australia coffee market's overall expansion. The industry has seen a significant surge in demand for certified organic coffee due to Australian consumers' increased environmental and health concerns.

Report Coverage

This research report categorizes the market for the Australia coffee market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia coffee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia coffee market.

Australia Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.47 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.70% |

| 2033 Value Projection: | USD 2.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Nestle SA, Luigi Lavazza S.p.A., JAB Holding Company, Vittoria Coffee Pty Ltd., FreshFood Services Pty Ltd and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Premiumization of the industry is on the rise due to customers' increasing desire for gourmet and specialty coffee experiences as well as the ease of quick and simple brewing methods. Customers are becoming more prepared to spend more for these coffees, which raises the Australia coffee market's total worth. The main factors driving the Australia coffee market's expansion include western culture, growing worldwide exposure, and the uptake of well-known coffee brands. The coffee market in Australia is undergoing a major transition due to shifting customer tastes and a developing coffee culture.

Restraining Factors

High production costs, supply chain interruptions, climatic unpredictability, volatile coffee bean prices, regulatory restrictions, competition from other beverages, and changing customer tastes are some of the difficulties affecting the stability and expansion of the Australian coffee market.

Market Segmentation

The Australia coffee market share is classified into product type and distribution channel.

- The coffee pods & capsules segment accounted for the largest share of the Australia coffee market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of product type, the Australia coffee market is divided whole bean, ground coffee, instant coffee, and coffee pods & capsules. Among these, the coffee pods & capsules segment accounted for the largest share of the Australia coffee market in 2023 and is anticipated to significant CAGR during the forecast period. The growing consumer desire for convenience and high-quality coffee experiences at home is driving the market for coffee pods and capsules. Premiumization of the market is on the rise, and customers are very interested in specialized and gourmet coffee alternatives.

- The hypermarkets/ supermarkets segment accounted for the largest share of the Australia coffee market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of distribution channel, the Australia coffee market is divided into hypermarkets/ supermarkets, convenience/grocery stores, online retail stores, and others. Among these, the hypermarkets/ supermarkets segment accounted for the largest share of the Australia coffee market in 2023 and is anticipated to significant CAGR during the forecast period. Supermarkets and hypermarkets are known for providing a wide range of items in one location, making it simple for customers to compare various coffee products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia coffee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle SA

- Luigi Lavazza S.p.A.

- JAB Holding Company

- Vittoria Coffee Pty Ltd.

- FreshFood Services Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia coffee market based on the below-mentioned segments:

Australia Coffee Market, By Product Type

- Whole Bean

- Ground Coffee

- Instant Coffee

- Coffee Pods and Capsules

Australia Coffee Market, By Distribution Channel

- Hypermarkets/ Supermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Others

Need help to buy this report?